Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 18 of 24

Page 18 of 24 •  1 ... 10 ... 17, 18, 19 ... 24

1 ... 10 ... 17, 18, 19 ... 24

Depression is not deflation

Depression is not deflation

http://www.marketoracle.co.uk/Article22571.html

Shelby wrote:Stathis wrote, "The second rule of thumb is to avoid any rhetoric from those who have agendas, such as that found from those who sell securities or gold."

Stathis again bashes gold, even though he got it wrong in 2009:

http://www.marketoracle.co.uk/Article19888.html#comment91123

Stathis's basic misunderstanding is he doesn't understand the concept of real interest rates. He should search and read my article, "How Deflation Is Inflation".

Depression is not monetary deflation. Monetary deflation means the value of the currency is rising. From 1929 to 1933, there was deflation, because Americans who still had a job were eating more butter, more chicken, etc, because everything went down in price. Thus 1929 to 1933 was not a depression, contrary to what you have read from others. Yes 1/5 of the population lost their jobs, but the other 4/5 were buying more with their wages.

The reason that the value of money rose from 1929 to 1933 was because the dollar was gold. But in 1934, FDR confiscated the gold and made it illegal for Americans to get gold for dollars, and thus the Great Depression began in 1934. After 1934, prices rose and people could buy less, even though FDR created many jobs with New Deal govt work programs. Hey why use shovels, when by using spoons you can create more jobs! But you don't create more production, and thus prices go up! By WW2, Americans could not even eat butter nor chicken. Everything was rationed (prices were skyhigh in the black market).

Stathis apparently does not understand that while the prices of houses has fallen, the cost of living continues to rise (check ShadowStats.com for the truth on that).

The cost of living is rising faster than the interest rates that can be earned on bonds.

Thus there is no incentive to hold bonds over gold, because gold pays no interest, but interest rates are lower than inflation. Thus gold goes up in price. And this will continue until the world's fiat system is good as gold again.

We are in the death march for the fiat system. I explained how the interest rates can keep falling forever and never hit 0%:

http://www.marketoracle.co.uk/Article22482.html#comment94490

While Nadeem explained why inflation won't stop:

http://www.marketoracle.co.uk/Article22462.html

China's personal savings doesn't really exist!?!

China's personal savings doesn't really exist!?!

http://www.marketoracle.co.uk/Article21266.html

http://www.marketoracle.co.uk/Article22633.html

I expected this, but this is some bombshell evidence!

My instincts says this is correct, because I see similar here in Philippines, the difference being that the filipinos only do it for small personal needs, there isn't the big speculation here by everyone as in China.

And of course we know much of China's net exports reserves are loaned to bankrupt westerners and/or heavily invested in commodities which depend on the continued boom in their economy.

http://www.marketoracle.co.uk/Article22633.html

I expected this, but this is some bombshell evidence!

My instincts says this is correct, because I see similar here in Philippines, the difference being that the filipinos only do it for small personal needs, there isn't the big speculation here by everyone as in China.

And of course we know much of China's net exports reserves are loaned to bankrupt westerners and/or heavily invested in commodities which depend on the continued boom in their economy.

Typical hyperinflation unlikely, rather a slow boiled descent into rationing

Typical hyperinflation unlikely, rather a slow boiled descent into rationing

http://globaledge.podbean.com/2010/09/10/the-trigger-for-a-hyperinflationary-shock/#comment-418391

Shelby wrote:There is nothing short of war that can stop the perpetually declining interest rates, because each halving of interest rate (which will never reach the asymptote of 0%) allows deficits to double without increasing debt service costs:

http://www.marketoracle.co.uk/Article22482.html#comment94490

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-420.htm#3507

We have +10% SGS CPI now, coupled with asset price deflation, so we already have a form of hyper-inflation:

http://www.marketoracle.co.uk/Article16212.html

Shelby Moore wrote:As I wrote in prior comment, the world is locked into perpetual halving of the interest rates. This is both inflationary and deflationary. It causes the public sector to cannibalize the private sector (insiders borrow at ever lower interest rates and thus can force the private sector out-of-business on a return on capital basis, see also my other reasons in my writings). It can't actually lead to hyper-inflation in the traditional sense, because the private sector will be selling assets to pay for basic necessities which are rising in price.

I have covered this extensively in my writings. I have even debated both Mish and Denninger and most of the major writers.

Read my writings before you go any further.

Mish is correct on some points, but misses the most important conclusions

Mish is correct on some points, but misses the most important conclusions

http://globaledge.podbean.com/2010/08/31/hyperinflation-ends-the-game-so-it-is-unlikely/#comment-418702

Shelby Moore wrote:Starting about 14 minutes into the interview, I strongly agree with Erik and Mish that the typical hyper-inflation that Lira experienced in Chile, is not possible, because we are in period where retiring westerners will need to sell assets, as the jobs have all been outsourced and they are retiring any way. Yet we have simultaneously price inflation in basic necessities which will exacerbate because of the perpetual declining interest rates of deficits in the west. There won't be some moment where westerners suddenly abandon the dollar and rush into commodities, because they don't have any cash. They are just trying to stay above water, by selling off things step-by-step to keep up with all the inflation (or drop in real wages which is the same thing).

What Mish fails to grasp is this duality of deflation and inflation and what is causing it.

I have written extensively about this, especially focusing the issues well in the past few weeks of my writings.

1) Public debt is increasing offsetting the drop in private debt. The public sector and insiders are cannibalizing the private sector. Thus we will get increasing inflation as the private sector supply craters. Low capacity utilization is a symptom of this, as the private sector simply can't get sufficient return on capital. Mish misinterprets this as meaning we have an oversupply. SGS price inflation metrics (and similars ones in UK, etc) prove this is not the case. We have oversupply in unnecessary things such as housing, manufactured goods, but not in basic necessities such as food, energy, commodities.

2) As interest rates half, deficits can double, and debt service doesn't increase (and fails as a % of total debt!). This means that westerners can continue to write themselves a blank check indefinitely at the federal level to fund the promises. Of course, this is highly inflationary for basic necessities and deflationary for business.

3) I could go on and on, but just go read my writings. We are in a death debt trap spiral for western civilization. There is no way to get off the hamster wheel. It will end in massive rationing, fascism, death, war, etc.

4) I urge you to read Peter Thiel's article (founder of Paypal), which is linked on my site. It has amazing insight into the battle over good globalization versus the NWO top-down scenario that we seem to be headed.

Folks this is real bad. Much worse than Mish and Erik realize.

This is not deflation and it is not hyper-inflation.

I also made 2 comments on the Lira interview which explain much more about my logic:

http://globaledge.podbean.com/2010/09/10/the-trigger-for-a-hyperinflationary-shock/#comment-418391

http://globaledge.podbean.com/2010/09/10/the-trigger-for-a-hyperinflationary-shock/#comment-418613

Specifically why hyper-inflation is not coming soon

Specifically why hyper-inflation is not coming soon

SRSrocco wrote:Shelby and Fekete have stated that the US TREASURY rate can keep halving forever before it hits zero. This is like telling a person to take a step toward a line, but only doing so by cutting each step half the distance to the line. Theoretically, you can keep halving your step and never hit the line. But who on earth would keep halving their step forever. Your typical Joe-Bag-of-doughnuts will do it for about 5 minutes, then say, "THE HELL WITH IT", cross the line and say, "HEY...LET's GO GET A BEER."...

Hahaha, you really made me laugh.

Seriously, you missed the point. Joe-Bag-of-doughnuts doesn't have anything to do with the setting of the interest rates other than his continued demand for the govt to take care of him. The point is that a halving of the interest rate is all that is necessary to satisfy all the parties in this current global game:

1) 100s of millions of politically powerful and entitlement-promised westerners (i.e. govt & private sector retirees, long-term unemployed, welfare recipients, etc) get to keep their fiat benefits indefinitely, because govt deficits can double, but interest payments stay constant and actually decline as a % of deficits.

2) Banks get to continue to make money for doing nothing but check kiting to purchase govt bonds with money they created out-of-thin air.

3) Investors continue to make a doubling of their networth for every halving of the interest rates. I find this Dr. Fekete claim controversial and perhaps incorrect, but apparently it is what has happened (I think the mechanism is via derivative leverage, a form of creating value of thin air). I think swaps are what allows leverage on the declining interest rates, so every halving of interest rates can result in same nominal boost in value by increasing leverage.

4) China gets to continue its bubble, which would be burst horrifically if they walked away from the dollar and western bonds.

None of the above can happen if there is a run away from govt bonds.

If there was a run from bonds, it would be an instant implosion for all the vested interests above. The only winners would be those who own all the gold. We do know that eventually those elite cabal who own most of the world's gold will eventually eat their own, and go for that final crackup hyper-inflation, but it will be on their terms and when they have already maximized the damage it will do. We are no where near maximized yet. They can take it much further.

The limiting factor is when the entitlements in #1 are not able to buy anything. Meaning the private sector has imploded from the socialism and wealth transfer effect of declining interest rates, and there is massive rationing or cutbacks in basic attainable needs by the broad population. At this point, the masses will be ready to act and the elite cabal will be ready to use the masses to destroy all the vested parties above, so that everything goes to them in a NWO chaos.

SRSrocco wrote:John Williams Sees The Onset Of Hyperinflation In As Little As 6 To 9 Months As Fed "Tap Dances On A Land Mine"

John Williams has been following the markets for decades. His shadowstats website is the only one that reports REAL ECONOMIC STATS that the US GOVT puts out. He has been correct on many forecasts. Again....2 years ago he stated that HYPERINFLATION would hit within the decade. Last year he moved it up to within 2-3 years. Now he says 6-9 months. You can read the post at ZERO HEDGE HERE:

http://www.zerohedge.com/article/john-williams-sees-onset-hyperinflation-little-6-9-months-fed-tap-dances-land-mine

This goes right inline with what GONZALO LIRA states about hyperinflation from a crack in the US TREASURY MARKET. Looking at Shelby and Fekete's assessment on the TREASURY MARKET, I find it works in a mathematical mind, but not in a public who lives by psychology.

Shelby enjoys filling his posts with detailed mathematics to prove his points. I believe math has a certain use in the world, but it fails to forecast the psychological mind.

John Williams wrote:Now, as business activity sinks anew, much expanded supportive measures will be needed to maintain short-term systemic stability. Such official actions, however, in combination with global perceptions of limited U.S. fiscal flexibility, likely will trigger massive flight from the U.S. dollar and force the Federal Reserve into heavy monetization of otherwise unwanted U.S. Treasury debt.

This is wrong. When the USA has its next liquidity crisis, everything BUT bonds (and possibly gold, but I think it will selloff some too) is going to be sold. We already went through this in 2008. Nothing has changed. The vested parties above still have no incentive to jump ship, because they cut their own throat if they do.

There is nothing to run to. Do you really live in the fantasy world that thinks the Chinese communist party crooks who rape their own country, are going to suddenly destroy their own power and implode their bubble Yuan peg economy thus causing massive riots and overthrow of their govt, by making the Yuan as good as gold?

Whose psychology are you expecting to ignite this massive move to commodities causing hyper-inflation? And where are they going to get the cash to do so? Could you walk into the mall today and point to a few of them for me? Come on Steve, get a grip on reality. You been on the farm too long. Go back to the mall and observe the McFat population please.

Sure gold and silver will go up because there isn't much of it and we only need like 0.1% of the people in the world to buy some to make it go up. But that is not the same as a massive run on commodities in general by the general population. Get real.

Re: Inflation or Deflation?

Re: Inflation or Deflation?

shelby wrote:It is about the interest rates. The lower rates is what is causing the interest expense to level off or decline.

...but this is not stopping the parabolic ascent in the deficit, which ultimately is what causes the crack-up and/ or implosion.

Precisely. And this is allowing the fiscal situation to get worse for a long-time (slow-cooking the sheeple) before it finally cracks-up or implodes. It is the mechanism by which we get to the level of socialism and failure required for a NWO chaos. Without the lowering interest rate phenomenon, then this fraud would stop too soon:

http://www.marketoracle.co.uk/Article20263.html

http://www.marketoracle.co.uk/Article16212.html

shelby wrote:Do you mean that bond investors are not profiting significantly off of lower rates?

Unleveraged bond owners profit little on the halving of rates when rates are so low. When the rate on our checking account dropped in half, from .1% to .05%, as a joke I felt like telling my wife "You've got to spend less; our interest income was just cut in half!" But if my wife checked she would have seen that the actual interest was only a few dollars a month anyway, and in fact we changed to an interest free account just to simplify things.

Leveraged players are profiting, but not without risk. There have been big whipsaws. I suppose if these players and are in on the rigging and can print money to cover margin calls, like we saw with silver, the risk is less.

While I agree that it's not in anyone's interest to cause a flight out of Treasuries or US dollars, the the nature of parabolas is that they are very unstable and sudden changes can occur at any time, as they relentlessly approach the inevitable.

There is no risk as long as there is no mark-to-market and the insiders control the game any way. They can use this leverage and their control over the timing of whipsaws to shake out any competition.

You see this paradigm is one where the fat cats eat the private sector by a 1000 paper cuts.

Thanks you have confirmed my understanding.

Hussman ignored relative REAL rates

Hussman ignored relative REAL rates

http://www.marketoracle.co.uk/Article22645.html

Shelby wrote:It is getting extremely exhausting to correct all the analysts who have real interest rate myopia. I think I am going to give up.

Mish you quote Hussman, and at the link your provided, Hussman's thesis is that the dollar will have quick devaluation in order to offset the lower relative rate of interest paid on dollar versus foreign bonds. However, Hussman seems to forget that in China (and other developing countries) where higher interest rates are paid, the inflation rate is also much higher, thus the real interest rates may in many cases not be that much higher than for the dollar. And his analysis seems to ignore the Yuan peg, which requires dollars to find their way back to dollar bonds.

Mish I appreciated you recent revelations about China and I also agree with you that hyper-inflation is not possible in traditional sense, however I continue to not agree that we have a simple deflationary macro-economics:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3570

Also Nadeem if you are not going to allow me to respond to nonsense and slander, then let's just make this my final contribution to your site:

http://www.marketoracle.co.uk/Article22571.html#comment94711

You know very well that gold is NOT my favored pet investment:

http://www.marketoracle.co.uk/Article20327.html

Please allow this last statement. Thank you for everything and good luck.

Exactly what you wrote SRSrocco, and agrees with my thesis too

Exactly what you wrote SRSrocco, and agrees with my thesis too

http://www.marketoracle.co.uk/Article22824.html

But there will be no rapid hyperinflation, except in commodities but these bursts of commodity prices will deflate from time-to-time, because they send the world crashing into renewed bouts of implosion. Wash, rinse, repeat.

But there will be no rapid hyperinflation, except in commodities but these bursts of commodity prices will deflate from time-to-time, because they send the world crashing into renewed bouts of implosion. Wash, rinse, repeat.

As I said, "Til Debt Do Us Bust"

As I said, "Til Debt Do Us Bust"

http://www.kitco.com/ind/Summers/sep212010.html

Note I disagree with Summers' conclusions in the rest of the article. There is no imminent default/restructure/hyper-inflation. What is imminent is more QE and more gyrations of the implode, wash, rinse, repeat "until debt do us bust" some heartbroken years from now.

The big financial myth-buster of the week is that the alleged deleveraging of the US consumer has in fact been a giant myth. According to the Wall Street Journal, if you account for defaults, US consumers have only pared down their debts by an annual rate of 0.8% since mid-2008.

The Journal writes (emphasis added):

Over the two years ending June 2010, the total value of home-mortgage debt and consumer credit outstanding has fallen by about $610 billion… Our own analysis of data from the Fed and the Federal Deposit Insurance Corp. suggests that over the two years ending June 2010, banks and other lenders charged off a total of about $588 billion in mortgage and consumer loans.

That means consumers managed to shave off only $22 billion in debt... In other words, in the absence of defaults, they would have achieved an annualized decline of only 0.08%.

Whether this is because Americans are stuck on a “buy ‘til you’re bust” mania, or if it’s simply because the cost of living in the US today is so high relative to incomes and other expenses that most folks can’t get by without using credit is up for debate.

Personally I think it’s a bit of both, with some folks obsessively buying the new iPad while skipping on mortgage payments while others are simply using credit cards to try and get by after being unemployed or underemployed.

Note I disagree with Summers' conclusions in the rest of the article. There is no imminent default/restructure/hyper-inflation. What is imminent is more QE and more gyrations of the implode, wash, rinse, repeat "until debt do us bust" some heartbroken years from now.

20 years of 0% interest in Japan

20 years of 0% interest in Japan

Martin D. Weiss is very intelligient and well respected:

http://www.marketoracle.co.uk/Article22847.html

There is not going to be any hyper-inflation, only a continued (but volatile) increase in price of things we use and gold+silver.

Westerners will be caught in a squeeze of declining real wages, while prices of things they use go up. They won't have cash to go chase goods and cause hyper-inflation, they will simply stop using (become poor).

Haha, thanks for putting it that way! Helps me to explain it to others.

Excellent explanation!

Distinguish between prices in gold units and prices in fiat units. In fiat units, it is possible to have a situation as we have today, where the production of "things we use" is not declining faster (or peaking and not growing further) than the use is declining or increasing. In other words, as the companies try to fight deflation, they move their operations to the developing world, where 10 workers cost the price of 1 western worker. Thus the demand for food increases by 10, so the price of food is going up while we have deflation in other things.

Reality is that prices of things we use are going up in fiat, not down.

==========

Thus I am saying, warning double-dip will come eventually.

Probably 2012, or maybe 2011:

http://www.marketoracle.co.uk/Article22895.html

================

ADD: Note those with cash in excess of expenses will chase gold+silver (more so gold, but silver bullion market is so tiny it will rise more in price than gold).

ADD#2: Steve the USTreasuries market will never crack, they will go lower and lower nearer to 0%. When world devolves into 10-20 years of depression, we go into war probably. It is a mathematical treadmill. The hamsters can not get off. When it is time to leave Treasuries behind, there will be a world banking solution ready.

Steve this is much more dire than you realize. You are not pessimistic enough! You think this will end quickly.

John Williams is smart in a bean-counter way. He doesn't see big picture. You should also read Martin Armstrong, who agrees with Fekete and Weiss and myself. The 4 of us are 10 times smarter than John Williams.

Steve, hyperinflation requires that the govt continuously hand out money directly to the public. Do you see that happening? A one time stampeded to goods is not hyperinflation, it reverses and implodes when there are no more buyers. Think about it!

LONG ROAD AHEAD TO FINAL DEFAULT

http://www.marketoracle.co.uk/Article22847.html

There is not going to be any hyper-inflation, only a continued (but volatile) increase in price of things we use and gold+silver.

Westerners will be caught in a squeeze of declining real wages, while prices of things they use go up. They won't have cash to go chase goods and cause hyper-inflation, they will simply stop using (become poor).

]"hyperinflationary situation there is a shortage of money"

Haha, thanks for putting it that way! Helps me to explain it to others.

"deflation, ...velocity of money is ultra-slow and falling...mistake ...that deflation is the same as...collapse of the money supply...there is a superabundance of money due to...central bank and the government to pump up the price level. In spite of this, prices may keep falling..."

Excellent explanation!

Distinguish between prices in gold units and prices in fiat units. In fiat units, it is possible to have a situation as we have today, where the production of "things we use" is not declining faster (or peaking and not growing further) than the use is declining or increasing. In other words, as the companies try to fight deflation, they move their operations to the developing world, where 10 workers cost the price of 1 western worker. Thus the demand for food increases by 10, so the price of food is going up while we have deflation in other things.

Reality is that prices of things we use are going up in fiat, not down.

==========

Thus I am saying, warning double-dip will come eventually.

Probably 2012, or maybe 2011:

http://www.marketoracle.co.uk/Article22895.html

Time Line?

Between now and anytime in 2011.

At the latest, 2012.

================

ADD: Note those with cash in excess of expenses will chase gold+silver (more so gold, but silver bullion market is so tiny it will rise more in price than gold).

ADD#2: Steve the USTreasuries market will never crack, they will go lower and lower nearer to 0%. When world devolves into 10-20 years of depression, we go into war probably. It is a mathematical treadmill. The hamsters can not get off. When it is time to leave Treasuries behind, there will be a world banking solution ready.

Steve this is much more dire than you realize. You are not pessimistic enough! You think this will end quickly.

John Williams is smart in a bean-counter way. He doesn't see big picture. You should also read Martin Armstrong, who agrees with Fekete and Weiss and myself. The 4 of us are 10 times smarter than John Williams.

Steve, hyperinflation requires that the govt continuously hand out money directly to the public. Do you see that happening? A one time stampeded to goods is not hyperinflation, it reverses and implodes when there are no more buyers. Think about it!

LONG ROAD AHEAD TO FINAL DEFAULT

Is Buffet an idiot?

Is Buffet an idiot?

First, here is another person pointing out that Tbonds blowup isn't coming anytime soon:

http://www.marketoracle.co.uk/Article22645.html#comment94908

Buffett:

http://www.google.com/hostednews/ap/article/ALeqM5j6hJUWxMlYkSR66Z_VxVRdR09edwD9IDTB380

Doesn't he know the marginal-utility-of-debt has gone negative, meaning that each additional dollar of debt is subtracting from GDP, not adding to it!

More Berkshire nonsense:

http://market-ticker.org/akcs-www?singlepost=2179149

http://www.marketoracle.co.uk/Article22645.html#comment94908

Buffett:

http://www.google.com/hostednews/ap/article/ALeqM5j6hJUWxMlYkSR66Z_VxVRdR09edwD9IDTB380

Warren Buffett wrote:"It doesn't depend on calling it the stimulus bill to be stimulating. I mean, if the government is spending $3 for every $2 it takes in, that is, that is fiscal stimulus," Buffett said.

Doesn't he know the marginal-utility-of-debt has gone negative, meaning that each additional dollar of debt is subtracting from GDP, not adding to it!

More Berkshire nonsense:

http://market-ticker.org/akcs-www?singlepost=2179149

End game

End game

http://esr.ibiblio.org/?p=2556&cpage=9#comment-279815

http://esr.ibiblio.org/?p=2556&cpage=9#comment-279848

http://esr.ibiblio.org/?p=2556&cpage=9#comment-279848

Shelby aka Jocelyn wrote:> recruit the work force of countries with a “surplus” of workers.

> How to get the people who work for us in 30 years to accept our currency?

Gold has the highest stocks-to-flows ratio, thus has highest marginal utility of any commodity on earth. Next is silver. Platinum, Pd, Cu, etc have very low stocks-to-flows ratio and are not suitable for store-of-value function.

Problem is the nation-state doesn’t like capital flight, and is “cooperating” with G20 to shut out tax havens. In USA at least, gold is taxed on capital gains, yet gold’s function is only to remain level with the per-capita production, i.e. purchasing power. Thus gold can lose purchasing power parity value after taxes.

Flows means periodic mining production and industrial draw-down. Stocks means readily available above ground supply. For example, silver's above ground supply is very high (≈20 billion troy oz), but it is mostly in jewelry, silverware, electronics, etc where the recovery cost is higher than (or significant portion of) the value of the metal.

The best strategy is to invest in productive assets that have pricing power in inflation and deflation. Buffett wrote about this criteria.

The best investment is in knowledge. It is portable, doesn’t suffer from inflation, and can not be taxed.

Also knowledge can not be stolen. Most often a thief wouldn't even know what to do with it.

> the only possible outcomes, long-term, are hyperinflation and sovereign default

Hyperinflation requires the fiat issuer to continually supply more fiat to the masses, i.e. any stampede to commodities is inherently limited and will reverse when there are no more buyers. Hyperinflation destroys the creditors, so it won't happen if ever, until the power broker banks who own the political class, have dumped their ownership of loans on the public.

The more likely outcome is that budget deficits will increase for years to come, because each halving of the interest rate (e.g. 1%, 0.5%, 0.25%, 0.125%, etc) halves the cost of the debt service. This destroys the private sector while increasing the size of the public sector, i.e. the marginal utility-of-debt went negative in USA in 2008. Companies hire up to 10 developing world workers for the price of 1 westerner, to fight against this deflation squeeze, which then increases the demand for basic commodities by up to 10 times, causing simultaneous inflation in "things we use" driving real wages of westerners lower, exacerbating deficits in a feedback spiral.

There doesn't have to be any default until the people who suffer from it, run away from such a broken system, but what can they run to? Gold? There is no mathematical way to make the net-worth of even 10% of the people whole in gold-- moving to gold would bankrupt the massive dead-weight in the global economy.

Unfortunately, inexorable creep towards world war is all I can see at the end game. Please tell me it isn't so?

re: $10 Oil; gold & silver to rocket up?

re: $10 Oil; gold & silver to rocket up?

Good basic video on money creation and the problems that it has created today. He believes in deflation and that OIL will be at 10 bucks a barrel.

25 minutes

http://www.silverbearcafe.com/private/09.10/schooling.html

http://www.silverbearcafe.com/private/09.10/schooling.html

Thanks for posting that!

He sees silver on an imminent H&S breakout going to $32!

He sees stock markets and commodities essentially heading to near 0.

His reasons are:

1. M3 declining slightly.

2. Stock overvalued by historic measures

3. H&S and dead-cat bounce chart patterns.

My reactions are:

1. Does this matter?

2. Does this matter?

3. I see a double-top in stocks, but it aborted into what appears to be sideways rollercoaster which may end up a H&S by 2014/5.

I do agree that the current falling interest rates is a death spiral for jobs. I think there is an offset of jobs to developing world, and I thought this would focus more spending on basic "things we use". I agree this all craters one day.

I hope he is correct, it means our metal will gain much more purchasing power.

This is why I am warning against illiquid stocks. This is a dangerous time.

=============================================================================

=============================================================================

=============================================================================

Well Maloney really got me thinking.

A. One of his points are bearish H&S patterns he sees in various commodities, some more well defined than others. However, if am I not mistaken that all of these so called H&S patterns project a price less than zero?!? That seems to invalidate them. Afaik, there can't be a valid pattern that projects an impossible price. Can anyone comment on this?

B. Bearish commodities assumes one of the following:

i) that the developing world goes back to the farm and back to eating "roots and grass" (filipinos say this when times get tough), or

ii) oil (input cost for other commodities) becomes much cheaper, but what would make oil cheaper other than #i above (reduced demand)? Note that global population is increasing.

iii) a massive increase in commodity production, which would increase price of oil, unless we get a massive increase in supply of oil.

iv) massive depopulation event (Georgia Guidestones 500 million target)

C. Let us understand the nature of this deflation. What is happening is that the indebted western countries are creating govt debt to sustain the lifestyle of the unproductive sectors of the economy. This is of course strangling the western private sector, so the private sector is transferring as much possible capital (and jobs) to the developing world. However, China is capturing a large chunk of this capital by central control of the exchange rate which keeps its labor priced lower internationally than is the actual purchasing power parity internally. Thus instead of Chinese businesses investing in other developing countries, they to a large extent are forced to invest domestically and so there is an oversupply of factories and it driving profit margins to 0 or even negative. It is not that China doesn't need more investment to create employment for the recent huge workforce bulge in their demographics, but rather that the investment is being forced into exports focus (and speculation in real estate and stock market) rather than being focused on imports by investing in other developing countries that actually have a lower purchasing power parity cost structure. This is why China is approaching the point where they can not grow any more without massive inflation, because they are not allowing the global free market to anneal.

Thus I conclude that Maloney is correct about the threat. The process of exporting the USA capital can not continue until China's peg is broken. Thus China will break into a depression, which will drag the rest of the world down. The western nations QE is just a mechanism for exporting the capital of the west in a politically palatable way.

The question is when does the Yuan peg paradigm reach exhaustion? And the fiat controllers could still decide to go to hyper-inflation as the end game instead.

I just looked at $WTIC:$GOLD chart on stockcharts, and it shows a huge bearish H&S pattern in oil as priced in gold, with the left shoulder starting in 1994, the right shoulder just started!! Wholly molley!! It projects to a ratio of 0.01 on the logarithmic chart which means at $10 oil if gold is $10,000!!

I always had the suspicion that Peak Oil was a planted psycho ops just like Global Warming and I suspected that we sent our military to the middle east to make sure the truth would not come out about how much oil there really is there. Or the above chart pattern could simply be warning of a massive implosion of the global economy for the reasons of capital mis-allocation as I described above.

==========

ADD:

Okay here is an inverted chart which I supplemented with latest data:

The red line scenario says oil will keep rising in price, outpacing gold.

http://www.kitco.com/ind/Thomson/sep212010.html

Thompson wrote:There are many many parameters that need to be considered before drawing a chart, before announcing you have a major market “all figured out”. To give power to a bull continuation head and shoulders, rule number one is that it must be continuing a major trend.

Thus I tend to think gold/oil will not deviate significantly from historical ratios, because the oil countries demand to be paid in gold. Thus I side more with the red line scenario. But any way, here follows the analysis of the green H&S scenario...

The green H&S scenarios, indicates that Maloney's timing is too soon! Just as I expected! The oil price will peak around 1/15 of the gold price about 2011.5 (when the real-estate resets peak) and decline slow to shoulder base until about 2014, then the entire global economy will implode and oil will drop to 1/45 (on the non-logarithmic chart above or 1/100 if the correct (proportional change) logarithmic chart is used) of the gold price! Wholly molley!!!! :eek: That is exactly the sort of confirmation I have been looking for my thesis about inflation vs. deflation.

Thus I redraw Maloney's projection with a pink line showing a double-top at $125 for oil in 2011.5, then decline to $85 by 2014, then everything falls off a cliff and the global economy implodes:

That makes a lot more sense than Maloney's immediate implosion, as the west is certainly going to try to QE in reaction to the deflation threat. And we don't finish the real estate resets until 2012. And then I think things will get more aggressive, also politically because we have another presidential election. I think this also agrees with the net macro cycles that Martin Armstrong had published? (any one remember what year his final peak before the cliff, wasn't it 2012.2?).

Armstrong does see 2011.5 (June 2011) as a pivotal date!

http://www.martinarmstrong.org/files/Gold%20an%2011%20Year%20High%20for%202010%2009-17-2010.pdf (see page 16, the last page)

Armstrong writes on page 4 (numbered 2) that land value falls to its non-leveraged value, on page 6 (numbered 4) he again re-iterates the market will bounce up until June 2011!

http://www.martinarmstrong.org/files/Staring-into-the-Abyss-7-31-2010.pdf

Again on page 9 (numbered 6) Armstrong mentions the 2011.45 date a key pivot, also see page 10 (numbered 7), we have since closed about the 2007 breakline for the first time since the liquidity crisis started (this indicates we are going higher until May 2011, but we will dip under 10,000 briefly in January along the way)!

http://www.usafreecall.com/files/World%20Share%20Market%20Outlook%20&%20Grand%20Unified%20Theory%208-15-2010.pdf

However it appears that Armstrong was formerly arguing for a low in 2011.45, not a high:

http://www.martinarmstrong.org/files/Will-the-Dow-Reach-30000-by-2015-0809.pdf

http://www.martinarmstrong.org/files/Understanding-the-Real-Economy-51509.pdf

http://www.martinarmstrong.org/files/Its-Just-Time-Martin-Armstrong.pdf

http://www.martinarmstrong.org/files/Closing-at-10520-32-Down-3-2-5-14-10.pdf

Also think why was Maloney allowed to come speak to these Russian bankers about oil imploding? Maybe it was because the person in charge knew he would give a premature forecast, which would then cause those bankers to totally ignore the truth in what he was saying after oil increase from now until middle of next year.

If the above green line H&S pattern is correct, then it will take roughly 67% to 85% taxes to cause us to break even on gold in purchasing power at the end game (higher taxes would cause us to lose). If the red line pattern is correct, then any tax on gold is going to cause us to lose purchasing power.

So how does silver fit into this type of scenario?

Silver is ready to make a big move NOW.

Assuming the green line H&S pattern for the gold/oil chart is valid (and not the red line scenario), so the question is what happens to silver after it fails to break $50 in 2011 and the global economy implodes again and oil starts its decline? Does silver follow suit because of industrial demand decline while the base metal mines overload the supply as they did in 2009? I say yes! I say this is why the elite were never worried about silver. So these means silver will peak at 30 ratio to gold in 2011. I don't think silver will fall from as much as oil relative to gold, I see silver dropping back to 50-60 ratio to gold by 2012, so roughly $20 - 30. Then as gold picks up steam as the crisis worsens towards 2014, I see base mines shutting down and silver keeping pace with gold but at 50-60 ratio just as it did from 2008 to 2010. Then after 2014, I see silver gathering steam again to rise back up to 15 - 30 ratio to gold at its final peaks some where in the low 3 digit range.

China's capital controls causing real-estate mania

China's capital controls causing real-estate mania

Read whole article and the linked comment:

http://www.marketoracle.co.uk/Article23054.html#comment95051

I had mentioned this already:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3695

http://www.marketoracle.co.uk/Article23054.html#comment95051

http://www.marketoracle.co.uk/Article22952.html

http://www.marketoracle.co.uk/Article22011.html

Private gold ownership is of no threat to the Yuan peg and resultant mercantalism, so it provides a release value for inflation. China is very wise to promote gold ownership, as it allows them to continue their Yuan peg longer. And at the end game, they can confiscate this gold, just as USA did in 1934.

http://www.marketoracle.co.uk/Article23054.html#comment95051

I had mentioned this already:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3695

Shelby wrote:...C. Let us understand the nature of this deflation. What is happening is that the indebted western countries are creating govt debt to sustain the lifestyle of the unproductive sectors of the economy. This is of course strangling the western private sector, so the private sector is transferring as much possible capital (and jobs) to the developing world. However, China is capturing a large chunk of this capital by central control of the exchange rate which keeps its labor priced lower internationally than is the actual purchasing power parity internally. Thus instead of Chinese businesses investing in other developing countries, they to a large extent are forced to invest domestically and so there is an oversupply of factories and it driving profit margins to 0 or even negative. It is not that China doesn't need more investment to create employment for the recent huge workforce bulge in their demographics, but rather that the investment is being forced into exports focus (and speculation in real estate and stock market) rather than being focused on imports by investing in other developing countries that actually have a lower purchasing power parity cost structure. This is why China is approaching the point where they can not grow any more without massive inflation, because they are not allowing the global free market to anneal.

Thus I conclude that Maloney is correct about the threat. The process of exporting the USA capital can not continue until China's peg is broken. Thus China will break into a depression, which will drag the rest of the world down. The western nations QE is just a mechanism for exporting the capital of the west in a politically palatable way.

The question is when does the Yuan peg paradigm reach exhaustion? And the fiat controllers could still decide to go to hyper-inflation as the end game instead...

http://www.marketoracle.co.uk/Article23054.html#comment95051

Shelby wrote:I am trying to understand the mechanisms that keep capital within China from escaping to greener pastures, thus causing bubbles in real estate and for-export factories.

1. China's central bank controls all foreign exchange of Yuan.

2. While citizens are free to travel abroad, most countries where they would find undervalued investment opportunities, will either not give visas to non-wealthy Chinese (e.g. USA and Europe), or do not allow foreign business and land ownership (e.g. Philippines, Thailand, India, etc). Vancouver and Hong Kong have so many Chinese immigrants and real estate bubbles because they encouraged Chinese immigration.

3. Although Chinese can buy gold domestically, the price over spot is excessive and there are probably restrictions or taxes to be paid if it is exported.

So when the western countries say they want the Yuan peg to end, they are lying because if they really wanted it, they could just encourage Chinese visitor visas for tourism and investment purposes (no need to give politically sensitive immigrant visas).

However, this presents an enormous business opportunity to those market makers who want to provide a way for Chinese exporters to get paid in local Yuan that wants to get exported. The foreign importers then provide the exported foreign exchange. This could be run on the internet. However, you could expect the world's govts to shutdown any such thing.

http://www.marketoracle.co.uk/Article22952.html

Shelby wrote:James Quin wrote:"The Federal Reserve does not want a 20 year recession like Japan. They will not get it. They’ll get a hyperinflationary collapse instead. Japan entered their 20 years of stagnation with a population that saved 18% of their income and huge trade surpluses. The Japanese government could count on the Japanese population to buy every bond they issued to pay for worthless stimulus projects. The US has entered this Depression with a population that saved 2% of their income and a trade deficit of $500 billion."

The world saves in US dollars (and Euros), e.g via the Yuan peg, so there is no danger of a run away from bonds any time soon, rather I have described the likely path forward and the end game (too much to repeat here, refer to follow links):

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3703

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3675

http://www.marketoracle.co.uk/Article22011.html

Doug Casey wrote:DC: I think it is. The Chinese know that one of the reasons Mao took over is because the government of Chiang Kai-shek destroyed the national currency. The Chinese can see the problems with the U.S. dollar. That it could blow up in their hands. They also see the problems they're creating for themselves by creating trillions of new renminbi. So I think that they're encouraging the average guy in the street to do some saving with gold so that if things go sideways with these paper currencies, the average guy isn't left too destitute and too angry. At least he'll have some gold coins. I think they're being quite intelligent about encouraging their people to buy gold.

Private gold ownership is of no threat to the Yuan peg and resultant mercantalism, so it provides a release value for inflation. China is very wise to promote gold ownership, as it allows them to continue their Yuan peg longer. And at the end game, they can confiscate this gold, just as USA did in 1934.

Last edited by Shelby on Wed Sep 29, 2010 1:13 am; edited 4 times in total

No hyper-inflation; end-game

No hyper-inflation; end-game

http://www.marketoracle.co.uk/Article23030.html#comment95050

See also:

http://jasonhommelforum.com/forums/showthread.php?p=55571#post55571

======================

ADD:

http://www.marketoracle.co.uk/Article22959.html

Shelby wrote:There can't be hyper-inflation unless the central banks drop money from helicopters directly to the masses, because the masses have negative net worth:

http://www.getmoneyenergy.com/2010/03/net-worth-of-whole-entire-world/

By hyper-inflation, I mean a sustained period of monthly double-digit price inflation.

What is more likely at the end game, is a quick devaluation (replacement of fiat system with something new), which leaves the masses impoverished. This will come after years of declining interest rates (1%, 0.5%, 0.25%, 0.125%, etc) wherein each halving of interest rates, also halves the interest payments on the fiscal public debts, thus enabling the public sector to take on orders-of-magnitude more debt between now and the end game time.

We will see inflation in commodities, because the declining interest rates and public sector debt crowding, is a deflation that forces companies to lower labor costs to stay alive. With 7 - 10 developing world workers hired for every outsourced westerner, demand for basic commodities increases.

We have deflation of the western hemisphere and inflation of the developing world. Mixed in with this is massive mis-allocation of capital due to centralized interference, e.g. Yuan peg is causing real estate and export infrastructure bubble because capital can't escape to greener pastures.

Thus the end game is implosion of the western hemisphere which will drag the developing world mis-allocations into their Great Depression (as what happened to USA in 1930s as Europe imploded).

This is why gold & silver are the most preservative, i.e. gold has the highest marginal utility of any commodity due to its highest stocks-to-flows ratio (copper etc have only 6 months supply above ground).

See also:

http://jasonhommelforum.com/forums/showthread.php?p=55571#post55571

======================

ADD:

http://www.marketoracle.co.uk/Article22959.html

Shelby wrote:Lira's description is accurate, but it doesn't make a good case for hyper-inflation, because this is not getting into the hands of the masses as cash, because total debt is not increasing, rather public sector is merely displacing losses in private sector economy:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-435.htm#3684

And networth is negative:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-450.htm#3709

So unless the central banks start dropped cash from helicopters in amounts sufficient to increase total debt faster than the negative networth is increasing, then hyper-inflation can't happen.

Another point to remember about the stampede to commodities, this only works when it is one country, not th entire globe. If the entire globe tries to move to commodities, it is not a flight to safety, but a greater fool move to implode the global economy, with commodities crashing in price soon thereafter.

Re: Inflation or Deflation?

Re: Inflation or Deflation?

http://esr.ibiblio.org/?p=2653&cpage=2#comment-280801

It does not amaze me that most people have not studied enough to have a very good understanding of the current macro environment.

That hyper-inflation theory only works when the rest of the world has a strong currency to run to. The world saves in US dollars (and Euros), e.g via the Yuan peg, so there is no danger of a run away from bonds any time soon. The entire globe dumping dollar reserves for non-monetary (i.e. low stocks-to-flows) commodities doesn't work either because it would implode the global economy-- that only worked when a small portion (e.g. Weimer Germany, Zimbabwe, Chile, Argentina, etc) of the world flighted to commodities. Instead, the world has no realistic alternative but to allow the central banks to monetize the debt via perpetual lowering of the sovereign bond interest rates in order to prevent an interest expense spiral[1].

Fundamentally the nature of a global debt trap is that no nation-state has enough free capital to write off the debt or standards-of-living deficit, thus all governments have to continue to be supportive of piling on more debt. The developing countries have an excess of idle human capital which counts as a liability greater than their accumulated production-- much of which is badly mis-appropriated to exports and speculation.

We will see inflation in commodities, because the declining interest rates and public sector debt crowding, is a deflation[1] that forces companies to lower labor costs to stay alive. With 7 - 10 developing world workers hired for every outsourced westerner, demand for basic commodities increases.

We have deflation of the western hemisphere (any finance-able "asset") and inflation of the developing world ("things every human buys"). Mixed in with this is massive mis-allocation of capital due to centralized interference, e.g. Yuan peg is causing real estate speculation bubble and export infrastructure bubble (driving profit margins near 0, or actuarially negative) because individual Chinese capital can't escape to greener pastures (e.g. other less developed countries). The western countries are complicit in enforcing the Yuan peg (so they are either lying about wanting, or too compartmentalized to get, a free market for the Yuan to appreciate).

Private gold ownership is of no near-term threat to the Yuan peg and resultant mercantalism, so it provides a near-term release value for inflation. China is very wise to promote gold ownership, as it allows them to continue their Yuan peg longer. And at the end game, they can confiscate this gold, just as USA did in 1934.

The end game comes when the public sector has displaced so much of the private sector, that rationing of production becomes intolerable for voters, i.e. riots and war. The Obama health care bill is a rationing mechanism. Thus the end game is implosion of the western hemisphere which will drag the developing world mis-allocations into their Great Depression (as what happened to USA in 1930s as Europe imploded).

This is why gold & silver are the most preservative, i.e. gold has the highest marginal utility of any commodity due to its highest stocks-to-flows ratio (copper etc have only 6 months supply above ground). However, it is likely at the end game, monetary metals investors will find their gains stolen via taxation.

P.S. Hyper-inflation is a shortage of cash, and the government must replenish the cash to masses, else hyper-inflation can not occur. The western masses have a negative net-worth, so any cash they receive will be used to pay down debt. The developing world has rising Gini coefficients with capital controls, so personal savings is mis-allocated instead of solving the mass standard-of-living deficit. This high global debt and standard-of-living-deficit load on the masses, is nothing like the situations that caused hyper-inflations.

[1] http://professorfekete.com

http://www.marketoracle.co.uk/Article23053.html#comment95123

> Decades? I severely doubt it. We passed the event horizon in March, when Social Security went cash-flow negative

It does not amaze me that most people have not studied enough to have a very good understanding of the current macro environment.

That hyper-inflation theory only works when the rest of the world has a strong currency to run to. The world saves in US dollars (and Euros), e.g via the Yuan peg, so there is no danger of a run away from bonds any time soon. The entire globe dumping dollar reserves for non-monetary (i.e. low stocks-to-flows) commodities doesn't work either because it would implode the global economy-- that only worked when a small portion (e.g. Weimer Germany, Zimbabwe, Chile, Argentina, etc) of the world flighted to commodities. Instead, the world has no realistic alternative but to allow the central banks to monetize the debt via perpetual lowering of the sovereign bond interest rates in order to prevent an interest expense spiral[1].

Fundamentally the nature of a global debt trap is that no nation-state has enough free capital to write off the debt or standards-of-living deficit, thus all governments have to continue to be supportive of piling on more debt. The developing countries have an excess of idle human capital which counts as a liability greater than their accumulated production-- much of which is badly mis-appropriated to exports and speculation.

We will see inflation in commodities, because the declining interest rates and public sector debt crowding, is a deflation[1] that forces companies to lower labor costs to stay alive. With 7 - 10 developing world workers hired for every outsourced westerner, demand for basic commodities increases.

We have deflation of the western hemisphere (any finance-able "asset") and inflation of the developing world ("things every human buys"). Mixed in with this is massive mis-allocation of capital due to centralized interference, e.g. Yuan peg is causing real estate speculation bubble and export infrastructure bubble (driving profit margins near 0, or actuarially negative) because individual Chinese capital can't escape to greener pastures (e.g. other less developed countries). The western countries are complicit in enforcing the Yuan peg (so they are either lying about wanting, or too compartmentalized to get, a free market for the Yuan to appreciate).

Private gold ownership is of no near-term threat to the Yuan peg and resultant mercantalism, so it provides a near-term release value for inflation. China is very wise to promote gold ownership, as it allows them to continue their Yuan peg longer. And at the end game, they can confiscate this gold, just as USA did in 1934.

The end game comes when the public sector has displaced so much of the private sector, that rationing of production becomes intolerable for voters, i.e. riots and war. The Obama health care bill is a rationing mechanism. Thus the end game is implosion of the western hemisphere which will drag the developing world mis-allocations into their Great Depression (as what happened to USA in 1930s as Europe imploded).

This is why gold & silver are the most preservative, i.e. gold has the highest marginal utility of any commodity due to its highest stocks-to-flows ratio (copper etc have only 6 months supply above ground). However, it is likely at the end game, monetary metals investors will find their gains stolen via taxation.

P.S. Hyper-inflation is a shortage of cash, and the government must replenish the cash to masses, else hyper-inflation can not occur. The western masses have a negative net-worth, so any cash they receive will be used to pay down debt. The developing world has rising Gini coefficients with capital controls, so personal savings is mis-allocated instead of solving the mass standard-of-living deficit. This high global debt and standard-of-living-deficit load on the masses, is nothing like the situations that caused hyper-inflations.

[1] http://professorfekete.com

http://www.marketoracle.co.uk/Article23053.html#comment95123

Shelby wrote:I will be submitting an article to explain this difference between Japan's deflation and the current global deflation, which ends up being inflationary as priced in every currency except for gold and silver.

Suffice it to say that the current deflation of financed "assets" is forcing companies to lower labor costs, and 7 to 10 developing world workers for every outsourced western worker, means more basic commodities consumed (but not 7 to 10 times more, because developing world people save more).

Also Japan internally financed much from their very high personal savings rates, which is opposite of the current situation.

Keep an eye out for my new article tomorrow. It is going to explain everything about inflation versus deflation succinctly.

Perpetual Deflation Causes Inflation

Perpetual Deflation Causes Inflation

Published:

http://financialsense.com/contributors/shelby-moore/perpetual-deflation-causes-inflation

"Global perpetual deflation relative to gold, causes price inflation"

Another link about trade wars coming:

http://www.marketoracle.co.uk/Article23142.html#comment95152

http://financialsense.com/contributors/shelby-moore/perpetual-deflation-causes-inflation

"Global perpetual deflation relative to gold, causes price inflation"

Shelby in email wrote:Antal you are wrong about China

http://financialsense.com/contributors/antal-fekete/the-donkey-in-the-china-shop

The centralization of fitness is always a weakness. Maximum annealing to optimum fitness only occurs with a free market of individual trials. I am sure you understand why I say, this is why only gold is money.

Read my recent article for weakness of China's centralized economic and monetary policy:

http://financialsense.com/contributors/shelby-moore/perpetual-deflation-causes-inflation

Another link about trade wars coming:

http://www.marketoracle.co.uk/Article23142.html#comment95152

you still don't get it

you still don't get it

Good article.

A pretty good description of what is to come and SOON.

http://www.businessinsider.com/how-hyperinflation-will-happen-in-america-2010-9

Differentiate between a parabolic increase in price, and 10,000% increase in price (99-to-1 loss of purchasing power).

The former is a stampede that ends once everyone has traded their cash for goods. The masses do not have 99 times more cash than the value of all commodities right now. The latter is the one where the government keeps handing out more cash in every greater quantities DIRECTLY TO THE MASSES.

The latter is not happening and can not happen, because it would allow the people to pay off their debts. There is no way the elite will ever allow that. They will not waste this opportunity to move to a one world government system.

Another bout of food inflation now!

Another bout of food inflation now!

Could this be the big one, that starts the rationing of food?

http://www.agweb.com/article/shockwaves_from_fridays_usda_production_report/

My take on this is that we are likely to get another inflation run (higher interest rates, lower dollar) starting now and running until the next liquidity crisis in 2011 or 2012, a repeat of early 2008. Then the liquidity crisis will rescue the dollar and send the interest rates to new lows, a repeat of late 2008. This global crash will again abate the demand temporarily and crash commodity prices again. Remember that runaway hyper-inflation is impossible (the negative net-worth of masses is a margin call), unless the governments respond by handing out cash in orders-of-magnitude more than current cash flow of consumers. The governments are instead going to bail out the "too big to fail" and sustain the entitlements. What is underlying through these gyrations between inflation and deflation, is that each gyration will take another segment of the western population into poverty. This is the Great Harlots regression towards a one world order (global socialism) of the "share and share alike" level.

Btw, this gives further validation to my chart reading that silver is heading to $32- $47.

http://financialsense.com/contributors/stewart-thomson/the-great-gold-revaluation

================

We are having El Nino drought in Philippines this year, so much so that we are seeing brownouts during the peak time during day here in Davao, because the hydro-power dams have low water levels (well so they say). Also Davao is booming too much, but that boom came largely on the back of electricity being 1/3 the cost in Manila. Electricity prices must go up.

http://www.agweb.com/article/shockwaves_from_fridays_usda_production_report/

My take on this is that we are likely to get another inflation run (higher interest rates, lower dollar) starting now and running until the next liquidity crisis in 2011 or 2012, a repeat of early 2008. Then the liquidity crisis will rescue the dollar and send the interest rates to new lows, a repeat of late 2008. This global crash will again abate the demand temporarily and crash commodity prices again. Remember that runaway hyper-inflation is impossible (the negative net-worth of masses is a margin call), unless the governments respond by handing out cash in orders-of-magnitude more than current cash flow of consumers. The governments are instead going to bail out the "too big to fail" and sustain the entitlements. What is underlying through these gyrations between inflation and deflation, is that each gyration will take another segment of the western population into poverty. This is the Great Harlots regression towards a one world order (global socialism) of the "share and share alike" level.

Btw, this gives further validation to my chart reading that silver is heading to $32- $47.

http://financialsense.com/contributors/stewart-thomson/the-great-gold-revaluation

Stewart Thomson wrote:This is crash season for the stock market, and for you, and it extends from the start of August to the end of October, approximately. Today is October 5th. Not Oct 31. I’m enjoying my financial holiday from the market while the market achieves zero...

...Historically, the reason the stock market crashes has to do with farm crops

24. Here’s a look at the CRB General Commodity Index Chart. Note the massive consolidation in place. It’s a consolidation because prise has risen up into a sideways pattern, for time, from the lows. The Great Gold Revaluation is beginning to spread its wings into the general commodity asset class. Are You Prepared?

================

We are having El Nino drought in Philippines this year, so much so that we are seeing brownouts during the peak time during day here in Davao, because the hydro-power dams have low water levels (well so they say). Also Davao is booming too much, but that boom came largely on the back of electricity being 1/3 the cost in Manila. Electricity prices must go up.

bond bubble won't end soon

bond bubble won't end soon

http://www.marketoracle.co.uk/Article23304.html

Shelby wrote:amelia, the free market will always overrun socialism in time. I urge you to read the links I will provide below.

I agreed with everything Doug Casey wrote in this article, except as I have emailed his editor-in-chief David Galland last year and this year, and also his chief economist Bud Conrad this year, and explained why they are wrong about the end of the 3 decade bond bubble and interest rates sustaining rises any time too soon:

http://www.marketoracle.co.uk/Article23162.html

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=5#comment-90474

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=2#comment-90391

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297#comment-90249

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=3#comment-90396

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=6#comment-90646

The basic problem with rising interest rates is that the world is bankrupt. The west masses have a negative net-worth, and the developing world has a huge liability of massive underemployment. If the interest rates rise, not only does the sovereign debt interest payments increase, but the tax receipts plummet, meaning the governments will default if they don't QE. The rising interest rate scenario is the end game, because it is the death of the dollar, and the death of the world economy.

We will restart from a much smaller world economy.

So yes it does come at the bitter end, but the world will resist it and wither into it instead, with increasing socialism and bringing the west down to the level of the developing world in a "share and share equally" mantra.

This current inflationary run, which is getting ready to accelerate, will also peak and implode into another liquidity crisis, because the masses and the debt load is unserviceable. Rather upon the liquidity crisis, the only thing to do is QE some more:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-450.htm#3755

This is the Perpetual Deflation Causes Inflation, that I wrote an article about as linked above.

Mortgage payments funneled to TBonds?

Mortgage payments funneled to TBonds?

http://www.marketoracle.co.uk/Article23387.html

There are perhaps 10% of mortgages in there that are performing. This provides a steady cash flow to buy more Treasuries and keep the value of the Fed's balance sheet from falling. The Fed can control what % of those mortgages perform, simply by increasing or decreasing QE.

Shelby wrote:Barry, are you saying that the Fed is funneling all the mortgage payments into Treasury bonds, from the mortgages it obtained during the crisis?

So are you saying it tries to renegotiate mortgages so people can keep paying, and it tries to re-inflate the housing market (even indirectly via the wealth effect of re-inflating stocks as the banks deposit Tbonds with the Fed and earn an interest and banks are earning a huge interest rate differential now to on deposits), so people can sell and pay off their mortgage?

There are perhaps 10% of mortgages in there that are performing. This provides a steady cash flow to buy more Treasuries and keep the value of the Fed's balance sheet from falling. The Fed can control what % of those mortgages perform, simply by increasing or decreasing QE.

Last edited by Shelby on Tue Oct 12, 2010 3:41 pm; edited 1 time in total

hyper-inflation impossible

hyper-inflation impossible

http://www.marketoracle.co.uk/Article23427.html

Shelby wrote:Nadeem,

Excellent article and analysis. You may be the best trend technical analyst I have read. Your dollar projection for probable rally to 80 soon (and thus possible consolidation in gold dollar price), then a drop to 70 by mid-2011, is very well supported by the technical chart as you show, and is also supported by the macro-economic events I see on the horizon.

Specifically we are in the stage of the QE reflation from 2007/8 crisis (correlate elapsed time to the 2002/3 dot.com crisis where next crash started 2007), where it feeds through to a blow off move up in commodities that thus bankrupts the cash flow of westerners again, and coincides with a new peak in mortgage resets in USA by summer 2011:

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=6#comment-90991 (see end of blog post)

So very likely we get a renewed liquidity crisis (or scare) by mid-2011, that gives us another rally in the dollar as you predict. After that, I see the wheels falling off the commercial real estate in USA by 2012, thus dollar plummets out of that wedge on your chart to new lows below 70, all in agreement with your forecast.

I also commend you on the refuting the perma-dollar bears and bulls, and rather pointing out that the NECESSARY re-balancing of the world is instead taking place by rising commodity prices and rising NOMINAL wages in developing world (REAL wages flat or declining, except rising for those who land outsourced jobs or lift themselves with education, but with PPP rising for all which is reflection of the overvalued dollar), with falling REAL wages (NOMINAL wages flat) and increasing unemployment (i.e. falling average wages if unemployed included) in the west.

However, the one critical error I find is in your analysis of the "debt as % of GDP", the possibility of end of the bond bubble, and hyperinflation in USA.

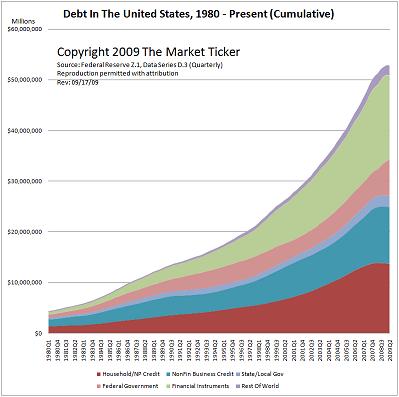

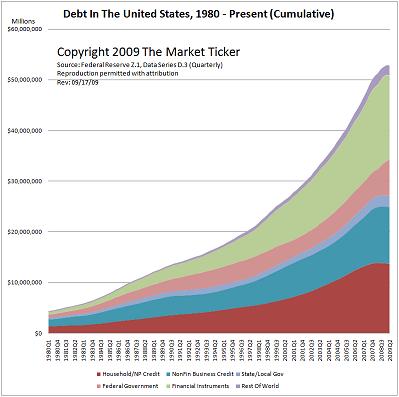

- Private debt and total debt in USA has peaked and shrinking. Here is a chart from market-ticker.net:

http://market-ticker.denninger.net/uploads/2010/Jun/debt-2000onward.png- Public debt in USA is increasing, but interest payments as a % of total deficits are shrinking, because interest payments are chopped in half for each halving of the interest rate, which has no mathematical end, e.g. 2%, 1%, 0.5%, 0.125%, 0.0625%, etc.. This means there is no mathmatical means by which the Fed must stop QE. The only way to stop it, is for oil producers to refuse to sell for dollars, but of course that is why our military is in the Middle East, and that is why we install socialist dictators in countries such as Venezuela (who ever agrees to keep the oil priced in dollars).

- Although the nominal GDP is shrinking faster than the total debt (i.e. marginal-utility-of-(new-)debt is negative since 2008), as long as rest of world can buy oil with dollars, they have no incentive to dump dollars but rather to beggar-thy-neighbor competitively devalue as you point out. The masses of the USA have no way to run from the dollar to commodities, because if they attempt to, they will find they have no cash flow and will turn around and sell in order to eat. You can't compare the "stampede event" of single nation-states to the stampede from the world's reserve currency. I explained this is more detail at following blog:

http://www.chrismartenson.com/blog/prediction-things-will-unravel-faster-than-you-think/45297?page=5#comment-90474

I respect your work very much, so you know my comments will remain respectful. If you can provide a compelling counter argument, I want to be swayed. Otherwise, perhaps my link above will sway you?

P.S. The current period is actually deflationary, but one must price everything in gold in order to see it. This is the end of the Bretton Woods system (and a move back to gold as money), which started in 1971 and now in its final end game (which will last on the order of a decade more), which will culminate in chaos (gold as money) and then a new global fiat system reconstituted with gold. As priced in fiat, this is an inflationary period.

P.S.S. The Yuan peg is a problem, because any centralized distortion (price fixing) _ALWAYS_ causes misallocation of capital. For example, it forces very smart people in China to work like slaves producing junk (and career experience) at near 0 profit margins, instead of developing and using their skills to invest abroad and employ less skilled people in other developing countries (producing goods that have more free market need, i.e. profit margin). This causes a waste of human capital, and they don't get the years back. Once China moves over its demographic peak in 2025, there won't be enough new youth to support their retirees, and they fall into similar trap as the west is in now. Misallocation of human lifespan time is very important factor that causes pain, impoverishment, and war. The (banksters and socialized masses of the) west are complicit and desire the Yuan peg:

http://www.marketoracle.co.uk/Article23142.html#comment95152

P.S.S.S The way the end game will play out, is basically a trap in the form of a decade of volatile withering of quality-of-life in USA (and much of the west), ending up at fascism and rationing (including rationing health care) at least in USA. The bond bubble won't end in any major western nation as this is the death spiral bubble for this global financial system, pension plans (retirees) will never be allowed to sell by the time it becomes clear they should (capital controls), besides the Fed can QE forever, as long the military backs the dollar for oil. It is the perverse nature of holding a bond, that its value increases as interest rates fall, so retirees stay vested until the bitter end. Eventually (10 years?) the commodity inflation will choke the developing world too, that is when the world heads into world war, gold as money, and out of that chaos will come the new world order system, with a new global currency "backed by gold" (but only those who pay their taxes can participate, all tax havens will be closed). Any one who wants a different outcome, has to compete with the banksters (and their military), to provide a better solution for feeding the billions of masses. Afaics, they've won already on the fate the masses. The only game remaining, is for the individual to save him/herself from this maturing global socialism heading into fascism.

Fed is distributing cash via bonds

Fed is distributing cash via bonds

Shelby wrote:Oh and here is more of the same nonsense:

http://www.kitco.com/ind/Summers/oct112010.html#2: “There are only about $550 billion of Treasuries outstanding with a remaining maturity of greater than 10 years.”

This horrifying fact comes courtesy of Morgan Stanley analyst David Greenlaw. And it confirms what I’ve been saying since the end of 2009, that the US has entered a debt spiral: a time in which fewer and fewer investors are willing to lend to us for any long period of time… at the exact same time that we must roll over trillions in old debt and issue an additional $100-150 billion in NEW debt per month in order to finance our massive deficit.

And only $550 billion of the debt we’ve got to roll over has a maturity greater than 10 years!?!?

So we’re talking about TRILLIONS of old debt coming due in the next decade.

The Fed is going to QE. The more debt that has to be rolled over, the faster the average interest rate on the outstanding debt can drop.

People don't seem to understand that our money is made out-of-thin-air. It costs nothing to make as much as is needed.

The only thing that can stop that trend, is for the masses to walk away from the dollar. But they can't. They can't eat without dollars, because they have no capacity to survive outside the current financial system. They have no savings. They have huge debts.

You forget Steve, the borrower is slave to lender. The borrower can not escape this servitude to the banksters.

What you do not apparently realize is that the Fed can drop the interest rates at will, simply by underbidding all bidders on Tbonds. Whether they do it in their own name or via proxy banks is irrelevant-- important is they do it.

In this way, the Fed is feeding as much cash as they want to the public who holds bonds (drop in interest rate, increases the nominal value of the existing bonds).

This is how they reflate and control the money supply now.

Nobody wants out, it is too lucrative, because basically what is happening is the world economy is being parasited by bond holders and the end game is a withering of real capital and a growth of public spending.

As long as oil is still available in dollars, then no one can stop the Fed from controlling interest rates this way. This is why our military is based all over the world. It is all about protecting the Federal reserve system:

http://www.marketoracle.co.uk/Article23427.html#comment95419

Page 18 of 24 •  1 ... 10 ... 17, 18, 19 ... 24

1 ... 10 ... 17, 18, 19 ... 24

Page 18 of 24

Permissions in this forum:

You cannot reply to topics in this forum|

|

|