Changing World Order

+2

SRSrocco

Shelby

6 posters

Page 3 of 6

Page 3 of 6 •  1, 2, 3, 4, 5, 6

1, 2, 3, 4, 5, 6

Excellent line of logic

Excellent line of logic

angophera wrote:...Q. What can/must the USA faction of the PTB extract from the USA and offer to the Chinese PTB (and other PTB factions) to buy their continued support of the "system" while they take their plans to completion?

One of the answers I come up with is Technology. (Some of the others include Real Estate (but on a continental scale -think Africa, Agriculture, Commodities and some others. However, these three are the main ones.)

This thinking is all part of the "what comes after" theory that I am developing which I alluded to in two earlier posts where I mentioned Agriculture.

Cheers!

I agree there are factions. I agree with your line of logic. Keep me posted.

The Chinese are playing the fiddle also:

http://financialsense.com/fsu/editorials/laird/2009/1028.html <--MUST READ

...US debt to GDP...roughly 400 pct of US GDP. Interpretation: well if the US ‘earns’ $14 trillion a year, it has to service debt on the aggregate of $56 trillion a year. Clearly on that measure, the US is just on the verge of a financial default across the public and private sectors. If interest rates start to rise, look out.

In fact, the US Federal government had to issue a tremendous amount of new debt (treasuries etc) in the second quarter of 09, basically bailing out the entire defaulting world banking system. The US used a combination of quantitative easing, and actually buying its own debt for half of its issuance. The Chinese went ballistic immediately and have been warning the Fed not to do that or else. Treasury Secretary Geithner flew to China to explain...

The point is the Chinese and the Wallstreet PTB both realize the implications of (and Chris got the specifics a bit wrong) impossibility of servicing interest payments on $56 trivillion per year with $14 trivillion gross sales (that is not income!, maybe only a few % of that is net income).

And so yes both PTB are jockeying for position on how they think this will play out.

It is clear that the take down in 2007-2008 was to show the developing countries that they can not decouple, so they will politically be able to participate in the currency swabs, stimulost, and other hippocracy to try to prop up the financial system as currently composed.

I find plausible Chris's logic that they take us into one more big financial bubble that so severely mis-allocates the developing world capital, that entire world is sucked into a world currency with the Greatest Depression every known to modern man. You can see this mis-allocation because factories are being sucked (out of even developing countries) into only a few countries, there are too many people in world now to be all farmers, ... etc... so what are the rest of the people being employed to do now? Basically service the bubble...

Remember that the basic creed of the PTB is that someone has to manage the lives of the useless eaters. Well it is sort of true (but that is a deep topic best covered here on the question of Intellectual Property and the value of artists: http://esr.ibiblio.org/?p=1337 )

* trivillion aka trillion, swabs aka swaps, stimulost aka stimulus

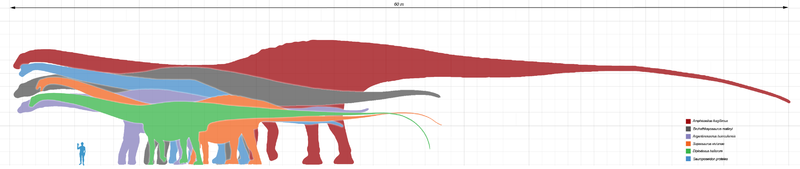

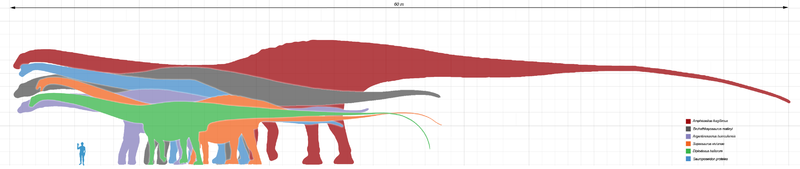

Dinasour Economic Model

Dinasour Economic Model

Notice that the design is to suck all profit to the "top", i.e. a few people.

http://financialsense.com/fsu/editorials/schiff/2009/1029.html

Basically the various PTB factions (Wallstreet, Taipans, Industrialists, Bankers, etc) look for ways to siphon wealth to themselves with the least resistance from the public. Wealth as power = control, because without control you can't really maintain your wealth or your power. So they do not really care if the wealth of the world grows less slowly and thus their total wealth is less than it could have been. What they care about is the fact that bigger fish eat big fish which eat the less big fish, and they don't want to be the one eaten someday.

This all comes from not following Biblical principles about wealth.

So we can deduce that they will inflate like hell and thus mis-allocate like hell, with the inflation flowing through them so they spend it first, and they get suck up the mis-allocation as defaults which throws more control to the center.

This is a dinasour game now. Every body is trying to get bigger so they won't get eaten, as we know that ended in their extinction (at least except for the small adept ones like birds and lizards, which we still have "millions of years" later):

http://en.wikipedia.org/wiki/Argentinosaurus#Description

See that little guy, that is you and me. Do not get trampled! Get out of their way!

Actually the model is not entirely accurate as I described it above, because the largest dinasours were actually vegetarians and were the food for the smaller (yet still large enough) but more voracious meat eaters. Well some think that they were just vultures, eating those big ones that died from other causes. Any way, that seems to be the actual model we have now. Wallstreet would be the vultures and the nations (the biggest dinasours) would be the small brain, useless eaters food supply.

http://financialsense.com/fsu/editorials/schiff/2009/1029.html

...And for the first time ever, the Fed is paying interest on bank reserves. Therefore, the banks can loan money to the Fed and to the government, via Treasury securities, at an interest rate spread of some 3 to 4 percent without risk. Given these incentives, it makes no sense to loan to anybody else...

Basically the various PTB factions (Wallstreet, Taipans, Industrialists, Bankers, etc) look for ways to siphon wealth to themselves with the least resistance from the public. Wealth as power = control, because without control you can't really maintain your wealth or your power. So they do not really care if the wealth of the world grows less slowly and thus their total wealth is less than it could have been. What they care about is the fact that bigger fish eat big fish which eat the less big fish, and they don't want to be the one eaten someday.

This all comes from not following Biblical principles about wealth.

So we can deduce that they will inflate like hell and thus mis-allocate like hell, with the inflation flowing through them so they spend it first, and they get suck up the mis-allocation as defaults which throws more control to the center.

This is a dinasour game now. Every body is trying to get bigger so they won't get eaten, as we know that ended in their extinction (at least except for the small adept ones like birds and lizards, which we still have "millions of years" later):

http://en.wikipedia.org/wiki/Argentinosaurus#Description

See that little guy, that is you and me. Do not get trampled! Get out of their way!

Actually the model is not entirely accurate as I described it above, because the largest dinasours were actually vegetarians and were the food for the smaller (yet still large enough) but more voracious meat eaters. Well some think that they were just vultures, eating those big ones that died from other causes. Any way, that seems to be the actual model we have now. Wallstreet would be the vultures and the nations (the biggest dinasours) would be the small brain, useless eaters food supply.

skylick- Posts : 54

Join date : 2008-11-19

skylick- Posts : 54

Join date : 2008-11-19

What I Think I Now Know! (Part 1)

What I Think I Now Know! (Part 1)

Hi All,

My key assumptions are:

1. Fiat currencies and fractional reserve banking ie. control of the money is the foundation for the power and control of ALL Elites. Their "temple' has several pillars including control of energy sources but control of the money trumps everything else.

2. There is NO unified, co-ordinated PTB. It is made up of Factions who compete or co-operate as the situation and their self-interest demands.

I believe that the situation we are witnessing in the US and UK is analogous to the behaviour of a biological parasite. When the parasite detects that the host is dying it stops injecting the chemicals that fool the host's body into thinking the parasite is benefical. It then begins to attack the host, helping to kill it so the parasite can harvest the resources it needs to breed and continue its life cycle.

This is how I view the looting of the remains of the UK wealth and the final stages of the looting of the USA primarily by two "parasite" factions of the Elites ie. the Anglo-American Finance faction and the Military/Industrial complex.

3. The Bank for International Settlements (BIS) is the "one world bank" project.

4. The UN is the "one world government" project implemented through agencies such as the (WTO) World Trade Organisation. The EU and other trade blocs are just steps along the way. (This is a far from perfect construct but it's a human project and they are never perfect.)

5. The "one world currency" project (USD) has been cancelled and is being wound down (profitably) through a carry trade strategy (tested and perfected using gold and then Japan as the testing ground).

6. The Euro project and the Freegold thesis concerning gold are designed to deliver the bulk of the capital to the Factions who come on board.

The European Elites/PTB/Giants (call them what you like) have launched a project called the Euro. This is not motivated by altruism. I speculate that they launched it because they could see that the behaviour of the Anglo-American Elites was going to lead to disaster for the US and UK economies. I speculate that they saw this behaviour as "killing the host".

7. The Carbon Cap & Trade is the rollout of a global tax on every citizen and business (except for the "chosen few" who get an upfront pay-off in carbon "credits"). Please see also (8) Bond Markets.

8. The transfer of capital (5) and the global tax (6) replace the cancelled "one world currency" project (4).

9. Carbon C&T replaces the US Bond market as a "feeding" ground. Professor Fekete has explained how the structure of the US bond market is designed to give guarranteed profits to bond traders through falling interest rates. The Carbon C&T provides guarranteed profits for traders because the "caps" are continually adjusted downwards so the securities are guarranteed to rise.

10. The Elites greatest threat is the US Constitution and the Bill of Rights. Suppressing or destroying them has been a 200+ year preoccupation of the Elites.

11. The Elites may have over-reached themselves this time around. Perhaps because they think they can ignore or are above the laws of nature and mathematics.

Cheers!

My key assumptions are:

1. Fiat currencies and fractional reserve banking ie. control of the money is the foundation for the power and control of ALL Elites. Their "temple' has several pillars including control of energy sources but control of the money trumps everything else.

2. There is NO unified, co-ordinated PTB. It is made up of Factions who compete or co-operate as the situation and their self-interest demands.

I believe that the situation we are witnessing in the US and UK is analogous to the behaviour of a biological parasite. When the parasite detects that the host is dying it stops injecting the chemicals that fool the host's body into thinking the parasite is benefical. It then begins to attack the host, helping to kill it so the parasite can harvest the resources it needs to breed and continue its life cycle.

This is how I view the looting of the remains of the UK wealth and the final stages of the looting of the USA primarily by two "parasite" factions of the Elites ie. the Anglo-American Finance faction and the Military/Industrial complex.

3. The Bank for International Settlements (BIS) is the "one world bank" project.

4. The UN is the "one world government" project implemented through agencies such as the (WTO) World Trade Organisation. The EU and other trade blocs are just steps along the way. (This is a far from perfect construct but it's a human project and they are never perfect.)

5. The "one world currency" project (USD) has been cancelled and is being wound down (profitably) through a carry trade strategy (tested and perfected using gold and then Japan as the testing ground).

6. The Euro project and the Freegold thesis concerning gold are designed to deliver the bulk of the capital to the Factions who come on board.

The European Elites/PTB/Giants (call them what you like) have launched a project called the Euro. This is not motivated by altruism. I speculate that they launched it because they could see that the behaviour of the Anglo-American Elites was going to lead to disaster for the US and UK economies. I speculate that they saw this behaviour as "killing the host".

7. The Carbon Cap & Trade is the rollout of a global tax on every citizen and business (except for the "chosen few" who get an upfront pay-off in carbon "credits"). Please see also (8) Bond Markets.

8. The transfer of capital (5) and the global tax (6) replace the cancelled "one world currency" project (4).

9. Carbon C&T replaces the US Bond market as a "feeding" ground. Professor Fekete has explained how the structure of the US bond market is designed to give guarranteed profits to bond traders through falling interest rates. The Carbon C&T provides guarranteed profits for traders because the "caps" are continually adjusted downwards so the securities are guarranteed to rise.

10. The Elites greatest threat is the US Constitution and the Bill of Rights. Suppressing or destroying them has been a 200+ year preoccupation of the Elites.

11. The Elites may have over-reached themselves this time around. Perhaps because they think they can ignore or are above the laws of nature and mathematics.

Cheers!

Guest- Guest

Why are you making it complicated?

Why are you making it complicated?

angophera,

It appears you are responding to the ongoing discussion at the other thread:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-45.htm#2272

May I suggest you reduce the number of bolds and underlines (try to make it like 3 or 4 per post, prioritize), your prose is very hard to read. I think everyone knows how to read the words you've underlined and we understand what the intended importance of those words in context is. The problem is not one of understanding your points. The problem is one of you not yet having the complete picture of how it all fits together. I already do. You are adding some useful observations to fine-tune my understanding. I am on the look-out for some point that could invalidate my understanding.

Absolutely. And this can't be done with 100% gold reserve, as stated here:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-60.htm#2283

How can you ignore the meetings of the intellectual elite?

There is a faction of the Giant-most (a few families, Rockefeller, Rothschild, Morgans, and the intermarriages), and they are coordinating, but not with explicit top-down management. The way they coordinate things is via consensus, i.e. Bilderberg meetings, Trilateral Commission, Council on Foreign Relations, G20, all the bilateral and multi-lateral meetings of sub-officials, etc.. The coordination achieved is not in terms of explicit commands, but rather in terms of structure, and the structure matches the natural law, as stated by the (sinful) wishes of the people. I remind you to read 1 Samuel 8, as God advised the people not to depend on a government, but the people refused, so in 1 Samuel 15, God carried out the natural law, where he told the King to send all the people's sons to war and to kill everyone in Egypt who had persecuted the Jews. So both sides got destroyed in a way. This is how the natural law works. Both the rich, the poor, and the middle class will be destroyed now by their sins.

So what? Yes some factions are looting in support of the overall trend towards NWO.

Yes and many other organizations as I mentioned above. We are definitely moving towards a NWO. You are questioning whether ONE currency will be part of it. I know it will be because #1 the Bible says so, and #2 because the Giant-most have said so, and #3 the CFR and others have put out timelines for currency blocs, and #4 the structure of the SDRs and the float against gold (but without 100% reserve) will naturally result in blocs (common demographics will join to counter-balance extremely disruptive, competing blocs with radically different demographics, and socialism by its nature must grow in population in order to not die...e.g. USSR).

(Btw, I was aware of Basel rounds also)

Why do you ignore what I wrote at the link above? The USD was never a one-world currency (it was not used as a currency in every sovereign nation... the locals have not given up their control over their own interest rates!!!). If you are going to make me say things 3x, then I am going to stop replying. I am losing valuable time.

That was RobRoy's mistake, he thinks USD was fulfillment of Revelations, but he didn't pay attention to the fact that USD was not a global currency. It was only a global reserve.

Yes the Euro is part of the myraid of schemes that capture natural law and move us structurally towards NWO, but you are myopic if only focus on the Euro.

It is a transistion from USD reserve (not currency!) system to the next stage in the march towards NWO.

Astute (I mean I already knew that too). And this will be another "kill the host" programs. It is all a big march of socialism forward. The USD served its useful life to the Giants-most. They have pulled the factions to consensus (in some cases and other cases they will use factions against each other).

The free mind of people to reject socialism (i.e. to follow the 1 Samuel 8 ) is the greatest threat to Satan yes. The Giants are winning. But God wins in the end (after the world is destroyed by Revelations).

If the crisis gets too far and fast out-of-control, they will resort to war, in order to capture that chaos in their hand, as the nations must borrow and spend to finance war, and it voids rule of law and puts the young men under control.

They are very much in resonance with the socialism that enough of the people want.

Carrol Quigley (an insider of Giants) argued they should publicly disclosure their existence and plans. His rational is that since they are and must be in harmony (resonance) with what "enough of the people" want, then make it public can only help refine and will not cause any hindrance. I think the Giants have been somewhat afraid to go public, but the closer they get to NWO, the more public they are and this is by necessity, because they must be even more in tune with the socialism trend and thus more people and more meetings contributing to the feedback loop of the factions organism.

NWO = trend of globalized socialism

It appears you are responding to the ongoing discussion at the other thread:

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-45.htm#2272

May I suggest you reduce the number of bolds and underlines (try to make it like 3 or 4 per post, prioritize), your prose is very hard to read. I think everyone knows how to read the words you've underlined and we understand what the intended importance of those words in context is. The problem is not one of understanding your points. The problem is one of you not yet having the complete picture of how it all fits together. I already do. You are adding some useful observations to fine-tune my understanding. I am on the look-out for some point that could invalidate my understanding.

angophera wrote:Hi All,

My key assumptions are:

1. Fiat currencies and fractional reserve banking ie. control of the money is the foundation for the power and control of ALL Elites. Their "temple' has several pillars including control of energy sources but control of the money trumps everything else...

Absolutely. And this can't be done with 100% gold reserve, as stated here:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-60.htm#2283

angophera wrote:...2. There is NO unified, co-ordinated PTB. It is made up of Factions who compete or co-operate as the situation and their self-interest demands...

How can you ignore the meetings of the intellectual elite?

There is a faction of the Giant-most (a few families, Rockefeller, Rothschild, Morgans, and the intermarriages), and they are coordinating, but not with explicit top-down management. The way they coordinate things is via consensus, i.e. Bilderberg meetings, Trilateral Commission, Council on Foreign Relations, G20, all the bilateral and multi-lateral meetings of sub-officials, etc.. The coordination achieved is not in terms of explicit commands, but rather in terms of structure, and the structure matches the natural law, as stated by the (sinful) wishes of the people. I remind you to read 1 Samuel 8, as God advised the people not to depend on a government, but the people refused, so in 1 Samuel 15, God carried out the natural law, where he told the King to send all the people's sons to war and to kill everyone in Egypt who had persecuted the Jews. So both sides got destroyed in a way. This is how the natural law works. Both the rich, the poor, and the middle class will be destroyed now by their sins.

angophera wrote:...I believe that the situation we are witnessing in the US and UK is analogous to the behaviour of a biological parasite. When the parasite detects that the host is dying it stops injecting the chemicals that fool the host's body into thinking the parasite is benefical. It then begins to attack the host, helping to kill it so the parasite can harvest the resources it needs to breed and continue its life cycle.

This is how I view the looting of the remains of the UK wealth and the final stages of the looting of the USA primarily by two "parasite" factions of the Elites ie. the Anglo-American Finance faction and the Military/Industrial complex...

So what? Yes some factions are looting in support of the overall trend towards NWO.

angophera wrote:...3. The Bank for International Settlements (BIS) is the "one world bank" project.

4. The UN is the "one world government" project implemented through agencies such as the (WTO) World Trade Organisation. The EU and other trade blocs are just steps along the way. (This is a far from perfect construct but it's a human project and they are never perfect.)...

Yes and many other organizations as I mentioned above. We are definitely moving towards a NWO. You are questioning whether ONE currency will be part of it. I know it will be because #1 the Bible says so, and #2 because the Giant-most have said so, and #3 the CFR and others have put out timelines for currency blocs, and #4 the structure of the SDRs and the float against gold (but without 100% reserve) will naturally result in blocs (common demographics will join to counter-balance extremely disruptive, competing blocs with radically different demographics, and socialism by its nature must grow in population in order to not die...e.g. USSR).

(Btw, I was aware of Basel rounds also)

angophera wrote:...5. The "one world currency" project (USD) has been cancelled and is being wound down (profitably) through a carry trade strategy (tested and perfected using gold and then Japan as the testing ground)...

Why do you ignore what I wrote at the link above? The USD was never a one-world currency (it was not used as a currency in every sovereign nation... the locals have not given up their control over their own interest rates!!!). If you are going to make me say things 3x, then I am going to stop replying. I am losing valuable time.

That was RobRoy's mistake, he thinks USD was fulfillment of Revelations, but he didn't pay attention to the fact that USD was not a global currency. It was only a global reserve.

angophera wrote:...6. The Euro project and the Freegold thesis concerning gold are designed to deliver the bulk of the capital to the Factions who come on board.

The European Elites/PTB/Giants (call them what you like) have launched a project called the Euro. This is not motivated by altruism. I speculate that they launched it because they could see that the behaviour of the Anglo-American Elites was going to lead to disaster for the US and UK economies. I speculate that they saw this behaviour as "killing the host"...

Yes the Euro is part of the myraid of schemes that capture natural law and move us structurally towards NWO, but you are myopic if only focus on the Euro.

angophera wrote:...7. The Carbon Cap & Trade is the rollout of a global tax on every citizen and business (except for the "chosen few" who get an upfront pay-off in carbon "credits"). Please see also (8) Bond Markets.

8. The transfer of capital (5) and the global tax (6) replace the cancelled "one world currency" project (4)...

It is a transistion from USD reserve (not currency!) system to the next stage in the march towards NWO.

angophera wrote:...9. Carbon C&T replaces the US Bond market as a "feeding" ground. Professor Fekete has explained how the structure of the US bond market is designed to give guarranteed profits to bond traders through falling interest rates. The Carbon C&T provides guarranteed profits for traders because the "caps" are continually adjusted downwards so the securities are guarranteed to rise...

Astute (I mean I already knew that too). And this will be another "kill the host" programs. It is all a big march of socialism forward. The USD served its useful life to the Giants-most. They have pulled the factions to consensus (in some cases and other cases they will use factions against each other).

angophera wrote:...10. The Elites greatest threat is the US Constitution and the Bill of Rights. Suppressing or destroying them has been a 200+ year preoccupation of the Elites...

The free mind of people to reject socialism (i.e. to follow the 1 Samuel 8 ) is the greatest threat to Satan yes. The Giants are winning. But God wins in the end (after the world is destroyed by Revelations).

angophera wrote:...11. The Elites may have over-reached themselves this time around. Perhaps because they think they can ignore or are above the laws of nature and mathematics.

Cheers!

If the crisis gets too far and fast out-of-control, they will resort to war, in order to capture that chaos in their hand, as the nations must borrow and spend to finance war, and it voids rule of law and puts the young men under control.

They are very much in resonance with the socialism that enough of the people want.

Carrol Quigley (an insider of Giants) argued they should publicly disclosure their existence and plans. His rational is that since they are and must be in harmony (resonance) with what "enough of the people" want, then make it public can only help refine and will not cause any hindrance. I think the Giants have been somewhat afraid to go public, but the closer they get to NWO, the more public they are and this is by necessity, because they must be even more in tune with the socialism trend and thus more people and more meetings contributing to the feedback loop of the factions organism.

NWO = trend of globalized socialism

Re: Changing World Order

Re: Changing World Order

Hi Shelby,

Shelby wrote:

"Why do you ignore what I wrote at the link above? The USD was never a one-world currency (it was not used as a currency in every sovereign nation... the locals have not given up their control over their own interest rates!!!). If you are going to make me say things 3x, then I am going to stop replying. I am losing valuable time."

I did read what you wrote. You do not need to repeat things. I did not find your arguments convincing in regard to a supposed intention of delivering a one world currency nor on your categorization of the USD as nothing more than a reserve currency.

The USD was/is the No.1 reserve currency because just about every country on the planet needed to hold it in order to buy oil. For most of the developing world and poor nations their debts were denominated in USD so they HAD to hold/accumulate USD. In deference to you I introduced the words "de facto". I see the USD as a test run for a one world currency and I maintain it failed in this role. I believe none of the factions will ever again trust one faction to control the No. 1 printing press.

We will have to agree to disagree on this point, or not if you prefer.

As to this centrally managed NWO program you believe in I think this is designed to exploit people's tendency to subscribe to the "effective manager fallacy". People want to believe that "someone is in charge" that "someone is running the show" because the notion that "no-one is in charge" frightens them. I have read a lot about the Bilderbergers, Illuminati, CFR etc. Yes I agree they facilitate discussion, co-operation and so on. You then go on to talk about this as if it automatically proves your point. I don't believe it does.

The CIA never confirms or denies their involvement in any of the assassinations, toppling of Governments etc that they are accused of precisely because the speculation adds to their mystique.

In relation to the quotations from the bible. I have never met anyone who I felt was sufficiently gifted to be able to accurately interpret the bible's meaning regardless of the depth of their faith. So I treat pronouncements that "X event" is the event predicted in a given passage of the bible as nothing more than speculation.

I grew up in an environment where it was believed that whenever the Pope sat in St Peter's chair (it looks more like a throne) his pronouncements were infallible. How's that working out so far?

Cheers!

Shelby wrote:

"Why do you ignore what I wrote at the link above? The USD was never a one-world currency (it was not used as a currency in every sovereign nation... the locals have not given up their control over their own interest rates!!!). If you are going to make me say things 3x, then I am going to stop replying. I am losing valuable time."

I did read what you wrote. You do not need to repeat things. I did not find your arguments convincing in regard to a supposed intention of delivering a one world currency nor on your categorization of the USD as nothing more than a reserve currency.

The USD was/is the No.1 reserve currency because just about every country on the planet needed to hold it in order to buy oil. For most of the developing world and poor nations their debts were denominated in USD so they HAD to hold/accumulate USD. In deference to you I introduced the words "de facto". I see the USD as a test run for a one world currency and I maintain it failed in this role. I believe none of the factions will ever again trust one faction to control the No. 1 printing press.

We will have to agree to disagree on this point, or not if you prefer.

As to this centrally managed NWO program you believe in I think this is designed to exploit people's tendency to subscribe to the "effective manager fallacy". People want to believe that "someone is in charge" that "someone is running the show" because the notion that "no-one is in charge" frightens them. I have read a lot about the Bilderbergers, Illuminati, CFR etc. Yes I agree they facilitate discussion, co-operation and so on. You then go on to talk about this as if it automatically proves your point. I don't believe it does.

The CIA never confirms or denies their involvement in any of the assassinations, toppling of Governments etc that they are accused of precisely because the speculation adds to their mystique.

In relation to the quotations from the bible. I have never met anyone who I felt was sufficiently gifted to be able to accurately interpret the bible's meaning regardless of the depth of their faith. So I treat pronouncements that "X event" is the event predicted in a given passage of the bible as nothing more than speculation.

I grew up in an environment where it was believed that whenever the Pope sat in St Peter's chair (it looks more like a throne) his pronouncements were infallible. How's that working out so far?

Cheers!

Guest- Guest

Come back to reality

Come back to reality

angophera wrote:...I did not find your arguments convincing in regard to a supposed intention of delivering a one world currency nor on your categorization of the USD as nothing more than a reserve currency.

The USD was/is the No.1 reserve currency because just about every country on the planet needed to hold it in order to buy oil. For most of the developing world and poor nations their debts were denominated in USD so they HAD to hold/accumulate USD. In deference to you I introduced the words "de facto". I see the USD as a test run for a one world currency and I maintain it failed in this role. I believe none of the factions will ever again trust one faction to control the No. 1 printing press...

You have just stated that it was only a reserve currency. You have contradicted yourself.

Then you raise a new point, which is you do not think people will ever again trust anything centralized. Cripes, you think they will toss aside their national govts? (I wish they would follow 1 Samual 8!) The national govts are not autonomous, they are squeezed in between the will of the people and the external trade realities. This collective desire of the people, will not have changed by some magic of destroying the USD system. People (on aggregate) never learn (haven't you observed that in life?).

Actually they eventually will toss their nation govts in favor of currency blocs.

angophera wrote:...As to this centrally managed NWO program...

First of all, I have made a careful point that it is not centrally managed, but rather symbiotic at many meshing levels, and there is a level of Giant-most who stand to be above its wrath until the final killing of the host. The Giant-most are most definitely not in control (even they may think they are having great influence, it is more like natural resonance), the sin of man is in control.

For example, if there is a need to resort to war due to chaos, the will of the people will be in support of it. The people will be tasting revenge for their pitiful, chaotic plight down into their bones.

angophera wrote:...you believe in I think this is designed to exploit people's tendency to subscribe to the "effective manager fallacy". People want to believe that "someone is in charge" that "someone is running the show" because the notion that "no-one is in charge" frightens them...

People want to have all they want, then they want someone else to figure out how to give it to them. Read 1 Samuel 8. That always has been and always will be until the end of them.

angophera wrote:...I have read a lot about the Bilderbergers, Illuminati, CFR etc. Yes I agree they facilitate discussion, co-operation and so on. You then go on to talk about this as if it automatically proves your point. I don't believe it does...

You are misdirecting from the mathematical proof of my point. The structure of man will insure that socialism can never decrease. It didn't decrease when USSR fell, the socialism just accelerated in the west. Perhaps one can argue it decreased after Rome fell, and it was precisely because people used physical metal as currency. It also imploded the progress of man enormously and lead to a lot of ready bad intrigues, plagues, etc.. The reason being because the people were not happy (with their gold currency deflation)-- they couldn't get everything they wanted, so they let the Catholic church take out their revenge.

I believe a wise man is a student of history.

angophera wrote:...In relation to the quotations from the bible. I have never met anyone who I felt was sufficiently gifted to be able to accurately interpret the bible's meaning regardless of the depth of their faith...

Then the wisdom is not for you. And it might explain why you can't understand me. It is supposed to be that way. Only a few will understand.

Btw, please do not associate the Pope with Christianity. There was a corruption of Christianity in 300 AD by the King of Spain. I do not use the Roman Catholic bible. If you do not even know that it violates the 2nd Commandment and thus the Pope, Saints, and all that are idols and sins, then I would say you are not even near the level where you could understand any of the Biblical interpretations to even judge if they are correct or not. But you will have to decide that for yourself. I am not here to judge you, only to refute some points about direction of socialism.

Ah ha! So the capital controls will come from the outside!?

Ah ha! So the capital controls will come from the outside!?

Maybe the capital controls will not be inside the western countries to prevent capital from leaving, but rather inside the developing countries to prevent dollar toilet paper (carry trade) from coming in!?

And the logical extension of this is that these currency blocs will try to join together so that their trade is not suffocated. Thus we can see early indication of currency blocs forming. See how the larger economy of China is able to peg their currency to the dollar.

http://www.kitco.com/ind/nadler/nov202009.html

My prior prognostications:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-75.htm?sid=c00e99d04f5c74d00fc9d6642b94f7e9#2332

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-60.htm?sid=c00e99d04f5c74d00fc9d6642b94f7e9#2301

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-60.htm#2308

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-45.htm#2169

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-45.htm#2284

Competing currency debasement (global fiats devaluation relative to gold and silver) will be futile ("race to the inflationary, distortionary, mis-allocation bottom), because unlike in Japan, there is no larger part of the global economy to leech off of (to export to with a devalued currency), but society can not stop it because society is already dependent on this fiat (aka "road to socialism") system:

http://www.telegraph.co.uk/finance/economics/6599281/Societe-Generale-tells-clients-how-to-prepare-for-global-collapse.html

But the investment advice they give won't protect you from the inflationary part:

Problem with sugar is that price of oil is a major factor on cultivation and on bringing to market. Bonds won't outpace the debasement inflation. Currencies will compete to devalue, so selling dollar might not outpace. Shorting equities may fail, or not outpace, if debasement is sufficient.

I explained above (if sub-links are followed), that even if gold outpaces (oil and debasement), after taxes and other threats, it is also not a panacea. Investors are in a real pickle no matter what they do. I have stated that I like Buffet's strategy on investing in the shift in trend (a railroad, most fuel efficient bulk goods transport) and the inevitable decline of sprawling suburbs. We want to leverage to the changes that must come-- that is only way to get ahead during this period. Gold should be your 10% insurance policy, maybe you throw another 10 - 20% in the silver story, especially if you don't have a clear Buffet style winning leverage investment. In short, if gold skyrockets, then it means society is coming after you if you have a "too visibl"e exposure to gold, and if gold doesn't skyrocket, then you lost ground relative to those who leveraged with income, how society must change in order to prosper (prosper or at least bottom out). By "too visible", I mean that you want to actually do something with the gold before you die, so you can't just hide it until socialism decays enough, and it amounts to vast amount of wealth (which will be true if gold skyrockets and you had a large net worth invested, and if not true then gold lost ground against income investments).

In short, you are either part of the problem or part of the solution. Wouldn't it be best to be earning an income that is leveraged to increase as the side-effects of socialism increases? (i.e. be part of a fledgling capitalist trend that exploits the socialism trend) I think what many people do not grasp is that a skyrocketing gold price is consistent with skyrocketing socialism. When socialism has peaked, then gold price will have peaked, because gold pays no income and thus is in demand when people fear the socialism. But the problem is that when socialism peaks, socialism will be much worse (and for still much longer) than it is today. Are you confident you can convert your gold to good levered investments in a period of maximum socialism? Wouldn't it be better to be pre-positioned in a by-then peaking industry (Buffet will sell his railroad perhaps at peak in this wave of socialism in USA) that everyone wants to buy and that is not perceived jealously by govts? Some people argue that socialism is decreasing, e.g. China become more capitalistic, but the fact remains that although there are pockets of new capitalistic trends, until gold peaks in fiat price, then these new capitalistic trends are not the most dominant (yet). And this is not a straight line, as we see that gold fell in price drastically from 1980 to 2001 (even more drastically in inflation-adjusted terms, except oil which also fell), because the socialism of USSR and developing world was decreasing, but lately the socialism of the western world and the fiat system has grown more dominant.

So there are many counter-trends and there are even temporary reversals along the path of the final 100% socialism of a 100% one world system. Rubber band measuring sticks galore, it is hard to pick one asset class to measure performance against. To bury one's capital entirely in gold and silver hoping for that final end, or hoping for some interim reversal peak, is some what risky, because people are still today digging up gold that was buried in the Dark Ages, which lasted centuries. Ideally you would find a way to use gold as a currency and hold your liquid capital in gold, spend it, and get paid in it, without ever needing to convert to and from fiat. Unfortunately it doesn't work, because we have to trade with the world, and the world is dependent on the more liquid fiat system, which I explain in depth in the next post below.

The Bible gives me the answer. Those who hoard wealth in the end times are doomed. The story of the talents admonishes the one who buried his talent, as being worse than the despicable usury return. We are told in numerous places in the Bible to invest our talents in the poor. We are told we can not take our wealth with us when we die any way, and that we are not supposed to worry and cling to wealth ("a rich man has a better chance of pushing a camel through eye of needle, than to enter gates of heaven" and "if God can feed birds, why not humans"). How much more simple and clear can it be?

And the logical extension of this is that these currency blocs will try to join together so that their trade is not suffocated. Thus we can see early indication of currency blocs forming. See how the larger economy of China is able to peg their currency to the dollar.

http://www.kitco.com/ind/nadler/nov202009.html

Easy money in the United States, a falling dollar and growing flows of funds seeking better returns in emerging markets are touching off a round of capital controls in hot emerging markets, a trend that could accelerate...loose money in the developed world is helping to spur investment in emerging markets, driving their currencies up and making local exports less competitive for countries that, unlike China, are not hitching free rides as the dollar declines.

...On Wednesday, Russia joined the list of countries considering measures to stem currency speculation and appreciation...making it tougher or more expensive for money borrowed abroad to be taken into Russia...

...Elsewhere across developing Asia, central banks have been intervening to cap gains in the value of their currencies, with Taiwan going so far as to ban foreign funds from investing in local time deposits. Brazil announced a 2 percent tax last month on foreign investment in stocks and fixed-income securities to limit the strengthening of its currency, the real...

...There must be a risk that capital controls become part of an escalating series of beggar-thy-neighbor steps taken by countries fighting over the scraps of a diminished U.S. and European appetite for imported goods...

...“There’s more going on to this than just small little plans that are being made to tweak things here and there to discourage people from speculating in the currency markets,” a BMO analyst said.

“It’s all part of a general theme right now that countries outside the U.S. and China are extremely concerned about the weak dollar and yuan, and are attempting in any way to arrest the strengthening of their currencies,”...

...Authorities from Brasilia to Moscow to Jakarta are moving to curb what they say are ‘hot money’ speculative flows fuelling rapid currency appreciation and destabilizing their recovering economies. With currency market intervention seen as increasingly inflationary, governments are resorting to direct capital controls to prevent local bubbles expanding and bursting. In contrast to controls imposed by emerging economies at the height of the global financial crisis last year, the latest measures are aimed at slowing massive capital flows from investors seeking higher yields amid the persistence of near-zero interest rates in the biggest developed economies.

My prior prognostications:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-75.htm?sid=c00e99d04f5c74d00fc9d6642b94f7e9#2332

Shelby wrote:...Every direction I look, I see the society is preparing to say "no way" to people (other than the ones giving the masses what they want) being able to escape with their idle capital while the titantic sinks. I suspect there will be no problem with escaping (sovereign, tax, theft risk) with say 10% of your net worth in gold and slowly spend it until you die in small opportune increments. But to be able to rely on a stash of gold as your regular cash and liquidity, and for large capital store-of-value, seems risky...

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-60.htm?sid=c00e99d04f5c74d00fc9d6642b94f7e9#2301

Shelby wrote:...One that will allow socialism to march to greater heights, because no fiat will have any accountability except relative to other fiats. Since all people of the world are (on aggregate) infinitely socialistic (no upper limit to insatiable desires of humans), then this will be a race of the fiats to see who can be the most socialistic.

Your concept that gold will provide a discipline to these fiats, is your BIG MISTAKE. Think about that for a few days. Eventually you will realize. I explained this to you yesterday. How can gold regulate the fiats, when they are competing to be as bad as they can be? I had explained the mechanism for that to you yesterday, in terms of interest rates and trade dependencies. For example, if the Euro is so much more disciplined than every other fiat, then the Euro will become so highly valued, that all the wealth of EU will flow out (as trade deficits) to the developing world (as trade surpluses, because EU is a retirement community and has low production per capita). So it pays for the developing world to devalue their currency as fast as possible...

https://goldwetrust.forumotion.com/economics-f4/what-is-money-t44-60.htm#2308

Shelby wrote:"Pay in Blood" System

Understanding the precise mechanism for the transistion to NWO...

[.....8<....]

...The new global financial model will be one where currencies are not stores-of-value, but merely transactional and political conveniences. The major coup is that for the first time in history of world, people will trust currencies that have no store-of-value component. They will trust that a free float of currencies against gold will function as a regulator. But this will be a race to "who can debase the most", due to the insatiable march of socialist human nature. Free floating gold as a store-of-value, will provide no brake to grouping of populaces into a plurality of brakeless currencies, because of the Iron Law of Group Politics. Also I have explained, how such a model will force formation of currency blocs...

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-45.htm#2169

Shelby wrote:...the take down in 2007-2008 was to show the developing countries that they can not decouple, so they will politically be able to participate in the currency swabs, stimulost, and other hippocracy to try to prop up the financial system as currently composed.

I find plausible Chris's logic that they take us into one more big financial bubble that so severely mis-allocates the developing world capital, that entire world is sucked into a world currency with the Greatest Depression every known to modern man. You can see this mis-allocation because factories are being sucked (out of even developing countries) into only a few countries, there are too many people in world now to be all farmers, ... etc... so what are the rest of the people being employed to do now? Basically service the bubble...

* trivillion aka trillion, swabs aka swaps, stimulost aka stimulus

https://goldwetrust.forumotion.com/economics-f4/changing-world-order-t32-45.htm#2284

Shelby wrote:...#3 the CFR and others have put out timelines for currency blocs, and #4 the structure of the SDRs and the float against gold (but without 100% reserve) will naturally result in blocs (common demographics will join to counter-balance extremely disruptive, competing blocs with radically different demographics, and socialism by its nature must grow in population in order to not die...e.g. USSR)...

[.....8<....]

...NWO = trend of globalized socialism

Competing currency debasement (global fiats devaluation relative to gold and silver) will be futile ("race to the inflationary, distortionary, mis-allocation bottom), because unlike in Japan, there is no larger part of the global economy to leech off of (to export to with a devalued currency), but society can not stop it because society is already dependent on this fiat (aka "road to socialism") system:

http://www.telegraph.co.uk/finance/economics/6599281/Societe-Generale-tells-clients-how-to-prepare-for-global-collapse.html

...Inflating debt away might be seen by some governments as a lesser of evils.

If so, gold would go "up, and up, and up" as the only safe haven from fiat paper money...

...The bank said the current crisis displays "compelling similarities" with Japan during its Lost Decade (or two), with a big difference: Japan was able to stay afloat by exporting into a robust global economy and by letting the yen fall. It is not possible for half the world to pursue this strategy at the same time...

But the investment advice they give won't protect you from the inflationary part:

...SocGen advises bears to sell the dollar and to "short" cyclical equities such as technology, auto, and travel to avoid being caught in the "inherent deflationary spiral". Emerging markets would not be spared. Paradoxically, they are more leveraged to the US growth than Wall Street itself. Farm commodities would hold up well, led by sugar.

Mr Fermon said junk bonds would lose 31pc of their value in 2010 alone. However, sovereign bonds would "generate turbo-charged returns" mimicking the secular slide in yields seen in Japan as the slump ground on. At one point Japan's 10-year yield dropped to 0.40pc. The Fed would hold down yields by purchasing more bonds. The European Central Bank would do less, for political reasons...

Problem with sugar is that price of oil is a major factor on cultivation and on bringing to market. Bonds won't outpace the debasement inflation. Currencies will compete to devalue, so selling dollar might not outpace. Shorting equities may fail, or not outpace, if debasement is sufficient.

I explained above (if sub-links are followed), that even if gold outpaces (oil and debasement), after taxes and other threats, it is also not a panacea. Investors are in a real pickle no matter what they do. I have stated that I like Buffet's strategy on investing in the shift in trend (a railroad, most fuel efficient bulk goods transport) and the inevitable decline of sprawling suburbs. We want to leverage to the changes that must come-- that is only way to get ahead during this period. Gold should be your 10% insurance policy, maybe you throw another 10 - 20% in the silver story, especially if you don't have a clear Buffet style winning leverage investment. In short, if gold skyrockets, then it means society is coming after you if you have a "too visibl"e exposure to gold, and if gold doesn't skyrocket, then you lost ground relative to those who leveraged with income, how society must change in order to prosper (prosper or at least bottom out). By "too visible", I mean that you want to actually do something with the gold before you die, so you can't just hide it until socialism decays enough, and it amounts to vast amount of wealth (which will be true if gold skyrockets and you had a large net worth invested, and if not true then gold lost ground against income investments).

In short, you are either part of the problem or part of the solution. Wouldn't it be best to be earning an income that is leveraged to increase as the side-effects of socialism increases? (i.e. be part of a fledgling capitalist trend that exploits the socialism trend) I think what many people do not grasp is that a skyrocketing gold price is consistent with skyrocketing socialism. When socialism has peaked, then gold price will have peaked, because gold pays no income and thus is in demand when people fear the socialism. But the problem is that when socialism peaks, socialism will be much worse (and for still much longer) than it is today. Are you confident you can convert your gold to good levered investments in a period of maximum socialism? Wouldn't it be better to be pre-positioned in a by-then peaking industry (Buffet will sell his railroad perhaps at peak in this wave of socialism in USA) that everyone wants to buy and that is not perceived jealously by govts? Some people argue that socialism is decreasing, e.g. China become more capitalistic, but the fact remains that although there are pockets of new capitalistic trends, until gold peaks in fiat price, then these new capitalistic trends are not the most dominant (yet). And this is not a straight line, as we see that gold fell in price drastically from 1980 to 2001 (even more drastically in inflation-adjusted terms, except oil which also fell), because the socialism of USSR and developing world was decreasing, but lately the socialism of the western world and the fiat system has grown more dominant.

So there are many counter-trends and there are even temporary reversals along the path of the final 100% socialism of a 100% one world system. Rubber band measuring sticks galore, it is hard to pick one asset class to measure performance against. To bury one's capital entirely in gold and silver hoping for that final end, or hoping for some interim reversal peak, is some what risky, because people are still today digging up gold that was buried in the Dark Ages, which lasted centuries. Ideally you would find a way to use gold as a currency and hold your liquid capital in gold, spend it, and get paid in it, without ever needing to convert to and from fiat. Unfortunately it doesn't work, because we have to trade with the world, and the world is dependent on the more liquid fiat system, which I explain in depth in the next post below.

The Bible gives me the answer. Those who hoard wealth in the end times are doomed. The story of the talents admonishes the one who buried his talent, as being worse than the despicable usury return. We are told in numerous places in the Bible to invest our talents in the poor. We are told we can not take our wealth with us when we die any way, and that we are not supposed to worry and cling to wealth ("a rich man has a better chance of pushing a camel through eye of needle, than to enter gates of heaven" and "if God can feed birds, why not humans"). How much more simple and clear can it be?

Last edited by Shelby on Sat Nov 21, 2009 8:02 pm; edited 17 times in total

Gold & Silver can not be *CURRENCIES* ever again

Gold & Silver can not be *CURRENCIES* ever again

Please first re-read (I added to it), the prior post Ah ha! So the capital controls will come from the outside!?:

Bottom line: we can not restore non-socialistic monetary system, by first dis-hoarding the society of wealth via extreme socialism, because there is no way to restore the wealth in a human generation (20 years) non-socialistically.

I guess I am not quite done commenting on my forum, as I first need to satisfy myself that I have addressed the theory (and thus what is appropriate investment), that postulates a return to some form of gold (or commodity basket, or bi-metallic with silver) standard, or that these real goods stores-of-value will somehow brake the current slide into global chaos and socialistic responses (i.e. "universal stimulost, mis-allocation, debasement, distortion, inflation"). Bix Weir has a series of thought-provoking articles (seminal) (and I take him seriously because he published the expose on the US govt 470 Moz silver WW2 Manhattan Project hoard).

First, note that "store-of-value" is a valid property of money, but not of currency, and in fact currencies are always debased even on a metallic standard, because people needs credit, i.e. paper promises (e.g. certificates-of-deposit, real bills, letters-of-credit, etc) and these promises become more liquid and thus always become the more popular currencies even on a metallic standard. People (all of us) can not resist the urge for more liquidity, because we are concerned about not living forever and the opportunity cost of time. This is actually a Biblical statement of natural law and human nature, enumerated in 1 Samuel 8, wherein people are not able to accept their immortality under they King of Kings, because we reject the 2nd Commandment (Old Testament, was replace in Roman Catholic bible) and refuse to stop whor(e)shipping and clinging to things of this material world (which btw, is scientifically only one of infinite parallel universes that exist right now all around us, which I have discussed at length and proven beyond any doubt, e.g. Shannon-Nyquist theorem, in the Technology, Biblical, and interspersed in the other forums of this site).

Second, note that not even including the potential monetary store-of-value demand for silver which will snowball if silver's price rises significantly (and certainly not including demand if it were to come back as currency!), that it is impossible for the world to industrialize without 1+Boz of additional annual supply of silver (and thus enticing the 16+Boz of silverware to market at orders-of-magnitude higher price, noting that most applications for silver are not price sensitive because small % of end product cost).

Bix Weir postulates that "Road to Roota" is a return to the gold standard; whereas, I as postulate in Ah ha! So the capital controls will come from the outside!? that we are in a fiat "Road to Socialism", and I actually see the supporting symbolism for "Road to Socialism" in the Fed cartoon Weir analyzes. Afaics, Bix Weir postulates that the fiat system is being destroyed in an egregious manner that will force global adoption of a gold standard. But the (most so in the developed country) populations will be disenfranchised unless the govts distribute gold, and how can the govts distribute gold when they do not have any? Digital gold doesn't change the fact that not even 1% of the population can move into gold without having the other 99% lose all their net worth. The only two possible answers are attempt (and fail) to steal the gold (taxation, etc) and thus send it into hiding until the socialism has destroyed itself, which means the population must either die or work as slaves for those who hold gold. In short, returning to a gold standard now is a feudal system. Btw, this may explain the H1N1 virus developments. The coming feudal lords want to get rid of the population who consume more than they produce (part of the socialism killing itself and reseting). That process took centuries in Dark Ages, after the socialism of Roman Empire peaked.

Also we have to consider a dichotomy in the global economy, in that the boomers are now ready to enter socialism (to be taken care of, are unproductive or much less so in most cases) and thus are a big expense on the balance sheet of the world, so whereas the 300+ million boomers drove demand for liquidity in 70s, 1500+ million developing youth are driving liquidity demands now. So the boomers did not want gold after 1971 because they wanted credit (liquidity), driving interest rates skyhigh, and thus neither will the developing world youth want their liquidity to be constrained to a gold standard now. This is why the carry trade is going to developing world investments, and this correctly increases the buying power of the developing world, but the problem is the developing world has been so mis-allocated on building things for the developed world, that it can not de-couple quickly enough to building things only for itself (that capitalism is growing fast, but not fast enough to offset an implosion of the developing world, but eventually these 2 trends will kiss, cross, and say goodbye heading in different directions, but not without some perhaps decades volatility first).

So the outcome is crystal clear. There is no way to return a gold standard, where currency (legal tender or otherwise) is backed by gold. The dominant trend is liquidity and debasement, as a process of shifting the wealth from developed to developing world, not through investment from developed world, but by consumption of the developed world and then a gradual self-investment diversification by the developing world itself. And thus the world is going to run to extremely high levels of mis-allocation, debasement, destruction, trade wars, etc, before the developing world is able to pull away. The way this process is currently dominantly structured, the developed world will destroy itself with socialism (the PTB is apparently trying to accelerate the process with H1N1), and the developing world is trying to pull away into more capitalism, but it can't pull away fast enough to be the dominant trend, and thus there will be interim trade wars and destructive maneuvers. That is unless all us in developed world stop putting our capital in holes and get busy on accelerating the investment in making things in developing world for the developing world.

As I detailed in prior discussion (see links in prior post and my "Pay In Blood" financialsense.com article), we are moving towards a new type of gold standard, wherein no national currency will claim to be "as good as gold", and gold will be a rising store-of-value. All the currencies will be viewed as trash, except maybe for the Euro (if it doesn't fracture due to varied demographics in EU), because the retirement politics of Old Europe demand a higher interest rates and lower debasement there. This will dragged out longer than need be because people will prefer to mis-allocate capital and bury it in gold, than to invest it on counter-socialism trends in developing world. Until there is a break away from the cancer of the developed world, there are no savior investments, except those that are income (not just debasement psychology, i.e. inflation expectations) leveraged to that cancer.

Pertaining to the quote of the cartoon in Bix Weir's article and important followup, it is possible that the "BIG people who might accidentally step" on the little people in pebbleland, are actually the politicians and national govts. These socialists stand in the way of faster progress, because they express the wishes of the majority for more "status quo" (insurance, safety, no change) thus increasing socialism. The point of the globalists such as Rothschild, Rockefeller, Trilateral, CFR, Bilderberg, BIS/Basel, etc.. has been that a NWO is preferable to the barriers of auto-determined sovereign nations, and this is because politics always creates local, provincial, national, or federal officials who block progress (e.g. we have noted how the Chinese/Asian politburo/Taipans have enriched themselves and block our ability to go invest and compete with them in their locales). So the globalists see themselves at doing a better job of managing progress (but of course that is their folly, because a further centralization is actually mathematically worse in entropy terms, less free market, more certain to mis-allocate and fail, which is exactly what Revelation explains). If you look carefully at the golden road cartoon frame, you see that it jives with my understanding of the future of more centralization, where all gold leads to the center perfect controlled city and away from the savage freedom of the diverse rural area. We are headed for a world where gold is controlled more by larger entities, and the little people are left with currencies that float. If we want a less centralized future world, we need to get off our butt now and head to developing world and make our capital work for counter-trend direction with leverage to the trend.

More on the Bix Weir cartoon analysis, I see the shift from Asians in 1981 version to Caucasians in 2007 version, is because those fighting for a gold standard were defeated (9-11 being the culmination), because the Asians were not successfully taught to diversify their asset strategies before it was too late for them to de-couple. Reagan's group failed. They did bring down the USSR and they made a lot of progress (search out the $5 trillion slush fund for that, which may still be abroad), but they didn't get the final result of a gold standard. So now we are left with Caucasians cashing in their gold and silver for paper. Even I read Indian population is slowing down its consumption of silver and gold, as its fiat banking system grows.

Now let's analyze Weir's follow up points:

http://news.goldseek.com/GoldSeek/1214492700.php

A lot seems plausible, except how is the public going to buy-in? Weir has his Feinstein/Chocolate Mountain and hidden oil fields thesis for the USA. How do you distribute that to the people in a non-socialistic manner?

Interesting is the interplay of forces within the various PTB discussed here (link that I had read in 2007, is from Weir's article), but which I am reasonably sure is planted mis-information due to numerous errors in logic including that to kill the leaders of the PTB would send the world in chaos and would risk setting off nuclear annihilation of human race. But nevertheless, the bottom line always comes down to financial. The people have no gold. Japan is bankrupt. Asia can't decouple from USA consumers, USA which the Rockfellers apparently have great influence on. And Bix Weir realizes that when he writes:

http://news.goldseek.com/GoldSeek/1252994940.php

But he doesn't seem to make the mental connection that a gold standard is unworkable, and will not be accepted by the billions of developing world youth entering their 20s and 30s and demanding liquidity and their life progress. The people will not demand to move to a money standard that turns them into serfs working for the people who have the gold! The people will demand that the govt print and spend more money on them! Weir does not understand that democracies get more socialistic, the larger they get, it is a basic fact. Apparently the "Road to Roota" cartoon is mocking Roota (Weir claims Roota is Greenspan) and saying, "Checkmate, you lost" and socialism can not be stopped.

Now if he is claiming a complete wipeout, so the people reset from nothing and earn their way back up in gold and/or silver, that can take centuries, and the developing world youth are not going to wait for that. You will have wars. That is only possible outcome. Rockfeller is waiting to finance and play both sides of the wars (unless we can somehow just kill off the non-productive populace and then grow onwards...H1N1).

Greenspan lost precisely because he tried to manipulate the end result (with computers, financial futures, etc) and did not trust the free market:

http://silverstockreport.com/2009/greenspan-misapplied.html

Bottom line: we can not restore non-socialistic monetary system, by first dis-hoarding the society of wealth via extreme socialism, because there is no way to restore the wealth in a human generation (20 years) non-socialistically.

==========

ADD: regarding the assertion that we can restore a gold standard by distributing gold to citizens, and why that is socialism and failure directed:

http://economicedge.blogspot.com/2009/04/martin-armstrong-article-anthology.html

http://www.scribd.com/kzuur58

Repeating cycle waves of a gold standard (on, off, then back on a gold standard...repeat):

===========

ADD: interesting that Zimbabwe's hyperinflation experience is that it ended up on a world currency standard ($USD) at the end, which supports my hypothesis that smaller countries will eventually be forced into currency blocs as the demands of their populations or rulers squander their wealth:

http://www.gold-eagle.com/editorials_08/field112309.html

Shelby wrote:...I think what many people do not grasp is that a skyrocketing gold price is consistent with skyrocketing socialism. When socialism has peaked, then gold price will have peaked, because gold pays no income and thus is in demand when people fear the socialism. But the problem is that when socialism peaks, socialism will be much worse (and for still much longer) than it is today. Are you confident you can convert your gold to good levered investments in a period of maximum socialism? Wouldn't it be better to be pre-positioned in a by-then peaking industry...

Bottom line: we can not restore non-socialistic monetary system, by first dis-hoarding the society of wealth via extreme socialism, because there is no way to restore the wealth in a human generation (20 years) non-socialistically.

I guess I am not quite done commenting on my forum, as I first need to satisfy myself that I have addressed the theory (and thus what is appropriate investment), that postulates a return to some form of gold (or commodity basket, or bi-metallic with silver) standard, or that these real goods stores-of-value will somehow brake the current slide into global chaos and socialistic responses (i.e. "universal stimulost, mis-allocation, debasement, distortion, inflation"). Bix Weir has a series of thought-provoking articles (seminal) (and I take him seriously because he published the expose on the US govt 470 Moz silver WW2 Manhattan Project hoard).

First, note that "store-of-value" is a valid property of money, but not of currency, and in fact currencies are always debased even on a metallic standard, because people needs credit, i.e. paper promises (e.g. certificates-of-deposit, real bills, letters-of-credit, etc) and these promises become more liquid and thus always become the more popular currencies even on a metallic standard. People (all of us) can not resist the urge for more liquidity, because we are concerned about not living forever and the opportunity cost of time. This is actually a Biblical statement of natural law and human nature, enumerated in 1 Samuel 8, wherein people are not able to accept their immortality under they King of Kings, because we reject the 2nd Commandment (Old Testament, was replace in Roman Catholic bible) and refuse to stop whor(e)shipping and clinging to things of this material world (which btw, is scientifically only one of infinite parallel universes that exist right now all around us, which I have discussed at length and proven beyond any doubt, e.g. Shannon-Nyquist theorem, in the Technology, Biblical, and interspersed in the other forums of this site).

Second, note that not even including the potential monetary store-of-value demand for silver which will snowball if silver's price rises significantly (and certainly not including demand if it were to come back as currency!), that it is impossible for the world to industrialize without 1+Boz of additional annual supply of silver (and thus enticing the 16+Boz of silverware to market at orders-of-magnitude higher price, noting that most applications for silver are not price sensitive because small % of end product cost).

Bix Weir postulates that "Road to Roota" is a return to the gold standard; whereas, I as postulate in Ah ha! So the capital controls will come from the outside!? that we are in a fiat "Road to Socialism", and I actually see the supporting symbolism for "Road to Socialism" in the Fed cartoon Weir analyzes. Afaics, Bix Weir postulates that the fiat system is being destroyed in an egregious manner that will force global adoption of a gold standard. But the (most so in the developed country) populations will be disenfranchised unless the govts distribute gold, and how can the govts distribute gold when they do not have any? Digital gold doesn't change the fact that not even 1% of the population can move into gold without having the other 99% lose all their net worth. The only two possible answers are attempt (and fail) to steal the gold (taxation, etc) and thus send it into hiding until the socialism has destroyed itself, which means the population must either die or work as slaves for those who hold gold. In short, returning to a gold standard now is a feudal system. Btw, this may explain the H1N1 virus developments. The coming feudal lords want to get rid of the population who consume more than they produce (part of the socialism killing itself and reseting). That process took centuries in Dark Ages, after the socialism of Roman Empire peaked.

Also we have to consider a dichotomy in the global economy, in that the boomers are now ready to enter socialism (to be taken care of, are unproductive or much less so in most cases) and thus are a big expense on the balance sheet of the world, so whereas the 300+ million boomers drove demand for liquidity in 70s, 1500+ million developing youth are driving liquidity demands now. So the boomers did not want gold after 1971 because they wanted credit (liquidity), driving interest rates skyhigh, and thus neither will the developing world youth want their liquidity to be constrained to a gold standard now. This is why the carry trade is going to developing world investments, and this correctly increases the buying power of the developing world, but the problem is the developing world has been so mis-allocated on building things for the developed world, that it can not de-couple quickly enough to building things only for itself (that capitalism is growing fast, but not fast enough to offset an implosion of the developing world, but eventually these 2 trends will kiss, cross, and say goodbye heading in different directions, but not without some perhaps decades volatility first).

So the outcome is crystal clear. There is no way to return a gold standard, where currency (legal tender or otherwise) is backed by gold. The dominant trend is liquidity and debasement, as a process of shifting the wealth from developed to developing world, not through investment from developed world, but by consumption of the developed world and then a gradual self-investment diversification by the developing world itself. And thus the world is going to run to extremely high levels of mis-allocation, debasement, destruction, trade wars, etc, before the developing world is able to pull away. The way this process is currently dominantly structured, the developed world will destroy itself with socialism (the PTB is apparently trying to accelerate the process with H1N1), and the developing world is trying to pull away into more capitalism, but it can't pull away fast enough to be the dominant trend, and thus there will be interim trade wars and destructive maneuvers. That is unless all us in developed world stop putting our capital in holes and get busy on accelerating the investment in making things in developing world for the developing world.

As I detailed in prior discussion (see links in prior post and my "Pay In Blood" financialsense.com article), we are moving towards a new type of gold standard, wherein no national currency will claim to be "as good as gold", and gold will be a rising store-of-value. All the currencies will be viewed as trash, except maybe for the Euro (if it doesn't fracture due to varied demographics in EU), because the retirement politics of Old Europe demand a higher interest rates and lower debasement there. This will dragged out longer than need be because people will prefer to mis-allocate capital and bury it in gold, than to invest it on counter-socialism trends in developing world. Until there is a break away from the cancer of the developed world, there are no savior investments, except those that are income (not just debasement psychology, i.e. inflation expectations) leveraged to that cancer.