Peak Oil Nonsense

Page 1 of 3

Page 1 of 3 • 1, 2, 3

Peak Oil Nonsense

Peak Oil Nonsense

There is no shortage or peaking of energy due to natural causes:

http://financialsense.com/editorials/casey/2009/0722.html

Oil may be peaking, primarily because there is a govt monopoly on oil worldwide.

Some people will erroneously blame Peak Oil for the coming Greater Depression, which is actually caused by govt capital misallocation theft machine:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-180.htm#1650

The root cause (enabler) of all the monopolies and misallocation is the public's trust in debt money, instead of real God made money. This has transferred the power to controllers of the levers of debt based money. Of course these elite deceive themselves, because in the end they must fight each other for the last slices of the shrinking pie they engineer. The Fed is the borrower (http://silverstockreport.com/2009/deflation.html) only when people think fiat is not money-- an abrupt change (hyperinflation) that can come at any time that people decide not to be debt slaves. Until then, the Fed the the lender and the citizens are enslaved.

http://financialsense.com/editorials/casey/2009/0722.html

Oil may be peaking, primarily because there is a govt monopoly on oil worldwide.

Some people will erroneously blame Peak Oil for the coming Greater Depression, which is actually caused by govt capital misallocation theft machine:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-180.htm#1650

The root cause (enabler) of all the monopolies and misallocation is the public's trust in debt money, instead of real God made money. This has transferred the power to controllers of the levers of debt based money. Of course these elite deceive themselves, because in the end they must fight each other for the last slices of the shrinking pie they engineer. The Fed is the borrower (http://silverstockreport.com/2009/deflation.html) only when people think fiat is not money-- an abrupt change (hyperinflation) that can come at any time that people decide not to be debt slaves. Until then, the Fed the the lender and the citizens are enslaved.

Oil production is peaking, as is everything else in the economy

Oil production is peaking, as is everything else in the economy

Peak ________ is all caused by peak debt:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-210.htm#1711

SRSrocco has a good post about peaking of oil production:

http://jasonhommelforum.com/forums/showthread.php?p=52133#post52133

Which has not yet started declining:

http://financialsense.com/editorials/powers/2009/0731.html

Oil production (and food production and metals production, etc) is peaking because the "notional values of everything in world are all out of wack", due to the misallocations of debt. Cheap oil enabled this debt bubble to run much farther than it should have. Debt/Oil are like Egg/Chicken, which caused which? No one will ever know, they are mutually coupled. See also:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-195.htm#1701

Money will have to return to gold/silver, which will eventually (probably not in short-term) run up to astronomical values as compared to fiat, but as will oil and food run up compared to fiat. People who have gold and silver will feel fine (except that everyone else will want to steal it). Everyone else will lowered into a massive depression.

The question is will the depression be inflationary or deflationary? Eventually it will be inflationary, as stated above. But in the interim time, about 2 - 5 years, it will first run as a Hyper-Deflation, because the people do not want to crash the debt:

https://goldwetrust.forumotion.com/precious-metals-f6/silver-as-an-investment-t33-120.htm#1704

Even during this Hyper-Deflation, basic needs stuff (things people MUST buy, and can not reduce) will be persistantly refusing to fall in price. I mean basic foods. I agree with Steve about that, but these are such a small portion of the american debt ATM machine, that this basic inflation will not be driving the trend (not driving them to riot) until populations net worth (their notion of their net worth, as it is all just a notion now) comes down considerably first. First the bankers have to bleed their net worth, then the inflation in basic goods will be a big factor causing riots (probably about 2012 as Celente predicts). It is a question of relative size and thus relative effect. Food and basic needs inflation is not yet the driving force. The driving force is the vaporizing of notional value, with the bankers able to funnel it to themselves, where they will convert it to real power and real assets, thus eventually causing the revolution and hyperinflation as people catapult from fiat.

SRSrocco asks what will happen to all the billions that live in cities? Many will die. In prior 4th Turnings, revolutionary war like 50,000 died, civil war 600,000, WW2 73 million, so likely a billion or more will die during this 4th Turning. Those that survive will bond together to create lifestyles that use energy much more efficiently (e.g. live like rats in small cubicles and use mass transportation). Come over here to Asia and see how they use energy more efficiently. Put 10 people in one small house, pack people into buses standing position and other mass transport like sardines, etc. one problem is the American population is too sparse for mass transport, so there will be a migration to higher density cities, or a resurgence of small farms. I think the former will be the predominant trend.

============

Speaking about nonsense mass misconceptions such as Peak Energy or Global Warming, founder of Weather Channel and 30,000 scientists want to sue Al Gore:

https://www.youtube.com/watch?v=z6l1Cp3MYCQ&feature=related

P.S. We do have Peak Cheap Oil. We do not have Peak Energy as some geological limitation, rather it is a misallocation limitation on investment (we grew faster than natural, and now we have to revert to the mean and below, before growing again).

https://www.youtube.com/watch?v=SMwBbl6RoIs (Obama believes in Global Warming, he wants to bankrupt coal)

https://www.youtube.com/watch?v=HlTxGHn4sH4 (he admits he will cause skyrocketing electricity rates on purpose)

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-210.htm#1711

SRSrocco has a good post about peaking of oil production:

http://jasonhommelforum.com/forums/showthread.php?p=52133#post52133

Which has not yet started declining:

http://financialsense.com/editorials/powers/2009/0731.html

Oil production (and food production and metals production, etc) is peaking because the "notional values of everything in world are all out of wack", due to the misallocations of debt. Cheap oil enabled this debt bubble to run much farther than it should have. Debt/Oil are like Egg/Chicken, which caused which? No one will ever know, they are mutually coupled. See also:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-195.htm#1701

Money will have to return to gold/silver, which will eventually (probably not in short-term) run up to astronomical values as compared to fiat, but as will oil and food run up compared to fiat. People who have gold and silver will feel fine (except that everyone else will want to steal it). Everyone else will lowered into a massive depression.

The question is will the depression be inflationary or deflationary? Eventually it will be inflationary, as stated above. But in the interim time, about 2 - 5 years, it will first run as a Hyper-Deflation, because the people do not want to crash the debt:

https://goldwetrust.forumotion.com/precious-metals-f6/silver-as-an-investment-t33-120.htm#1704

Even during this Hyper-Deflation, basic needs stuff (things people MUST buy, and can not reduce) will be persistantly refusing to fall in price. I mean basic foods. I agree with Steve about that, but these are such a small portion of the american debt ATM machine, that this basic inflation will not be driving the trend (not driving them to riot) until populations net worth (their notion of their net worth, as it is all just a notion now) comes down considerably first. First the bankers have to bleed their net worth, then the inflation in basic goods will be a big factor causing riots (probably about 2012 as Celente predicts). It is a question of relative size and thus relative effect. Food and basic needs inflation is not yet the driving force. The driving force is the vaporizing of notional value, with the bankers able to funnel it to themselves, where they will convert it to real power and real assets, thus eventually causing the revolution and hyperinflation as people catapult from fiat.

SRSrocco asks what will happen to all the billions that live in cities? Many will die. In prior 4th Turnings, revolutionary war like 50,000 died, civil war 600,000, WW2 73 million, so likely a billion or more will die during this 4th Turning. Those that survive will bond together to create lifestyles that use energy much more efficiently (e.g. live like rats in small cubicles and use mass transportation). Come over here to Asia and see how they use energy more efficiently. Put 10 people in one small house, pack people into buses standing position and other mass transport like sardines, etc. one problem is the American population is too sparse for mass transport, so there will be a migration to higher density cities, or a resurgence of small farms. I think the former will be the predominant trend.

============

Speaking about nonsense mass misconceptions such as Peak Energy or Global Warming, founder of Weather Channel and 30,000 scientists want to sue Al Gore:

https://www.youtube.com/watch?v=z6l1Cp3MYCQ&feature=related

P.S. We do have Peak Cheap Oil. We do not have Peak Energy as some geological limitation, rather it is a misallocation limitation on investment (we grew faster than natural, and now we have to revert to the mean and below, before growing again).

https://www.youtube.com/watch?v=SMwBbl6RoIs (Obama believes in Global Warming, he wants to bankrupt coal)

https://www.youtube.com/watch?v=HlTxGHn4sH4 (he admits he will cause skyrocketing electricity rates on purpose)

Peak Stupidity

Peak Stupidity

I see SRSrocco is up to his usual habit of misstating what he thinks I wrote (and providing no reference to my context for readers to see what I really wrote):

http://jasonhommelforum.com/forums/showpost.php?p=52158&postcount=67

Any way, what I have said is that Peak Debt (and the Peak of Stupidity that debt enables, i.e misallocation of capital), is the driver of Peak Oil. I thought Steve would be smart enough to understand that I was not saying that oil production was not declining, but rather that we overused our oil because of stupidity (and also due to cheap prices, didn't develop other oil):

http://www.motherearthnews.com/Sustainable-Farming/Joel-Salatin-Interview.aspx?page=5

Steve one day you may understand that the issue is not how much oil is in the ground or what is the EROEI to extract it at any given time in history, but rather the issue is having centralized money systems that encourage people to waste energy. Just imagine all the good science (the free roaming bison is an example of a positive science) that did not get implemented because people didn't need to-- everything was free...until now. What I wrote in 2006 in the Hommel forum thread Peak Oil, is that we have Peak CHEAP Oil, meaning that oil was too cheap (high EROEI) and this enabled the debt bubble to run as far as did. I have NEVER DENIED Peak CHEAP Oil. My point consistently since 2006, is that debt enables people to use resources unwisely. So the did Peak Cheap Oil cause the debt, or did the debt cause us to overuse the Cheap (high EROEI) oil? Well it is a philosophical distinction, since obviously they are symbiotic. The distinction for me is that people had a choice, and had they chosen non-debt money systems, then energy would have been allocated in more sustainable manner. And much other knowledge would have not have been ignored, as people would have had to actually produce something of value before they consumed something. This knowledge could have renewed the supply of high EROEI systems (maybe not oil, but quicker advances in nuclear, or in energy de-intensive production, e.g. free grazing bison, finishing pigs on acorns in Oak forests, etc).

Bottom line is that the world resources aren't finite (they are not! they renew! hydrogen+carbon is fuel and it is never destroyed!), rather our stupidity was infinite. Had we used sustainable capital/financial systems (with their non-distorted feedback loops on resource allocation), then our knowledge would have been much greater.

As I said, rising prices and scarcity is a positive thing. It means people need to return to sanity. Then energy use can return to sanity. The path back to sanity is going to be chaotic, because we overshot sustainability by a long way. And the masses now will try to maintain the status quo-- thus thrusting themselves into a deeper hole.

But don't worry, the planet will take care of the problem. The masses can insure their death, that is about all insurance does, is insure the center of the bell curve fails:

https://goldwetrust.forumotion.com/biblical-f3/new-vs-old-testament-is-christianity-a-lie-t94-15.htm#1747

Steve asks why big oil companies invest to produce in the North Sea at high costs. Well Steve have you ever noticed that the USA govt and the environmentalists are blocking the production of all resources in the USA? Did you ever wonder if that contributed to USA decline in production? Did you ever notice that the peak in USA production coincided with the end of the dollar-gold connection in 1971??

Well why don't we look at what happened in USSR:

http://cluborlov.blogspot.com/2009/06/slope-of-dysfunction.html

We see that production fell 43% when the USSR collapsed, but that the peak was reversed when new foreign investment came in later.

http://jasonhommelforum.com/forums/showpost.php?p=52158&postcount=67

Any way, what I have said is that Peak Debt (and the Peak of Stupidity that debt enables, i.e misallocation of capital), is the driver of Peak Oil. I thought Steve would be smart enough to understand that I was not saying that oil production was not declining, but rather that we overused our oil because of stupidity (and also due to cheap prices, didn't develop other oil):

http://www.motherearthnews.com/Sustainable-Farming/Joel-Salatin-Interview.aspx?page=5

...America has traded 73 million bison requiring no petroleum, machinery or fertilizer for 45 million beef cattle, and we think we’re efficient...

Steve one day you may understand that the issue is not how much oil is in the ground or what is the EROEI to extract it at any given time in history, but rather the issue is having centralized money systems that encourage people to waste energy. Just imagine all the good science (the free roaming bison is an example of a positive science) that did not get implemented because people didn't need to-- everything was free...until now. What I wrote in 2006 in the Hommel forum thread Peak Oil, is that we have Peak CHEAP Oil, meaning that oil was too cheap (high EROEI) and this enabled the debt bubble to run as far as did. I have NEVER DENIED Peak CHEAP Oil. My point consistently since 2006, is that debt enables people to use resources unwisely. So the did Peak Cheap Oil cause the debt, or did the debt cause us to overuse the Cheap (high EROEI) oil? Well it is a philosophical distinction, since obviously they are symbiotic. The distinction for me is that people had a choice, and had they chosen non-debt money systems, then energy would have been allocated in more sustainable manner. And much other knowledge would have not have been ignored, as people would have had to actually produce something of value before they consumed something. This knowledge could have renewed the supply of high EROEI systems (maybe not oil, but quicker advances in nuclear, or in energy de-intensive production, e.g. free grazing bison, finishing pigs on acorns in Oak forests, etc).

Bottom line is that the world resources aren't finite (they are not! they renew! hydrogen+carbon is fuel and it is never destroyed!), rather our stupidity was infinite. Had we used sustainable capital/financial systems (with their non-distorted feedback loops on resource allocation), then our knowledge would have been much greater.

As I said, rising prices and scarcity is a positive thing. It means people need to return to sanity. Then energy use can return to sanity. The path back to sanity is going to be chaotic, because we overshot sustainability by a long way. And the masses now will try to maintain the status quo-- thus thrusting themselves into a deeper hole.

But don't worry, the planet will take care of the problem. The masses can insure their death, that is about all insurance does, is insure the center of the bell curve fails:

https://goldwetrust.forumotion.com/biblical-f3/new-vs-old-testament-is-christianity-a-lie-t94-15.htm#1747

Steve asks why big oil companies invest to produce in the North Sea at high costs. Well Steve have you ever noticed that the USA govt and the environmentalists are blocking the production of all resources in the USA? Did you ever wonder if that contributed to USA decline in production? Did you ever notice that the peak in USA production coincided with the end of the dollar-gold connection in 1971??

Well why don't we look at what happened in USSR:

http://cluborlov.blogspot.com/2009/06/slope-of-dysfunction.html

We see that production fell 43% when the USSR collapsed, but that the peak was reversed when new foreign investment came in later.

So many alternatives to Cheap (high EROEI) Oil

So many alternatives to Cheap (high EROEI) Oil

So many alternatives to Cheap (high EROEI) Oil, but they are not the stupid alternatives being promoted by the govt.

The point of the prior post was the world has so many alternatives to Cheap (high EROEI) Oil that were not pursued due to the impatience (mis-allocated priorities) of the society which has been in a debt bubble.

I mentioned in the prior "Peak Supidity" post ( https://goldwetrust.forumotion.com/economics-f4/peak-oil-nonsense-t102.htm#1749 ) that our production of beef and pork using oil is much less efficient (lower EROEI) than producing them from the natural, renewable hydrogen-carbon FUEL cycle of the earth, where the sun grows grasses (bison) and acorns (pigs), plants which eat CO2.

The new volt will get 230 MPG relative to oil use, because it will use electricity for most of the city driving (and this could improve as people get more crammed into cities by this current debt deflation):

http://finance.yahoo.com/news/GM-says-new-Volt-could-get-apf-2785315765.html?x=0&sec=topStories&pos=3&asset=&ccode=

As I told SRSrocco many times in Peak Oil thread of the Hommel forum back in 2007, that nuclear has a very high EROEI and the people will be crammed into cities, where many of the things we do with Oil can be replaced with electricity. Farming will change also from oil based to either natural methods (like above) or to electric machinery (made easier as farms are consolidated into even bigger farms during the crisis). SRSrocco and others argue that the conversion will take too long and cost too much in terms of oil that is remaining. But consider the huge implosion (deflation plus possible killing of billions) coming-- this will enable a supply of Oil to move to the next higher EROEI paradigm. Brings to mind that the forced 25% reduction in consumption caused by WW2 (thus higher savings and investment), is what ended the 1930 Great Depression. This could have been done long ago by the free market, if we had not been on a debt money system. But instead, we have give the control to PTB, which will organize it for us. I can now see how PTB feel they are the managers of the world progress.

Note I heard (think from CaseyResearch.com) that there are now small nuclear reactors that can power a small city and these can be put into action much faster than the former designs and put in more places.

Peak Oil is a myopia. Those focused on it, are going to miss some incredible opportunities.

P.S. As a side note, notice in my prior post that Russia was able to reverse the decline from their peak in oil production, once they returned to a slightly more free market economy. Notice that almost all oil now is produced by non-free market economies. It is not central to my thesis above, but I do suspect that there is a lot of high EROEI oil still out there waiting for the oil monopolies and govt beauracracy/environmentalists to get out of the way. Now watch SRSrocco will focus on attacking this point, even though it is not central to my thesis. Any way, there should be no problem mustering the oil needed to make the transistion to the electric economy for this reason and moreover for the reasons I started earlier in this post. It is common sense that since oil is being produced by monopolies and intense govt control, that oil production is peaking. The govt kills everything it gets involved in. And why does the govt have this control? Because society chose debt money system (govts can't spend and grow on a gold money standard).

The point of the prior post was the world has so many alternatives to Cheap (high EROEI) Oil that were not pursued due to the impatience (mis-allocated priorities) of the society which has been in a debt bubble.

I mentioned in the prior "Peak Supidity" post ( https://goldwetrust.forumotion.com/economics-f4/peak-oil-nonsense-t102.htm#1749 ) that our production of beef and pork using oil is much less efficient (lower EROEI) than producing them from the natural, renewable hydrogen-carbon FUEL cycle of the earth, where the sun grows grasses (bison) and acorns (pigs), plants which eat CO2.

The new volt will get 230 MPG relative to oil use, because it will use electricity for most of the city driving (and this could improve as people get more crammed into cities by this current debt deflation):

http://finance.yahoo.com/news/GM-says-new-Volt-could-get-apf-2785315765.html?x=0&sec=topStories&pos=3&asset=&ccode=

As I told SRSrocco many times in Peak Oil thread of the Hommel forum back in 2007, that nuclear has a very high EROEI and the people will be crammed into cities, where many of the things we do with Oil can be replaced with electricity. Farming will change also from oil based to either natural methods (like above) or to electric machinery (made easier as farms are consolidated into even bigger farms during the crisis). SRSrocco and others argue that the conversion will take too long and cost too much in terms of oil that is remaining. But consider the huge implosion (deflation plus possible killing of billions) coming-- this will enable a supply of Oil to move to the next higher EROEI paradigm. Brings to mind that the forced 25% reduction in consumption caused by WW2 (thus higher savings and investment), is what ended the 1930 Great Depression. This could have been done long ago by the free market, if we had not been on a debt money system. But instead, we have give the control to PTB, which will organize it for us. I can now see how PTB feel they are the managers of the world progress.

Note I heard (think from CaseyResearch.com) that there are now small nuclear reactors that can power a small city and these can be put into action much faster than the former designs and put in more places.

Peak Oil is a myopia. Those focused on it, are going to miss some incredible opportunities.

P.S. As a side note, notice in my prior post that Russia was able to reverse the decline from their peak in oil production, once they returned to a slightly more free market economy. Notice that almost all oil now is produced by non-free market economies. It is not central to my thesis above, but I do suspect that there is a lot of high EROEI oil still out there waiting for the oil monopolies and govt beauracracy/environmentalists to get out of the way. Now watch SRSrocco will focus on attacking this point, even though it is not central to my thesis. Any way, there should be no problem mustering the oil needed to make the transistion to the electric economy for this reason and moreover for the reasons I started earlier in this post. It is common sense that since oil is being produced by monopolies and intense govt control, that oil production is peaking. The govt kills everything it gets involved in. And why does the govt have this control? Because society chose debt money system (govts can't spend and grow on a gold money standard).

My most complete rebuttal to Peak Oil yet

My most complete rebuttal to Peak Oil yet

Read 3rd paragraph:

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-225.htm#1795

===================

In the late 1800s, there were people like you talking about peak whale oil. Well I see it turned out ok. We "discovered" oil, even though it had been discovered back in the time of the Egyptians. Seems we already discovered nuclear energy.

100-150MPG do-it-yourself cars by putting a 20HP diesel in a small car:

http://www.free-energy.ws/Update_4-2007

http://www.autoblog.com/2006/02/27/loremo-debuts-150-mpg-concept-car-in-geneva/

Also Lee Raymond CEO of Exxon stated in 2007:

========

I would lean towards skeptism of any new energy technology.

I would also have extreme skeptism to trust that the govts of the world and the large oil companies are not colluding to make oil scarce. It is called Fascism and seems to be the prevelant economic mode these days.

It is all too convenient the timing of 9/11, invasion of Iraq, and sudden run up in oil prices. Massive war spending to hold up the world's dollar debt bubble. Study history and this pattern repeats near the end of credit bubbles.

============

re: experts think (do they really?)

>

> "You can't know with certainty that exploration has peaked geologically."

>

> From what I've read, geophysicists/geologists firmly believe that the land

> mapping and exploration has been done so extensively and with such refined

> technology that there can be no doubt about production declines. Iraq is

They thought that too until they had massive discovery in the North Sea.

We know almost nothing with confidence about Russia and Siberia for example.

Don't pretend you know, what you can't know, it is not science. Also I don't mean that to be a snub.

Also remember the fact:

All oil is nationalized. When have you ever seen govts run things well or with good transparency of data?

The truth is, the "experts" are extrapolating.

And never in the history of the earth is the "it is different this time" been true, when it comes to economics or natural resources.

====================

New Deal caused Greater Depression; Peak "___" caused by cartelization

Must read for anyone who thinks that the New Deal (and our current version of it in subprime plans) got us out of the Great Depression, and everyone who thinks Peak Oil or Peak Whatever, is caused by earth's limits:

http://www.gold-eagle.com/editorials_08/baltin041608.html

...New Deal (1933–34) was one giant cartel scheme to raise prices; completely confusing cause and effect, whereby the government attempted to enforce cartel price fixing through output reductions in hundreds of industries as well as in agriculture (Burning crops and pouring milk into the streets) [shelby notes: sounds like making ethanol from food, hedging mines, shorting commodity futures prices, nationalizing oil, increasing consumer debt to overconsume oil & commodities, etc], drastically reducing employment. Falling prices are an effect, not a cause of a Depression...

==========================

Peak Resource Fallacy

Have you considered the correlation between debt, nationalization, price manipulation, and the divestment of the resource sector?

Most resources, oil especially, is highly regulated, politicized, nationalized, and so heavily taxed that the (especially oil) producers only receive a small fraction of the end price, and thus it doesn't pay to invest in the sector.

Price fixing causes shortages or causes overconsumption. That is the central point of my article above. I personally know of many high grade mines that can not be profitable at the current resource prices (from my work on Miningpedia.com).

For example, in the silver market, we have 2 big banks (JP Morgan suspected) with 80% share of selling short unlimited quantities of paper silver on the futures markets to depress the silver paper price, simultaneous with well-documented severe shortages of silver in the retail dealers worldwide. We have 900 Moz annual demand and only 550 Moz annual mine production-- deficit met by recycling (most 90% coin from 1960s de-monetization of silver worldwide). Silver translated means "money" in 14 languages. Silver throughout history of world was 1/15 to 1/10 price of gold, but lately has been 1/100 - 1/50 the price of gold.

So the Peak Resources is fundamentally a Peak Fraud caused by Peak Debt. The root cause of Peak Resources is the fractional reserve banking model.

When the Peak Debt implodes, so will the manipulation of prices and investment, thus the free market will fix the resource gap throught a mix of conservation, efficiency, renewed investment, and new paradigms.

It seems you are also implying that there is some natural limit of resources. We simply have no reliable way to measure such a theory, because investment in resources has not been climbing in exponential parity with debt. Measurements based on a rubber band money system, are inherently ambiguous.

The very highest grade near surface mines are indeed mostly gone, and certainly probably all of the massive ones, except for perhaps burried deep in Amazon and other unexplored places.

However, technology has increased greatly since those low hanging fruit were picked. We won't know the equilibrium price, investment, and thus supply/demand, until we remove the false pricing effect of fiat and the politics that fiats induces.

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-225.htm#1795

===================

In the late 1800s, there were people like you talking about peak whale oil. Well I see it turned out ok. We "discovered" oil, even though it had been discovered back in the time of the Egyptians. Seems we already discovered nuclear energy.

100-150MPG do-it-yourself cars by putting a 20HP diesel in a small car:

http://www.free-energy.ws/Update_4-2007

http://www.autoblog.com/2006/02/27/loremo-debuts-150-mpg-concept-car-in-geneva/

Also Lee Raymond CEO of Exxon stated in 2007:

An unlikely Paul Revere. When Lee Raymond retired in early

2006 after leading ExxonMobil to record profits, he was the

quintessential Texas oilman. If the notion of developing alternative

fuels and putting pressure on Detroit to build more fuel-efficient

cars ever crossed his mind, it didn’t cross his lips. But as architect

of a new study by the National Petroleum Council, a federal

advisory group, Raymond has become a sort of Paul Revere of

energy, warning of coming shortages by 2030 if America does not

act now. "The problems that the world faces are not related to what

I call geologic risk. They’re related to above-ground risk. They’re

related to political issues, access issues, financing issues, scale

issues, technology issues. Major projects in this industry take a long

time. So even in the most optimistic case, I suspect that the industry

would have trouble keeping up with the growth in demand. All

sources of energy that meet the competitive standard set by the

market should be encouraged. That’s coal, clean coal, nuclear,

conventional oil and gas, nonconventional oil and gas, biofuels,

solar." Q: When you were CEO of ExxonMobil, you said many

times that there are few alternatives to oil when it comes to

transportation. Do you still feel that way? Does it concern you that

the Chinese are trying to lock up oil assets all around the globe? A:

"The Chinese can’t be energy independent. The US can’t be energy

independent. All the major users of energy are going to have to

learn how to work together to make sure that there are adequate

energy supplies." Maria Bartiromo, Business Week, 24 Sep 07

========

I would lean towards skeptism of any new energy technology.

I would also have extreme skeptism to trust that the govts of the world and the large oil companies are not colluding to make oil scarce. It is called Fascism and seems to be the prevelant economic mode these days.

It is all too convenient the timing of 9/11, invasion of Iraq, and sudden run up in oil prices. Massive war spending to hold up the world's dollar debt bubble. Study history and this pattern repeats near the end of credit bubbles.

============

re: experts think (do they really?)

>

> "You can't know with certainty that exploration has peaked geologically."

>

> From what I've read, geophysicists/geologists firmly believe that the land

> mapping and exploration has been done so extensively and with such refined

> technology that there can be no doubt about production declines. Iraq is

They thought that too until they had massive discovery in the North Sea.

We know almost nothing with confidence about Russia and Siberia for example.

Don't pretend you know, what you can't know, it is not science. Also I don't mean that to be a snub.

Also remember the fact:

All oil is nationalized. When have you ever seen govts run things well or with good transparency of data?

The truth is, the "experts" are extrapolating.

And never in the history of the earth is the "it is different this time" been true, when it comes to economics or natural resources.

====================

New Deal caused Greater Depression; Peak "___" caused by cartelization

Must read for anyone who thinks that the New Deal (and our current version of it in subprime plans) got us out of the Great Depression, and everyone who thinks Peak Oil or Peak Whatever, is caused by earth's limits:

http://www.gold-eagle.com/editorials_08/baltin041608.html

...New Deal (1933–34) was one giant cartel scheme to raise prices; completely confusing cause and effect, whereby the government attempted to enforce cartel price fixing through output reductions in hundreds of industries as well as in agriculture (Burning crops and pouring milk into the streets) [shelby notes: sounds like making ethanol from food, hedging mines, shorting commodity futures prices, nationalizing oil, increasing consumer debt to overconsume oil & commodities, etc], drastically reducing employment. Falling prices are an effect, not a cause of a Depression...

==========================

Peak Resource Fallacy

Have you considered the correlation between debt, nationalization, price manipulation, and the divestment of the resource sector?

Most resources, oil especially, is highly regulated, politicized, nationalized, and so heavily taxed that the (especially oil) producers only receive a small fraction of the end price, and thus it doesn't pay to invest in the sector.

Price fixing causes shortages or causes overconsumption. That is the central point of my article above. I personally know of many high grade mines that can not be profitable at the current resource prices (from my work on Miningpedia.com).

For example, in the silver market, we have 2 big banks (JP Morgan suspected) with 80% share of selling short unlimited quantities of paper silver on the futures markets to depress the silver paper price, simultaneous with well-documented severe shortages of silver in the retail dealers worldwide. We have 900 Moz annual demand and only 550 Moz annual mine production-- deficit met by recycling (most 90% coin from 1960s de-monetization of silver worldwide). Silver translated means "money" in 14 languages. Silver throughout history of world was 1/15 to 1/10 price of gold, but lately has been 1/100 - 1/50 the price of gold.

So the Peak Resources is fundamentally a Peak Fraud caused by Peak Debt. The root cause of Peak Resources is the fractional reserve banking model.

When the Peak Debt implodes, so will the manipulation of prices and investment, thus the free market will fix the resource gap throught a mix of conservation, efficiency, renewed investment, and new paradigms.

It seems you are also implying that there is some natural limit of resources. We simply have no reliable way to measure such a theory, because investment in resources has not been climbing in exponential parity with debt. Measurements based on a rubber band money system, are inherently ambiguous.

The very highest grade near surface mines are indeed mostly gone, and certainly probably all of the massive ones, except for perhaps burried deep in Amazon and other unexplored places.

However, technology has increased greatly since those low hanging fruit were picked. We won't know the equilibrium price, investment, and thus supply/demand, until we remove the false pricing effect of fiat and the politics that fiats induces.

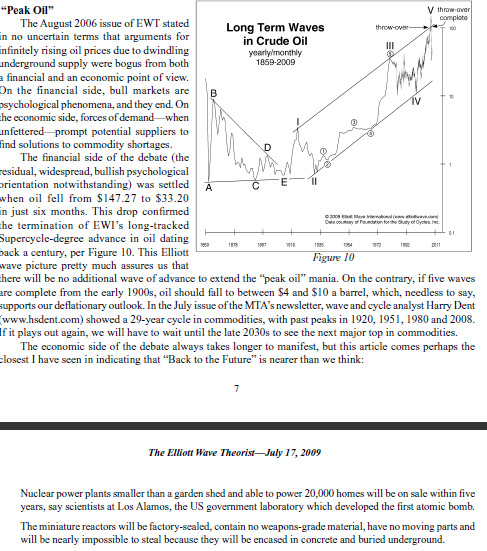

Oil will never exceed $140 again! Micro-nuclear reactors coming...

Oil will never exceed $140 again! Micro-nuclear reactors coming...

http://www.elliottwave.com/club/protected/pdf/free-theorist-july-2009.pdf

(free signup to read entire: http://www.elliottwave.com/r.asp?acn=finsense&rcn=aa38c&dy=aa082009c&url=/club/free-theorist/default.aspx?code=34719)

He goes on to explain that these are buried in ground, have no moving parts, need to refueled only every 7 - 10 years, they are only a few meters in diameter and get delivered to your location on a truck. They have already 100 firm orders to start delivery in 2013. See also this Wikipedia link:

http://en.wikipedia.org/w/index.php?title=Toshiba_4S&oldid=300866783

(free signup to read entire: http://www.elliottwave.com/r.asp?acn=finsense&rcn=aa38c&dy=aa082009c&url=/club/free-theorist/default.aspx?code=34719)

He goes on to explain that these are buried in ground, have no moving parts, need to refueled only every 7 - 10 years, they are only a few meters in diameter and get delivered to your location on a truck. They have already 100 firm orders to start delivery in 2013. See also this Wikipedia link:

http://en.wikipedia.org/w/index.php?title=Toshiba_4S&oldid=300866783

Hydrocarbon is the Fuel of Life on Earth

Hydrocarbon is the Fuel of Life on Earth

Originally written November 2007:

https://goldwetrust.forumotion.com/economics-f4/global-warming-nonsense-t108.htm#1816 (scroll down a bit)

https://goldwetrust.forumotion.com/economics-f4/global-warming-nonsense-t108.htm#1816 (scroll down a bit)

Brazil has 100 years of oil plus more ethanol than it can use!

Brazil has 100 years of oil plus more ethanol than it can use!

If there is a Peak Oil problem, Brazil won't be have a problem:

http://finance.yahoo.com/news/Alternative-energy-powerhouse-apf-3449508334.html?x=0&sec=topStories&pos=2&asset=&ccode=

http://finance.yahoo.com/news/Alternative-energy-powerhouse-apf-3449508334.html?x=0&sec=topStories&pos=2&asset=&ccode=

BP drills deepest-ever oil well

BP drills deepest-ever oil well

BP drills deepest-ever oil well in Gulf of Mexico, taps vast pool of crude

By Chris Kahn, The Associated Press

NEW YORK - More than 10 kilometres below the Gulf of Mexico, oil company BP has tapped into a vast pool of crude after digging the deepest oil well in the world.

The Tiber Prospect is expected to rank among the largest petroleum discoveries in the United States, potentially producing half as much crude in a day as Alaska's famous North Slope oil field.

The company's chief of exploration on Wednesday estimated that the Tiber deposit holds between four billion and six billion barrels of oil equivalent, which includes natural gas. That would be enough to satisfy U.S. demand for crude for nearly one year. But BP does not yet know how much it can extract.

"The Gulf of Mexico is proving to be a growing oil province, and a profitable one if you can find the reserves," said Tyler Priest, professor and director of Global Studies at the Bauer College of Business at the University of Houston.

The Tiber well is about 400 kilometres southeast of Houston in U.S. waters. At 10,685 metres, it is as deep as Mount Everest is tall, not including more than 1,200 metres of water above it.

Drilling at those depths shows how far major oil producers will go to find new supplies as global reserves dwindle, and how technology has advanced, allowing them to reach once-unimaginable depths.

Deep-water operations are considered to be the last frontier for pristine oil deposits, and the entire petroleum industry is sweeping the ocean floor in search of more crude.

BP needs to invest years of work and millions of dollars before it draws the first drop of oil from Tiber. Such long waits are not uncommon. Three years after announcing a discovery at a site in the Gulf called Kaskida, BP has yet to begin producing oil there.

Projects like the Tiber well will not reduce U.S. dependency on foreign oil, which continues to grow. But new technology does permit access to major oil finds closer to U.S. shores.

BP expects Tiber to be among the company's richest finds in the Gulf on par with its crown jewel, the Thunder Horse development. Thunder Horse produces about 300,000 barrels of oil equivalent per day, as much crude as half of Alaska's famous North Slope.

Even if Tiber produces that much, it would still be a trickle compared with the largest oil producers in the world - the Ghawar field in Saudi Arabia, which produces 5 million barrels per day.

But because it's close to home, Tiber would be especially attractive to refiners in America, where the government wants to cut down on oil imports from the Middle East.

"Early indications are that it's a significant positive discovery," said Matt Snyder, lead analyst with Wood MacKinzie's Gulf of Mexico research team.

Exploration companies recently have been pushing drilling operations farther from shore because of technological improvements that allow them to handle extreme depths and pressure, Snyder said.

It's an expensive process. A production platform costs more than US$1 billion to build. Drilling a deep-water well can add another $100 million, and if crude is located, it could cost another $50 million to bring the oil to the surface.

"And when they finally get down there, it's very hot," said Leta Smith, a director with Cambridge Energy Research Associates' Global Oil Supply Group.

"It could be upwards of 250 degrees Fahrenheit. The pressures can be the most challenging aspect of it. These rocks are over-pressured, which means you need to have a lot of special equipment."

For an ambitious project like Tiber to pay off, experts say crude must cost at least $70 to $75 per barrel, though lower prices have never slowed the industry. When crude prices fell below $20 per barrel in the late 1990s, exploration and Thunder Horse never slowed.

"They're not swayed by daily price swings when it comes to planning deep-water exploration," Priest said.

BP's discovery is the latest in what's called the "lower tertiary" region, an ancient section of rock in the Gulf that is roughly 300 square miles and formed between 24 million and 65 million years ago.

Chevron Corp. drilled one of the first wells in the region in 2001, followed by more than a dozen others from companies such as Royal Dutch Shell, Australian oil company BHP Billiton, BP and Total SA, according to the U.S. Department of Interior's Minerals Management Service.

In 2006, Chevron estimated that the lower tertiary holds between three billion and 15 billion barrels. But it has taken years to develop wells for commercial use.

Smith said that the first drops of crude from the lower tertiary will arrive in 2010 with Shell's Perdido operation and Petrobras's Cascade and Chinook developments.

BP has a 62 per cent working interest in the Tiber well. Petrobras owns 20 per cent while ConocoPhillips owns 18 per cent.

By Chris Kahn, The Associated Press

NEW YORK - More than 10 kilometres below the Gulf of Mexico, oil company BP has tapped into a vast pool of crude after digging the deepest oil well in the world.

The Tiber Prospect is expected to rank among the largest petroleum discoveries in the United States, potentially producing half as much crude in a day as Alaska's famous North Slope oil field.

The company's chief of exploration on Wednesday estimated that the Tiber deposit holds between four billion and six billion barrels of oil equivalent, which includes natural gas. That would be enough to satisfy U.S. demand for crude for nearly one year. But BP does not yet know how much it can extract.

"The Gulf of Mexico is proving to be a growing oil province, and a profitable one if you can find the reserves," said Tyler Priest, professor and director of Global Studies at the Bauer College of Business at the University of Houston.

The Tiber well is about 400 kilometres southeast of Houston in U.S. waters. At 10,685 metres, it is as deep as Mount Everest is tall, not including more than 1,200 metres of water above it.

Drilling at those depths shows how far major oil producers will go to find new supplies as global reserves dwindle, and how technology has advanced, allowing them to reach once-unimaginable depths.

Deep-water operations are considered to be the last frontier for pristine oil deposits, and the entire petroleum industry is sweeping the ocean floor in search of more crude.

BP needs to invest years of work and millions of dollars before it draws the first drop of oil from Tiber. Such long waits are not uncommon. Three years after announcing a discovery at a site in the Gulf called Kaskida, BP has yet to begin producing oil there.

Projects like the Tiber well will not reduce U.S. dependency on foreign oil, which continues to grow. But new technology does permit access to major oil finds closer to U.S. shores.

BP expects Tiber to be among the company's richest finds in the Gulf on par with its crown jewel, the Thunder Horse development. Thunder Horse produces about 300,000 barrels of oil equivalent per day, as much crude as half of Alaska's famous North Slope.

Even if Tiber produces that much, it would still be a trickle compared with the largest oil producers in the world - the Ghawar field in Saudi Arabia, which produces 5 million barrels per day.

But because it's close to home, Tiber would be especially attractive to refiners in America, where the government wants to cut down on oil imports from the Middle East.

"Early indications are that it's a significant positive discovery," said Matt Snyder, lead analyst with Wood MacKinzie's Gulf of Mexico research team.

Exploration companies recently have been pushing drilling operations farther from shore because of technological improvements that allow them to handle extreme depths and pressure, Snyder said.

It's an expensive process. A production platform costs more than US$1 billion to build. Drilling a deep-water well can add another $100 million, and if crude is located, it could cost another $50 million to bring the oil to the surface.

"And when they finally get down there, it's very hot," said Leta Smith, a director with Cambridge Energy Research Associates' Global Oil Supply Group.

"It could be upwards of 250 degrees Fahrenheit. The pressures can be the most challenging aspect of it. These rocks are over-pressured, which means you need to have a lot of special equipment."

For an ambitious project like Tiber to pay off, experts say crude must cost at least $70 to $75 per barrel, though lower prices have never slowed the industry. When crude prices fell below $20 per barrel in the late 1990s, exploration and Thunder Horse never slowed.

"They're not swayed by daily price swings when it comes to planning deep-water exploration," Priest said.

BP's discovery is the latest in what's called the "lower tertiary" region, an ancient section of rock in the Gulf that is roughly 300 square miles and formed between 24 million and 65 million years ago.

Chevron Corp. drilled one of the first wells in the region in 2001, followed by more than a dozen others from companies such as Royal Dutch Shell, Australian oil company BHP Billiton, BP and Total SA, according to the U.S. Department of Interior's Minerals Management Service.

In 2006, Chevron estimated that the lower tertiary holds between three billion and 15 billion barrels. But it has taken years to develop wells for commercial use.

Smith said that the first drops of crude from the lower tertiary will arrive in 2010 with Shell's Perdido operation and Petrobras's Cascade and Chinook developments.

BP has a 62 per cent working interest in the Tiber well. Petrobras owns 20 per cent while ConocoPhillips owns 18 per cent.

Guest- Guest

Lying With Charts

Lying With Charts

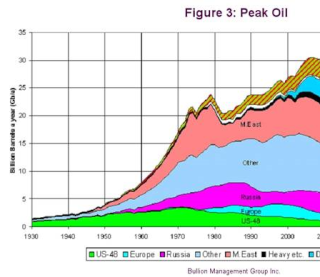

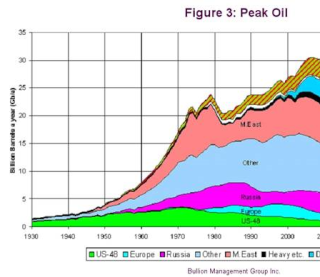

Compare this chart, the one on the page of this link:

"OIL PRODUCTION HAS ALREADY PEAKED" (oh really, where is proof?)

http://financialsense.com/fsu/editorials/bms/2009/images/1029_clip_image008.jpg

What is the difference? Yeah I know half the chart is chopped off, but what half?

(Hint: my chart tells what has happened, the chart in the link above purports to predict the future)

Be careful how charts can trick you into confusing fact from "predictions". Look at my chart and see what happened in 1980. Was that the peak? No!!!

Here is statement of facts on Peak Oil that I mostly agree with (I do not agree with all of her positions on all matters):

http://esr.ibiblio.org/?p=1337#comment-241751

"OIL PRODUCTION HAS ALREADY PEAKED" (oh really, where is proof?)

http://financialsense.com/fsu/editorials/bms/2009/images/1029_clip_image008.jpg

What is the difference? Yeah I know half the chart is chopped off, but what half?

(Hint: my chart tells what has happened, the chart in the link above purports to predict the future)

Be careful how charts can trick you into confusing fact from "predictions". Look at my chart and see what happened in 1980. Was that the peak? No!!!

Here is statement of facts on Peak Oil that I mostly agree with (I do not agree with all of her positions on all matters):

http://esr.ibiblio.org/?p=1337#comment-241751

Peak Hydro-carbon fuels is NONSENSE

Peak Hydro-carbon fuels is NONSENSE

https://goldwetrust.forumotion.com/technology-f8/energy-t119.htm#2360

(before you click link above, also scroll up this page and see the prior post on this page)

.

(before you click link above, also scroll up this page and see the prior post on this page)

.

New technology will create a world awash in excess natural gas!

New technology will create a world awash in excess natural gas!

And there is a process to covert natural gas to oil, if that became necessary, although I think that won't be the most efficient use of the natural gas (most efficient for heating):

http://financialsense.com/editorials/casey/2009/1204.html

http://www.financialsense.com/editorials/casey/2009/0722.html

Peak energy is nonsense. Peak "too cheap" oil is the only reality we are faced with. Oil can go to $200+ while the salaries of Asians go up 20 - 30% per year and the westerners will fade away into poverty.

http://financialsense.com/editorials/casey/2009/1204.html

http://www.financialsense.com/editorials/casey/2009/0722.html

Peak energy is nonsense. Peak "too cheap" oil is the only reality we are faced with. Oil can go to $200+ while the salaries of Asians go up 20 - 30% per year and the westerners will fade away into poverty.

Last edited by Shelby on Mon Dec 21, 2009 7:53 pm; edited 1 time in total

Peak Energy is a lie fabricated to create a world currency based on carbon credits

Peak Energy is a lie fabricated to create a world currency based on carbon credits

Read this:

https://goldwetrust.forumotion.com/economics-f4/global-warming-nonsense-t108.htm#2458

We have sufficient carbon fuels which are also renewable. And of course the nuclear options discussed earlier in this thread.

We only need higher prices to stimulate production of sufficient energy. Another link on that.

Do not forget the following post about transportation fuel options (other than converting converting carbon fuels to gas or diesel):

https://goldwetrust.forumotion.com/technology-f8/energy-t119.htm#2360

https://goldwetrust.forumotion.com/economics-f4/global-warming-nonsense-t108.htm#2458

We have sufficient carbon fuels which are also renewable. And of course the nuclear options discussed earlier in this thread.

We only need higher prices to stimulate production of sufficient energy. Another link on that.

Do not forget the following post about transportation fuel options (other than converting converting carbon fuels to gas or diesel):

https://goldwetrust.forumotion.com/technology-f8/energy-t119.htm#2360

Technology Explosion Coming (and a new world order sans nation-states)

Technology Explosion Coming (and a new world order sans nation-states)

There is a battle coming between the old politics and the new technology. Gold is bridge between the two epochs. Hold on tight...

The 339 times more prosperous for savers in 1800s math makes sense when you realize that governments have been holding back a technology explosion, which will finally break out as a result of this crisis:

http://www.caseyresearch.com/displayCwc.php?id=25

We've been saving in technology, not money, in 1900s, and the payout will come after the financial payback has obliterated the old models that were holding us back, i.e. monopolies, patents, copyrights, centralized power, including the end of server farms (Google) and the move to mesh networking, etc........................

The end of the nation-state and a new world order:

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-60.htm#2536

The old politics (PTB) are going to attempt to cull 90% of the world's population so they can maintain control, and they will fail (but there might be some very nasty interim transistion period):

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-300.htm#2530

They will use scare tactics like this (the opening video for that failed Global Warming treaty at Copenhagen):

https://www.youtube.com/watch?v=_OIPYUlHv38

Who knows maybe they even have the power with HAARP to actually create natural disasters...I doubt it...

==================

ADD:

I had the idea for one more article before I say adios to the financial commentary community to focus on my core career competency. What I have realized is that we will have an explosion of technology after we get through this global financial crisis (gold+silver are the bridge from 1900s stagnation to coming technology epoch), because it has been held back by the politics of the world (patents, copyrights, govt supported centralization of technology e.g. NASA, military, FCC licensings, etc), and is reflected in the undeniably proven mathematical fact shown in article you just published, that savers earned 339 times (33,900%) more real wealth in 1800s than 1900s. It has been shown to repeat in history that technology is held back, then explodes into an epoch that alters reality (e.g. Industrial Revolution). I have a lot of specific data to bring together for such an article. We should have already had the technology of Star Trek and Jetsons long ago, instead the mass media (and socialism of collective society) gave us the bread&circus cinematic replacements (but that is how nature works in exponential bursts and decay). Do not know when I will have time...

The 339 times more prosperous for savers in 1800s math makes sense when you realize that governments have been holding back a technology explosion, which will finally break out as a result of this crisis:

http://www.caseyresearch.com/displayCwc.php?id=25

We've been saving in technology, not money, in 1900s, and the payout will come after the financial payback has obliterated the old models that were holding us back, i.e. monopolies, patents, copyrights, centralized power, including the end of server farms (Google) and the move to mesh networking, etc........................

The end of the nation-state and a new world order:

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-60.htm#2536

The old politics (PTB) are going to attempt to cull 90% of the world's population so they can maintain control, and they will fail (but there might be some very nasty interim transistion period):

https://goldwetrust.forumotion.com/economics-f4/inflation-or-deflation-t9-300.htm#2530

They will use scare tactics like this (the opening video for that failed Global Warming treaty at Copenhagen):

https://www.youtube.com/watch?v=_OIPYUlHv38

Who knows maybe they even have the power with HAARP to actually create natural disasters...I doubt it...

==================

ADD:

I had the idea for one more article before I say adios to the financial commentary community to focus on my core career competency. What I have realized is that we will have an explosion of technology after we get through this global financial crisis (gold+silver are the bridge from 1900s stagnation to coming technology epoch), because it has been held back by the politics of the world (patents, copyrights, govt supported centralization of technology e.g. NASA, military, FCC licensings, etc), and is reflected in the undeniably proven mathematical fact shown in article you just published, that savers earned 339 times (33,900%) more real wealth in 1800s than 1900s. It has been shown to repeat in history that technology is held back, then explodes into an epoch that alters reality (e.g. Industrial Revolution). I have a lot of specific data to bring together for such an article. We should have already had the technology of Star Trek and Jetsons long ago, instead the mass media (and socialism of collective society) gave us the bread&circus cinematic replacements (but that is how nature works in exponential bursts and decay). Do not know when I will have time...

Energy waves paradigm shifts in history

Energy waves paradigm shifts in history

https://goldwetrust.forumotion.com/technology-f8/computers-t112-30.htm#2585

And note we have been finding huge natural gas deposits lately, and do not forget my posts in the silver as investment thread about technology coming for solar panels to double or triple their output (1/2 or 1/3 cost per watt).

And note we have been finding huge natural gas deposits lately, and do not forget my posts in the silver as investment thread about technology coming for solar panels to double or triple their output (1/2 or 1/3 cost per watt).

12th ‘Super-giant’ oil field discovery since 1996

12th ‘Super-giant’ oil field discovery since 1996

http://www.marketoracle.co.uk/Article16893.html

..It is what oil geologists call a ‘Super-giant’ field. Estimates are that the Cuban field contains as much as 20 billion barrels of oil, making it the twelfth Super-giant oilfield discovered since 1996...

...retired oil geologist Colin Campbell and Texas oil banker Matt Simmons, claimed that there had not been a single new Super-giant oil discovery since 1976...

...Despite the promising 1979 results in Haiti, Dr. Georges Michel reported that, “the big multinational oil companies operating in Haiti pushed for the discovered deposits not to be exploited.” Oil exploration in and offshore Haiti ground to a sudden halt as a result...

...A US military occupation of Haiti under the guise of earthquake disaster ‘relief’ would give Washington and private business interests tied to it a geopolitical prize of the first order. Prior to the January 12 quake, the US Embassy in Port-au-Prince was the fifth largest US embassy in the world, comparable to its embassies in such geopolitically strategic places as Berlin and Beijing. With huge new oil finds off Cuba being exploited by Russian companies, with clear indications that Haiti contains similar vast untapped oil as well as gold, copper, uranium and iridium, with Hugo Chavez’ Venezuela as a neighbor to the south of Haiti, a return of Aristide or any popular leader committed to developing the resources for the people of Haiti, -- the poorest nation in the Americas -- would constitute a devastating blow to the world’s sole Superpower...

Gold manipulation caused the energy crisis (Evidence that gold manipulation retarted energy technology)

Gold manipulation caused the energy crisis (Evidence that gold manipulation retarted energy technology)

Watch this:

https://www.youtube.com/watch?v=6rzd8GX6Pqw

Read this:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-60.htm?sid=ec950f55234dcbbdf6787b79de13bff1#2832

100 MPG mopeds (Honda has a new one PCX which is very hi-tech and comfortable) can lower the transportation use by 75% in USA, and that is about all the Americans will be able to afford soon any way.

Migration from cold climates could be intense in coming decades. Too bag Global Warming was a lie (just as peak energy will be proven to be a lie).

I had already posted long ago how Toshiba has a small nuclear reactor that can be buried and power a small city or large community for 10 years without maintenance. Uses salt cooling, so 100% safe.

What is likely is that people will huddle into more dense cities, with more dense electrically powered mass transportation and elevators. Eliminate the battery by tethering. People ("useless eaters" see my link below) will spend much more time on the computer doing social programming and other "useless" jobs that other people value. Mankind is being reduced to the arts, as due to automation, cost of industrial production will reach towards 0, especially when the nuclear era hits full speed with near 0 cost.

Add to this nanotechnology, which is going make orders-of-magnitude changes in the material properties we use from everything to generating energy to using it. For example, solar panels are already with 25-50% of competing with coal (include the cost of laying transmission wire to less dense locales), and new nanotechnology gold/silver wires have increased this to 100% in the lab. An explosion of technology is going, and it is being ushered in by the demands of the crisis. Technology priorities had been held back for decades with the manipulation of the gold price, and probably peaked in rate when the govt got into the science business with the NASA lunar projects in the 1960s. And now we are nearing the bottom in the technology suppression on the materials front. Since material technology was held back by mispricing of capital investment past 4 decades due to manipulation of gold price, this is why computer (virtual and nearly 0 capital cost) had advanced at a much faster rate. And this computer infrastructure has enabled the networking which is now accelerating the material sciences, etc. Steve, I do not expect you to understand this, but you might try.

I have for years said that the energy problem is being caused by the mis-allocation of priorities in society due to the manipulation of the gold price:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-195.htm#2843

eSolar is getting close to fossil fuels:

http://www.businessinsider.com/green-innovation-bill-gross-full-interview-2010-3

(skip to the 19 - 20 minute portion to read about financing paradox of solar grid parity, very big eye opener that gives credence to the theory that gold manipulation retarted energy technology)

Bill Gross may not be aware that some companies are eliminating the use of silicon in solar panels.

https://www.youtube.com/watch?v=6rzd8GX6Pqw

Read this:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-60.htm?sid=ec950f55234dcbbdf6787b79de13bff1#2832

SRSrocco wrote:Poor Shelby

100 MPG mopeds (Honda has a new one PCX which is very hi-tech and comfortable) can lower the transportation use by 75% in USA, and that is about all the Americans will be able to afford soon any way.

Migration from cold climates could be intense in coming decades. Too bag Global Warming was a lie (just as peak energy will be proven to be a lie).

I had already posted long ago how Toshiba has a small nuclear reactor that can be buried and power a small city or large community for 10 years without maintenance. Uses salt cooling, so 100% safe.

What is likely is that people will huddle into more dense cities, with more dense electrically powered mass transportation and elevators. Eliminate the battery by tethering. People ("useless eaters" see my link below) will spend much more time on the computer doing social programming and other "useless" jobs that other people value. Mankind is being reduced to the arts, as due to automation, cost of industrial production will reach towards 0, especially when the nuclear era hits full speed with near 0 cost.

Add to this nanotechnology, which is going make orders-of-magnitude changes in the material properties we use from everything to generating energy to using it. For example, solar panels are already with 25-50% of competing with coal (include the cost of laying transmission wire to less dense locales), and new nanotechnology gold/silver wires have increased this to 100% in the lab. An explosion of technology is going, and it is being ushered in by the demands of the crisis. Technology priorities had been held back for decades with the manipulation of the gold price, and probably peaked in rate when the govt got into the science business with the NASA lunar projects in the 1960s. And now we are nearing the bottom in the technology suppression on the materials front. Since material technology was held back by mispricing of capital investment past 4 decades due to manipulation of gold price, this is why computer (virtual and nearly 0 capital cost) had advanced at a much faster rate. And this computer infrastructure has enabled the networking which is now accelerating the material sciences, etc. Steve, I do not expect you to understand this, but you might try.

I have for years said that the energy problem is being caused by the mis-allocation of priorities in society due to the manipulation of the gold price:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-195.htm#2843

eSolar is getting close to fossil fuels:

http://www.businessinsider.com/green-innovation-bill-gross-full-interview-2010-3

(skip to the 19 - 20 minute portion to read about financing paradox of solar grid parity, very big eye opener that gives credence to the theory that gold manipulation retarted energy technology)

Bill Gross may not be aware that some companies are eliminating the use of silicon in solar panels.

Last edited by Shelby on Tue Mar 23, 2010 11:36 pm; edited 2 times in total

And long-term oversupply of natural gas

And long-term oversupply of natural gas

http://www.marketoracle.co.uk/Article17825.html

Which can be used to tide the world over as the transistions to new energy order is achieved as discussed in prior post.

Which can be used to tide the world over as the transistions to new energy order is achieved as discussed in prior post.

Denninger says it better than I could

Denninger says it better than I could

http://market-ticker.org/archives/2380-There-Are-Times....html

http://www.market-ticker.org/archives/2385-Energy-Are-You-A-Pig-And-A-Bigot.html

Bravo Denninger.

Except Denninger still thinks the problem and solutions are laws and regulations (socialism is the cause, not the solution!). Denninger the laws and regulations will always be made by (and benefit) those who print the money, don't you remember what Rothschild said? (this is why Denninger would never conceive of the BP spill or 9/11 as false flag events, planted by those who have the power over money creation out-of-thin-air)

Any energy crisis is self-inflicted. We have mainly a monetary crisis, which even Denninger apparently does not fully understand:

http://www.marketoracle.co.uk/Article19914.html

EROEI is a crock when the base power load can be nuclear. The assertion that nuclear will have a very low EROEI is a lie, steeped in political logjams (regulations, political delays and cost overruns, does not consider the new modular style nuclear reactors, etc).

We may have an energy crisis, if the politics succeeds in creating one.

But the real problem is monetary and thus political. Energy is a side-show (although it could end up being a big side-show).

====

P.S. It is noteable that Denninger understands thermodynamics and compounding, but yet he doesn't extrapolate that to the centralizing power of fiat money (and that socialism destroys capital). He argues for more centralized power and thus more socialism. He is so close to the truth, yet so far:

http://www.market-ticker.org/archives/2386-When-Do-We-Start-Arresting-The-Central-Bankers.html

http://www.market-ticker.org/archives/2385-Energy-Are-You-A-Pig-And-A-Bigot.html

Bravo Denninger.

Except Denninger still thinks the problem and solutions are laws and regulations (socialism is the cause, not the solution!). Denninger the laws and regulations will always be made by (and benefit) those who print the money, don't you remember what Rothschild said? (this is why Denninger would never conceive of the BP spill or 9/11 as false flag events, planted by those who have the power over money creation out-of-thin-air)

Any energy crisis is self-inflicted. We have mainly a monetary crisis, which even Denninger apparently does not fully understand:

http://www.marketoracle.co.uk/Article19914.html

EROEI is a crock when the base power load can be nuclear. The assertion that nuclear will have a very low EROEI is a lie, steeped in political logjams (regulations, political delays and cost overruns, does not consider the new modular style nuclear reactors, etc).

We may have an energy crisis, if the politics succeeds in creating one.

But the real problem is monetary and thus political. Energy is a side-show (although it could end up being a big side-show).

====

P.S. It is noteable that Denninger understands thermodynamics and compounding, but yet he doesn't extrapolate that to the centralizing power of fiat money (and that socialism destroys capital). He argues for more centralized power and thus more socialism. He is so close to the truth, yet so far:

http://www.market-ticker.org/archives/2386-When-Do-We-Start-Arresting-The-Central-Bankers.html

re: debt saturation of misallocation

re: debt saturation of misallocation

Mis-allocation of capital causes peak production, not vice versa.

http://jasonhommelforum.com/forums/showthread.php?p=53918#post53918

Steve, you are correct, except what do you think causes the falling efficiency of capital?

MISALLOCATION VIA DECADES OF SOCIALISM AND DEBT.

It is not technology that fails, it is the overuse of debt and socialism, which eventually wastes all the capital and when there haven't been no correct investments for decades, then the efficiency of everything implodes.

Here is some more interesting related commentary:

http://esr.ibiblio.org/?p=1951 (the comments explain how socialism has priced human capital out of the market of doing work, as one example of misallocation)

https://goldwetrust.forumotion.com/economics-f4/is-capitalism-or-is-socialism-increasing-t18-45.htm#3154 (computation of rising cost of govt regulation)

Understand that "capital" is not "money" and vice versa, once it has been wasted, you can't get it back, you can't just store money and expect it to remain capital, nor can you misuse money and not lose capital:

https://goldwetrust.forumotion.com/economics-f4/is-capitalism-or-is-socialism-increasing-t18.htm#3091

Normally burying your money in the ground with gold is counter-productive (wastes capital), except at times like this where it is the regulator against negative real interest rates and socialism:

http://www.marketoracle.co.uk/Article19914.html (see my comments at bottom)

http://www.marketoracle.co.uk/Article19888.html (see my comments at bottom)

As I have written at above links, Denninger has a good understanding of all of it, except that he fails to understand the "the law" is socialism and is not self-regulating. And he never grew up and understood that democracy is a lie, as it is enslaved to the bell curve or Gaussian distribution of human nature and IQ. The Bible had this wisdom 2000 years ago in 1 Samuel 8:

http://www.biblegateway.com/passage/?search=1%20Samuel%208&version=NIV (substitute "govt and law" for "king")

And the economic warning (truth) does come true every time:

http://www.biblegateway.com/passage/?search=1%20Samuel%2015&version=NIV

The 2nd commandment (which was removed for Catholics by King of Spain) is explicit that we are not to whor(E)ship things of this world (Harlots/symbolic prostitutes in Revelation), we are only to place trust in God's (nature's or natural) law (i.e. the 1856 law of thermo, which states the universe scale trends to maximum possibilities/disorder/entropy), which is why a centralized force (e.g. "man's law") can never be sustainable. Jesus said render unto Caesar what is his (his failure) and render unto God (natural law) what is his.

http://jasonhommelforum.com/forums/showthread.php?p=53918#post53918

SRSrocco wrote:shelbylook wrote:I have been trying to avoid touching on the subject of peak oil, because it renews the same old debate that just goes on and on...

Any way, Denninger says it better than I could:

https://goldwetrust.forumotion.com/economics-f4/peak-oil-nonsense-t102-15.htm#3167

EROEI is a crock when the base power load can be nuclear. The assertion that nuclear will have a very low EROEI is a lie, steeped in political logjams (regulations, political delays and cost overruns, does not consider the new modular style nuclear reactors, etc).

We may have an energy crisis, if the politics succeeds in creating one.

But the real problem is monetary and thus political. Energy is a side-show (although it could end up being a big side-show).

======

ADD: Steve I am not disagreeing with your focus on potential supply chain and energy problems. I appreciate your research in this area. We could end up having some really severe shortages, given the politics of waste and destruction and malinvestment, which is enabled to continue because the people don't force the monetary end soon by trading their paper for precious metal money.

Some much to write...and so little time.

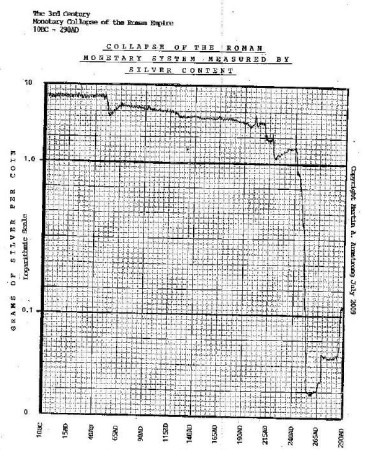

Martin Armstrong, the poor fella still held in jail who is famous for his pi-cycles and analytical work, wrote how the Roman Empire fell because of Socialism by certain leaders. Martin Armstrong goes on further to state that the Roman Monetary system collapsed as it was devalued over 98% in only 13 years:

Martin Armstrong attributes the fall of the Roman Empire to Socialistic Emperors who redistributed the wealth from the rich to the poor as well as currency debasement. He goes on further to say the same parallel is happening in America.

I BEG TO DIFFER:

Here is why

My upcoming article will prove that it is not monetary printing, socialism or debasement of a currency that destroys the economy of an empire, but rather a FALLING EROI which is also called DIMINISHING RETURNS on TECHNOLOGY-COMPLEXITY.

The Roman Empire did not fall due to SOCIALISM or a CURRENCY DEVAUATION of the silver coin, but rather due to the same reason the great American Empire will fall. Roman in its infancy grew by taking over other countries that had gold, silver and lead mines....as well as other natural resources. The first countries they took over were the easiest, and produced the most booty.

As time went on, it took MORE ENERGY and RESOURCES to keep the larger and growing ROMAN EMPIRE together from invading enemies, or problems from within. At the last stages of the empire, a great deal of energy and resources were consumed only gaining marginal lands and countries with poor gold-silver mines and resources. Thus we had a FALLING EROI.

The debasement of the currency and the socialism were the last stages of an attempt to try to postpone the inevitable. So.......those who blame monetary printing and socialism....are looking at the symptoms and not the disease itself.

THE DISEASE is a falling EROI or DIMINISHING RETURNS OF TECHNOLOGY or COMPLEXITY.

I will discuss this in detail in the article coming to online websites.

Steve, you are correct, except what do you think causes the falling efficiency of capital?

MISALLOCATION VIA DECADES OF SOCIALISM AND DEBT.

It is not technology that fails, it is the overuse of debt and socialism, which eventually wastes all the capital and when there haven't been no correct investments for decades, then the efficiency of everything implodes.

Here is some more interesting related commentary:

http://esr.ibiblio.org/?p=1951 (the comments explain how socialism has priced human capital out of the market of doing work, as one example of misallocation)

https://goldwetrust.forumotion.com/economics-f4/is-capitalism-or-is-socialism-increasing-t18-45.htm#3154 (computation of rising cost of govt regulation)