Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 15 of 24

Page 15 of 24 •  1 ... 9 ... 14, 15, 16 ... 19 ... 24

1 ... 9 ... 14, 15, 16 ... 19 ... 24

China to run a trade deficit!

China to run a trade deficit!

After reading the following, go back to my prior post (2 posts above this one), where I have been pointing out that all future growth is coming from developing world:

http://finance.yahoo.com/news/China-warns-US-against-apf-2448997968.html?x=0&sec=topStories&pos=3&asset=&ccode=

http://finance.yahoo.com/news/China-warns-US-against-apf-2448997968.html?x=0&sec=topStories&pos=3&asset=&ccode=

How to explain "Doom Calculation" to the average person

How to explain "Doom Calculation" to the average person

The USA is bankrupt (99% of people do not know this) and USA will soon collapse into massive poverty. America's top accountant says so:

https://www.youtube.com/watch?v=7WHwcDF3hhU

https://i.servimg.com/u/f68/13/18/36/81/sc33.png

https://www.youtube.com/watch?v=cgJjr-kX7KI (protectionist forces to rise)

https://www.youtube.com/watch?v=KAS_Xjer7Nw

http://caseyresearch.com/pdfs/20090504_StreetFightingMan.pdf

https://www.youtube.com/watch?v=n0ywCHKXJ5o (plan is to ruin millionaires)

US CBO officially projects US national debt (credit) to $20 trillion soon, when interest rates rise to 10%, that will be $2 trillion yearly interest payments, but USA govt only collects $2 trillion in taxes. And unemployment is increasing (jobs are being outsourced to cheaper countries, i.e. call centers), 80 million 62 year olds are retiring, thus tax receipts will fall to $1.4 trillion, thus the USA govt will be unable to pay (bankrupt), causing interest rates to rise more. DOLLAR DEFAULT! In 2005, I predicted the 2007/8 crisis, and now I am predicting a DEADLY crisis by 2012/14. I have strong skills in math & research.

USA dream (& Europe) is dying.

CBO interprets next 10 years too optimistically, because they are not factoring in the next wave of mortgage resets and other stuff that is going to wrong between now and 2012:

http://www.financialsense.com/editorials/conrad/2010/0323.html

The plan is after this global depression, there will only be 2 classes, the billionaires and the rest of humanity (no more millionaires):

I think it should be a given, that TPTB have a plan to take away the gold and silver from those who try to hoard $millions of it. The problem is you can't easily hide that much metal. They know who is buying metal in that quantity. And the rest of us, won't have the scale to do much more than survive with the amount of metal we are able to get away from the roaming gangs, etc.

There is a bigger trend, which is the end of the monetary incentive:

https://goldwetrust.forumotion.com/economics-f4/peak-oil-nonsense-t102-15.htm#2845 (watch the video at this link)

The current Doom is fabricated lie because TPTB are afraid of the lack of scarcity!

After you watch the video at that link, TPTB are trying to retain control over the technology, so they can retain control over these excess resources. As we need less and less people to do the hard-engineering, then we have a mass of "useless eaters". TPTB want to use this mass as political force to maintain their control.

But what is happening is that as price of resources drops to near 0 due to automation, then the value of art/creativity is rising relatively speaking. Thus the new money has to be some form of way to trade art. So again the money can be based on truth or the lie of usury. I think this is why TPTB are forced to move to 666 (pay in blood) digital body tagging, because they will need to control the trade of digital art/creativity.

This is very interesting because it shows me exactly what I need to be working on in the computer realm.

===========

ADD: to elaborate on the theme of the "Resource Economy" (see video in above link), I think the trend may not be mostly about removing profit, as it is about making the added value of the industrial economy and labor, nearly irrelevant (very insignificant cost), and making the input resources (think silver!) and creativity/art a much more significant portion of the economy. Thus the ideal should not be to eliminate profit, but as it has always been, to make savings ideally in the resources we need. The new wrinkle is that software itself could possibly be a resource and could be a form of money, except it is probably not fungible. So I think we are still looking at silver and gold as representations of effort, as the most equitable system, and still the bankster trying to keep the masses on the hamster wheel of usury. What really changes is that added value of the industrial economy and labor deflate precipitiously now and this will cause massive dislocations and opportunities. The opportunity to add value with creativity/art/technology will have never been greater, because the resource/manual labor cost will be so low in doing so. The person who can figure out the way to involve as much of humanity as possible in creativity/art/technology production, will become a $trillionaire.

Google has apparently recognized that ultimately industrial monopoly will fade as creativity/art/technology surges, thus China will be the big loser:

http://finance.yahoo.com/banking-budgeting/article/109159/stance-by-china-to-limit-google-is-risk-by-beijing

We are surely to get a disintegration of the current monetary system, with TPTB's driving the masses towards false (human induced, via socialism) scarcity and chaotic failure, and the terminal descent towards hyperinflationary (relative to gold) greatest hell depression is accelerating:

http://market-ticker.denninger.net/archives/2104-How-Far-Down-The-Rabbit-Hole-Must-We-Go.html

https://www.youtube.com/watch?v=7WHwcDF3hhU

https://i.servimg.com/u/f68/13/18/36/81/sc33.png

https://www.youtube.com/watch?v=cgJjr-kX7KI (protectionist forces to rise)

https://www.youtube.com/watch?v=KAS_Xjer7Nw

http://caseyresearch.com/pdfs/20090504_StreetFightingMan.pdf

https://www.youtube.com/watch?v=n0ywCHKXJ5o (plan is to ruin millionaires)

US CBO officially projects US national debt (credit) to $20 trillion soon, when interest rates rise to 10%, that will be $2 trillion yearly interest payments, but USA govt only collects $2 trillion in taxes. And unemployment is increasing (jobs are being outsourced to cheaper countries, i.e. call centers), 80 million 62 year olds are retiring, thus tax receipts will fall to $1.4 trillion, thus the USA govt will be unable to pay (bankrupt), causing interest rates to rise more. DOLLAR DEFAULT! In 2005, I predicted the 2007/8 crisis, and now I am predicting a DEADLY crisis by 2012/14. I have strong skills in math & research.

USA dream (& Europe) is dying.

CBO interprets next 10 years too optimistically, because they are not factoring in the next wave of mortgage resets and other stuff that is going to wrong between now and 2012:

http://www.financialsense.com/editorials/conrad/2010/0323.html

The plan is after this global depression, there will only be 2 classes, the billionaires and the rest of humanity (no more millionaires):

I think it should be a given, that TPTB have a plan to take away the gold and silver from those who try to hoard $millions of it. The problem is you can't easily hide that much metal. They know who is buying metal in that quantity. And the rest of us, won't have the scale to do much more than survive with the amount of metal we are able to get away from the roaming gangs, etc.

There is a bigger trend, which is the end of the monetary incentive:

https://goldwetrust.forumotion.com/economics-f4/peak-oil-nonsense-t102-15.htm#2845 (watch the video at this link)

The current Doom is fabricated lie because TPTB are afraid of the lack of scarcity!

After you watch the video at that link, TPTB are trying to retain control over the technology, so they can retain control over these excess resources. As we need less and less people to do the hard-engineering, then we have a mass of "useless eaters". TPTB want to use this mass as political force to maintain their control.

But what is happening is that as price of resources drops to near 0 due to automation, then the value of art/creativity is rising relatively speaking. Thus the new money has to be some form of way to trade art. So again the money can be based on truth or the lie of usury. I think this is why TPTB are forced to move to 666 (pay in blood) digital body tagging, because they will need to control the trade of digital art/creativity.

This is very interesting because it shows me exactly what I need to be working on in the computer realm.

===========

ADD: to elaborate on the theme of the "Resource Economy" (see video in above link), I think the trend may not be mostly about removing profit, as it is about making the added value of the industrial economy and labor, nearly irrelevant (very insignificant cost), and making the input resources (think silver!) and creativity/art a much more significant portion of the economy. Thus the ideal should not be to eliminate profit, but as it has always been, to make savings ideally in the resources we need. The new wrinkle is that software itself could possibly be a resource and could be a form of money, except it is probably not fungible. So I think we are still looking at silver and gold as representations of effort, as the most equitable system, and still the bankster trying to keep the masses on the hamster wheel of usury. What really changes is that added value of the industrial economy and labor deflate precipitiously now and this will cause massive dislocations and opportunities. The opportunity to add value with creativity/art/technology will have never been greater, because the resource/manual labor cost will be so low in doing so. The person who can figure out the way to involve as much of humanity as possible in creativity/art/technology production, will become a $trillionaire.

Google has apparently recognized that ultimately industrial monopoly will fade as creativity/art/technology surges, thus China will be the big loser:

http://finance.yahoo.com/banking-budgeting/article/109159/stance-by-china-to-limit-google-is-risk-by-beijing

Google's decision may not cause major problems for China right away, experts said. But in the longer run, they said, China's intransigent stance on filtering the flow of information within its borders has the potential to weaken its links to the global economy.

We are surely to get a disintegration of the current monetary system, with TPTB's driving the masses towards false (human induced, via socialism) scarcity and chaotic failure, and the terminal descent towards hyperinflationary (relative to gold) greatest hell depression is accelerating:

http://market-ticker.denninger.net/archives/2104-How-Far-Down-The-Rabbit-Hole-Must-We-Go.html

Deflation is winning

Deflation is winning

$HUI:$GOLD compared in prior 2001 reflation, shows that deflation is winning (gold is gaining relative strength to gold stocks):

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-195.htm#2861

My broad view is crushing deflation (declining assets, purchasing power) combined with inflation (negative real interest rates), and capital controls/seizure to sustain socialism, position in physical precious metals and long-term invest for next epoch technological shift.

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-195.htm#2861

My broad view is crushing deflation (declining assets, purchasing power) combined with inflation (negative real interest rates), and capital controls/seizure to sustain socialism, position in physical precious metals and long-term invest for next epoch technological shift.

re: Deflation is winning

re: Deflation is winning

http://investophoria.blogspot.com/2010/03/long-term-hui.html?showComment=1269686346310#c4007926895665526281

Jerry I did not write "negative interest rates", I wrote "negative *REAL* interest rates". We will have negative REAL interest rates until gold peaks in value and until socialism has been defeated. Because to have positive REAL interest rates, would mean to let all the defaults (and over indebted "useless eaters") go bust and to reset the western economies to 3rd world status. Positive REAL interest rates would mean that no one is bailed out, no one is given welfare, all the fat is chopped off, so only the lean and mean part of the economy can grow fast. It would end all of the mis-allocation and put billions of people in their deserved place as "nearly worthless eaters" (so they could change or starve, and the former with God inspired community). So it is extremely unlikely we will see positive REAL interest rates. We will see world war before that, because socialism is deeply engrained and will go on until it fails into fascism.

We do have some offsetting growth of capitalism in developing world, which mitigates and extends the time that the socialism parasite can live on.

I did not write "deflation", I wrote "deflation of assets and purchasing power" and monetary "inflation measured as negative REAL interest rates". How can any one argue that we don't have deflation of the RELATIVE value of stocks, houses, and other leveraged assets. Jerry you would have to blind to look at $SPY:$GOLD chart and tell me that S&P500 has not declined in value (purchasing power!) relative to gold (money)!

Did I really need to explain that?

The trap of land is that it can keep its value in inflation (energy cost is too high a component of the food profit) and the C$ is going to be worse than the dollar under deflation because of its resource dependence.

Only technology offers us any hope out of this mess. Otherwise hold tight to the most liquid asset (gold) and pray. And try to be productive in technology paradigm shifts that could defeat the socialism faster.

You will not be able to win by sitting in your easy chair, with a cigar and land, as socialism spreads every where. This will take everything down. Even gold could become so dangerous, we will throw it into the street. As I said, pray we are not in the final tribulations, and that this socialism is breakable early enough. I do see hope with nanotechnology and the internet. Google's move to uncensor for China is pointing towards the internet breaking the back of the socialism. The big push will come from P2P commercialization, which will then be unstoppable by courts and govts.

-S

Jerry I did not write "negative interest rates", I wrote "negative *REAL* interest rates". We will have negative REAL interest rates until gold peaks in value and until socialism has been defeated. Because to have positive REAL interest rates, would mean to let all the defaults (and over indebted "useless eaters") go bust and to reset the western economies to 3rd world status. Positive REAL interest rates would mean that no one is bailed out, no one is given welfare, all the fat is chopped off, so only the lean and mean part of the economy can grow fast. It would end all of the mis-allocation and put billions of people in their deserved place as "nearly worthless eaters" (so they could change or starve, and the former with God inspired community). So it is extremely unlikely we will see positive REAL interest rates. We will see world war before that, because socialism is deeply engrained and will go on until it fails into fascism.

We do have some offsetting growth of capitalism in developing world, which mitigates and extends the time that the socialism parasite can live on.

I did not write "deflation", I wrote "deflation of assets and purchasing power" and monetary "inflation measured as negative REAL interest rates". How can any one argue that we don't have deflation of the RELATIVE value of stocks, houses, and other leveraged assets. Jerry you would have to blind to look at $SPY:$GOLD chart and tell me that S&P500 has not declined in value (purchasing power!) relative to gold (money)!

Did I really need to explain that?

The trap of land is that it can keep its value in inflation (energy cost is too high a component of the food profit) and the C$ is going to be worse than the dollar under deflation because of its resource dependence.

Only technology offers us any hope out of this mess. Otherwise hold tight to the most liquid asset (gold) and pray. And try to be productive in technology paradigm shifts that could defeat the socialism faster.

You will not be able to win by sitting in your easy chair, with a cigar and land, as socialism spreads every where. This will take everything down. Even gold could become so dangerous, we will throw it into the street. As I said, pray we are not in the final tribulations, and that this socialism is breakable early enough. I do see hope with nanotechnology and the internet. Google's move to uncensor for China is pointing towards the internet breaking the back of the socialism. The big push will come from P2P commercialization, which will then be unstoppable by courts and govts.

-S

silberruecken- Posts : 30

Join date : 2008-11-12

re: Deflation is winning

re: Deflation is winning

The proof of western deflation is that everything that is not purchased by the developing world, is declining in price relative to gold.

Period. Read the above paragraph over and over until the fact sinks in.

And the above is accelerating, as I showed with the chart of $HUI:$GOLD (comparing gold stocks to gold during 2001 and 2008 reflations).

Resource economics such as Canada and Australia are booming, but I say these are bubbles because the BRICs are not on a sustainable path. They've tried to move too fast, in China's case using slave (not free market, market access control over) labor (a Yuan peg) to try to undo decades of socialism unnaturally fast while maintaining control of the privileged, i.e. massive mis-allocation of resources. In Brazil, also have massive govt central planning boondoggles in the making. Ditto Russia.

The only inflation is monetary, but these is not being captured by most assets, rather we have deflation as these are declining against gold (money). This will accelerate as the socialism is accelerating. The only defense the common man has against those in control of the fiat system, is gold. They are ratcheting the economy lower and seizing all the assets at fire sale prices relative to gold:

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

They are not buying gold. They were accumulating at < $300. They are now using the fiat system to accumulate all the secured assets and turn the former "owners" (mortgagees) into renters and slaves.

There is no scarcity of energy, land, or any other natural resources except for precious metals. These artificial scarcity bubbles are being manufactured by the debt bubble and its decline into socialism. Keep your eye on the relative price of things to gold, and this will paint an accurate picture of inflation versus deflation.

-S

=====================

Contrary to what most people believe, mining company stocks did not prosper during the Great Depression for as long as gold was money up to 1933:

https://goldwetrust.forumotion.com/stocks-f2/junior-mining-companies-t15.htm

The 1970s was primarily inflationary, with most everything the westerners were buying was increasing faster in price than gold, until the very end when gold price choked off mis-allocation, and there was high REAL interest rates to choke off the gold price. But this was possible, because the USA was not a debtor nation. And the boomers were in their prime working years (30s). Neither is the case today. We are now in a massively deflationary period. Run away from stocks, including mining stocks, as they will increasingly lose relative strength to gold. The only money to be made in these paper assets are buying and shorting ONLY the extreme ranges of volatility. The daily, weekly, and monthly volatility can not be consistently played to out-perform buy&hold of gold.

-S

========================

For example, one would have been wise to sell gold on the Oct 2008 crash, and buy mining stocks or silver. One should have moved to cash at $1200 & $19, and now should be scaling back in to gold, or to silver/stocks if one believes there is another reflation wave higher before the next implosion wave.

And at no time should one sell their core position in precious metals, as eventually capital controls are going to be put in place, and only physical precious metals will potentially escape unscathed.

-S

=======================

Your 20 reasons link fails to mention that 80 million boomers (50% the working age population) are retiring in USA. Even if they don't retire, they are beyond their most productive years. I don't even think Einstein was productive beyond 60, it is just a fact of physical and mental decline. That is only for USA, these demographic time bombs are occurring in Europe, Japan, and then in China by 2020.

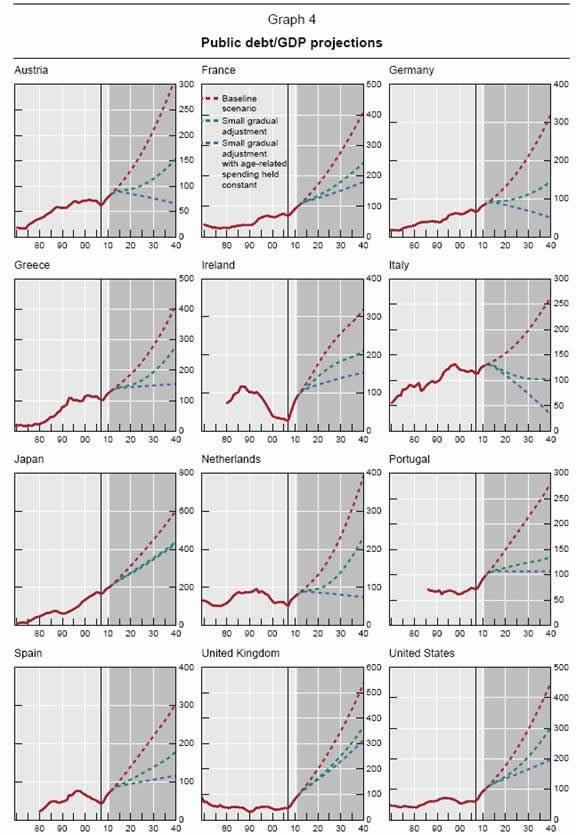

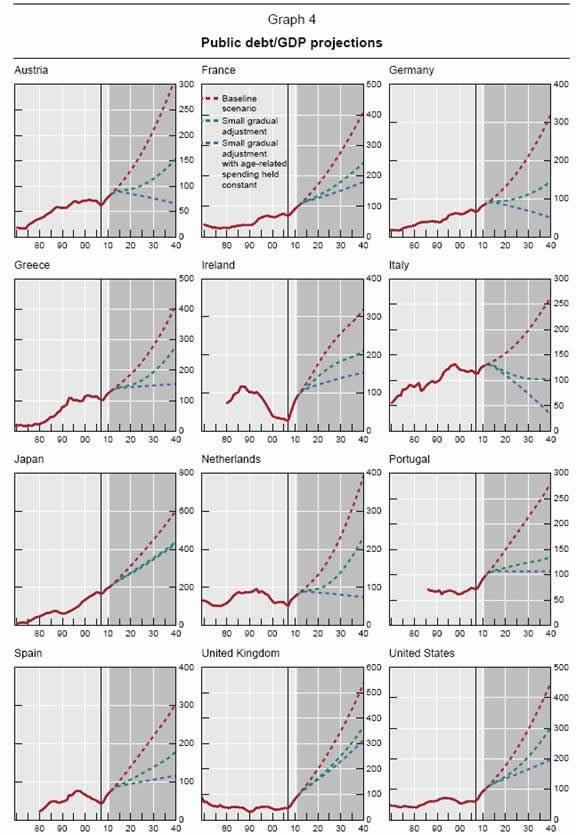

Using only the current trajectory, USA national debt goes to $20 trillion this decade, but USA only collects $2 trillion in taxes, with a huge decline to come from retirement of 50% of the working age population. Also the 2nd wave of mortgage defaults including commercial (currently in a valley or lull) will be worse than 2007/8 and peak again by 2011, and will cause a re-adjustment of that $20 trillion projection significantly upwards. So in order for us to get POSTIVE REAL interest rates, we would need something north of 10%, but the USA is bankrupt in that scenario, because even if tax rates are doubled or tripled, there won't be enough taxes to pay the interest on the national debt. And that is just national debt, not including local and state and personal and corporate debts. This situation exists in much of the western world. The developing world has better fundamentals for debt and savings, except their economies are also in bubbles linked to the western debt bubble.

There will be massive deflation relative to gold, because the govts/banks will massively monetarily inflate. But this monetary inflation will only be captured by those who hold the gold. Remember "he who has the gold, makes the rules".

-S

=================

Oh and I forgot the most important reason deflation is the trend. We have no scarcity of labor in the world, as automation is increasing at an exponential rate.

Manufacturing costs will continue to decline towards zero, until things cost nearly the same as the raw materials cost when produced in million unit volumes.

The next trend is to bring the volume down so that "zero manufacturing cost" can be applied to diverse niches. This social networking or design engineering is what can employ the world and lift us out of this deflation. This is why I say technology is so important now, especially nanotechnology and networking/collaboration/cloud software (what I am working on, Copute.com).

-S

====================

Folks the industrial revolution is dying. We need to move to the next wave of the information revolution, which is P2P networked collaborative. The client-server model must die. Nano and biotech is really just software. Everyone will become involved in software, even if they don't realize it because there will be clever user interfaces for people to design with. Watch the western youth, the smart ones get it already. There is a reason they embrace social networking and gadgets. We old folk don't get it yet.

And moving back to the agricultural revolution is not the solution (which is why land is not the winner in this epoch).

-S

Period. Read the above paragraph over and over until the fact sinks in.

And the above is accelerating, as I showed with the chart of $HUI:$GOLD (comparing gold stocks to gold during 2001 and 2008 reflations).

Resource economics such as Canada and Australia are booming, but I say these are bubbles because the BRICs are not on a sustainable path. They've tried to move too fast, in China's case using slave (not free market, market access control over) labor (a Yuan peg) to try to undo decades of socialism unnaturally fast while maintaining control of the privileged, i.e. massive mis-allocation of resources. In Brazil, also have massive govt central planning boondoggles in the making. Ditto Russia.

The only inflation is monetary, but these is not being captured by most assets, rather we have deflation as these are declining against gold (money). This will accelerate as the socialism is accelerating. The only defense the common man has against those in control of the fiat system, is gold. They are ratcheting the economy lower and seizing all the assets at fire sale prices relative to gold:

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

They are not buying gold. They were accumulating at < $300. They are now using the fiat system to accumulate all the secured assets and turn the former "owners" (mortgagees) into renters and slaves.

There is no scarcity of energy, land, or any other natural resources except for precious metals. These artificial scarcity bubbles are being manufactured by the debt bubble and its decline into socialism. Keep your eye on the relative price of things to gold, and this will paint an accurate picture of inflation versus deflation.

-S

=====================

Contrary to what most people believe, mining company stocks did not prosper during the Great Depression for as long as gold was money up to 1933:

https://goldwetrust.forumotion.com/stocks-f2/junior-mining-companies-t15.htm

The 1970s was primarily inflationary, with most everything the westerners were buying was increasing faster in price than gold, until the very end when gold price choked off mis-allocation, and there was high REAL interest rates to choke off the gold price. But this was possible, because the USA was not a debtor nation. And the boomers were in their prime working years (30s). Neither is the case today. We are now in a massively deflationary period. Run away from stocks, including mining stocks, as they will increasingly lose relative strength to gold. The only money to be made in these paper assets are buying and shorting ONLY the extreme ranges of volatility. The daily, weekly, and monthly volatility can not be consistently played to out-perform buy&hold of gold.

-S

========================

For example, one would have been wise to sell gold on the Oct 2008 crash, and buy mining stocks or silver. One should have moved to cash at $1200 & $19, and now should be scaling back in to gold, or to silver/stocks if one believes there is another reflation wave higher before the next implosion wave.

And at no time should one sell their core position in precious metals, as eventually capital controls are going to be put in place, and only physical precious metals will potentially escape unscathed.

-S

=======================

Your 20 reasons link fails to mention that 80 million boomers (50% the working age population) are retiring in USA. Even if they don't retire, they are beyond their most productive years. I don't even think Einstein was productive beyond 60, it is just a fact of physical and mental decline. That is only for USA, these demographic time bombs are occurring in Europe, Japan, and then in China by 2020.

Using only the current trajectory, USA national debt goes to $20 trillion this decade, but USA only collects $2 trillion in taxes, with a huge decline to come from retirement of 50% of the working age population. Also the 2nd wave of mortgage defaults including commercial (currently in a valley or lull) will be worse than 2007/8 and peak again by 2011, and will cause a re-adjustment of that $20 trillion projection significantly upwards. So in order for us to get POSTIVE REAL interest rates, we would need something north of 10%, but the USA is bankrupt in that scenario, because even if tax rates are doubled or tripled, there won't be enough taxes to pay the interest on the national debt. And that is just national debt, not including local and state and personal and corporate debts. This situation exists in much of the western world. The developing world has better fundamentals for debt and savings, except their economies are also in bubbles linked to the western debt bubble.

There will be massive deflation relative to gold, because the govts/banks will massively monetarily inflate. But this monetary inflation will only be captured by those who hold the gold. Remember "he who has the gold, makes the rules".

-S

=================

Oh and I forgot the most important reason deflation is the trend. We have no scarcity of labor in the world, as automation is increasing at an exponential rate.

Manufacturing costs will continue to decline towards zero, until things cost nearly the same as the raw materials cost when produced in million unit volumes.

The next trend is to bring the volume down so that "zero manufacturing cost" can be applied to diverse niches. This social networking or design engineering is what can employ the world and lift us out of this deflation. This is why I say technology is so important now, especially nanotechnology and networking/collaboration/cloud software (what I am working on, Copute.com).

-S

====================

Folks the industrial revolution is dying. We need to move to the next wave of the information revolution, which is P2P networked collaborative. The client-server model must die. Nano and biotech is really just software. Everyone will become involved in software, even if they don't realize it because there will be clever user interfaces for people to design with. Watch the western youth, the smart ones get it already. There is a reason they embrace social networking and gadgets. We old folk don't get it yet.

And moving back to the agricultural revolution is not the solution (which is why land is not the winner in this epoch).

-S

Ability to inflate dies when the larger sovereign debt ratings die

Ability to inflate dies when the larger sovereign debt ratings die

What we have in Europe and USA is that the accumulated deficits from 15+ years of exporting jobs to developing world, are unable to be financed. The derivative swaps used to hide this reality are now unable to sustain the ponzi scheme. To prevent the inevitable deflation, those remaining sovereigns with some headroom before reaching "banana republic" debt ratios, have chosen to ruin their ratios to kick the can down the road a little bit longer. This will finally bust the larger sovereigns around 2011 - 2014. Then there will be fighting, because that is all people know how to do when there is no solution any more.

We need a technology solution to this unemployment and we need it fast!

-S

We need a technology solution to this unemployment and we need it fast!

-S

Industrial Age Dying in China circa 2012

Industrial Age Dying in China circa 2012

http://investophoria.blogspot.com/2010/03/third-and-wildly-bullish-scenario-for.html?showComment=1270494018475#c7932285578628067668

Ray, agreed on great change, but bear-in-mind that manufacturing profits are being driven to 0 (even negative as China is subsidizing their production now). China has been handed the industrial revolution at it's death throes.

Food economies-of-scale were driven so high with petro-farming, that it became unprofitable to be a farmer and farms were subsidized by govts, debt financing, and by a *negative* EROEI for farming petrol inputs. Now industrial production is entering a similar fate.

The future is not the agricultural nor industrial revolutions, just as we are not going back to Stone or Bronze ages.

Rather the future is about information and knowledge networking. Nanotech, biotech, and cloud computing...

Unless someone can figure out a way to involve the masses in producing value with these new technologies, then the masses have been reduced to "useless eaters". This shift to making industrial production a 0 profit (raw material cost), which is making billions of people unemployed, is what is causing the deflation. This is why the world has no choice but to use money printing to socialize the problem. There is excess industrial productive economies-of-scale now (capacity).

I understand that the technology solution in the cloud computing space will be one of proliferating the ability of masses to do mashups and design. We will have all this 0 cost productive capacity and we need a proliferation of designs to match all the varied needs of humans, since humans are not cookie cutter and have diverse needs.

The energy economies-of-scale will take another leap with nuclear. TPTB are holding this card back, they will play it when it best suits their interests.

This is a N-dimensional chess board, you need to look at how all this interacts and timing.

-Shelby

Add to above post, that developing world has billions been forced from farms into cities to seek income. Right now they are taking over the mundane office work from the western world ("call centers"), professional services (nurses, doctors, programmers, etc), but many of these are jobs that will be eliminated with computer automation in coming years.

All trash (dead end) jobs are being dumped on the developing world, leaving the west a shell of debt-dependent masses and developing world too will never reach full employment.

The people supporting the economy now are the high tech workers (and some one-time infrastructure build out in developing world), and this will worsen, unless someone figures out a way to involve these masses in the new information technology economy. That is why I am working on copute.com

-Shelby

And this is why so many are being turned into gamblers (ahem "traders"), because they can find no suitably profitable employment.

But there is a role for people who can involve themselves in the new technologies and/or in the transitional chessboard (e.g. the infrastructure build out in developing world, cultural/language interfacing, etc).

Last edited by Shelby on Tue Apr 06, 2010 7:00 pm; edited 2 times in total

re: Industrial Age Dying in China circa 2012

re: Industrial Age Dying in China circa 2012

http://investophoria.blogspot.com/2010/03/third-and-wildly-bullish-scenario-for.html?showComment=1270579737152#c7767653970789960140

Ray thanks for you thoughts.

I have not been to China, but I've been to Hong Kong, and I am in Philippines right now. What I see is that China has a huge population, and much of it is still rural and not educated with the type of creativity that will be necessarily to compete in the new technology epoch.

Given that a large population is a liability in era of increasing automation, then I do not see how China has a strong position. Also China has a severe demographic bubble that will peak around 2020, due to their insane 1 child policy.

Someone sent me humorous image of how China "does not waste anything", and it was 100m meter track start, with the starting gun pointed at a dissident's head, with arms tied behind back.

I have also been told by someone who outsources manufacturing to China, that the factories have razor thin profit margins, and they get by not paying their suppliers on time, floating on the inventory for 90+ days, etc.. Also I have observed the mentality of the Chinese who run most of the business in Philippines, they try to extract every last penny (centavo) of cost cutting, even if it means service sucks. For example, the least expensive place to buy computer supplies here in Philippines is CR King, and they have walls and walls of stuff from China at like 1/2 to 1/3 the price of the other name brand stuff in other computer stores. But their are only 5 ladies serving dozens of customers, and so you have to take a number and wait up to 1 hour to get served. That cuts the costs as much as possible, except for the customer who loses the cost of his time. That works economically here, because there are billions of underemployed people in Asia with nothing to do with their time. That is why SMS txting is so popular here (and becoming more popular in west), because even it is slow to type with 2 thumbs, people have too much time to waste.

And where does all this wasted time end up? It ends up in economic failure.

Ray the point is that manufacturing (industry) is now a liability, not an asset. Proof is as I wrote before, China is forced to subsidize their factories now with their savings, proving it is a negative ROI activity. Farming has long been a liability.

The assets now will be pure technology and design.

TPTB in old europe have handed China the trash.

The strong position now is not a nation, but individuals who possess strong new technology skills. The rest will have to attach themselves (even if indirect recipients of govt spending in their area) on the coattails of an expanding government (that must expand to steal from the producers to feed the expanding supply of useless eaters).

To make it clear, the reason that manufacturing is a liability is because the value added (over the input raw materials cost) is driving towards 0. This is because automation is accelerating exponentially.

The value added is in the design of both the automation and even more so on the products to be produced.

And this applies to software also. The cost of manufacturing software is 0 (electronic copy), the valued added is in the programming or design of the electronic product.

The X generation understands this shift. They grew up with it. The smartest 20 year olds are in biotech, nanotech, or at least looking for jobs abroad to be part of the transitional phase of this epoch of globalization and industrial revolution death throes.

Although a smaller population is preferable in the death throes of industrial age, a declining population is also a transitional social delimma, because the lower quantity of workers have to support an increasing quantity of retirees.

China is expending savings to subsidize industrial full employment, and this is evidenced by both a Yuan peg (that traps all savings in the country) and the recent govt stimulost in excess of 20% of GDP. The savings of China is not allowed to seek its optimum path. Rather it is centrally allocated to western treasury bonds, commodity stockpiles, overexpansion of manufacturing capacity at razor-thin profit margins, etc..

TPTB are driving us away from the technnology solutions and towards a massive global implosion in employment that will drive the world towards a one world govt.

To defeat this, we technologists/futurists (such as myself) have to get more busy at delivering technological paradigm shifts. So in short, I need to shut up.

Hope my input has helped some. If you have necessary skills (I mean if you are top 1% in your university and career), please get in touch with me. I am working on some revolutionary things in software.

Madmax nearly certain now

Madmax nearly certain now

Finally Hommel admits how bad it could get:

http://silverstockreport.com/2010/doj.html

Preparation for big changes in the global financial order. The craziness I see coming, outstrips the imagination. The federal debt is now more than annual GDP, and if all current retirement mandates are funded, then it will rise to several times GDP in coming decade or two. This means at double-digit interest rates (which is likely given rampant inflation needed to inflate away value of the debt), even 100% of GDP could not pay the interest on the national debt. This will cause increased borrowing, which will increase the national debt faster, which make it even worse than above statement. The only way out is to drastically reduce the lifestyle (including housing, etc), or to inflate away the value of the debt. Even 100% taxes won't solve the problem without doing one of those 2 actions. Thus we can be nearly certain that massive inflation is on the way. But this doesn't solve the problem, because it continually raises the quantity of the national debt. This would be an endless debt trap spiral with massive inflation that ends only with a MadMax outcome (or world war). You would have massive social unrest during this. The most sane option is for westerners to right now decrease their standard-of-living voluntarily and buy gold and silver. But this won't happen. Less than 1 in 1000 own gold, and many of them own it in IRAs or certificate forms, and the govt can steal of all this through taxation.

Note that is monetary inflation, combined with cost of manufacturing deflation. This is a wicked mix, and no country will be spared.

The cockiness of the westerner, who doesn't even understand that Shannon-Nyquist theorem of sampling says that science can not know anything, because until you've sampled a signal infinite samples, you don't know if your reconsruction is aliased to the opposite result from the true signal being measured. An example, is take a grid of pixels and sample vertical lines that are narrower than 1 pixel. Some of the lines disappear entirely.

How can I debate someone who is ignorant of basic math and theorems? They are too stupid to even know what science is, so they put science on a separate plane from the Bible. If they only had studied math and science at the fundamental level, they wouldn't be so cocky. And you know what the Bible says will happen to these cocky fools during this epoch?

Maybe you can pray that the Bible is a fairy tale. I sure hope it is. Facts above speak for them self. Bible says clearly this would happen. It even says we will throw our gold in the streets because it will be too dangerous to use it. This is what happens when only 1 in 1000 has any wealth and the rest can be used against the millionaires. TPTB have a plan to wipeout the millionaires in this decade. There will only be billionaires and the cattle.

Make that quadrillionaires and the cattle.

Fiddling while Rome burned...

I don't know why I waste me time, but here is the typical example used to claim the Bible is barbaric:

http://www.biblegateway.com/passage/?search=1%20Samuel%2015:1-3

The part about killing women and children.

But readers take it out-of-context. Lord warned the people that if they use a govt (King), he will steal everything and it will lead to use barbaric outcomes:

http://www.biblegateway.com/passage/?search=1%20Samuel%208

The Lord is just fulfilling the natural law. The Bible is simply a statement of how the universe works (nature's laws). It is not a bearded man making these decisions to kill children. Don't hallucinate. The fact is whorEshipping a government and law, as we have done in the west, leads to barbaric outcomes, as you are about to witness in this decade and/or next decade.

Man is barbaric, not the Bible. The Bible is just stating reality.

Seems you are the one fabricating fairytales, if you think man's nature is not barbaric.

http://silverstockreport.com/2010/doj.html

The silver price suppression scheme, and the resulting failure of paper money, and the resulting collapse of commerce and world trade risks sending the entire world into a severe depression that risks famine on a world scale unlike what has ever been seen before in world history, and could therefore cause the direct deaths of anywhere up to a third of all humans on earth, or even more.

Preparation for big changes in the global financial order. The craziness I see coming, outstrips the imagination. The federal debt is now more than annual GDP, and if all current retirement mandates are funded, then it will rise to several times GDP in coming decade or two. This means at double-digit interest rates (which is likely given rampant inflation needed to inflate away value of the debt), even 100% of GDP could not pay the interest on the national debt. This will cause increased borrowing, which will increase the national debt faster, which make it even worse than above statement. The only way out is to drastically reduce the lifestyle (including housing, etc), or to inflate away the value of the debt. Even 100% taxes won't solve the problem without doing one of those 2 actions. Thus we can be nearly certain that massive inflation is on the way. But this doesn't solve the problem, because it continually raises the quantity of the national debt. This would be an endless debt trap spiral with massive inflation that ends only with a MadMax outcome (or world war). You would have massive social unrest during this. The most sane option is for westerners to right now decrease their standard-of-living voluntarily and buy gold and silver. But this won't happen. Less than 1 in 1000 own gold, and many of them own it in IRAs or certificate forms, and the govt can steal of all this through taxation.

Note that is monetary inflation, combined with cost of manufacturing deflation. This is a wicked mix, and no country will be spared.

The cockiness of the westerner, who doesn't even understand that Shannon-Nyquist theorem of sampling says that science can not know anything, because until you've sampled a signal infinite samples, you don't know if your reconsruction is aliased to the opposite result from the true signal being measured. An example, is take a grid of pixels and sample vertical lines that are narrower than 1 pixel. Some of the lines disappear entirely.

How can I debate someone who is ignorant of basic math and theorems? They are too stupid to even know what science is, so they put science on a separate plane from the Bible. If they only had studied math and science at the fundamental level, they wouldn't be so cocky. And you know what the Bible says will happen to these cocky fools during this epoch?

Maybe you can pray that the Bible is a fairy tale. I sure hope it is. Facts above speak for them self. Bible says clearly this would happen. It even says we will throw our gold in the streets because it will be too dangerous to use it. This is what happens when only 1 in 1000 has any wealth and the rest can be used against the millionaires. TPTB have a plan to wipeout the millionaires in this decade. There will only be billionaires and the cattle.

Make that quadrillionaires and the cattle.

Fiddling while Rome burned...

I don't know why I waste me time, but here is the typical example used to claim the Bible is barbaric:

http://www.biblegateway.com/passage/?search=1%20Samuel%2015:1-3

The part about killing women and children.

But readers take it out-of-context. Lord warned the people that if they use a govt (King), he will steal everything and it will lead to use barbaric outcomes:

http://www.biblegateway.com/passage/?search=1%20Samuel%208

The Lord is just fulfilling the natural law. The Bible is simply a statement of how the universe works (nature's laws). It is not a bearded man making these decisions to kill children. Don't hallucinate. The fact is whorEshipping a government and law, as we have done in the west, leads to barbaric outcomes, as you are about to witness in this decade and/or next decade.

Man is barbaric, not the Bible. The Bible is just stating reality.

Seems you are the one fabricating fairytales, if you think man's nature is not barbaric.

Pumping up a bigger crash to come (final encore in boomer land)

Pumping up a bigger crash to come (final encore in boomer land)

Shelby wrote:Finally Hommel admits how bad it could get:

http://silverstockreport.com/2010/doj.htmlThe silver price suppression scheme, and the resulting failure of paper money, and the resulting collapse of commerce and world trade risks sending the entire world into a severe depression that risks famine on a world scale unlike what has ever been seen before in world history, and could therefore cause the direct deaths of anywhere up to a third of all humans on earth, or even more.

Preparation for big changes in the global financial order. The craziness I see coming, outstrips the imagination. The federal debt is now more than annual GDP, and if all current retirement mandates are funded, then it will rise to several times GDP in coming decade or two. This means at double-digit interest rates (which is likely given rampant inflation needed to inflate away value of the debt), even 100% of GDP could not pay the interest on the national debt. This will cause increased borrowing, which will increase the national debt faster, which make it even worse than above statement. The only way out is to drastically reduce the lifestyle (including housing, etc), or to inflate away the value of the debt. Even 100% taxes won't solve the problem without doing one of those 2 actions. Thus we can be nearly certain that massive inflation is on the way. But this doesn't solve the problem, because it continually raises the quantity of the national debt. This would be an endless debt trap spiral with massive inflation that ends only with a MadMax outcome (or world war). You would have massive social unrest during this. The most sane option is for westerners to right now decrease their standard-of-living voluntarily and buy gold and silver. But this won't happen. Less than 1 in 1000 own gold, and many of them own it in IRAs or certificate forms, and the govt can steal of all this through taxation.

Note that is monetary inflation, combined with cost of manufacturing deflation. This is a wicked mix, and no country will be spared...

Consumer spending increasing because people are not paying their mortgages (also $8000 new home buyer credit, etc):

http://market-ticker.denninger.net/archives/2194-Oh,-So-The-Recovery-Is-About-Delinquency.html

Federal Deficits (as a % of GDP) are increasing 10% faster than GDP is, this means private sector GDP is imploding by -10% per year:

http://market-ticker.denninger.net/archives/2195-Bernanke-I-Tricked-You-And-Now-Youre-Screwed.html

Folks that is already GREAT DEPRESSION in private sector, being levitated by bankers not calling in their loans yet.

When TPTB are ready, they are going to crash this sucker and going to see -20% fall out of the economy overnight at least. Actually with all the leverage, derivatives, etc, this can easily be -90% blow to the economy at the flip of a bankster lever, when they are ready:

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

Enjoy this final party while you can. Will it last into 2015? I feel we will see extreme rollercoaster ride, but we might just see the nations hold it together for another years, moving to very severe controls and massive monetary inflation and misallocation.

It is going to ugly if they hold it together that long, so either way, we are looking at forms of chaos not too far out...

Tompson sees TPTB core (Rothchilds) going to war against the nations' bonds soon:

http://www.gold-eagle.com/editorials_08/thomsons041310.html

Are you prepared for massive changes in global order?

=================

http://investophoria.blogspot.com/2010/04/market-overview.html?showComment=1271258942253#c3074914251297776106

Ray, you do not understand what is going on. China is a nation, on the aggregate it will suffer immensely. China's controlling elite know this and they are just maximizing their position. The old world bankers are playing the strengths and weaknesses and will continue to increase power.

It is not "he who holds the gold". It is "he who holds the gold, and does not hold 1.5 billion peasants liability". There is no way China will ever have as much gold per capita as the USA once had.

That time is finished, never to return again. We are in the final mopping up stages of the one world order, where gold can not be held by people any more. That is what this big shift will do by the end of it.

You do not seem to understand that China came to the party too late, and too debt in socialism debt. They can not undo 50 years of shooting themselves in the feet, with 2 decades of Yuan-pegged anti-capitalism.

=============

In short, the Chinese elite are just pimping their population to the old european banksters. Communist party is nothing but a massive sheeple herding system. Pimps and their socialism sheeple whores. That is what world is coming to now.

Soros says much worse coming

Soros says much worse coming

http://moneynews.com/StreetTalk/GREECE-GREEK-SOVEREIGNDEBT-CRISIS/2010/04/16/id/355942

Soros wrote:"The correction has scarcely started."

Global interest rate manipulation scam

Global interest rate manipulation scam

> Shelby wrote:

>> Tiny houses in Vancouver selling for over $1 million:

>>

>> http://market-ticker.denninger.net/archives/2202-No,-Theres-No-Bubble-In-Canada-Real-Estate.html

>>

>> The point is there will be crash in the NorthWet eventually and housing

>> values will fall drastically to something more consumerate with their

>> value (pine trees are not expensive).

>

>

> Chinese money going in there. Maybe also some speculation post-Olympics.

> Vancouver is a BIG, international city. Too weird for me.

It is balloon that will pop, just as China will pop.

China tried to recover from decades of socialism (centralized mismanagment, misallocation; an experiement the USA is now trying), by trapping all their citizen's savings inside the country, by controlling all foreign exchange (Yuan exchanged to other currencies), and thus keeping their masses international purchasing power lower. This entrapment of personal savings (deposited at banks in China) was loaned at super low interest rates to factories and enabled their factories to undercut pricing and increase global market share of exports. So now we have too much supply of industrial production, at too low of prices. The free market pricing mechanism were killed by the centralized control over exchange rate. This has put the entire world in a state of misallocation of human resources (pricing). The result is too much production of things people do not need, as much as other things people need more. This paradigm lead to ultra-low interest rates in West, which fueled a misallocation in housing.

They had to sell 1000x more paper gold and silver (than physical metal), and write quadrillions in derivatives, to keep this global interest rate fraud scheme from busting earlier.

This is failing. We are in the last stages as the socialists all huddle together, printing more misallocation (money), so they can all go down to complete failure together.

That is what this is all about.

>> Tiny houses in Vancouver selling for over $1 million:

>>

>> http://market-ticker.denninger.net/archives/2202-No,-Theres-No-Bubble-In-Canada-Real-Estate.html

>>

>> The point is there will be crash in the NorthWet eventually and housing

>> values will fall drastically to something more consumerate with their

>> value (pine trees are not expensive).

>

>

> Chinese money going in there. Maybe also some speculation post-Olympics.

> Vancouver is a BIG, international city. Too weird for me.

It is balloon that will pop, just as China will pop.

China tried to recover from decades of socialism (centralized mismanagment, misallocation; an experiement the USA is now trying), by trapping all their citizen's savings inside the country, by controlling all foreign exchange (Yuan exchanged to other currencies), and thus keeping their masses international purchasing power lower. This entrapment of personal savings (deposited at banks in China) was loaned at super low interest rates to factories and enabled their factories to undercut pricing and increase global market share of exports. So now we have too much supply of industrial production, at too low of prices. The free market pricing mechanism were killed by the centralized control over exchange rate. This has put the entire world in a state of misallocation of human resources (pricing). The result is too much production of things people do not need, as much as other things people need more. This paradigm lead to ultra-low interest rates in West, which fueled a misallocation in housing.

They had to sell 1000x more paper gold and silver (than physical metal), and write quadrillions in derivatives, to keep this global interest rate fraud scheme from busting earlier.

This is failing. We are in the last stages as the socialists all huddle together, printing more misallocation (money), so they can all go down to complete failure together.

That is what this is all about.

China is resisting the computer revolution

China is resisting the computer revolution

We can see it with their censorship of Google. Their resistance of technology which enables individuals to make their own free market decisions. I can even argue that China is causing the debt binge in the west and causing the resistance of the globe to adjust to the new technology revolution. China is holding everything back. China is feeding the boomer debt/entitlement addictions. Read my prior post.

We can see now the effects spreading globally with the recent expose on the secret global ACTA treaty negotiations. The state legislates when they have no solution to technology shift. Technology (nature, increase of entropy/free market of diverse actors) always wins!

http://crisismaven.wordpress.com/2010/02/13/bloom-of-doom-vi-will-china-survive-the-crisis/

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271907010671#c454320514745239164

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271870217074#c3709715772748944006

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271908987126#c442956837281004902

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271910159269#c3852399992321236271

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271922708892#c3889192598046959152

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923106720#c1498932837061999537

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923609811#c4222161232483382228

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923887993#c5752483707147267539

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271932873122#c6066738242937363688

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271934490316#c1596662213620505871

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271934753536#c5034094174071790057

http://www.kitco.com/ind/Laird/apr222010.html

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271948900905#c4935165674641377578

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271999314036#c961691712676861307

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271999772582#c2306236146798236375

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272006968009#c8777283203058427022

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272007317353#c4383121917754622957

http://www.kitco.com/reports/KitcoNews20100412J2.html

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272059063792#c7692646763393957397

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272095657483#c1577730867397567346

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272096571098#c6151976276888673353

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272097379456#c49862607856182674

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272106394873#c5034202574240970919

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272106825922#c5783162348528074766

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272107403870#c3682365691103345954

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272109041357#c828975167254219453

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272110184578#c2338026583832533456

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272112455083#c3498171463798049296

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272126097760#c4485105546622865797

http://www.latimes.com/business/la-fi-china-realestate-20100426,0,3213754,full.story

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272270004288#c5448395057027909296

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272270549692#c1200734758719685089

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272280158230#c5194529821247817439

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272288079761#c1799932521423993363

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272288564658#c8947739180889834684

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272298303700#c6802239043466499657

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272298930072#c4555151983386276066

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272365490190#c6397973774056950987

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272469524830#c6442245961798688485

I wanted to correct my prior post within about 1 min of posting it, but we had a brownout here that lasted entire night here. Here is the correction:

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272469524830#c6442245961798688485

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1272502466200#c740884891731931027

http://investophoria.blogspot.com/2010/04/minor-top-is-nigh.html?showComment=1272829791129#c8358198540669286913

http://investophoria.blogspot.com/2010/04/minor-top-is-nigh.html?showComment=1272830668264#c878930767006934756

http://investophoria.blogspot.com/2010/05/opportunity-made.html?showComment=1274010156309#c6257465959592743907

http://investophoria.blogspot.com/2010/05/opportunity-made.html?showComment=1274193140314#c4043161343379543547

http://investophoria.blogspot.com/2010/05/opportunity-made.html?showComment=1274198054343#c9186319156704511691

http://investophoria.blogspot.com/2010/05/opportunity-made.html?showComment=1274221803489#c7306008984579998180

That famous Chinese reliability:

http://my350z.com/forum/motorcycles/432373-kymco-super-8-150cc-scooter.html#post7349883

http://www.kitco.com/ind/Guild/may242010.html

Socialism does not result in prosperity. This centrally managed simulost (bumping imports up by giving away appliances and cars) is socialism and it will lead to very high inflation and eventually a deflationary depression when the Yuan is finally revalued. When China goes into deflation, the west will go into hyper-inflation.

We can see now the effects spreading globally with the recent expose on the secret global ACTA treaty negotiations. The state legislates when they have no solution to technology shift. Technology (nature, increase of entropy/free market of diverse actors) always wins!

http://crisismaven.wordpress.com/2010/02/13/bloom-of-doom-vi-will-china-survive-the-crisis/

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271907010671#c454320514745239164

Shelby wrote:If China is so great at technology, why did it produce capacitors that explode:

http://market-ticker.denninger.net/archives/2226-Chinaman-Fails-To-Hose-American.html

Also apparently you did not read the link I provided for crisismaven. It explained how China is rapidly wasting it's cash hoard. Essentially the capital moved from western debt addicts to China's central managers, and now wasted on increasing production beyond supply. The GDP numbers are lies (more like nominal GDP without the inflation adjustment).

Ray you don't understand the basic concept of economics, which is that the free market always wins (meaning no interference by central managers against individual opportunity cost). China is prime example of state misallocation. As I said, they are forcing all private capital to stay within the country. This is causing a massive misallocation globally and internally.

This will result in an epic global crash, and old world banksters have this planned out as a way to move the world to NWO.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271870217074#c3709715772748944006

Shelby wrote:here is the correct link for crisismaven blog on china:

http://crisismaven.wordpress.com/2010/02/13/bloom-of-doom-vi-will-china-survive-the-crisis/

Ray, if China is so good at making software, how come they have not produced any commercial success outside of China? Rather what you have is a captive audience, due to state censorship and the natural language barrier.

China is competing with slave labor. This worked for the Southern USA for a while too. It has worked for the banana republics too. And just look how backward these turned out to be, when the big shift came (e.g. end of slavery in south, or the plunge in sugar prices).

Ray the bottom line is that centralized economies NEVER outperform free market ones.

China is doing relatively better primarily because the rest of the world is becoming more centrally managed.

But the who world is headed into massive unemployment, because of factory automation. The future jobs are for the intellectual work. The designers, the engineers, etc. In short, the information revolution.

The USA is not suffering because of losing manufacturing jobs. The USA is suffering because the people got binged on debt.

Immigration is a good thing. It means a freer market. The most robust economy would be the one that has a completely open border.

Free markets always win. Centralized control always loses.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271908987126#c442956837281004902

Shelby wrote:I will repeat again, that the loss of manufacturing is not what ails USA.

It is the inordinate rise in debt, that enabled Americans refuse to adjust to the new opportunity costs of the information revolution.

The highest value activity is not in making stone tools, plowing a farm, being a blacksmith, nor in a sweatshop. The current computer/information/software revolution is having effects similar to the labor replacing machines invented in the textile/industrial revolution. China's current centrally managed attempt to monopolize the dying industrial model, is the death throes of it's centralized communist political system!

Empires die when they don't adjust to labor-saving technology, read about Roman empire's preference for slave labor over technology:

http://www.nytimes.com/books/first/j/johnson-renaissance.html

Google for "ENTERING AN EPOCH OF SOCIAL REVOLUTION", then search for "

Search for "Every schoolbook

states that the industrial revolution brought down feudalism" in this document.

The Luddites resisted the textile and industrial revolution, but ultimately these labor replacing machines actually created more prosperity and higher employment!

http://en.wikipedia.org/wiki/Industrial_Revolution#Social_effects

http://en.wikipedia.org/wiki/Textile_industry#History_during_the_industrial_revolution

http://en.wikipedia.org/wiki/Cotton_gin#Effects_of_the_cotton_gin

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271910159269#c3852399992321236271

Shelby wrote:Let me repeat what I have written in past, which is that manufacturing is becoming increasingly automated, and China is driving profit margins to near 0. This is the death throes of the industrial revolution. The profit is in the design/engineering of the products and machines to produce them.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271922708892#c3889192598046959152

Shelby wrote:The point is that China is operating at near 0 margins and this is why they used a faulty electrolyte in their capacitors.

They cut costs by destroying their own environment (just west did in our industrial revolution).

The problem is the industrial revolution was 100 years ago. China is too late, and the way they gain market share is by cutting costs and this is accomplished by trapping their capital inside the country and not letting it seek higher opportunity costs.

The fact that China can not allow unlimited access to information is proof enough.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923106720#c1498932837061999537

Everyone knows that China produces inferior quality products. This will improve over time as they learn that people will pay more for quality, but the point I am making is this was not the economic incentive given to them.

The govt has basically given them free capital to produce at 0 profit margins, and so they careless about profit and care only about volume. It is all about pumping up their GDP and employment, as billions of people unemployed is main problem in China.

I told you this is a huge liability for China and it is the death of the industrial revolution, as margins are driven to near 0.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923609811#c4222161232483382228

Shelby wrote:I know someone who does manufacturing in China. And he said (prior to 2007 crash) that manufacturers float on their suppliers' capital. They will refuse to pay for greater than 90 days. And they lie, cheat, and steal. I read an article yesterday, about how popular it is to work for state company, steal all their clients, then run your private company from your office at the public company. Then eventually leave the state company after some years, taking the clients with you.

The entire system is one of connections, favoritism, etc.. This is a failure oriented economic model. Study entropy and the free market.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271923887993#c5752483707147267539

Shelby wrote:The basic family values in China may be good, but there is one major thing missing. They do not demand freedom. Chinese have learned to co-exist with their lack of freedoms. But freedom is necessary for a free market and to prevent the massive misallocations that are happening now, which are going to drive China into the ground again.

The basic problem boils done to the people placing too much trust in the government and the communist system. In fact, they are quite proud now of their system and its recent accomplishments. They think the system is working for them, because their middle class is expanding. They don't see the massive leverage in real estate and their savings being wasted on over production of high volume, low quality goods and other misallocations (e.g. brand new cities with no one living in them, etc).

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271932873122#c6066738242937363688

Shelby wrote:I have not subscribed to economic theory as taught in the institutions. Fortunately I was not a victim to that abuse of having to attend one of their indoctrination centers as you claim to. I am using fundamental theorems of physics, such as the 1856 law of thermodynamics, which states that the universe (a closed system by definition) is trending to maximum disorder.

If you look at the equations for entropy in any discipline, what you understand mathematically is that increasing disorder is correlated with increasing diversity of actors (increasing possibilities).

Thus any force which attempts to direct a mass of matter (e.g. a group of formerly independent decision makers being constricted by a central control), will fail eventually. These forces must act with exponential increase in order to counteract the opposing force of the direction of entropy in the universe. These exponential bursts of order, are local (closed systems) while the global system is acting upon them to break them down.

TPTB (the elite) can operate only within trends of entropy. They are currently aligned with the human nature that aspires to debt and to be taken care of (order provided) by a government authority. But this trend is an exponential order that ultimately leads to widespread failure for the entire world. This mathematically inevitable outcome of human nature was predicted 2000 years ago, as it was written down in Revelation.

China as an actor in this trend is already documented in Revelation as the red dragon. But I don't subscribe to the Biblical theories, rather just note when they correlate to physical science.

Napoleon was also a victim of his own exponential push for order, and so will follow all those elite who attempt to defy the trend of the universe.

China's elite know their system is failing. They don't care. They are milking it for maximum gain, and they have already sent all their children to Vancouver and will flee when the shit hits the fan.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271934490316#c1596662213620505871

Shelby wrote:I suspect the top level of TPTB are purposely aligning to the human nature trends that drive misallocation of capital and failure (e.g. desire for debt, desire for insurance, desire for order/govt, desire for laws other than natural laws). I think TPTB have tried to maximize this push for failure. China and West have been played off as symbiotic elements of maximizing this failure.

Out of this failure, will exist a huge belly of "useless eaters" and major problem for the world to feed them, because the misallocation of capital is going to drive massive shortages and widepread failure of economies.

This is a trend of society towards a world government. The Bible talks about this trend of human nature and explains that man can only remain free by "not being surety to a friend", "not choosing to have a govt" (1 Samuel 8), "no idoling things of this earth" (e.g. laws, govt, order).

At the same time this failure trend is occurring, there are zillion lights of new freedom occurring. Remember the exponential equation, "small things grow faster". A kid can double his net worth in an hour, buying a can of cold coke on a hot day, and selling it for double price at stop light.

Those who have studied this math and see the correlations to the wisdom in the Bible, will always be free. We understand the limitations of TPTB. We understand their weaknesses.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271934753536#c5034094174071790057

Shelby wrote:Chinese elite understand Ying and Yang, so they too understand very well that China can not rise up on the back of massive debt addiction in West. This was not a wise model of how to build a sustainable China. This was a model of how the elite could cash out and maximize the global failure necessary to bring about dependent class to drive the NWO.

http://www.kitco.com/ind/Laird/apr222010.html

Chris Laird wrote:China certainly is well aware that 60% of their economic growth in recent years is construction related. Did you know that? If China is popping a huge construction bubble that is 60% of their economy then why is everyone talking about using basic commodities as an investment haven? There is a difference between a haven and a speculation. Commodity markets are speculation markets right now. That makes them subject to wild price swings.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271948900905#c4935165674641377578

Shelby wrote:Coarse's Theorem is there are no externalities, only transactions costs. Nature will also route around any artificial barriers to maximum efficiency, the same way as a river will always route around a dam given enough time.

http://en.wikipedia.org/wiki/Coase_theorem#The_theory

Coarse Theorem is just another way of stating the 1956 law of Thermodynamics that says the universe is always trending to maximum disorder.

If you don't understand these concepts, then you won't understand me or what I am writing about.

http://investophoria.blogspot.com/2010/04/how-do-you-measure-paradigm-shift.html?showComment=1271999314036#c961691712676861307

Shelby wrote:You speak of "largest" but you forget to divide by the population to get a "per capita" normalization.

And you wrote nothing which refutes the hard facts and economic realities of bubbles.

Where do you live? I've been living in Asia since 1994.

Marc Faber lives in Asia (has a beachfront home in Vietnam) and visits China regularly: