Stocks vs. Precious Metals vs. Bonds vs. Real Estate

4 posters

Page 1 of 2

Page 1 of 2 • 1, 2

Stocks vs. Precious Metals vs. Bonds vs. Real Estate

Stocks vs. Precious Metals vs. Bonds vs. Real Estate

I have this theory that the stock market basically exists to lets a small group of insiders cash out quickly the lifetime POTENTIAL value of the future company profit, leaving the stockholders holding the bag for all the years or decades of risk and opportunity cost. Thus I think the long-term hold strategy does not pay. Speculation gains from "greater fool" waves generate real gains only for those who have the discipline to buy low and sell on near-term peaks. The degree of risk (speculation), will correlate to the degree of real gain and also the frequency of failure. A speculator who stays in the game long enough, eventually sees a big payoff, but due to their very nature that allowed them to stay in the game, they may not cash out before their luck runs out again.

I set out to start some preliminary research on whether this theory is true or not. I know Warren Buffet has mentioned Coca-Cola (NYSE:KO) as one of those type of companies he likes to buy and hold (forever is his preferred holding time). Yahoo Finance reports the share price was 1.98 on January 2, 1962. I plugged this into the ShadowStats.com Inflation Calculator (using the SGS adjustments for correctness), I see the inflation adjusted price as of Sept, 2008 is $41.25 ($14.44 for incorrect BLS inflation). I see the share price today hit $41.50.

So all the price gains in Coca-Cola stock since 1962 have been due to inflation. No stockholder has made a real inflation-adjusted penny in equity in Coca-Cola in 46 years. I have read that Coca-Cola pays a dividend of about 2 - 4% per year, which I bet just about has kept up with world population growth since 1920. The point being that the investment would take about 25 years to double, adjusted to inflation.

Gold since it was un-pegged from a govt mandated price in 1971 of $40.80, has a inflation adjust price as of Sept. 2008 of $640, yet recently gold has been between $750 to $950. However, a 3% inflation adjusted annual yield would be $1911. So clearly gold is under performing Coca-Cola thus far.

Thus clearly Coca-Cola has thus far been a superior investment than gold, yet Coca-Cola still has not been a fabulous investment so far during my lifetime. But physical gold in my hands, has less risk than Coca-Cola, because it can't nationalized, frozen, nor debased with hyperinflation. I pay for this lowered risk, by expecting gold not to yield anything but keep pace with inflation, which it has done.

But when the govt is hyperinflating, as they are now, then precious metals should out perform every other investment class, because gold will always pace with the inflation (over a long enough window of time). Hyperinflation means hyper gains in gold relative to other asset classes. In a true deflation, where the value of fiat is increasing (supply of fiat is decreasing and/or demand increasing), then gold could decline in value, but we by no means have that, as all major fiats of world are being debased at double-digit rates, and demand for dollars should decrease precipitiously as global trade in dollars abates.

So one aspect of my initial thesis is dubious, in that buy & hold works for stable large caps, but I was correct that it is not very lucrative. It is like being average in society. And gold is an even better buy & hold asset during times of hyperinflation (when inflation is not successfully obscured from the general public). And regarding stocks, the only way to get ahead of average is by being earlier in wave of influx into a stock, or by owning a company that truely grows faster than people expected it to when you bought it. Who is smart enough to pick these stocks and who is just riding the wave or creating their own waves? I think it is instructive to view a stock promoter's performance on all his/her picks, not just while he/she held them but what they did after he/she sold them. A good performing (low risk, high reward) pick would be one that continues to significantly outgrow inflation even after sold by the promoter, not one with a stock price that returns to below the price the promoter initially recommended buying. And this is the metric by which I will judge any person who promotes stocks. I think it will be very sobering for me.

I set out to start some preliminary research on whether this theory is true or not. I know Warren Buffet has mentioned Coca-Cola (NYSE:KO) as one of those type of companies he likes to buy and hold (forever is his preferred holding time). Yahoo Finance reports the share price was 1.98 on January 2, 1962. I plugged this into the ShadowStats.com Inflation Calculator (using the SGS adjustments for correctness), I see the inflation adjusted price as of Sept, 2008 is $41.25 ($14.44 for incorrect BLS inflation). I see the share price today hit $41.50.

So all the price gains in Coca-Cola stock since 1962 have been due to inflation. No stockholder has made a real inflation-adjusted penny in equity in Coca-Cola in 46 years. I have read that Coca-Cola pays a dividend of about 2 - 4% per year, which I bet just about has kept up with world population growth since 1920. The point being that the investment would take about 25 years to double, adjusted to inflation.

Gold since it was un-pegged from a govt mandated price in 1971 of $40.80, has a inflation adjust price as of Sept. 2008 of $640, yet recently gold has been between $750 to $950. However, a 3% inflation adjusted annual yield would be $1911. So clearly gold is under performing Coca-Cola thus far.

Thus clearly Coca-Cola has thus far been a superior investment than gold, yet Coca-Cola still has not been a fabulous investment so far during my lifetime. But physical gold in my hands, has less risk than Coca-Cola, because it can't nationalized, frozen, nor debased with hyperinflation. I pay for this lowered risk, by expecting gold not to yield anything but keep pace with inflation, which it has done.

But when the govt is hyperinflating, as they are now, then precious metals should out perform every other investment class, because gold will always pace with the inflation (over a long enough window of time). Hyperinflation means hyper gains in gold relative to other asset classes. In a true deflation, where the value of fiat is increasing (supply of fiat is decreasing and/or demand increasing), then gold could decline in value, but we by no means have that, as all major fiats of world are being debased at double-digit rates, and demand for dollars should decrease precipitiously as global trade in dollars abates.

So one aspect of my initial thesis is dubious, in that buy & hold works for stable large caps, but I was correct that it is not very lucrative. It is like being average in society. And gold is an even better buy & hold asset during times of hyperinflation (when inflation is not successfully obscured from the general public). And regarding stocks, the only way to get ahead of average is by being earlier in wave of influx into a stock, or by owning a company that truely grows faster than people expected it to when you bought it. Who is smart enough to pick these stocks and who is just riding the wave or creating their own waves? I think it is instructive to view a stock promoter's performance on all his/her picks, not just while he/she held them but what they did after he/she sold them. A good performing (low risk, high reward) pick would be one that continues to significantly outgrow inflation even after sold by the promoter, not one with a stock price that returns to below the price the promoter initially recommended buying. And this is the metric by which I will judge any person who promotes stocks. I think it will be very sobering for me.

Gambler's Fallacy

Gambler's Fallacy

Shelby wrote:...I think it is instructive to view a stock promoter's performance on all his/her picks, not just while he/she held them but what they did after he/she sold them. A good performing (low risk, high reward) pick would be one that continues to significantly outgrow inflation even after sold by the promoter, not one with a stock price that returns to below the price the promoter initially recommended buying. And this is the metric by which I will judge any person who promotes stocks. I think it will be very sobering for me.

This is to combat the Gambler's Fallacy:

http://skepdic.com/gamblers.html

...gambler's fallacy is the mistaken notion that the odds for something with a fixed probability increase or decrease depending upon recent occurrences...

In other words, some years ago there were, as there always are in any given point in time, there were many people making many varied bold predictions and investments, different from each other, but overall covering the gamut of possible outcomes. As is always the case for "hole in one" type boldness, most of them failed, but there are always in any given outcome, a few who got lucky, maybe even made $millions and started to believe them self to be omniscient. Such a deluded gambler will likely deny his/her lack of omniscience until the over-time average odds of the casino have humbled the gambler into destitution.

Caveat emptor.

How YOU are programmed to miss the obvious

How YOU are programmed to miss the obvious

Watch the video, and keep your eye on the ball, if you can:

http://www.free4him.org/dougblog/?p=306#more-306

The ties into my prior 2 posts in this thread.

Btw, I failed the test, because I let my emotions get involved, as you will see. Maybe also because I only have vision in 1 eye.

I think this explains why people missed this credit implosion, and continue to miss how much worse it will get.

Thanks to Jeremy for posting this to the Hommel forum, wish he had posted in this forum as well.

http://www.free4him.org/dougblog/?p=306#more-306

The ties into my prior 2 posts in this thread.

Btw, I failed the test, because I let my emotions get involved, as you will see. Maybe also because I only have vision in 1 eye.

I think this explains why people missed this credit implosion, and continue to miss how much worse it will get.

Thanks to Jeremy for posting this to the Hommel forum, wish he had posted in this forum as well.

Last edited by Shelby on Wed Oct 29, 2008 3:18 am; edited 2 times in total

re: How YOU are programmed to miss the obvious

re: How YOU are programmed to miss the obvious

Shelby wrote:Watch the video, and keep your eye on the ball, if you can:

http://www.free4him.org/dougblog/?p=306#more-306

The ties into my prior 2 posts in this thread.

Btw, I failed the test, because I let my emotions get involved, as you will see. Maybe also because I only have vision in 1 eye.

I think this explains why people missed this credit implosion, and continue to miss how much worse it will get.

Thanks to Jeremy for posting this to the Hommel forum, wish he had posted in this forum as well.

You beat me to the punch. i just signed in to post this.

Last edited by Shelby on Wed Oct 29, 2008 3:18 am; edited 3 times in total (Reason for editing : corrected the Subject to match prior post, since same topic; thanks again Jeremy. very much. Excellent.)

Jeremy- Posts : 23

Join date : 2008-10-23

re: How YOU are programmed to miss the obvious

re: How YOU are programmed to miss the obvious

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25119820

I programmed that rule automatically into http://Miningpedia.com, but the problem is that our projections may be wildly inaccurate in either direction. The more stable the business, then usually the lower the standard deviation of the forecast, but also usually the higher the P/E ratio and thus already fully valued and perhaps only keeps up with inflation in the case of Coca-Cola example:

https://goldwetrust.forumotion.com/general-f1/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11.htm#17

So again I maintain as in the linked post above, we rarely beat the market, and we do not get ahead in stock market, we just ride the population growth rate and inflation. Only investors who buy based on inside or intimate knowledge of a business, typically do better over the long-haul, e.g. Warren Buffet.

Face it, we are mostly just speculators, gambling with the money we made from our brow in real work.

Btw, I assert it is this reality of risk, and hard work it takes to invest to be better than average, that drives so many people to bonds (usury), which is what drives a paper fiat economy via credit and eventually into the ground every 100 years or so. There have been 100s of paper fiat currencies, and they all ended up at their intrinsic value of zero after usually much less than a few decades. This is a sad fact of reality of the way economics works and some people even have a religious slant on that (but let's not go there as that is not focus of this forum).

Warren Buffet is not free to speak truth

Warren Buffet is not free to speak truth

Warren Buffet's major holdings all depend on favors from the establishment, so you can ignore everything he is saying lately because he is forced to say these things in order to keep the establishment happy.

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aMFK0L7_PtRA

http://www.nypost.com/seven/11182008/business/governments_cant_handle_global_run_on_go_139306.htm?page=0

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aMFK0L7_PtRA

Didn't American Express just recently get special permission from the govt + Fed, to become a bank so they can borrow a Fed Funds low interest rates directly from the Fed?

I remember writing when he made those agreements in 2007, that Buffet was beholden to the establishment now.

Buffet is not a free man.

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aMFK0L7_PtRA

..Wells Fargo & Co., Berkshire's No. 2 investment...

http://www.nypost.com/seven/11182008/business/governments_cant_handle_global_run_on_go_139306.htm?page=0

...investigate whether some government officials who formerly worked at Goldman let their "relationships" cloud their judgment during the merger of Wells Fargo and Wachovia...

...Specifically, Grassley is concerned about a tax code change that paved the way for the acquisition of Wachovia by Wells Fargo...

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aMFK0L7_PtRA

...American Express Co., the credit-card company that is one of Berkshire's top 10 stock holdings..

Didn't American Express just recently get special permission from the govt + Fed, to become a bank so they can borrow a Fed Funds low interest rates directly from the Fed?

...$37 billion bet on world equity values more than a decade from now. Buffett sold contracts to undisclosed counterparties for $4.85 billion protecting the buyers against declines in four stock indexes including the S&P 500.

Under the agreements, Berkshire will pay as much as $37 billion if, on specific dates beginning in 2019, the indexes are below the point where they were when he made the agreements...

I remember writing when he made those agreements in 2007, that Buffet was beholden to the establishment now.

...The cost to protect against Berkshire being unable to meet its debt payments, based on credit-default swaps, has more than tripled in two months.

The swaps jumped to 475 basis points today from 129 points two months ago, according to CMA Datavision. That translates to $475,000 a year to protect $10 million for five years...

Buffet is not a free man.

Bond Hell on the horizon

Bond Hell on the horizon

http://www.kitco.com/ind/willie/nov262008.html

Jim Willie - 'Golden Jackass' wrote:...A VERY QUEER ANOMALY

We are working toward a nasty climax of historic proportions. Notice that the US Treasury Bill has an artificially high price, with staggering huge volume, which is backwards. This condition defies Mother Economic Nature. Notice that gold has an artificially low price on the paper contracts, with staggering huge demand for physical metal, which is also backwards. This condition defies Mother Economic Nature.

The US Treasurys, given the staggering high volume, should be valued lower. The gold bullion, with its staggering high demand, should be valued higher. Something must break, and break soon. Regard these two anomalies as temporary distress symptoms of ass-backward price mechanisms. The natural tendencies of man, full of human emotions like vengeance and retribution, will soon be unleashed to correct the PHONY HIGH USTBILL PRICE AND PHONY LOW GOLD PRICE. All kinds of key evidence points to a COMEX default in December, discussed in the November Gold & Currency Report. The keys are in the Open Interest, which for gold is collapsing. But the December OI is holding up at relatively high levels. The interpretation from Mr Market, who is a distant cousin of Mother Economic Nature, is “The paper gold market is flawed, and people want no part of it. What physical gold becomes available is being grabbed immediately.”...

Here is what I had written about this recently:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-15.htm#351

Shelby wrote:....So the more important question is what does the world demand next?

In my view, the world (including China & Russia) will resist a hard money (e.g. gold & silver) standard for as long as possible, as it is not in any one's interest. And thus there will be a dearth of hard assets (resources), by the time the world finally goes kicking and screaming to hard capital money.

So the relevant question is not inflation or deflation, as these are relative terms that can never have precise meanings when on a rubberband credit system.

The relevant question is, how far will the world go in malinvestment before it returns to hard money?

The longer the delay, the more astronomical the value of hard assets will be in the end. And thus the more dangerous it will be to hold/own them...

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-15.htm#438

Shelby wrote:....The big question is how long does it take to occur.

The hyperinflation will manifest as soon as the world's bond holders become aware that they are being debased at double-digit negative real interest rates (see the money base inflation chart above, note M3 inflation is still in double digits as well). It seems that bond holders are currently focused on the imploding credit, not on the money supply. It is going to be whiplash in the bond markets sometime in 2009 or 2010. Then all hell will break lose...

Bet on the reversal of the bond bubble?

Bet on the reversal of the bond bubble?

Seems to me if someone wants leverage at this time, more than just buying physical gold & silver (which will inherently leverage the bond reversal), they would want to leverage short on Treasuries, or derivative interest rate arbitrage opportunities:

http://www.gold-eagle.com/editorials_08/baltin121208.html

http://www.frontlinethoughts.com/article.asp?id=mwo121208

http://www.gold-eagle.com/editorials_08/morgan121208.html

However, I am staying away from that, as it is not risk free, and the hardest thing now is to predict the timing and specificity of "Black Swan" events. Also it may be hard to get more leverage on margin, as credit is harder to find.

http://www.gold-eagle.com/editorials_08/baltin121208.html

http://www.frontlinethoughts.com/article.asp?id=mwo121208

http://www.gold-eagle.com/editorials_08/morgan121208.html

...Jimmy Rogers states, "I'm now selling long-term U.S. government bonds short. That's the last bubble I can find in the U.S. I cannot imagine why anybody would give money to the U.S. government for 30 years for less than a 4% yield. I certainly wouldn't. There are going to be gigantic amounts of bonds coming to the market, and inflation will be coming back."...

However, I am staying away from that, as it is not risk free, and the hardest thing now is to predict the timing and specificity of "Black Swan" events. Also it may be hard to get more leverage on margin, as credit is harder to find.

Mainstream people are starting to jump from stocks!!

Mainstream people are starting to jump from stocks!!

> remember i ask you about my friends stocks? i guess she want to get out

> from that stocks and get a better one...i told her that you will

> tell me or you to buy silver coins and keep it....should i tell her

> that???

Let her read this.

If she thinks oil price will go back up, she can buy the stock:

USO

If she thinks the silver price will go up, she can buy stock:

SLV

Those are supposed to track the prices of oil and silver, but the problem is that if things gets really bad, then Obama may be forced to block the selling of stocks and money could get stuck. Also both of those ETF stocks are known to not really have the oil and silver, thus they are going to fail in future (but maybe not for year or more). She could buy those temporarily, but don't hold them more than several months and be ready to get out them.

I am getting ready to launch a new business:

CoinATM.com

People will be able to hold real silver and gold metal at a vault company by simply clicking a button and wiring money. Then at any time, they can take delivery of the actual silver and gold bars, or they can take delivery of 1oz coins of silver if they prefer. These means they are sure to be able to get their money no matter how bad things get.

I suggest your friend hold some of each.

Also many of the commodity stocks will rebound and do well, while the general stocks will continue to crash. I would suggest top/largest gold stocks, but she has to be careful because some of the gold mining commpanies are a fraud, such as Barrick. I think Yamana and Agnico-Eagle are good ones, but I haven't looked at their charts lately to see if they are at good buying points. Producer stocks are more risky. Maybe she should stick with buying the actual commodities, such as oil, gold, and silver. There will be a massive fight now in the world for resources, as China and India will dehitch from the US dollar, the US will fall apart.

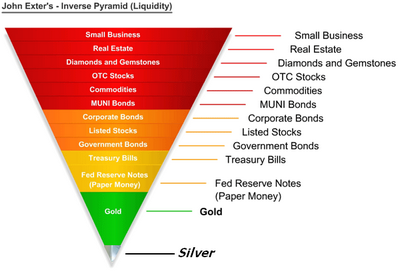

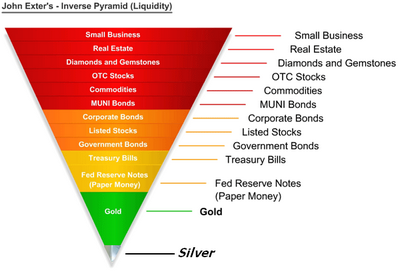

We have been moving down Exter's pyramid. Google it "Exter's Pyramid". Everyone just moved to Tbonds which caused the dollar to go up. The next big move after March (or now!) is to gold and silver. Silver will go up more than gold (but it also goes down more after it peaks). Oil should also rebound because billions of people in the world are moving from farms to modern life in Asia and Latin America. The deflation we are seeing is only in debt-inflated assets like housing and american luxury life. The developing world is dehitching now.

Buy "e-estate" instead of real estate?

Buy "e-estate" instead of real estate?

When the fiat economy crashes and gold will buy the DOW, perhaps the dot.com names will see faster appreciation from their bottoms than real estate. For example, many of the 4 letter .com names (e.g. Zaag.com) are for sale right now for about $5000, but I bet 1oz of gold will buy them easily in few years.

Then contemplate this about real estate versus "e-estate":

https://goldwetrust.forumotion.com/precious-metals-f6/how-will-we-physically-trade-gold-silver-at-5000-500-t61-90.htm#1094

Then contemplate this about real estate versus "e-estate":

https://goldwetrust.forumotion.com/precious-metals-f6/how-will-we-physically-trade-gold-silver-at-5000-500-t61-90.htm#1094

My rebuttal on gold not being a contrarian play now at $1000

My rebuttal on gold not being a contrarian play now at $1000

I am rebutting (responding) to this article:

http://www.investmentu.com/IUEL/2009/February/shorting-gold2.html?o=1652087&u=7445297&l=1605124

Here is my logic:

Thanks for your thought provoking article.

But consider that the 30 million oz in GLD is only $30 billion. Figure there are maybe 100 million global investors with access, so $300 each on average. Is that saturation in a "death of financial system" scenario? They've got $trillions in net worth in fiat.

Short-term correction yes. Secular bubble for gold, no. The move up has been a little too fast, correction to give time to build up more participants from the next wave of fear and the eventual run from long-dated Treasuries once inflation heats up. And that means other investments may have more upside than gold which just peaked at all time highs in most currencies, specifically silver which is still way off it's recent highs even in other currencies.

Of course there are better shorter term speculations than gold (e.g. shorting long-dated treasuries if you know what you doing, picking small caps, etc), because gold's role is to be a smooth interperolation of the transformation of the current global financial system. Other things are priced relative to gold, and thus will have more price action, including fiat itself.

But long term, gold is the currency, always has been, always will be. And if you want a play on that with more leverage, then silver leaves the monetary world periodically but always comes back with a venegence.

It depends on your investment goals. For me, I need my savings to represent stored labor, not extract more labor from me, chasing investments 24 x 7.

In my current thinking, the simplest play right now, is buy silver and sit back. It is coming back to play it's historical role as money, as it always does.

Why? Because the financial system is a Ponzi system in extremis (read the logic at VaultOz.com -- apologies for the plug because that site is not taking orders yet).

I make my living programming software, not as an investor. And I want it to remain that way. I want to protect my stored past labor. And equities have not out performed generally over time.

I set out to start some preliminary research on whether this theory is true or not. I know Warren Buffet has mentioned Coca-Cola (NYSE:KO) as one of those type of companies he likes to buy and hold (forever is his preferred holding time). Yahoo Finance reports the share price was 1.98 on January 2, 1962. I plugged this into the ShadowStats.com Inflation Calculator (using the SGS adjustments for correctness), I see the inflation adjusted price as of Sept, 2008 is $41.25 ($14.44 for incorrect BLS inflation). I see the share price today hit $41.50.

So all the price gains in Coca-Cola stock since 1962 have been due to inflation. No stockholder has made a real inflation-adjusted penny in equity in Coca-Cola in 46 years. I have read that Coca-Cola pays a dividend of about 2 - 4% per year, which I bet just about has kept up with world population growth since 1920. The point being that the investment would take about 25 years to double, adjusted to inflation.

Gold since it was un-pegged from a govt mandated price in 1971 of $40.80, has a inflation adjust price as of Sept. 2008 of $640, yet recently gold has been between $750 to $950. However, a 3% inflation adjusted annual yield would be $1911. So clearly gold is under performing Coca-Cola thus far.

Thus clearly Coca-Cola has thus far been a superior investment than gold, yet Coca-Cola still has not been a fabulous investment so far during my lifetime. But physical gold in my hands, has less risk than Coca-Cola, because it can't nationalized, frozen, nor debased with hyperinflation. I pay for this lowered risk, by expecting gold not to yield anything but keep pace with inflation, which it has done.

The following comment is thought-provoking:

Especially if viewed in context of this commentary:

http://www.gold-eagle.com/editorials_08/ash030109.html

And the scenario that could possibly make gold top temporarily, would be rising long-dated treasury interest rates (as gold performs better under negative real interest rates, although an exodus from Treasuries has to go some where and gold is next lower on Exter's Pyramid), as people abandon them in hyperinflation for either higher returns in equities and dividends (and possibly commodities) and/or safety of short-term 0% interest treasuries (you can hold them to maturity so no capital loss). So maybe shorting long-dated Treasuries is a good diversification right now. But keep in mind that is speculative because it depends on the velocity of money. We do know Paul Volcker is in there, and he knows to raise interest rates and has said the biggest mistake made in 1970s was not capping the gold price. But what will long-dated Treasury interest rate rises do to the financial system? Massive defaults or does that get the credit moving again because there is enough return on risk? Seems that fits into the game plan of forcing the masses to a socialized economy. This could also send the dollar up (appears to be nearing a break up or down at 88 resistance) as EU has to cut interest rates to stop disintegration of their union. Many questions that I don't have time to develop scientifically thorough answers to. I like silver on any dip below $12. The worst downside is probably $9, and the upside is tremendous, especially if holding to 2010 when any dip in gold will be finished.

Consult your own professional advisor, and do not hold me responsible for anything you do after reading my personal opinions above.

This response may appear as an editorial published at financialsense.com and gold-eagle.com

All the best,

Shelby

http://www.investmentu.com/IUEL/2009/February/shorting-gold2.html?o=1652087&u=7445297&l=1605124

Here is my logic:

Thanks for your thought provoking article.

But consider that the 30 million oz in GLD is only $30 billion. Figure there are maybe 100 million global investors with access, so $300 each on average. Is that saturation in a "death of financial system" scenario? They've got $trillions in net worth in fiat.

Short-term correction yes. Secular bubble for gold, no. The move up has been a little too fast, correction to give time to build up more participants from the next wave of fear and the eventual run from long-dated Treasuries once inflation heats up. And that means other investments may have more upside than gold which just peaked at all time highs in most currencies, specifically silver which is still way off it's recent highs even in other currencies.

Of course there are better shorter term speculations than gold (e.g. shorting long-dated treasuries if you know what you doing, picking small caps, etc), because gold's role is to be a smooth interperolation of the transformation of the current global financial system. Other things are priced relative to gold, and thus will have more price action, including fiat itself.

But long term, gold is the currency, always has been, always will be. And if you want a play on that with more leverage, then silver leaves the monetary world periodically but always comes back with a venegence.

It depends on your investment goals. For me, I need my savings to represent stored labor, not extract more labor from me, chasing investments 24 x 7.

In my current thinking, the simplest play right now, is buy silver and sit back. It is coming back to play it's historical role as money, as it always does.

Why? Because the financial system is a Ponzi system in extremis (read the logic at VaultOz.com -- apologies for the plug because that site is not taking orders yet).

I make my living programming software, not as an investor. And I want it to remain that way. I want to protect my stored past labor. And equities have not out performed generally over time.

I set out to start some preliminary research on whether this theory is true or not. I know Warren Buffet has mentioned Coca-Cola (NYSE:KO) as one of those type of companies he likes to buy and hold (forever is his preferred holding time). Yahoo Finance reports the share price was 1.98 on January 2, 1962. I plugged this into the ShadowStats.com Inflation Calculator (using the SGS adjustments for correctness), I see the inflation adjusted price as of Sept, 2008 is $41.25 ($14.44 for incorrect BLS inflation). I see the share price today hit $41.50.

So all the price gains in Coca-Cola stock since 1962 have been due to inflation. No stockholder has made a real inflation-adjusted penny in equity in Coca-Cola in 46 years. I have read that Coca-Cola pays a dividend of about 2 - 4% per year, which I bet just about has kept up with world population growth since 1920. The point being that the investment would take about 25 years to double, adjusted to inflation.

Gold since it was un-pegged from a govt mandated price in 1971 of $40.80, has a inflation adjust price as of Sept. 2008 of $640, yet recently gold has been between $750 to $950. However, a 3% inflation adjusted annual yield would be $1911. So clearly gold is under performing Coca-Cola thus far.

Thus clearly Coca-Cola has thus far been a superior investment than gold, yet Coca-Cola still has not been a fabulous investment so far during my lifetime. But physical gold in my hands, has less risk than Coca-Cola, because it can't nationalized, frozen, nor debased with hyperinflation. I pay for this lowered risk, by expecting gold not to yield anything but keep pace with inflation, which it has done.

The following comment is thought-provoking:

...On gold, I said it would rise, as it has. I had the timing accurate. I said EVERYONE will be talking, and buying, gold. Then it will drop, bottoming in June 2010…a higher bottom. Around $550 to $650. Then will begin an erratic rise, that will become steeper and accelerated from 2011 till peaking in 2013. That will be the point of global depression, marked by inflation here, and deflation abroad…the opposite of the Great Depression. In 2013 will be the start of a 3 year world war. Again…all these were said in 1999. Also, I stated that people that are jumping into gold en-masse would lose their shorts. And when it becomes time to really take the plunge; no one will listen. Much like in 1976, June, when I said that gold would go to $300 to $400 for certain, maybe even $500 to $600. It was $120 at that time, and 20 major publications came out saying that gold was dead...

Especially if viewed in context of this commentary:

http://www.gold-eagle.com/editorials_08/ash030109.html

And the scenario that could possibly make gold top temporarily, would be rising long-dated treasury interest rates (as gold performs better under negative real interest rates, although an exodus from Treasuries has to go some where and gold is next lower on Exter's Pyramid), as people abandon them in hyperinflation for either higher returns in equities and dividends (and possibly commodities) and/or safety of short-term 0% interest treasuries (you can hold them to maturity so no capital loss). So maybe shorting long-dated Treasuries is a good diversification right now. But keep in mind that is speculative because it depends on the velocity of money. We do know Paul Volcker is in there, and he knows to raise interest rates and has said the biggest mistake made in 1970s was not capping the gold price. But what will long-dated Treasury interest rate rises do to the financial system? Massive defaults or does that get the credit moving again because there is enough return on risk? Seems that fits into the game plan of forcing the masses to a socialized economy. This could also send the dollar up (appears to be nearing a break up or down at 88 resistance) as EU has to cut interest rates to stop disintegration of their union. Many questions that I don't have time to develop scientifically thorough answers to. I like silver on any dip below $12. The worst downside is probably $9, and the upside is tremendous, especially if holding to 2010 when any dip in gold will be finished.

Consult your own professional advisor, and do not hold me responsible for anything you do after reading my personal opinions above.

This response may appear as an editorial published at financialsense.com and gold-eagle.com

All the best,

Shelby

Time to make our own MLM investment?

Time to make our own MLM investment?

Shelby wrote:I have this theory that the stock market basically exists to lets a small group of insiders cash out quickly the lifetime POTENTIAL value of the future company profit, leaving the stockholders holding the bag for all the years or decades of risk and opportunity cost. Thus I think the long-term hold strategy does not pay...

But if the bag is physical silver, then the last entrants to the pyramid will still have real money:

https://goldwetrust.forumotion.com/goldwetrustcom-f1/which-logo-is-best-for-new-coinatmcom-t85-45.htm#1136

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25475371

The Silver Pyramid

The Silver Pyramid

I have registered the domains:

agpyramid.com (silverpyramid.com is taken)

reapsilver.com

silverreap.com

gainsilver.com (silvergain.com is taken)

reapgold.com

Registered these to stop copycats:

reapbullion.com

bullionpyramid.com

gainbullion.com

growbullion.com

I did not register:

sowsilver.com (sosilver.com is taken)

harvestsilver.com

silvergravy.com

Perhaps I discovered the Silver Pyramid (see link in prior post), I imagine it grows like a profit virus, faster than the bankers can crash and steal the economy with TARPs, capturing the losses of the implosion as profit, forcing hyperinflation instead of the banker preference for totalitarian deflation, eating all the toilet paper money as it grows, freeing the people from the artificial slavery which is nothing more than a mirage concocted by mass media mind programming and mind manipulation.

Imagine Exter's Inverted Pyramid, where the very tip is silver (below gold), and that tip is (actually a very small inverted pyramid) growing faster than the gold pyramid at bottom, and both are racing upwards to consume all the paper trash above them on the pyramid:

Join the Silver Pyramid and watch all the fabricated problems of the world go POOF and vanish into the diabolical imagination of the paper money masters.

All investments are pyramids (early investors profit off later investors), Exter's inverted pyramid is actually just silver and gold pyramid growing in size and sucking in all the worthless paper value. The difference is the metals pyramid is always 100% based (not fractionally backed) by real value, so the last investors still get what they paid for.

agpyramid.com (silverpyramid.com is taken)

reapsilver.com

silverreap.com

gainsilver.com (silvergain.com is taken)

reapgold.com

Registered these to stop copycats:

reapbullion.com

bullionpyramid.com

gainbullion.com

growbullion.com

I did not register:

sowsilver.com (sosilver.com is taken)

harvestsilver.com

silvergravy.com

Perhaps I discovered the Silver Pyramid (see link in prior post), I imagine it grows like a profit virus, faster than the bankers can crash and steal the economy with TARPs, capturing the losses of the implosion as profit, forcing hyperinflation instead of the banker preference for totalitarian deflation, eating all the toilet paper money as it grows, freeing the people from the artificial slavery which is nothing more than a mirage concocted by mass media mind programming and mind manipulation.

Imagine Exter's Inverted Pyramid, where the very tip is silver (below gold), and that tip is (actually a very small inverted pyramid) growing faster than the gold pyramid at bottom, and both are racing upwards to consume all the paper trash above them on the pyramid:

Join the Silver Pyramid and watch all the fabricated problems of the world go POOF and vanish into the diabolical imagination of the paper money masters.

All investments are pyramids (early investors profit off later investors), Exter's inverted pyramid is actually just silver and gold pyramid growing in size and sucking in all the worthless paper value. The difference is the metals pyramid is always 100% based (not fractionally backed) by real value, so the last investors still get what they paid for.

Buffet does not matter to you

Buffet does not matter to you

http://financialsense.com/fsu/editorials/stathis/2009/0416.html

...One way to see through the smoke is to realize that what Buffett buys has no bearing on you. Certainly, Buffett is great value investor. But once you understand a few things, you might not be that impressed by him. You see, Buffett invests in businesses that generate large cash flows. This provides Berkshire Hathaway with cash on-hand to take advantage of buying opportunities. Every time his favorite stocks go down he buys more, lowering the cost basis. But he doesn’t buy risky stocks. He doesn’t need to. He buys well-known, conservative blue chips. He doesn’t know how to use market timing strategies. He doesn’t need to (although he would be a much better investor). He just buys more of his favorite gems when they decline in price.

Buffett might buy Johnson & Johnson at $70. You might follow his lead and buy some for yourself. But what happens when the stock falls to $35? Buffett will be able to buy enough to lower his cost basis to $36 if he wants. You can’t do that. Even if you had enough cash to do it, it’s unlikely you would because you hadn’t prepared for that possibility in advance.

The insurance industry is one of the best cash flow machines in the world. Now you know why Berkshire owns Geico. This cost-basis lowering approach is similar to that used by large mutual funds and pensions. Similar to Buffett, they also focus on buying large, conservative companies. Mutual fund managers aren’t able to get out of the market during sell-offs. In other words, they really don’t have any ways to reduce market risk. Instead, they use their continuous supply of cash to lower the cost basis of their holdings. During a bull market anyone can do well using that strategy. All it takes is a large pool of cash, some common sense and a conservative approach. The only problem is this strategy can be disastrous during bear markets because their supply of cash declines because investors tend sell.

Buffett also gets exclusive investment deals. Instead of buying a stock, he might purchase the convertible bonds with warrants. This is usually a much better deal than a direct purchase of the common stock. It certainly has less risk. Or he might pay below-market rates for securities. These transactions are done privately or out of the market, shielding these opportunities from individual investors.

Buffett also buys entire companies or takes controlling interests so he can influence managerial decisions. That makes Buffett an active investor because he has direct control over the companies he invests in. We can’t do that. We are passive investors. Therefore, it’s critical for us to actively manage our securities positions. One of the best ways to do that is to reduce market risk by selling in the early stages of a bear market.

Finally, what Buffett invests in might not be suitable for you or me because our investment objectives, horizons and financial resources are different. If you had an infinite investment horizon and hundreds of businesses that generated huge cash flows, you’d probably deliver nice returns if you were offered exclusive deals and used dollar-cost averaging for a portfolio of safe stocks like Coca-Cola, Procter & Gamble and Johnson & Johnson.

All of these considerations aside, let’s concede that Buffett is a great value investor. But he’s not so good at tech investing, derivatives, foreign currencies, emerging markets. And his investment management skills are limited to diversification and lowering the cost basis of his positions. He certainly doesn’t have expertise in shorting or market timing techniques. But remember, he doesn’t have to.

In all fairness, Buffett is very good at distressed securities analysis. Most important, he knows what he does not know and (usually) stays away from uncertainty. But even Buffett has made some big investment mistakes, as history shows. He’s only human after all. But there is one very valuable thing to learn from Buffett. Stick with what you’re good at and don’t wander into territories you’re less knowledgeable in. If you’re able to do that, you’ll have many more winners than losers over time. This approach will help you develop consistency – one of the keys to investment success.

If you have confidence in Buffett, just buy Berkshire Hathaway, plain and simple. I have no interest in Berkshire for a very good reason. It’s a value fund but it doesn’t distribute cash dividends. This violates one of the basic tenants of investing...

Time to buy precious metal stocks?

Time to buy precious metal stocks?

> What is your opinion on investing in gold & silver stocks at this point?

>

...

>

> Will shares of metal stocks hold up during the coming mayhem?

>

> Just trying to figure out what to do besides buying physical.

I see that precious metals stocks have being moving up lately (I was finally able to cash out of TK.V and NW.V), which is getting people to think that precious metal stocks may jump back to their pre-2007 levels, for some potentially spectacular gains.

I can not possibly give a completely thorough and balanced response to this, due to limitations of the time and to minimize verbosity. So I will just give my summary opinions, and fail to mention some counter-logic.

First, please re-read this entire thread, and also these specific posts from 2 threads:

https://goldwetrust.forumotion.com/stocks-f2/junior-mining-companies-t15.htm#544 (mining stocks performed horrible in Great Depression)

https://goldwetrust.forumotion.com/stocks-f2/junior-mining-companies-t15.htm#392 (come back to stocks when dollar is toasted globally)

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11.htm#17 (read entire thread, stocks are mathematical theft mechanism)

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11.htm#30 (Gambler's fallacy is that there will always be examples to make one jealous, but statistically these successes are not what happened to most people who tried)

If you simply want more leverage to the metal prices (risk cuts both ways, as mining leverage can also!), then you buy the AGQ, then you avoid all the numerous additional risks of failure/theft of the mining concern (mine the shareholders). If you think the Comex will bust, thus afraid to hold AGQ, then I think you should be just as afraid of entire brokerage failure and/or tax changes/theft. The concept of buy and hold long-term of stocks is nonsense. All investments (even bullion) are a wasting asset, where you must extract return and move on with timing.

So the short answer is that nothing is free. If you want to gain leverage, you need to have additional insight/work/effort. And it is hard to find good risk vs. reward advantanges. There is no free lunch.

I am dabbling in a bit of speculation with the AGQ, but I know if I play with fire too long, I will get burned. So I will only make a near sure bet once and a while, and I won't gain that much overall.

This is why Wallstreet steals. The only way to get more wealthy is by effort (intelligience) or theft. WHen one invests in real businesses, it takes effort (intelligience). This is why Buffet has become corrupted as his capital has grown too large. He has no choice but to buy into anti-Biblical, theft (socialism decay) businesses (e.g. insurance business, which requires licenses from TPTB).

A true diversification (hedge) away from bullion, would be a business you invest in personally and have personal effort/intelligience in. Mining stocks compound the risk of bullion.

As for timing, I think later this year comes another downleg in the stock market, and I think the mining shares will not be entirely immune, especially to the degree they have been run up exponentially before them. The time to buy mining stocks was the same time to buy silver, late last year at $9. If you bought the AGQ then, you would be up 155% (2.5x value).

re: Time to buy precious metal stocks?

re: Time to buy precious metal stocks?

Shelby wrote:...As for timing, I think later this year comes another downleg in the stock market, and I think the mining shares will not be entirely immune, especially to the degree they have been run up exponentially before them. The time to buy mining stocks was the same time to buy silver, late last year at $9. If you bought the AGQ then, you would be up 155% (2.5x value).

http://www.gold-eagle.com/editorials_08/brochert053109.html

...buy and hold a basket of Gold mining stocks or buy a Gold stock mutual fund or ETF (like GDX). There's only one catch, and it's a minor one: you should wait until the price comes down from current lofty levels...

Valuations (P/E ratios) are not a valid short-term trading timing indicator

Valuations (P/E ratios) are not a valid short-term trading timing indicator

http://www.gold-eagle.com/gold_digest_08/hamilton061209.html

Especially when we have already hyperinflation:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-165.htm#1494

...this chart, it utterly shatters the popular notion among traders today that a stock bear can't end until we see 7x earnings. While a secular bear won't end until such low valuations are seen, cyclical bears can end regardless of where valuations happen to be because valuations are not what drive these cyclical moves within secular trends...

Especially when we have already hyperinflation:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-165.htm#1494

Buffet bets that S&P index will outperform stock picking over the long-term

Buffet bets that S&P index will outperform stock picking over the long-term

Buffet agrees with the theories I made at the start of this thread back in 2008 and where I explained Gambler's Fallacy:

http://money.cnn.com/2010/04/27/news/companies/buffett_protege.fortune/index.htm

Buffet invests for income and compounding, not for the gain in share price:

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11-15.htm#1323

In short, Buffet bets that only income and compounding win in long-term (not timing asset selection or equity value rise and fall), and that is why he says his favorite holding time is "forever". This is why he does not favor holding gold as major investment.

http://money.cnn.com/2010/04/27/news/companies/buffett_protege.fortune/index.htm

Buffet invests for income and compounding, not for the gain in share price:

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11-15.htm#1323

In short, Buffet bets that only income and compounding win in long-term (not timing asset selection or equity value rise and fall), and that is why he says his favorite holding time is "forever". This is why he does not favor holding gold as major investment.

Gambling vs. Speculation (no difference)

Gambling vs. Speculation (no difference)

http://investophoria.blogspot.com/2010/04/opportunity-in-making.html?showComment=1272817659642#c8685869492571308973

http://investophoria.blogspot.com/2010/04/opportunity-in-making.html?showComment=1272818293287#c2268155056676879328

http://investophoria.blogspot.com/2010/04/opportunity-in-making.html?showComment=1272818674383#c5201758785616856948

Shelby wrote:About gambling vs speculation, there is no mathematical distinction in these paper markets. And the inability to know this, is what suckers in many sheep for the slaughter by Wall street.

I will attempt to explain to you mathematically why any one who bets on Wall Street, is a loser in the long-run to the casino house.

In Las Vegas, the variables of a card game are deterministic (they were before they moved to multiple decks, shuffling the cards before each hand, etc), and if you were smart enough to count all the cards, then you were banned from the casino. Ditto on Wall street, if you are somehow able to count the probabilities (Martin Armstrong?), then you will be defeated in some other way (e.g. a planned take down at some point). But more salient, it is nearly impossible for you to count the probabilities in these markets, because the world is a very complex and random house.

There are those who think they have a formula, and they consistently are making say 20 - 40% per annum gains at this time. The problem with that is that the fiat is being debased at about the same rate, so they are not getting ahead. And worse, when the moment of truth comes, they won't be holding physical gold, and they will lose everything by decree, as will everyone else invested in the paper casino.

No I am sorry, nature will not reward you for the production of speculating on paper. And if we had time to do a thorough research paper on this, I could prove this to you mathematically.

You are chasing folklore, just as the banksters want you to do. You do not understand what Buffet knows, which is only income from production and compounding, will truely amass wealth. He started as a newspaper boy and he does not invest in speculations. Unfortunately most are not smart enough to understand this.

http://investophoria.blogspot.com/2010/04/opportunity-in-making.html?showComment=1272818293287#c2268155056676879328

Shelby wrote:Sorry for triple post, I do care about the gold bugs, and I urge them to study and think about the Gambler's Fallacy:

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11-15.htm#2967

And to consider what I wrote above. All the traders are capturing mathematically over the long-run is the debasement of the fiat. You do not earn real money (gold), by speculating in the paper casino (over the long-run, you might have a good year, then a bad year). If you can find one speculator with a consistent return above the true monetary inflation over many decades, then I will eat my words. I am not referring to speculations on real estate and hard assets (e.g. Doug Casey), those are investments. For example, if I can buy prime land near a city of 2 million people in Asia for $500 per acre, then that is not gambling. It is a fact of nature, that the land values much go up here.

http://investophoria.blogspot.com/2010/04/opportunity-in-making.html?showComment=1272818674383#c5201758785616856948

Shelby wrote:However if someone was buying copper right now, I would call that gambling, because it is dependent on China's bubble continuing. What I meant to write, is that buying highly undervalued tangible assets for the long-term holding, is not a speculation. Silver would be a prime example. But you must have a long-term view. Ditto gold. Ditto land in an overpopulated asian country that does not yet allow foreigners to buy land (if you are wise enough as to how to lock up this land).

Silver chart

Silver chart

Looks to me like it's getting ready to rumble. Point and figure bullish price objective is $29.

http://stockcharts.com/charts/gallery.html?$SILVER

http://stockcharts.com/charts/gallery.html?$SILVER

Jim- Posts : 963

Join date : 2008-10-23

Location : California

Gold bubble nonsense

Gold bubble nonsense

http://www.marketoracle.co.uk/Article22252.html#comment94196

Shelby wrote:Herb, the price of precious metals may dip (even severely), but the top of this secular bull market in PMs will not occur until the REAL interest rates are positive, which won't be until after the western economies implode:

http://www.marketoracle.co.uk/Article20327.html#comment94202

Go out into the street and do a survey of how many people own PHYSICAL gold and for that matter SILVER, and you find that less than 1 in 1000 own physical gold bullion and less than 1 in 10,000 own physical silver bullion. People own jewelry but in insignificant quantities relative to their networth.

Page 1 of 2 • 1, 2

Similar topics

Similar topics» **Silver**

» Inflation or Deflation?

» Ideas on how to get more cash to buy more precious metals

» Stocks to keep an eye on

» Market Comments & News

» Inflation or Deflation?

» Ideas on how to get more cash to buy more precious metals

» Stocks to keep an eye on

» Market Comments & News

Page 1 of 2

Permissions in this forum:

You cannot reply to topics in this forum