Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 12 of 24

Page 12 of 24 •  1 ... 7 ... 11, 12, 13 ... 18 ... 24

1 ... 7 ... 11, 12, 13 ... 18 ... 24

Dilution is not inflation (Saville's semantic confusion)

Dilution is not inflation (Saville's semantic confusion)

Regarding my prior post in this thread, the calculation for whether to buy gold or invest in business for income, should perhaps be the gold basis relative opportunity cost:

https://goldwetrust.forumotion.com/economics-f4/exponential-growth-t109.htm#1990

Saville explains correctly that the fiat system never has to stop diluting the value of our money:

http://www.gold-eagle.com/editorials_08/saville092909.html

However, Saville seems to imply that this means we can't have deflation (of what? deflation of production?). Either we have not properly defined the terminology, or Saville did not mention (in this article) that dilution of money causes mis-allocation of resources, which retards growth and even reaches the point that it causes deflation of economic production (as in China now), i.e. when the marginal utility of debt goes negative as it has:

http://www.coolpage.com/commentary/economic/shelby/Bell%20Curve%20Economics.html

The bottom line is that wealth is being transferred (via dilution), at the same time that global production may have peaked. My point is to do business in developing world (or in burgeoning markets in developed world, i.e. foreclosure counseling) because this transfer of wealth (via the dilution engine) will to some degree continue to sustain some sectors of the global economy, even aspects of global economy will continue to grow (remember small things grow faster, while mature things peak and decay).

So yes we will have deflation of many BIG things that were overdone by credit, and we have dilution of the average value of money (the small things everyone buys), while at same time having growth in smaller sectors and inflation in prices in some sectors.

Eventually this dilution/theft system (where the developing world are enslaved to provide for developed world, with the banksters parasiting off it all) will reach the point where the mis-allocation is such that the system can not function at all, and the world will break into chaos. At that point, gold goes to the moon and we have hyper-inflation of value of money (and deflation of global economy, a double whammy!). But Saville is correct, this won't happen in a straight line, even possibly may take years or even a decade.

Even during that coming double whammy crisis, some businesses could still thrive. The banksters preferred business of loaning to make war should do well. But I think communication (technology) will also do very well.

Here is a nice example:

http://market-ticker.denninger.net/archives/1473-Is-It-Time-To-Recognize-Reality.html

============

Looks like deflation is still alive:

http://www.financialsense.com/Market/cpuplava/2009/0930.html

https://goldwetrust.forumotion.com/economics-f4/exponential-growth-t109.htm#1990

Saville explains correctly that the fiat system never has to stop diluting the value of our money:

http://www.gold-eagle.com/editorials_08/saville092909.html

However, Saville seems to imply that this means we can't have deflation (of what? deflation of production?). Either we have not properly defined the terminology, or Saville did not mention (in this article) that dilution of money causes mis-allocation of resources, which retards growth and even reaches the point that it causes deflation of economic production (as in China now), i.e. when the marginal utility of debt goes negative as it has:

http://www.coolpage.com/commentary/economic/shelby/Bell%20Curve%20Economics.html

The bottom line is that wealth is being transferred (via dilution), at the same time that global production may have peaked. My point is to do business in developing world (or in burgeoning markets in developed world, i.e. foreclosure counseling) because this transfer of wealth (via the dilution engine) will to some degree continue to sustain some sectors of the global economy, even aspects of global economy will continue to grow (remember small things grow faster, while mature things peak and decay).

So yes we will have deflation of many BIG things that were overdone by credit, and we have dilution of the average value of money (the small things everyone buys), while at same time having growth in smaller sectors and inflation in prices in some sectors.

Eventually this dilution/theft system (where the developing world are enslaved to provide for developed world, with the banksters parasiting off it all) will reach the point where the mis-allocation is such that the system can not function at all, and the world will break into chaos. At that point, gold goes to the moon and we have hyper-inflation of value of money (and deflation of global economy, a double whammy!). But Saville is correct, this won't happen in a straight line, even possibly may take years or even a decade.

Even during that coming double whammy crisis, some businesses could still thrive. The banksters preferred business of loaning to make war should do well. But I think communication (technology) will also do very well.

Here is a nice example:

http://market-ticker.denninger.net/archives/1473-Is-It-Time-To-Recognize-Reality.html

...The Fed is literally the entire mortgage market. Yes, really. As Chris Martenson points out (correctly) we have issued roughly $685 billion in new mortgages through August, while The Fed has bought $722 billion of mortgage paper and GSE debt (I argue illegally, and have for months) with printed money. That is, they are the market - not a part of the market. But reality is much worse - there is no market when a central bank simply buys with printed money, intentionally overpaying. After all it's not their money, right? (On the contrary, it's yours they're spending - without your consent! Must be nice eh?)...

============

Looks like deflation is still alive:

http://www.financialsense.com/Market/cpuplava/2009/0930.html

Currency swaps are used to export dollar inflation and keep dollar value from plummetting

Currency swaps are used to export dollar inflation and keep dollar value from plummetting

See also the prior post above, which I made just about an hour ago.

See some peculiar evidence:

http://www.chrismartenson.com/blog/insatiable-demand-us-debt-or-something-else/28559

Look the world doesn't want a dollar free-fall, because the world is dependent on exports.

So the Fed has been doing currency swaps, so the foreigners can buy our Treasury debt (which hides the fact that our Fed is doing Zimbabwe style buying it's own debt), then it gives the Fed foreign currency to defend the dollar with. The Fed buys dollars which then repatriates the foreign currency while holding the dollar up. Clever!

See some peculiar evidence:

http://www.chrismartenson.com/blog/insatiable-demand-us-debt-or-something-else/28559

Look the world doesn't want a dollar free-fall, because the world is dependent on exports.

So the Fed has been doing currency swaps, so the foreigners can buy our Treasury debt (which hides the fact that our Fed is doing Zimbabwe style buying it's own debt), then it gives the Fed foreign currency to defend the dollar with. The Fed buys dollars which then repatriates the foreign currency while holding the dollar up. Clever!

re: Currency swaps are used to export dollar inflation and keep dollar value from plummetting

re: Currency swaps are used to export dollar inflation and keep dollar value from plummetting

Shelby wrote:See also the prior post above, which I made just about an hour ago.

See some peculiar evidence:

http://www.chrismartenson.com/blog/insatiable-demand-us-debt-or-something-else/28559

Look the world doesn't want a dollar free-fall, because the world is dependent on exports.

So the Fed has been doing currency swaps, so the foreigners can buy our Treasury debt (which hides the fact that our Fed is doing Zimbabwe style buying it's own debt), then it gives the Fed foreign currency to defend the dollar with. The Fed buys dollars which then repatriates the foreign currency while holding the dollar up. Clever!

Somebody else has deduced what I wrote in prior 2 posts:

http://financialsense.com/fsu/editorials/deepcaster/2009/1002.html

And from a Deepcaster reader:

“Evans-Pritchard suggests that the Fed has been forced to stop wholesale money creation [out of thin air] because of pressure from China, which fears dollar devaluation on account of its huge dollar holdings. Why don’t I believe that the Fed has slowed down its ‘quantitative easing’?

It’s because the US government is still spending far in excess of revenues, and where does it get the money to make up the difference except from selling bonds?

And who believes that foreigners and domestic buyers continue to be so stupid that they are buying those bonds in the required quantity? Since the Treasury has abdicated from printing its own money [Lincoln’s and JFK’s greenbacks], the Fed has to create money [out of thin air] to buy the bonds.

I think the Fed is still doing it, only more secretly, thus giving rise to the probably-false rumor that M3 is shrinking, or at least is rising at a slower pace. I am confident that increasing tons of electronic US$s are in central bank and banker hands, even if Main Street, USA, is hurting for lack of credit.

The risk of a double-dip Depressions is very real. Nevertheless, the assumption that it will be accompanied by price deflation may be misplaced. A double-dip Depression in an INFLATIONARY price environment seems as likely.”

This Astute Deepcaster Reader has got it right.

Yes we will have deflation of production (GDP) due to mis-allocation, while getting inflation in many sectors of things due to the dilution of (increase in) quantity of fiat money.

Off Topic (but very brief)

Off Topic (but very brief)

As my Granny used to say, "Many a true thing said in jest."

From Bob Chapman, International Forecaster:

"An interesting observation appeared in the Australian Shooter Magazine this week: If you consider that there has been an average of 160,000 troops in the Iraq theater of operations during the past 22 months, and a total of 2112 deaths, that gives a firearm death rate of 60 per 100,000 soldiers.

The firearm death rate in Washington, DC is 80.6 per 100,000 for the same period. That means you are about 25 percent more likely to be shot and killed in the US capital, which has some of the strictest gun control laws in the US, than you are in Iraq."

Conclusion: "The US should pull out of Washington."

From Bob Chapman, International Forecaster:

"An interesting observation appeared in the Australian Shooter Magazine this week: If you consider that there has been an average of 160,000 troops in the Iraq theater of operations during the past 22 months, and a total of 2112 deaths, that gives a firearm death rate of 60 per 100,000 soldiers.

The firearm death rate in Washington, DC is 80.6 per 100,000 for the same period. That means you are about 25 percent more likely to be shot and killed in the US capital, which has some of the strictest gun control laws in the US, than you are in Iraq."

Conclusion: "The US should pull out of Washington."

Guest- Guest

BOTTOM LINE: Deflation + Inflation = Distortion

BOTTOM LINE: Deflation + Inflation = Distortion

Listen to a very good debate of Inflation vs. Deflation with Mish Shedlock vs. Dan Amerman:

http://www.netcastdaily.com/broadcast/fsn2009-0919-3a.mp3 (listen especially to the 70:20 min mark! They both agree on inflation!)

Some of Dan's views are expressed in writing also:

http://financialsense.com/fsu/editorials/amerman/2009/1002.html

Harry Dent makes some good points also:

http://www.netcastdaily.com/broadcast/fsn2009-0926-3b.mp3

Google for "Mish" to read his blog.

There is a conclusion by Jim & John Puplava:

http://www.netcastdaily.com/broadcast/fsn2009-1003-3a.mp3 (listen to Peter Schiff at 18 min point!!!)

http://www.netcastdaily.com/broadcast/fsn2009-1003-3b.mp3 (listen to Peter Schiff at 20 min point also)

ALSO YOU MUST LISTEN THIS FROM START, THE REPORTED P&L is wrong:

http://www.netcastdaily.com/broadcast/fsn2009-1003-3b.mp3 (also listen at 41:20 min mark explains what I write about below)

Dan Amerman made 2 crucial points:

1) Banks do not care what asset prices do, they care about their assets not imploding in mark-to-market deflation, and thus diluting the value of money is in their interest.

2) Fannie Mae may be the source of massive dilution of money, as they continue to subsidize housing. Remember also I had written recently in my blog that Chris Martenson had pointed out that Fed had bought all the mortgages that were sold in past year, so the Fed is monetizing and diluting the value of the dollar now.

I haven't listened yet to Jim & John's conclusions, but I have already figured out in my research that both the deflationalists and the inflationalists are correct and they are both wrong also. Let me explain.

The increase in government debt is distortionary because it takes capital (i.e. resources, such as labor, commodities, brainpower, time...capital does not mean money, money is the conduit to direct the flow of capital) away from the private sector and redirects it to wasteful activities. Distortionary means that on the whole given enough time to play out, production will be reduced relative to what it had been if the capital was left in the private sector. And if the marginal utility of debt is negative then distortion is deflationary to production (GDP), i.e. there are no more fools willing to work more hours and strive harder for more things debt can buy, or simply that any marginal increases in production due to debt are unwanted, i.e. more houses, big screen TVs, etc.. I would say that in western countries we have mostly negative marginal utility of debt and thus deflating production; whereas, in developing world they are taking on new debt that is actually adding some % of useful production and some % of waste and redundancy. Also keep in the mind the Fed is doing currency swaps as a way to prop up the dollar and export the devaluation of the dollar as inflation in the developing world. I explained the mechanism in my blog.

However, deflation (or retardation) of production does not tell us what will happen to prices, because we must look also at the demand for goods. If demand falls less (or increases more) than production deflates (or grows slower), then we will have inflation of prices. Mish is correct we need to look at supply of credit and it is exploding in the developing world. So that is why we have inflation in the prices of commodoties again. However, if the demand falls more (or increases less) than production deflates (or grows slower), then we will have deflation of prices, which is what we are seeing in other sectors, especially those that were already saturated with debt, i.e. western housing. So we will have both inflation and deflation of different assets and goods, while seeing a huge theft of illusionary net worth from the west to the bankers, using the developing countries as a lever to keep the system in a state of stealthy equilibirium between bouts of bubbles and busts. At some point this theft system is going to break and chaos will probably break out.

The banks are sitting on huge reserves of Tbills which the Fed converted from their junk derivatives and then bribed them to keep it on reserve (by paying interest on the reserves). What can happen later after all the derivatives have been passed from the banks balance sheets (shits!) to the public sector (Fed or Treasury), then the banks will at some time (Amero!) be allowed to go on a spending or loaning spree with all these reserves. The salient point is that the developing world can absorb huge amounts of debt stimulation without negative marginal utility, so what is happening is a transfer of capital from the savers in the fiat system to the large corporations and banks as capital is absorbed by this process in developing world.

So the inflationalists are correct also, the saver of fiat is doomed (but he may not even realize it because it is being done so stealthly with the big effect to come later). And the deflationalist is correct also, that a huge deflation in production is occurring in the developed countries.

What is the bottom line? Grab gold and silver regularly from income and keep investing FOR INCOME (not yoyo equities or commodities) especially in developing world to capture some of the inflationary transfer of capital. That is the safest strategy.

As for other strategies, such as buying long-term LEAP puts on Treasury debt, shorting the stock market, etc... These all suffer from being timing plays, and we are going to see tremendous volatility, and the end will be a crackup chaos that will likely result in capital controls. So you could end up losing money on the timing, and then losing money again if the govt confiscates your gains when they finally occur. If you need a near-term strategy, you might want to capture volatility as I explained here:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-30.htm#2002

http://www.netcastdaily.com/broadcast/fsn2009-0919-3a.mp3 (listen especially to the 70:20 min mark! They both agree on inflation!)

Some of Dan's views are expressed in writing also:

http://financialsense.com/fsu/editorials/amerman/2009/1002.html

Harry Dent makes some good points also:

http://www.netcastdaily.com/broadcast/fsn2009-0926-3b.mp3

Google for "Mish" to read his blog.

There is a conclusion by Jim & John Puplava:

http://www.netcastdaily.com/broadcast/fsn2009-1003-3a.mp3 (listen to Peter Schiff at 18 min point!!!)

http://www.netcastdaily.com/broadcast/fsn2009-1003-3b.mp3 (listen to Peter Schiff at 20 min point also)

ALSO YOU MUST LISTEN THIS FROM START, THE REPORTED P&L is wrong:

http://www.netcastdaily.com/broadcast/fsn2009-1003-3b.mp3 (also listen at 41:20 min mark explains what I write about below)

Dan Amerman made 2 crucial points:

1) Banks do not care what asset prices do, they care about their assets not imploding in mark-to-market deflation, and thus diluting the value of money is in their interest.

2) Fannie Mae may be the source of massive dilution of money, as they continue to subsidize housing. Remember also I had written recently in my blog that Chris Martenson had pointed out that Fed had bought all the mortgages that were sold in past year, so the Fed is monetizing and diluting the value of the dollar now.

I haven't listened yet to Jim & John's conclusions, but I have already figured out in my research that both the deflationalists and the inflationalists are correct and they are both wrong also. Let me explain.

The increase in government debt is distortionary because it takes capital (i.e. resources, such as labor, commodities, brainpower, time...capital does not mean money, money is the conduit to direct the flow of capital) away from the private sector and redirects it to wasteful activities. Distortionary means that on the whole given enough time to play out, production will be reduced relative to what it had been if the capital was left in the private sector. And if the marginal utility of debt is negative then distortion is deflationary to production (GDP), i.e. there are no more fools willing to work more hours and strive harder for more things debt can buy, or simply that any marginal increases in production due to debt are unwanted, i.e. more houses, big screen TVs, etc.. I would say that in western countries we have mostly negative marginal utility of debt and thus deflating production; whereas, in developing world they are taking on new debt that is actually adding some % of useful production and some % of waste and redundancy. Also keep in the mind the Fed is doing currency swaps as a way to prop up the dollar and export the devaluation of the dollar as inflation in the developing world. I explained the mechanism in my blog.

However, deflation (or retardation) of production does not tell us what will happen to prices, because we must look also at the demand for goods. If demand falls less (or increases more) than production deflates (or grows slower), then we will have inflation of prices. Mish is correct we need to look at supply of credit and it is exploding in the developing world. So that is why we have inflation in the prices of commodoties again. However, if the demand falls more (or increases less) than production deflates (or grows slower), then we will have deflation of prices, which is what we are seeing in other sectors, especially those that were already saturated with debt, i.e. western housing. So we will have both inflation and deflation of different assets and goods, while seeing a huge theft of illusionary net worth from the west to the bankers, using the developing countries as a lever to keep the system in a state of stealthy equilibirium between bouts of bubbles and busts. At some point this theft system is going to break and chaos will probably break out.

The banks are sitting on huge reserves of Tbills which the Fed converted from their junk derivatives and then bribed them to keep it on reserve (by paying interest on the reserves). What can happen later after all the derivatives have been passed from the banks balance sheets (shits!) to the public sector (Fed or Treasury), then the banks will at some time (Amero!) be allowed to go on a spending or loaning spree with all these reserves. The salient point is that the developing world can absorb huge amounts of debt stimulation without negative marginal utility, so what is happening is a transfer of capital from the savers in the fiat system to the large corporations and banks as capital is absorbed by this process in developing world.

So the inflationalists are correct also, the saver of fiat is doomed (but he may not even realize it because it is being done so stealthly with the big effect to come later). And the deflationalist is correct also, that a huge deflation in production is occurring in the developed countries.

What is the bottom line? Grab gold and silver regularly from income and keep investing FOR INCOME (not yoyo equities or commodities) especially in developing world to capture some of the inflationary transfer of capital. That is the safest strategy.

As for other strategies, such as buying long-term LEAP puts on Treasury debt, shorting the stock market, etc... These all suffer from being timing plays, and we are going to see tremendous volatility, and the end will be a crackup chaos that will likely result in capital controls. So you could end up losing money on the timing, and then losing money again if the govt confiscates your gains when they finally occur. If you need a near-term strategy, you might want to capture volatility as I explained here:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-30.htm#2002

My recent plan to foil the giants...

My recent plan to foil the giants...

Tangentially, this week I irrefutably de-obfuscated the atheist mis-use of the faith called science:

http://esr.ibiblio.org/?p=1271#comments (use Ctrl+F to find all instances of "Shelby")

First see a further summary of inflation vs. deflation, and understand that the core thing that is going on now is an increase in wasteful production, which will lead to a reduction of resources for essential production (also note I sold SLV e-silver at end of this week, after buying on Monday at $16.10 spot, i.e. $15.92 SLV):

https://goldwetrust.forumotion.com/precious-metals-f6/silver-as-an-investment-t33-195.htm#2021

As part of my internet cafe business plans in developing world, I am working on a new software for Windows that could enable to connect multiple monitors, keyboards, and mice to one CPU tower:

http://en.wikipedia.org/wiki/Multiseat_configuration

This is not just multi-monitor, because multiple users are able to use the multiple monitors independently and simultaneously with the extra mice and keyboards. The problem with the existing software mentioned in the above link (add also Ncomputing.com which won't work 3D games at all), is that they do not support multi-media (i.e. YouTube) and 3D games well. They tend to add bugs in those cases, and be unstable with new releases of graphics cards drivers. Although Ncomputing.com claims to be able to do multi-media, do not count on it really working well in practice. Also all those existing software at $200 per 2 users (except for ASTER which won't support multi-media and games at all), are not more cost effective than buying another CPU tower ($200) per monitor.

My new software will fix that. Also it will support the options of multiple users (keyboards and mice) sharing the same monitor (e.g. each get left or right half of a widescreen). Once the CPU tower has been divided between 4 monitors (users), then the $50 cost per user of the tower is small compared to the $100 cost per user of the monitor, so my planned software has the potential to bring the hardware cost down to $100 per user total. If I sell my software for a few dollars per copy and we assume computer prices continue to drop by 50% every 18 months for the same performance (Moore's Law), then sub-$100 per user computing becomes a reality. This means the rental cost drops in half for each of the 4 monitors sharing a CPU tower and drops by 1/4 (as an option for those wish to share a screen, asians love to do things in groups not individually nor privately) to these people in Philippines that earn $3 per day. Also the power usage can drop from 100 watts per user to 25 watts, which could have a tremendous effect on peak energy.

Think about this, less than 1 billion people are on computers, and Microsoft projects another billion to come on before 2015. If I lower the cost per user for general computing (not limited like those other software), then we could see a doubling of that to 2 billion more by 2015. This could not only make me rich beyond my wildest imagination, but it could radically alter the current direction of the world.

This is the sort of technological revolution that can change the world drastically, increasing useful production, and foiling the plans of the giants (PTB) to enslave the world.

http://esr.ibiblio.org/?p=1271#comments (use Ctrl+F to find all instances of "Shelby")

First see a further summary of inflation vs. deflation, and understand that the core thing that is going on now is an increase in wasteful production, which will lead to a reduction of resources for essential production (also note I sold SLV e-silver at end of this week, after buying on Monday at $16.10 spot, i.e. $15.92 SLV):

https://goldwetrust.forumotion.com/precious-metals-f6/silver-as-an-investment-t33-195.htm#2021

As part of my internet cafe business plans in developing world, I am working on a new software for Windows that could enable to connect multiple monitors, keyboards, and mice to one CPU tower:

http://en.wikipedia.org/wiki/Multiseat_configuration

This is not just multi-monitor, because multiple users are able to use the multiple monitors independently and simultaneously with the extra mice and keyboards. The problem with the existing software mentioned in the above link (add also Ncomputing.com which won't work 3D games at all), is that they do not support multi-media (i.e. YouTube) and 3D games well. They tend to add bugs in those cases, and be unstable with new releases of graphics cards drivers. Although Ncomputing.com claims to be able to do multi-media, do not count on it really working well in practice. Also all those existing software at $200 per 2 users (except for ASTER which won't support multi-media and games at all), are not more cost effective than buying another CPU tower ($200) per monitor.

My new software will fix that. Also it will support the options of multiple users (keyboards and mice) sharing the same monitor (e.g. each get left or right half of a widescreen). Once the CPU tower has been divided between 4 monitors (users), then the $50 cost per user of the tower is small compared to the $100 cost per user of the monitor, so my planned software has the potential to bring the hardware cost down to $100 per user total. If I sell my software for a few dollars per copy and we assume computer prices continue to drop by 50% every 18 months for the same performance (Moore's Law), then sub-$100 per user computing becomes a reality. This means the rental cost drops in half for each of the 4 monitors sharing a CPU tower and drops by 1/4 (as an option for those wish to share a screen, asians love to do things in groups not individually nor privately) to these people in Philippines that earn $3 per day. Also the power usage can drop from 100 watts per user to 25 watts, which could have a tremendous effect on peak energy.

Think about this, less than 1 billion people are on computers, and Microsoft projects another billion to come on before 2015. If I lower the cost per user for general computing (not limited like those other software), then we could see a doubling of that to 2 billion more by 2015. This could not only make me rich beyond my wildest imagination, but it could radically alter the current direction of the world.

This is the sort of technological revolution that can change the world drastically, increasing useful production, and foiling the plans of the giants (PTB) to enslave the world.

Crash Course author interview

Crash Course author interview

I knew all of this, but I heard a few interesting points of view and some interesting pieces of data, it is bit long interview and Chris doesn't get to the point fast enough for me. Nevertheless I suggest listening to the first 42 mins:

http://www.anglofareast.com/download.php?file=downloads/Chris_Martenson_Interview_071009.mp3

http://www.anglofareast.com/download.php?file=downloads/Chris_Martenson_Interview_071009.mp3

Hyperinflation tipping point reached

Hyperinflation tipping point reached

http://www.caseyresearch.com/displayCdd.php?id=253

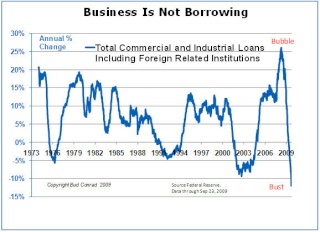

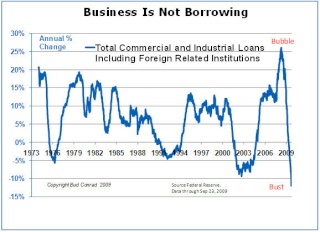

Consumer and business credit are not coming back (yet):

http://www.caseyresearch.com/displayCdd.php?id=246

...There have been 28 episodes of hyperinflation of national economies in the 20th century, with 20 occurring after 1980. Peter Bernholz (Professor Emeritus of Economics in the Center for Economics and Business (WWZ) at the University of Basel, Switzerland) has spent his career examining the intertwined worlds of politics and economics with special attention given to money.

In his most recent book, Monetary Regimes and Inflation: History, Economic and Political Relationships, Bernholz analyzes the 12 largest episodes of hyperinflations – all of which were caused by financing huge public budget deficits through money creation. His conclusion: the tipping point for hyperinflation occurs when the government’s deficit exceeds 40% of its expenditures. Guess what? The U.S. will hit the 40% mark in 2009...

Consumer and business credit are not coming back (yet):

http://www.caseyresearch.com/displayCdd.php?id=246

More deleveraging to come before Hyperinflation hits

More deleveraging to come before Hyperinflation hits

See also the prior post in this thread.

http://financialsense.com/editorials/casey/2009/1023.html

http://financialsense.com/editorials/casey/2009/1023.html

...so based on the general monetarist schedule:

* Some of the effect on stocks and bonds should already have been felt.

* The peak effect on economic activity should come between the middle of 2010 and the middle of 2011.

* The peak effect on consumer price inflation should come between the middle of 2011 and the end of 2012.

US Municipal Bond Market

US Municipal Bond Market

Hi Shelby et al,

I am reading the report linked to the piece below at ZeroHedge. I think it is worth a read. One of the major underlying themes of the report is, to me, most of the worst crap is sitting in the portfolios of retail and non-professional investors. The report claims around US$3 trivillions* in state, municipal, College etc bonds are on issue.

(I have adopted the convention "trivillions" to acknowledge that a trillion is now a small amount of money. Likewise I think we need to evolve to "minillions" and "banallions" in order to keep modern bankster finance in perspective.)

http://www.zerohedge.com/article/collapse-muni-bond-market

On a serious note, how does the following scenario fit with your thinking?

1. By collapsing the Muni Bond market the PTB achieve the following:

1.1 Bankrupt the levels below the Federal level.

1.2 We find out that certain favoured institutions ie. Wall Street banks (and friends), that advised the Muni Bond issuers, hold first ranking paper. The public holds the worst crap.

1.3 The pension entitlements etc of all of the non-Federal employees evaporate along with their employment contracts (to be re-set at a much lower level).

1.4 This unlocks a smorgasbord of cheap, highly strategic assets.

1.5 It helps to crash the stock markets again as it puts the spotlight on corporate revenues/profits again.

1.6 It drives some money back into the "safety" of Federal debt markets (for a while).

1.7 Continues to pressure the USD in order to keep the Wall Street carry traders happy.

BTW I am developing a theory that the plan for the "rehabilitation" of the US economy, after the PTB have all of the wealth and near total control, is to be based on agriculture. More on this later.

Cheers!

I am reading the report linked to the piece below at ZeroHedge. I think it is worth a read. One of the major underlying themes of the report is, to me, most of the worst crap is sitting in the portfolios of retail and non-professional investors. The report claims around US$3 trivillions* in state, municipal, College etc bonds are on issue.

(I have adopted the convention "trivillions" to acknowledge that a trillion is now a small amount of money. Likewise I think we need to evolve to "minillions" and "banallions" in order to keep modern bankster finance in perspective.)

http://www.zerohedge.com/article/collapse-muni-bond-market

On a serious note, how does the following scenario fit with your thinking?

1. By collapsing the Muni Bond market the PTB achieve the following:

1.1 Bankrupt the levels below the Federal level.

1.2 We find out that certain favoured institutions ie. Wall Street banks (and friends), that advised the Muni Bond issuers, hold first ranking paper. The public holds the worst crap.

1.3 The pension entitlements etc of all of the non-Federal employees evaporate along with their employment contracts (to be re-set at a much lower level).

1.4 This unlocks a smorgasbord of cheap, highly strategic assets.

1.5 It helps to crash the stock markets again as it puts the spotlight on corporate revenues/profits again.

1.6 It drives some money back into the "safety" of Federal debt markets (for a while).

1.7 Continues to pressure the USD in order to keep the Wall Street carry traders happy.

BTW I am developing a theory that the plan for the "rehabilitation" of the US economy, after the PTB have all of the wealth and near total control, is to be based on agriculture. More on this later.

Cheers!

Guest- Guest

Trivillions of Quadillars and No Private Ownership (=Socialism)

Trivillions of Quadillars and No Private Ownership (=Socialism)

Btw, I replied to your post in "Changing World Order" thread, Amazing Maze of 'Maes, ending with no Maize.

Haha, those are great! I will adopt those terms and attribute to you. I will use them in my next financial sense essay and link to here.

So is the basic unit of exchange now the quadillar?

If the money system is a rubberband, then why not the vocabulary of the money system. In fact, why don't we just start using a random word generator when speaking of the value of things? That is in real terms the chaotic outcome where we are headed!

Yup.

Yup.

The nominal payouts won't evaporate, but as seen with recent freeze in Social Security COLA (cost of living adjustment)-- the value will evaporate.

Gold! I can't remember where I read it in past few weeks, but apparently people are dumping it left and right now to raise cash. Said the dumping of 14K is nearly done (that lower class demographic is sold out) and now the 24K jewelry (from the upper middle class) is coming to market. Later comes silver, when silver rises to $100+ per ounce and the westerners are sufficiently impoverished that $100 is worth it (read the Silver Story by Shelby Moore was widely syndicated across the web in 2008).

This is the "slow burn" model that Catherine Austin Fitts describes and ascribes to.

I was published about land recently:

He Who Owns The Right Of Way... by Shelby Moore III

Yup, with Monsanto seeds every where (an inbred into neighboring private farms) so no one can't plant anything without violating a patent. Actually controlling the food is how they plan to control the world ever tightly/strictly on local level (they realize oil is not an intrusive enough control vehicle), I think someone wrote an article on that recently, maybe it was at Endal's website, or maybe it was some where in Fitts' site or interviews.

If people can grow their own food, they don't need the banksters as gods. Oil makes commercial scale farming dependent, but it can't stop the little guys from giving the banksters the middle finger. You can do effectively farming without oil, in fact some argue even more efficiently at medium scale. There are posts about that in this forum.

There was a story about the Rothschilds are heavily investing in agriculture in India, they plan to concentrate food production by undercutting the prices in other countries for vegetables. Maybe you can Google it. I think it was from 2008.

I want to again remind everyone the model from Belgium and countries very close to the center of Rothschild's power, and that is everything is taxed and regulated. In Belgium, your chicken lays an egg, you need a sticker and a tax code and an inspection. If you are found during the day not at your job, you get reported for potentially trying to find work where you do not have a permit to work. Your work permit only allows you to work where you work. The govt workers to monitor this outnumber the actual workers in private industry. Everything is designed to waste 99% of productivity and feed the 1% up to the banksters with tight control. Everybody prays and works for the banksters and accepts their 1%. Most people are on drugs (in Netherlands the govt even hands them out for free).

Actually most people don't realize that in USA if you get addicted to the opiates (Heroin, Cocaine, Methadone, Crack, Pain Killers, etc), then if you can't afford private care, or if you use health insurance, then the system is basically they put you on methadone, and they gradually increase it. You become a permenant opiate addict and it is almost impossible to detox from methadone because it has a half-life about 36 hours, so unlike herion detox which takes 3 - 5 days of utter hell, the methadone detox takes 14 days and is nearly impossible. You become a permanent cash cow for the medical system, drug companies, and the government who is paying these out via their social health welfare.

This is already happening on large scale in USA. We have the highest rate of incarceration in the world, and we have probably 20 - 30% of the population is hardcore opiate addicts, you just don't know it, because if someone gets their daily dose of methadone or other long-acting opiate, then they can function in a job. But if you wonder why people act strange, this can be one.

Read Endhal's article linked above about the real reason the banksters have us in middle east. DRUGS!

angophera wrote:...most of the worst crap is sitting in the portfolios of retail and non-professional investors. The report claims around US$3 trivillions...

(I have adopted the convention "trivillions" to acknowledge that a trillion is now a small amount of money. Likewise I think we need to evolve to "minillions" and "banallions" in order to keep modern bankster finance in perspective.)

Haha, those are great! I will adopt those terms and attribute to you. I will use them in my next financial sense essay and link to here.

So is the basic unit of exchange now the quadillar?

If the money system is a rubberband, then why not the vocabulary of the money system. In fact, why don't we just start using a random word generator when speaking of the value of things? That is in real terms the chaotic outcome where we are headed!

angophera wrote:...

http://www.zerohedge.com/article/collapse-muni-bond-market

On a serious note, how does the following scenario fit with your thinking?

1. By collapsing the Muni Bond market the PTB achieve the following:

1.1 Bankrupt the levels below the Federal level.

Yup.

angophera wrote:...1.2 We find out that certain favoured institutions ie. Wall Street banks (and friends), that advised the Muni Bond issuers, hold first ranking paper. The public holds the worst crap...

Yup.

angophera wrote:...1.3 The pension entitlements etc of all of the non-Federal employees evaporate along with their employment contracts (to be re-set at a much lower level)...

The nominal payouts won't evaporate, but as seen with recent freeze in Social Security COLA (cost of living adjustment)-- the value will evaporate.

angophera wrote:...1.4 This unlocks a smorgasbord of cheap, highly strategic assets...

Gold! I can't remember where I read it in past few weeks, but apparently people are dumping it left and right now to raise cash. Said the dumping of 14K is nearly done (that lower class demographic is sold out) and now the 24K jewelry (from the upper middle class) is coming to market. Later comes silver, when silver rises to $100+ per ounce and the westerners are sufficiently impoverished that $100 is worth it (read the Silver Story by Shelby Moore was widely syndicated across the web in 2008).

angophera wrote:...1.5 It helps to crash the stock markets again as it puts the spotlight on corporate revenues/profits again.

1.6 It drives some money back into the "safety" of Federal debt markets (for a while).

1.7 Continues to pressure the USD in order to keep the Wall Street carry traders happy...

This is the "slow burn" model that Catherine Austin Fitts describes and ascribes to.

angophera wrote:...BTW I am developing a theory that the plan for the "rehabilitation" of the US economy, after the PTB have all of the wealth and near total control, is to be based on agriculture. More on this later.

Cheers!

I was published about land recently:

He Who Owns The Right Of Way... by Shelby Moore III

Shelby wrote:...The land of the States may be vast, but I suppose we are approaching much greater than 50% to be owned by the federal government, central bank, corporations, and by the wealthiest. Americans will likely soon wake up to see that they are trespassing and enslaved in the vast land they thought was impervious to foreign invasion...

Yup, with Monsanto seeds every where (an inbred into neighboring private farms) so no one can't plant anything without violating a patent. Actually controlling the food is how they plan to control the world ever tightly/strictly on local level (they realize oil is not an intrusive enough control vehicle), I think someone wrote an article on that recently, maybe it was at Endal's website, or maybe it was some where in Fitts' site or interviews.

If people can grow their own food, they don't need the banksters as gods. Oil makes commercial scale farming dependent, but it can't stop the little guys from giving the banksters the middle finger. You can do effectively farming without oil, in fact some argue even more efficiently at medium scale. There are posts about that in this forum.

There was a story about the Rothschilds are heavily investing in agriculture in India, they plan to concentrate food production by undercutting the prices in other countries for vegetables. Maybe you can Google it. I think it was from 2008.

I want to again remind everyone the model from Belgium and countries very close to the center of Rothschild's power, and that is everything is taxed and regulated. In Belgium, your chicken lays an egg, you need a sticker and a tax code and an inspection. If you are found during the day not at your job, you get reported for potentially trying to find work where you do not have a permit to work. Your work permit only allows you to work where you work. The govt workers to monitor this outnumber the actual workers in private industry. Everything is designed to waste 99% of productivity and feed the 1% up to the banksters with tight control. Everybody prays and works for the banksters and accepts their 1%. Most people are on drugs (in Netherlands the govt even hands them out for free).

Actually most people don't realize that in USA if you get addicted to the opiates (Heroin, Cocaine, Methadone, Crack, Pain Killers, etc), then if you can't afford private care, or if you use health insurance, then the system is basically they put you on methadone, and they gradually increase it. You become a permenant opiate addict and it is almost impossible to detox from methadone because it has a half-life about 36 hours, so unlike herion detox which takes 3 - 5 days of utter hell, the methadone detox takes 14 days and is nearly impossible. You become a permanent cash cow for the medical system, drug companies, and the government who is paying these out via their social health welfare.

This is already happening on large scale in USA. We have the highest rate of incarceration in the world, and we have probably 20 - 30% of the population is hardcore opiate addicts, you just don't know it, because if someone gets their daily dose of methadone or other long-acting opiate, then they can function in a job. But if you wonder why people act strange, this can be one.

Read Endhal's article linked above about the real reason the banksters have us in middle east. DRUGS!

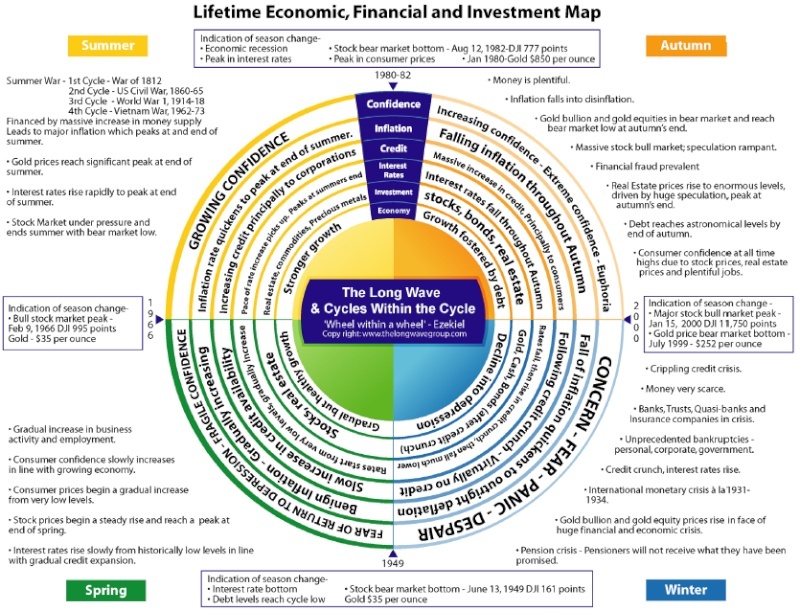

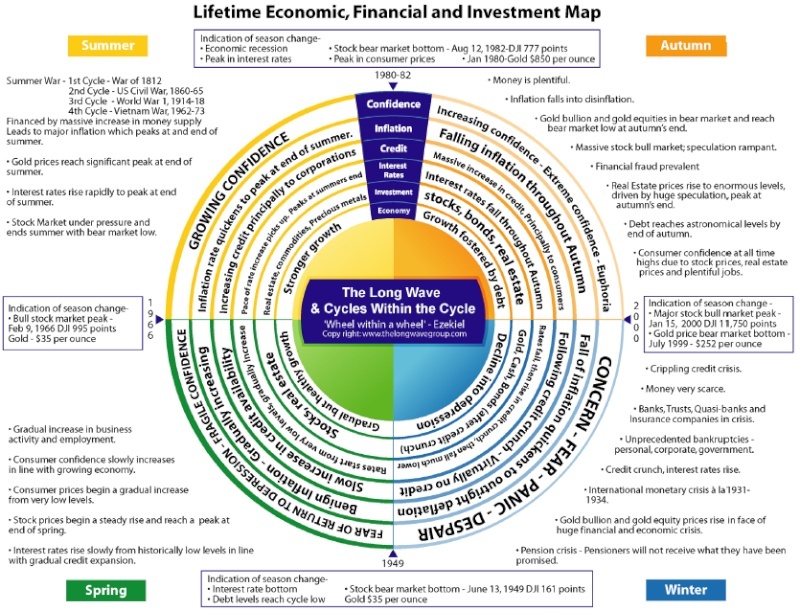

Long Wave Cycle

Long Wave Cycle

In short, a Hyperinflationary, Greater Depression with gold ownership punishable by death. More on that: http://www.kitco.com/ind/Wieg_cor/roger_oct302009.html

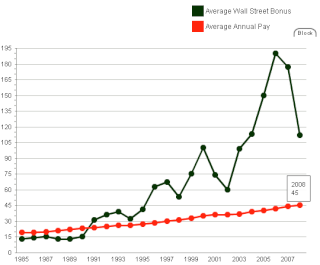

Graphical depiction of what we had read about.

http://www.pro-investory.cz/forum/attachments/att56/

Graphical depiction of what we had read about.

http://www.pro-investory.cz/forum/attachments/att56/

Interest swaps wags the Bonds

Interest swaps wags the Bonds

Wallstreet controls the long-term interest rates with interest rate swaps (it is not a free market!):

http://www.modavox.com/voiceamerica/vepisode.aspx?aid=42011 (listen from 26 min)

This is Ron Kirby, and I had posted his financialsense.com article on this in past.

http://www.modavox.com/voiceamerica/vepisode.aspx?aid=42011 (listen from 26 min)

This is Ron Kirby, and I had posted his financialsense.com article on this in past.

We built houses instead of lifting up developing world...

We built houses instead of lifting up developing world...

I accidentally deleted this post! No way to recover it. It was a link to Howard Katz's blog where he made point that we artificially suppressed the prices of food, built houses worldwide instead, and now we would pay for it.

Pretcher's illusion

Pretcher's illusion

http://www.elliottwave.com/freeupdates/archives/2009/10/26/Is-Gold-The-Bargain-Of-the-Decade-This-Chart-Cuts-To-the-Chase.aspx?code=cg

Pretcher's mistake is that he used the official CPI, which has been a lie since at least the early 1980s:

The difference can be calculated, and is exactly 8/3 = 2.67. So actually the 1913 dollar is only worth $0.04 / 2.67 = $0.015 (1.5 cents), or lost 98.5% of it's value. So thus gold should be $1402.

Additionally the prices of items reflects the confidence in the dollar. If that confidence stampedes away because people realize the dollar is bankrupt, then prices hyperinflate and price of gold does too.

Pretcher's thesis is dependent on a true deflation, but we have an inflationary depression, not a "too much savings" depression:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-15.htm#2216

Pretcher's mistake is that he used the official CPI, which has been a lie since at least the early 1980s:

The difference can be calculated, and is exactly 8/3 = 2.67. So actually the 1913 dollar is only worth $0.04 / 2.67 = $0.015 (1.5 cents), or lost 98.5% of it's value. So thus gold should be $1402.

Additionally the prices of items reflects the confidence in the dollar. If that confidence stampedes away because people realize the dollar is bankrupt, then prices hyperinflate and price of gold does too.

Pretcher's thesis is dependent on a true deflation, but we have an inflationary depression, not a "too much savings" depression:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-15.htm#2216

ALERT: market crash may be imminent

ALERT: market crash may be imminent

That is $0.3 trillion per week moving into negative yields (zero - inflation). So that is $1.2 trillion per month that is running to safety and expecting another liquidity crisis:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-75.htm#2365 <<--- must read

So you really think Christmas sales are going to be good news?

http://market-ticker.denninger.net/archives/1657-Whos-Lying-About-Personal-Spending.html

http://market-ticker.denninger.net/archives/1660-The-FDIC-Is-Broke.html

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-75.htm#2365 <<--- must read

So you really think Christmas sales are going to be good news?

http://market-ticker.denninger.net/archives/1657-Whos-Lying-About-Personal-Spending.html

Here are your possibilities:

* The BEA is lying....claim...+1.2%.

* Business that remit sales tax are lying. The overall sales tax collections in the 3rd quarter were down 8.2%...

http://market-ticker.denninger.net/archives/1660-The-FDIC-Is-Broke.html

Off the wire this morning:

FDIC Deposit fund had negative $8.2B balance in Q3

Deflation of wages

Deflation of wages

Whether we have deflation or inflation, depends on which currency you measure prices against.

With gold at $1200, the salaries are roughly 1/3 of what they were in 2001, as measured in gold.

This means the developing world has been repriced up by that amount relative to the developing world in terms of purchasing power parity.

If you are running a business in the developed world, and you have not more than doubled your AFTER-TAX salaries and profit since 2001, then your business is shrinking and your employees are getting poorer.

The overpriced things (those economies with a lot of credit) are deflating relative to gold (real money), and the other things (commodities) are roughly ahead of gold (inflating) by the amount of real growth in the under-priced economies.

So it is clear that the way to outpace gold is to invest in the under-priced economies, unless you think that the under-priced economies and free market will be delayed by some force.

=======

ADD: our after tax wages are much worse than in 1930s:

http://www.lewrockwell.com/case/case37.1.html

|

|

With gold at $1200, the salaries are roughly 1/3 of what they were in 2001, as measured in gold.

This means the developing world has been repriced up by that amount relative to the developing world in terms of purchasing power parity.

If you are running a business in the developed world, and you have not more than doubled your AFTER-TAX salaries and profit since 2001, then your business is shrinking and your employees are getting poorer.

The overpriced things (those economies with a lot of credit) are deflating relative to gold (real money), and the other things (commodities) are roughly ahead of gold (inflating) by the amount of real growth in the under-priced economies.

So it is clear that the way to outpace gold is to invest in the under-priced economies, unless you think that the under-priced economies and free market will be delayed by some force.

=======

ADD: our after tax wages are much worse than in 1930s:

http://www.lewrockwell.com/case/case37.1.html

Last edited by Shelby on Sat Nov 28, 2009 11:06 pm; edited 1 time in total

Money

Money

Lack of understanding starts with being obsessed about money.

Wages in USA priced in gold have declined by 2/3 since 2001.

What is really happening is a rebalancing of the value of the world.

Burying money in a hole enables someone else to better redistribute your capital to do the most good for the most in need who are the most productive.

If the world ever consumes 0.6oz silver per capita, as it does in the developed world, that would be 4 Billion oz per year consumed.

But anyone investing in small business in developing world right now, is seeing 100% returns on capital per year, so clearly those putting their money in precious metals are falling behind, unless the govts of the world totally destroy the financial system of the developing world (which I think is unlikely, because govts would be overthrown worldwide).

In short, it pays to not think so much about money, and think about doing good.

Wages in USA priced in gold have declined by 2/3 since 2001.

What is really happening is a rebalancing of the value of the world.

Burying money in a hole enables someone else to better redistribute your capital to do the most good for the most in need who are the most productive.

If the world ever consumes 0.6oz silver per capita, as it does in the developed world, that would be 4 Billion oz per year consumed.

But anyone investing in small business in developing world right now, is seeing 100% returns on capital per year, so clearly those putting their money in precious metals are falling behind, unless the govts of the world totally destroy the financial system of the developing world (which I think is unlikely, because govts would be overthrown worldwide).

In short, it pays to not think so much about money, and think about doing good.

re: ALERT: market crash may be imminent

re: ALERT: market crash may be imminent

Shelby wrote:That is $0.3 trillion per week moving into negative yields (zero - inflation). So that is $1.2 trillion per month that is running to safety and expecting another liquidity crisis:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-75.htm#2365 <<--- must read...

- Haven't researched it, but heard that Dubai had a crisis.

- Someone pointed out that we are near another turning point.

- Oil breaking down?

I am expecting a pullback, then a run higher in Spring, before the danger of another full scale liquidity crunch.

Mutual destruction assured

Mutual destruction assured

No one wants to stop the addiction which is driving imbalances to extremes:

http://finance.yahoo.com/news/No-winners-if-yuan-rises-says-rb-3068261701.html?x=0&.v=1

http://finance.yahoo.com/news/No-winners-if-yuan-rises-says-rb-3068261701.html?x=0&.v=1

Bob Chapman (idolizing men...2nd commandment)

Bob Chapman (idolizing men...2nd commandment)

SRSrocco and others at the jasonhommelforum.com are quoting some Bob Chapman warning of a 90% dollar devaluation by January 2010. Weren't Bob and Willie the ones warning of a similar bank holiday for Sept 2009? They have now clarified that it is only a directive for banks to tighten liquidity by January, then the devaluation event before end of 2010.

I just want to remind people that Chapman was purportedly accused of being a fraudster who fled to Mexico (I remember reading about this from more reliable sources back in 2006/7, I think Bob Moriarty?):

http://www.thesurvivalpodcast.com/episode-329-my-predictions-from-oct-2008#comment-21548

Google for more:

http://www.mail-archive.com/thepowerhourflashstats@thepowerhour.com/msg00509.html

http://www.google.com/search?hl=en&q=Bob+Chapman+sedona

I am not saying these gentlemen will always be wrong, and I am not saying we shouldn't be preparing, but I am saying that fear and greed are the enemies of success, and some men prey on these weaknesses.

Also about Jim Willie, I used to trade emails with him in 2006, and I will not share what he told me about his personal life, but I will just say there is reason I do not put too much weight in his dire warnings. I may read his opinion occassionally. My life is far from "perfect", so I wouldn't want people following me, but I am not an alcoholic. Meaning I have a hard time putting weight into rumors, because they can be emotionally driven.

Perhaps these rumors are being floated to prevent us from holding dollars during this correction coming where the dollar rises in value? Even rumors about Japan selling dollars:

http://market-ticker.denninger.net/archives/1693-Here-It-Comes...-Sovereign-Treasury-Sales.html

I think the long-term trend is clear. Emotionally charged rumors do not really add any utility. We should be making our asset allocation plans and putting them into effect methodically.

I just want to remind people that Chapman was purportedly accused of being a fraudster who fled to Mexico (I remember reading about this from more reliable sources back in 2006/7, I think Bob Moriarty?):

http://www.thesurvivalpodcast.com/episode-329-my-predictions-from-oct-2008#comment-21548

John_S Says:

December 4th, 2009 at 10:28 pm

In regard to Chapman; before you get all misty-eyed defending the guy, you may want to read

http://www.rgm.com/articles/sec7.html

SEC filing… He appears to be a pump and dump scam artist.

Here’s an excerpt:

In mid-January 2003, defendant Anthony Wile primed the market for Sedona and Renaissance shares by orchestrating touting by defendant “Robert J. Chapman”, a purportedly “independent” newsletter writer who secretly owned Renaissance shares, and other investment newsletter writers. Chapman issued at least one report touting the merger and telling the public that shares of Sedona, which had last traded at three cents per share, would open on January 21 at around $10 per share.

Maybe this is the reason why old Bob lives in Mexico? Or maybe there’s some perfectly reasonable alternative explanation for this stuff. You decide. I’ll be more inclined to take Jack’s advice on finance, myself…

Google for more:

http://www.mail-archive.com/thepowerhourflashstats@thepowerhour.com/msg00509.html

http://www.google.com/search?hl=en&q=Bob+Chapman+sedona

I am not saying these gentlemen will always be wrong, and I am not saying we shouldn't be preparing, but I am saying that fear and greed are the enemies of success, and some men prey on these weaknesses.

Also about Jim Willie, I used to trade emails with him in 2006, and I will not share what he told me about his personal life, but I will just say there is reason I do not put too much weight in his dire warnings. I may read his opinion occassionally. My life is far from "perfect", so I wouldn't want people following me, but I am not an alcoholic. Meaning I have a hard time putting weight into rumors, because they can be emotionally driven.

Perhaps these rumors are being floated to prevent us from holding dollars during this correction coming where the dollar rises in value? Even rumors about Japan selling dollars:

http://market-ticker.denninger.net/archives/1693-Here-It-Comes...-Sovereign-Treasury-Sales.html

I think the long-term trend is clear. Emotionally charged rumors do not really add any utility. We should be making our asset allocation plans and putting them into effect methodically.

Last edited by Shelby on Fri Dec 11, 2009 3:11 am; edited 2 times in total

chapman

chapman

still on kitco archives after all these years:

http://www.kitco.com/ind/Chapman/Jan202003.html

mr. chapman seems to be a feature on goldseek radio ... (guess why I don't listen to goldseek radio??)

... greetings to all on board, this is my first post

http://www.kitco.com/ind/Chapman/Jan202003.html

mr. chapman seems to be a feature on goldseek radio ... (guess why I don't listen to goldseek radio??)

... greetings to all on board, this is my first post

pilak- Posts : 3

Join date : 2009-09-14

Location : canada for now

Monetary Inflation is first mis-allocation (distortionary), with general price rise as the lagging indicator

Monetary Inflation is first mis-allocation (distortionary), with general price rise as the lagging indicator

See also dz20854 post today about the underground buildings at Denver Airport. Also Jesse Ventura reveals the accusation in part 5 of that 9/11 program, that the hijackers were in the cockpit BEFORE IT TOOK OFF! It is all starting to come out now. I predict before 2012, it will all

come out and there will be mayhem in the world. Ventura may bring the legitimacy needed to get more people to come forward. Realize the bankers set up the neocons to take the fall. They want the 9/11 truth to come out eventually, around 2012. It is all part of the plan for mayhem that pushes the world towards NWO and one world currency. The fact that Ventura has been allowed to do this program and that Glenn Beck of Fox News are being allowed to do more revealing shows is I think a probably sign that we are nearly the tipping point. I think 2010 is the last year to get positioned.

Jim Willie has an interesting hypothetical chart of how we probably are heading into the middle innings of the great dollar default:

click the chart for the article

click the chart for the article

come out and there will be mayhem in the world. Ventura may bring the legitimacy needed to get more people to come forward. Realize the bankers set up the neocons to take the fall. They want the 9/11 truth to come out eventually, around 2012. It is all part of the plan for mayhem that pushes the world towards NWO and one world currency. The fact that Ventura has been allowed to do this program and that Glenn Beck of Fox News are being allowed to do more revealing shows is I think a probably sign that we are nearly the tipping point. I think 2010 is the last year to get positioned.

...This counterfeiting distorts price signals, brings about the undeserved transfer of wealth to the first receivers of the new money, and depletes real savings. It therefore damages the economy...

...Unfortunately, an inflation problem will never be perceived as such by the average person, the average economist or the average central banker until the so-called "general price level" begins to rise by more than about 3% per year, even though a rise in the general price level is the most TRIVIAL effect of inflation. If monetary inflation did nothing other than shift all prices upward in unison then it would never be a big problem.

To put it another way: an inflation problem exists today, but the point of widespread recognition will only come after the effects spread to the "general price level". As discussed in the latest Interim Update, we think this will happen during 2010. Apart from ensuring that gold remains in a major upward trend relative to almost everything, this should set the scene for a secular decline in the Treasury Bond market.

Interestingly, the monthly chart of the T-Bond displayed below is consistent with the idea that the inflation problem will become more widely recognised over the years ahead. In particular, we appear to have the makings of a multi-year head-and-shoulders topping pattern, with the left shoulder, the head, and part of the right shoulder now in place.

Jim Willie has an interesting hypothetical chart of how we probably are heading into the middle innings of the great dollar default:

click the chart for the article

click the chart for the article Fallacy of Gain in Precious Metals (Form of the Greater Depression?)

Fallacy of Gain in Precious Metals (Form of the Greater Depression?)

States are depending on real estate taxes, but who is paying the taxes if the banks are refusing to admit the foreclosures (in order to hide their insolvency)?

http://www.martinarmstrong.org/files/The-Sum-of-All-Fears-A-Great-Depression-11-26-09.pdf#page=9

http://www.gold-eagle.com/editorials_08/benson122209.html

As Armstrong implies above, the Fed can keep the stock market afloat in nominal terms (see also page 4) with monetary inflation (look at Zimbabwe stock market), but this Great Depression will be in real estate. But in what form?

Will the minority of the population be able to vote down a bailout of real estate? If not, then would the federal govt continue to monetize real estate, and what form will that take?

Irregardless of what form it all takes on, the fact is UNTIL 72% of current homeowners are living on the street or moved in to live with their relatives paid for house (because such an economic hardship is not likely to provide the jobs for people to pay rents), then we will have monetarily inflation exported to the rest of world. This may appear to be a holding pattern in USA, when in fact the USA nominal value is being deflated away relative to the rest of the world's nominal GDP inflating up and up.

Eventually (and soon) this is going to show up as inflation in prices inside USA, of everything produced outside the USA. This will be coupled with rising unemployment inside USA (and some other developed countries). Any one with net worth is going to be waking up real fast to reality that bonds are not keeping pace, houses are being taxed at increasing rates by desperate state govts, and fed&state income taxes will be rising. They can choose between domestic stock market (which will crash anew, but maybe not much lower than before due to monetary inflation, when the real estate and unemployment worsen and more bailouts are called for), gold, or international investments.

The conclusion is that the big shift is taking place towards the realization that only moveable assets will retain value, because 72% of everything inside USA is toast. I think unemployment might exceed 50% as well by 2014 or so.

The time is running short before capital controls are implemented to limit the flight of capital trying to escape the desperate bankrupted majority (state & fed govts). I say this dip in precious metals is your last chance to get physical and get it out of USA in 2010. If you plan to fight it out in USA, prepare to become illegal when you sell your precious metals if do not report the sale to the IRS (to pay the 50 - 90% capital gains taxes I expect by then, I already see the effective federal top bracket rate is proposed to rise to 49% due to proposed war and health care taxes). You will be illegal in the eyes of the bankrupt majority, with maybe at best only a couple % (maybe even less than 1%) of population having any significant precious metals gains. I know you have families and are invested in the USA, but I can't understand those who are millionaires not being willing to do what they have to do to protect their capital outside the USA before it is too late. What are you folks thinking? Do you think you can sit on your precious metals until the high taxes abate? Perhaps you are correct and you can wait out the bad times and some great opportunity will present itself after the dark clouds pass. Note even if your capital is outside USA, as long as you are a US citizen, you are required to report and pay taxes on all activites to IRS. Ideally one needs to renounce their US citizenship and acquire a 2nd citizenship (e.g. Argentina, Ireland, etc). Europeans do not have this problem. I am not going to advise you how to keep your US citizenship (will eventually be sort of noose around one's neck, rather than a desirable passport) and avoid reporting and detection (and more and less be legal except for some obscure inability of the law), but clever people can probably think of ways. Remember all of us (any nationality!) break a law every day, because the law is so complex by now. There is no such thing as being perfectly legal. If you don't believe me, start reading some of the statues in the places where you reside, your home citizenship, and international laws and treaties.

Bottom line is any significant capital you need to be liquid for next several years, then need it outside the USA. If your expenses are low relative to your income, your income is secure, and then you have the capacity to bury your precious metals for a decade or more, then maybe you are okay, but realize you will fall way behind in the next decade. Asia will have doubled in GDP several times over by then, God will have taken most of your talents away from you and your heirs (your PMs will increase maybe 20 - 50% per year, while other businessmen in Asia will have seen gains of 30 - 100% per year), because you sat still while others (in developing world) were being productive. For example, if over the next decade your PMs gain 30% and the businessmen in Asia see 50% per annum gains, then you will have lost 1.5(x^y key)10 - 1.3(x^y key)10 / 1.5(x^y key)10 = 76% of your net worth in relative terms. In other words, the measuring stick you are using (the dollar) will have been inflated away. You will only be worth 24% of what you are now!!!. In short, the amount of gold&silver we have, is an indicator of what a poor future businessman we are becoming. We are retiring effectively. That is why I was trying to think of how to invest my capital (in fast ROI cash businesses in Asia) and get it out of gold&silver as fast as possible. I will have to go significantly into gold on this dip, which indicates that my business efforts are too slow thus far. I would advise 10% of net worth in precious metals as a "flight capital" and hedge against all things unknown (i.e. confiscation of your businesses), and even more into silver if you think have a chance of buying enough silver to really break the back of the current system.

If you are not a millionaire (at least a 1/4 millionaire) and you just want to protect a small net worth in precious metals, I suspect you may be successful at cashing out your PMs without being detected by the tax authorities, and any way you do not have the economy-of-scale to do any thing else, and thus I understand you buying physical in USA and keeping it there. But I am not giving you any advice or suggestion to break the law.

Could I be wrong about the % of the population what wants to fight for lower taxes and less govt? The audit the Fed bill has wide support for example. But when 72% of homeowners wake up to the reality that they are underwater (maybe only a fraction of the 25% that are, think they are now, for example in the NorthWet of the USA, the Vancouver, Canada market is still booming but will crash then that region of USA will domino), then I think the political realities will change also. See this chart of the number of mortgage resets coming in 2010-2012, and that doesn't include the commercial real estate sector implosion coming and the original implosion from 2007-2008 which was buried under the rug (banks refusing to issue the foreclosures). Many of the current angry "Republicans" will be emasculated and become "Democrat" beggars.

http://www.martinarmstrong.org/files/The-Sum-of-All-Fears-A-Great-Depression-11-26-09.pdf#page=9

http://www.gold-eagle.com/editorials_08/benson122209.html

As Armstrong implies above, the Fed can keep the stock market afloat in nominal terms (see also page 4) with monetary inflation (look at Zimbabwe stock market), but this Great Depression will be in real estate. But in what form?

Will the minority of the population be able to vote down a bailout of real estate? If not, then would the federal govt continue to monetize real estate, and what form will that take?

Irregardless of what form it all takes on, the fact is UNTIL 72% of current homeowners are living on the street or moved in to live with their relatives paid for house (because such an economic hardship is not likely to provide the jobs for people to pay rents), then we will have monetarily inflation exported to the rest of world. This may appear to be a holding pattern in USA, when in fact the USA nominal value is being deflated away relative to the rest of the world's nominal GDP inflating up and up.

Eventually (and soon) this is going to show up as inflation in prices inside USA, of everything produced outside the USA. This will be coupled with rising unemployment inside USA (and some other developed countries). Any one with net worth is going to be waking up real fast to reality that bonds are not keeping pace, houses are being taxed at increasing rates by desperate state govts, and fed&state income taxes will be rising. They can choose between domestic stock market (which will crash anew, but maybe not much lower than before due to monetary inflation, when the real estate and unemployment worsen and more bailouts are called for), gold, or international investments.

The conclusion is that the big shift is taking place towards the realization that only moveable assets will retain value, because 72% of everything inside USA is toast. I think unemployment might exceed 50% as well by 2014 or so.

The time is running short before capital controls are implemented to limit the flight of capital trying to escape the desperate bankrupted majority (state & fed govts). I say this dip in precious metals is your last chance to get physical and get it out of USA in 2010. If you plan to fight it out in USA, prepare to become illegal when you sell your precious metals if do not report the sale to the IRS (to pay the 50 - 90% capital gains taxes I expect by then, I already see the effective federal top bracket rate is proposed to rise to 49% due to proposed war and health care taxes). You will be illegal in the eyes of the bankrupt majority, with maybe at best only a couple % (maybe even less than 1%) of population having any significant precious metals gains. I know you have families and are invested in the USA, but I can't understand those who are millionaires not being willing to do what they have to do to protect their capital outside the USA before it is too late. What are you folks thinking? Do you think you can sit on your precious metals until the high taxes abate? Perhaps you are correct and you can wait out the bad times and some great opportunity will present itself after the dark clouds pass. Note even if your capital is outside USA, as long as you are a US citizen, you are required to report and pay taxes on all activites to IRS. Ideally one needs to renounce their US citizenship and acquire a 2nd citizenship (e.g. Argentina, Ireland, etc). Europeans do not have this problem. I am not going to advise you how to keep your US citizenship (will eventually be sort of noose around one's neck, rather than a desirable passport) and avoid reporting and detection (and more and less be legal except for some obscure inability of the law), but clever people can probably think of ways. Remember all of us (any nationality!) break a law every day, because the law is so complex by now. There is no such thing as being perfectly legal. If you don't believe me, start reading some of the statues in the places where you reside, your home citizenship, and international laws and treaties.

Bottom line is any significant capital you need to be liquid for next several years, then need it outside the USA. If your expenses are low relative to your income, your income is secure, and then you have the capacity to bury your precious metals for a decade or more, then maybe you are okay, but realize you will fall way behind in the next decade. Asia will have doubled in GDP several times over by then, God will have taken most of your talents away from you and your heirs (your PMs will increase maybe 20 - 50% per year, while other businessmen in Asia will have seen gains of 30 - 100% per year), because you sat still while others (in developing world) were being productive. For example, if over the next decade your PMs gain 30% and the businessmen in Asia see 50% per annum gains, then you will have lost 1.5(x^y key)10 - 1.3(x^y key)10 / 1.5(x^y key)10 = 76% of your net worth in relative terms. In other words, the measuring stick you are using (the dollar) will have been inflated away. You will only be worth 24% of what you are now!!!. In short, the amount of gold&silver we have, is an indicator of what a poor future businessman we are becoming. We are retiring effectively. That is why I was trying to think of how to invest my capital (in fast ROI cash businesses in Asia) and get it out of gold&silver as fast as possible. I will have to go significantly into gold on this dip, which indicates that my business efforts are too slow thus far. I would advise 10% of net worth in precious metals as a "flight capital" and hedge against all things unknown (i.e. confiscation of your businesses), and even more into silver if you think have a chance of buying enough silver to really break the back of the current system.

If you are not a millionaire (at least a 1/4 millionaire) and you just want to protect a small net worth in precious metals, I suspect you may be successful at cashing out your PMs without being detected by the tax authorities, and any way you do not have the economy-of-scale to do any thing else, and thus I understand you buying physical in USA and keeping it there. But I am not giving you any advice or suggestion to break the law.