Market Comments & News

+6

silberruecken

jack

Shelby

Jeremy

Jim

Yellowcaked

10 posters

Page 7 of 7

Page 7 of 7 •  1, 2, 3, 4, 5, 6, 7

1, 2, 3, 4, 5, 6, 7

Jim- Posts : 963

Join date : 2008-10-23

Location : California

Can S&P go to $1790 now and no more crashing?

Can S&P go to $1790 now and no more crashing?

I think he is correct, but next year, after the next round of global stimulus.

The reasons he provides are why we are not going to crash so far down as 2008.

More logic interleaved below...

They can sure remember 2008, where the same thing happened, and then worse happened.

It is good that articles like this will pump up the deadcat bounce, so more people can get slaughtered on the next down wave. Thanks.

I agree, but the bump isn't finished yet. It will be once QE3 is announced after a crash that is sufficient to scare the Fed into aggressive action.

"next four years", not next 2 months. Big difference.

Insiders have good long-term insight, but afaik not always specialists in short-term market speculation insight (their day jobs are not as market traders). These insiders will be correct over the long-run.

This is an interesting point.

http://www.tradersnarrative.com/wp-content/uploads/2008/04/consumer%20sentiment%20contrarian%20signals.png

http://www.socketsite.com/Bloomberg%20Consumer%20Confidence%20Graphic.jpg

http://bespokeinvest.typepad.com/bespoke/images/2007/07/31/consconf.png

However, let's zoom in on 2008, and we see that the S&P bottom didn't come until 2009, well after consumer confidenced bottomed at 38 a few months earlier, and that consumer confidence fell off a cliff almost a year earlier:

Hopefully you didn't listen to these guys at the start of 2008, making a similar argument:

Looking like a repeat of 2007 - 2009 to me, but on 2.5x acceleration:

Chris Puplava refuted that:

http://www.financialsense.com/contributors/chris-puplava/2011/08/19/bernankes-worst-nightmare-pushing-on-a-string

It is true that due to the $trillions in inflation, outsourcing, etc., that companies have higher profits than 2008, and that is another reason we won't see S&P fall to 666 again.

Also we have now more of a sovereign crisis, than a financial sector one.

But still the global economy is rolling over, and without additional stimulus, the global economy can implode. So the company profits stand on a knife's edge. And they can be threatened if the Fed does not act to keep the money spigots opening wider and wider to meet the acceleration of the quadrillion of derivatives that can suck everything out of the economy in a heartbeat.

The economy is become more and more on a knife's edge, and so volatility will increase.

When the Fed does finally pull out their big guns, then we will see inflation hell rapidly and everything will go up. And that will be the death blow to the global economy, then everything will go off the board by 2013 or so.

It could run up quite a bit, but it is more likely that it will soon crash again as the lack of stimulus takes hold. Consumer sentiment might bounce a little as it did in 2008, before going down again, perhaps even lower than 38 this time. Remember corporations have high profits, but consumers don't. Welcome to fascism.

Also:

http://www.financialsense.com/contributors/dominic-frisby/2011/08/31/is-it-time-to-exit-the-markets-this-signal-says-yes

Market does not believe Q3 is imminent

http://www.financialsense.com/contributors/chris-ciovacco/2011/08/31/tepid-interest-in-qe-2-winners-raises-questions-about-qe-3

Also Karl puts another hole in that theory that S&P PE ratios are at historic lows:

http://market-ticker.org/akcs-www?post=193344

The reasons he provides are why we are not going to crash so far down as 2008.

More logic interleaved below...

Four Signs the S&P 500 Index is Headed to 1,790

By Louis Basenese, Chief Investment Strategist

As my father loves to tell me, "No matter how flat you make a pancake, it still has two sides."

Yet, in the aftermath of the roughly 20% rout for the market, which erased $2.3 trillion in stock market wealth, the financial press can't seem to remember that truth.

They can sure remember 2008, where the same thing happened, and then worse happened.

Most keep playing up the significant burdens overhanging the market. Like out-of-control government deficits and debt, uncomfortably high unemployment, slowing economic growth and a still floundering real estate market. And they conclude the selloff that began in July is the start of a much longer and overdue downturn.

Hogwash!

It is good that articles like this will pump up the deadcat bounce, so more people can get slaughtered on the next down wave. Thanks.

We all know that bull markets don't go straight up forever. They're often interrupted by bouts of volatility and rapid selling. And I'm convinced that the recent selloff was nothing more than that. A bump in the road to higher prices.

I agree, but the bump isn't finished yet. It will be once QE3 is announced after a crash that is sufficient to scare the Fed into aggressive action.

Here are four bullish signs - the "other side of the pancake" if you will - to convince you of the same.

~ Bull Market Indicator #1: A Buyback Bonanza

More companies are set to buy back shares in August than in any month since the peak in 2007, according to Birinyi Associates. And research clearly demonstrates the impact of such optimism on the part of corporations.

Six months after a repurchase program is announced, a company's stock is up as much as an extra 4%, according to Allen Michel, a finance professor at Boston University.

Over the longer term, the outperformance is even more pronounced. A study out of the University of Illinois at Urbana-Champaign showed that companies buying back their own shares typically outperform the broad market over the next four years, by as much as 45%.

"next four years", not next 2 months. Big difference.

~ Bull Market Indicator #2: The Insider Connection

Corporate insiders sell shares of their company's stock for a host of reasons. But they only buy shares for one - to make money. And wouldn't you know it? In the aftermath of the latest market volatility, insiders are backing up the truck.

"We're seeing the most aggressive insider buying since March 2009," says Ben Silverman of Insiderscore.com, which tracks insider trading.

Clearly insiders believe their stocks are undervalued again. And who would know better?

Insiders have good long-term insight, but afaik not always specialists in short-term market speculation insight (their day jobs are not as market traders). These insiders will be correct over the long-run.

~ Bull Market Indicator #3: A Historically Gloomy Consumer

It's completely counterintuitive. But when U.S. consumers get the gloomiest, stocks typically rally.

Specifically, research out of Ned Davis shows that when the Conference Board's Consumer Confidence Index is low (below 66), the Dow rallies by an average of 13.1% over the next year.

Guess what? The latest consumer confidence reading was released yesterday. And confidence plummeted, with the Consumer Confidence Index dropping to 44.5 from 59.2 in July. That's the lowest level since April 2009.

This is an interesting point.

http://www.tradersnarrative.com/wp-content/uploads/2008/04/consumer%20sentiment%20contrarian%20signals.png

http://www.socketsite.com/Bloomberg%20Consumer%20Confidence%20Graphic.jpg

http://bespokeinvest.typepad.com/bespoke/images/2007/07/31/consconf.png

However, let's zoom in on 2008, and we see that the S&P bottom didn't come until 2009, well after consumer confidenced bottomed at 38 a few months earlier, and that consumer confidence fell off a cliff almost a year earlier:

Hopefully you didn't listen to these guys at the start of 2008, making a similar argument:

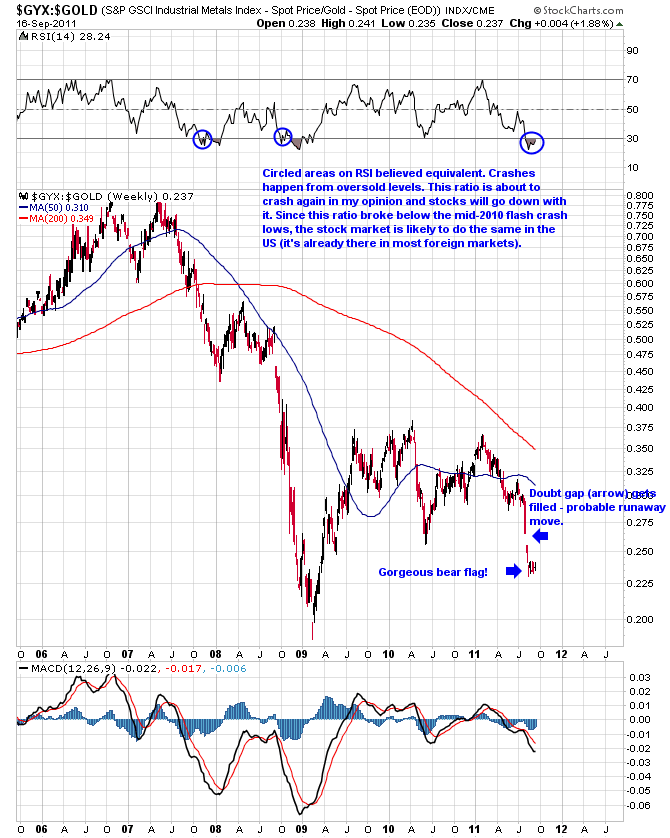

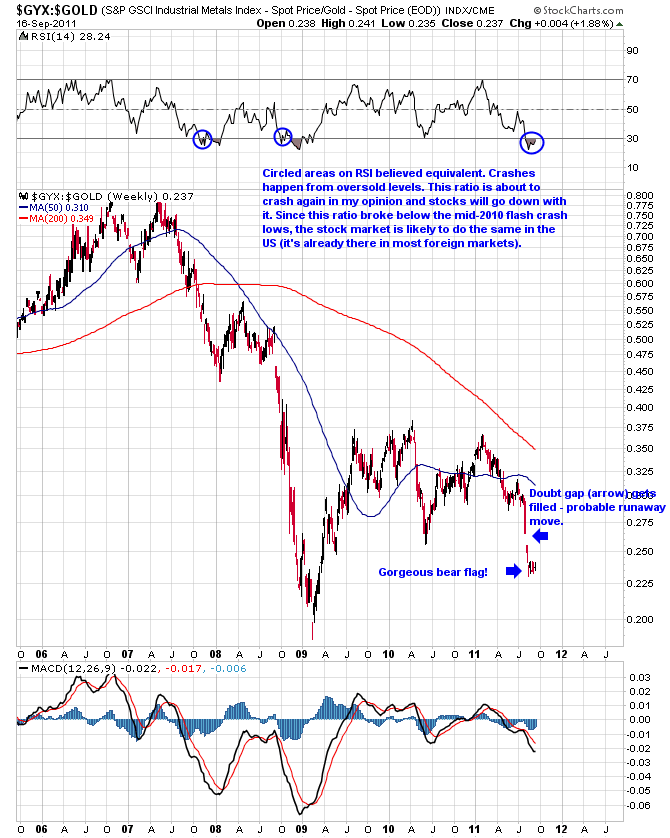

Looking like a repeat of 2007 - 2009 to me, but on 2.5x acceleration:

~ Bull Market Indicator #4: A Valuation Gap

Investing at its core is about nothing more than buying assets on the cheap and selling them for a higher price. And although it might be hard to believe, stocks are historically cheap right now.

In fact, we haven't seen stock valuations plumb such low levels in the aftermath of a recession since Ronald Reagan was president.

More than one-fifth of stocks in the S&P 500 are trading for single-digit price-to-earnings (P/E) ratios.

As a whole, the S&P 500 Index recently traded at a P/E ratio of 12.9. That's about 4% less than the average P/E ratio experienced during the 10 economic contractions since 1949, according to Bloomberg data.

On a forward-looking basis, the valuations are even more compelling.

Consider: The forward P/E ratio for the S&P 500 Index stands at just 10.8. If we assume stocks will eventually revert back to their 50-year average forward P/E ratio of 16.4, it can only be accomplished in one of two ways.

Either earnings have to fall to $71.76 per share for the S&P 500 Index, equivalent to a 22% decline. Or the S&P 500 has to rally to 1,790, about 50% higher than current prices.

The former is completely out of the question. Why? Because S&P 500 earnings are expected to climb 13% next year, marking the fourth straight year of profit growth. And even though analysts have a terrible track record of predicting profit growth, they're not that terrible.

Chris Puplava refuted that:

http://www.financialsense.com/contributors/chris-puplava/2011/08/19/bernankes-worst-nightmare-pushing-on-a-string

It is true that due to the $trillions in inflation, outsourcing, etc., that companies have higher profits than 2008, and that is another reason we won't see S&P fall to 666 again.

Also we have now more of a sovereign crisis, than a financial sector one.

But still the global economy is rolling over, and without additional stimulus, the global economy can implode. So the company profits stand on a knife's edge. And they can be threatened if the Fed does not act to keep the money spigots opening wider and wider to meet the acceleration of the quadrillion of derivatives that can suck everything out of the economy in a heartbeat.

The economy is become more and more on a knife's edge, and so volatility will increase.

When the Fed does finally pull out their big guns, then we will see inflation hell rapidly and everything will go up. And that will be the death blow to the global economy, then everything will go off the board by 2013 or so.

Bottom line: Wall Street and Main Street might be overrun with gloom and doom. But the truth is, this bull market could charge another 50% higher before it dies.

Ahead of the tape,

Louis Basenese

It could run up quite a bit, but it is more likely that it will soon crash again as the lack of stimulus takes hold. Consumer sentiment might bounce a little as it did in 2008, before going down again, perhaps even lower than 38 this time. Remember corporations have high profits, but consumers don't. Welcome to fascism.

Also:

http://www.financialsense.com/contributors/dominic-frisby/2011/08/31/is-it-time-to-exit-the-markets-this-signal-says-yes

Market does not believe Q3 is imminent

http://www.financialsense.com/contributors/chris-ciovacco/2011/08/31/tepid-interest-in-qe-2-winners-raises-questions-about-qe-3

You can read the lack of interest in QE2 winners in one of two ways:

1. The market does not believe QE3 is imminent.

2. The market questions if QE3 will be effective in boosting asset prices in a sustained manner.

Also Karl puts another hole in that theory that S&P PE ratios are at historic lows:

http://market-ticker.org/akcs-www?post=193344

Rumors of Greece default for this weekend (meaning today or tomorrow)

Rumors of Greece default for this weekend (meaning today or tomorrow)

So perhaps this is why Switzerland acted this past week. They might have known fireworks were coming.

http://market-ticker.org/akcs-www?post=193872

http://market-ticker.org/akcs-www?post=193848

http://www.bloomberg.com/news/2011-09-10/euro-falls-most-in-a-year-on-greek-financial-distress-ecb-dollar-surges.html

http://www.bloomberg.com/news/2011-09-09/u-s-stocks-drop-a-second-week-as-greece-concern-trumps-obama-growth-plan.html (ECB admits worsening, Lehman style event possible)

http://www.bloomberg.com/news/2011-09-09/papandreou-to-defend-greek-austerity-policies-as-opposition-doubts-mount.html (9 in 10 Greeks disagree with austerity)

I am getting a possible scenario in my mind. Looks like first gold will go up, along with the dollar's initial move up, because the initial focus will be on the Euro risk.

But if there is a Lehman-style liquidity event in the EU, and it causes a global cascade (e.g. USA banks are exposed to derivatives on EU debt), as it did from USA to EU (on a lag) in the opposite direction in 2008, then what could happen is the dollar's rise could accelerate, and then gold could take a fall, because the concern would not be about EU but the entire world being dragged into a liquidity crisis. At that point, the most liquid instrument is the dollar and the US Treasuries. I would expect this to be a 30 year peaking event for US Treasuries, some where below 2% on the 10 year.

So my original scenario may still be possible, but it is not likely that gold will tumble too far, maybe only to $1700. And then I would expect the breakout on mining stocks to come back and be tested as support, but probably to hold.

It is also possible that gold and the dollar both remain safe havens, even if we do get a liquidity crisis in EU that spreads to USA.

I don't think we are going to get a super liquidity crash like 2008, because the central banks have pumped a lot of reserve cash into the banks already. And they stand ready to pump more as needed. The Switzerland event shows that the nations are willing to sacrifice themselves to the world order (unified monetary system, in the too big to fail collectivist line of thinking "we all go down together, because we are all affected by the crisis of others").

But although collectivism can pool its depleting capital to spread the pain to everyone, it can't always do it in real-time. Thus liquidity events can spread for a short-time, while the collectivist institutions react.

It appears the Europeans have been somewhat proactive with the Switzerland decision, but that could just be a signal of desperation.

Germany's DAX has a -32% decline so far already, but remember the S&P had a -52% decline in 2008, and it had falls of -21%, -22%, and -28% earlier in 2008 before it finally succumbed. However, the DAX echoed those falls in 2008, whereas the S&P has only fallen -20% in 2011 and has recovered some while the DAX continues to fall. This signals that the market doesn't think the effect on the USA can be as great as 2008. And the Chinese market remains strong thus far.

http://stockcharts.com/h-sc/ui?s=DAX

http://www.bloomberg.com/news/2011-09-10/china-s-trade-surplus-in-august-reaches-17-76-billion-exports-rise-24-5-.html

So this leads me to believe we have already seen the lows for commodities in 2011, and that we may have already seen the lows for the S&P, but I tend to think we will get a mini-crash down to about 950 in Oct or Nov. I think this will give us one more chance to buy commodities on a dip, but it won't be as low as May. And we may get a slight dip in gold, with the lowest probably around $1550, but more likely above $1700. I don't think there is much chance of a sub-$1400 gold and sub-$30 silver in 2011.

http://market-ticker.org/akcs-www?post=193872

http://market-ticker.org/akcs-www?post=193848

http://www.bloomberg.com/news/2011-09-10/euro-falls-most-in-a-year-on-greek-financial-distress-ecb-dollar-surges.html

http://www.bloomberg.com/news/2011-09-09/u-s-stocks-drop-a-second-week-as-greece-concern-trumps-obama-growth-plan.html (ECB admits worsening, Lehman style event possible)

http://www.bloomberg.com/news/2011-09-09/papandreou-to-defend-greek-austerity-policies-as-opposition-doubts-mount.html (9 in 10 Greeks disagree with austerity)

I am getting a possible scenario in my mind. Looks like first gold will go up, along with the dollar's initial move up, because the initial focus will be on the Euro risk.

But if there is a Lehman-style liquidity event in the EU, and it causes a global cascade (e.g. USA banks are exposed to derivatives on EU debt), as it did from USA to EU (on a lag) in the opposite direction in 2008, then what could happen is the dollar's rise could accelerate, and then gold could take a fall, because the concern would not be about EU but the entire world being dragged into a liquidity crisis. At that point, the most liquid instrument is the dollar and the US Treasuries. I would expect this to be a 30 year peaking event for US Treasuries, some where below 2% on the 10 year.

So my original scenario may still be possible, but it is not likely that gold will tumble too far, maybe only to $1700. And then I would expect the breakout on mining stocks to come back and be tested as support, but probably to hold.

It is also possible that gold and the dollar both remain safe havens, even if we do get a liquidity crisis in EU that spreads to USA.

I don't think we are going to get a super liquidity crash like 2008, because the central banks have pumped a lot of reserve cash into the banks already. And they stand ready to pump more as needed. The Switzerland event shows that the nations are willing to sacrifice themselves to the world order (unified monetary system, in the too big to fail collectivist line of thinking "we all go down together, because we are all affected by the crisis of others").

But although collectivism can pool its depleting capital to spread the pain to everyone, it can't always do it in real-time. Thus liquidity events can spread for a short-time, while the collectivist institutions react.

It appears the Europeans have been somewhat proactive with the Switzerland decision, but that could just be a signal of desperation.

Germany's DAX has a -32% decline so far already, but remember the S&P had a -52% decline in 2008, and it had falls of -21%, -22%, and -28% earlier in 2008 before it finally succumbed. However, the DAX echoed those falls in 2008, whereas the S&P has only fallen -20% in 2011 and has recovered some while the DAX continues to fall. This signals that the market doesn't think the effect on the USA can be as great as 2008. And the Chinese market remains strong thus far.

http://stockcharts.com/h-sc/ui?s=DAX

http://www.bloomberg.com/news/2011-09-10/china-s-trade-surplus-in-august-reaches-17-76-billion-exports-rise-24-5-.html

So this leads me to believe we have already seen the lows for commodities in 2011, and that we may have already seen the lows for the S&P, but I tend to think we will get a mini-crash down to about 950 in Oct or Nov. I think this will give us one more chance to buy commodities on a dip, but it won't be as low as May. And we may get a slight dip in gold, with the lowest probably around $1550, but more likely above $1700. I don't think there is much chance of a sub-$1400 gold and sub-$30 silver in 2011.

S&P500 likely up for another week or two

S&P500 likely up for another week or two

We hit that crucial $1220 level on Friday:

http://www.gold-eagle.com/editorials_08/jones091211.html

Dollar is going much higher:

http://www.gold-eagle.com/editorials_08/radomski091311.html

http://www.gold-eagle.com/editorials_08/summers091211.html

EU's crash may be far from over:

http://www.gold-eagle.com/editorials_08/ciovacco091511.html

And thus crash of S&P is ahead in October or so, which the emerging markets are also warning:

http://www.gold-eagle.com/editorials_08/ciovacco091611.html

Thus precious metals and commodities likely also bearish until we get through the worst of this, but gold is unpredictable and I wouldn't want to bet on it going lower than $1640:

http://www.gold-eagle.com/editorials_08/ciovacco091611.html

If gold goes below $1640, we have serious deflation event and crash ahead:

http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-gold-report-091511.pdf

So what I am expecting is S&P to peak in a week or two at around 1250+. It may or may not dip slightly first. Then in October for it to crash to 950.

I am expecting gold to be in weak patch (but volatility surges are not impossible), probably to bottom before the S&P does, probably above $1640.

I am expecting silver and commodities to finally roll over and set their bottoms.

As this maximum fear sets in, that is the time to go long everything, with a strong preference for silver and leveraged calls on GDX (miners).

I would look to short the S&P or Wilshire 2000 at around 1250.

Remember these are only probabalistic guesses, and can be entirely wrong. I wouldn't sell gold at $1800, trying to capture a $160 dip that may never happen. At $1900+, I would lighten up on gold, if the final crash of markets has not completed.

http://www.gold-eagle.com/editorials_08/jones091211.html

Dollar is going much higher:

http://www.gold-eagle.com/editorials_08/radomski091311.html

http://www.gold-eagle.com/editorials_08/summers091211.html

EU's crash may be far from over:

http://www.gold-eagle.com/editorials_08/ciovacco091511.html

And thus crash of S&P is ahead in October or so, which the emerging markets are also warning:

http://www.gold-eagle.com/editorials_08/ciovacco091611.html

Thus precious metals and commodities likely also bearish until we get through the worst of this, but gold is unpredictable and I wouldn't want to bet on it going lower than $1640:

http://www.gold-eagle.com/editorials_08/ciovacco091611.html

If gold goes below $1640, we have serious deflation event and crash ahead:

http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-gold-report-091511.pdf

So what I am expecting is S&P to peak in a week or two at around 1250+. It may or may not dip slightly first. Then in October for it to crash to 950.

I am expecting gold to be in weak patch (but volatility surges are not impossible), probably to bottom before the S&P does, probably above $1640.

I am expecting silver and commodities to finally roll over and set their bottoms.

As this maximum fear sets in, that is the time to go long everything, with a strong preference for silver and leveraged calls on GDX (miners).

I would look to short the S&P or Wilshire 2000 at around 1250.

Remember these are only probabalistic guesses, and can be entirely wrong. I wouldn't sell gold at $1800, trying to capture a $160 dip that may never happen. At $1900+, I would lighten up on gold, if the final crash of markets has not completed.

A very scary chart

A very scary chart

Looks like 2008 again:

Ratio of gold to base metals:

http://www.gold-eagle.com/editorials_08/brochert091711.html

Ratio of gold to base metals:

http://www.gold-eagle.com/editorials_08/brochert091711.html

BS

BS

http://finance.yahoo.com/blogs/daniel-gross/why-economy-looks-expansion-feels-recession-152916110.html

============================

Here follow more rational analysis.

Saville:

http://www.gold-eagle.com/editorials_08/saville101111.html

Summers:

http://www.gold-eagle.com/editorials_08/summers101111.html

Mich:

http://www.financialsense.com/contributors/michael-shedlock/2011/10/13/unprecedented-drop-in-port-traffic

Chris Martenson:

http://www.financialsense.com/contributors/chris-martenson/2011/10/11/big-trouble-brewing

Sheridan:

http://www.financialsense.com/contributors/cris-sheridan/2011/10/12/markets-stage-strong-rally-fundamental-problems-still-remain

And yet the numbers continue to tell the story of a grinding, continuing recovery that, in some ways, appears to be accelerating. Amid the rising gloom, the data flow in recent weeks has generally been positive. Retail sales, reported this morning, were up strongly in September, up 1.1 percent from August; August's figure was revised upwards. Compared with a year ago, retail sales are up 8 percent. They were led by strong car sales. After putting up a bagel in August, the economy added 103,000 payroll jobs in September, including 137,000 private sector positions. Overall GDP growth, which fell dangerously close to flatlining in the first quarter, in which it grew at just a .4 percent annual rate, grew at a 1.3 percent rate in the second quarter. Macroeconomic Advisers, which tracks and continually updates estimates in real time with each new data point, currently has the third quarter expanding at a 2.7 percent rate. The Conference Board Leading Economic Index pushes higher every month.

- Car sales rebounded because Japan was shipping again.

- Consumers are increasing debt in back-to-school spending spree.

- Macroeconomic Advisers predicted 2.7 GDP for Q1 too.

- "Indicators Point to Continued Weak Growth", and it gave no warning of the current dip, and Chris Puplava has explained it is flawed because its monetary components no longer reflect reality. Other indicators say otherwise.

============================

Here follow more rational analysis.

Saville:

http://www.gold-eagle.com/editorials_08/saville101111.html

Widespread realisation that 2012 earnings will be lower -- perhaps much lower -- than 2011 earnings could be the next shoe to drop.

Summers:

http://www.gold-eagle.com/editorials_08/summers101111.html

As ZeroHedge noted, collapse in this economic metric has been greater than any two-month period in the last ten years, including 2008.

We also see that the ISM purchasers managers' index, the Philly Fed index, payrolls, and the ECRI weekly leading index are all at or about to break into recessionary levels.

Here is the reality of the financial system today:

- The European banking system is facing systemic collapse.

- The US economy has rolled over and is in a confirmed double dip in the context of a larger DE-pression.

- The Central Banks and regulators have admitted we are peering into the abyss and they have no clue what to do.

remember, stocks took six months to bottom after Lehman… and that was when the Fed still had some bullets left to combat the collapse

Mich:

http://www.financialsense.com/contributors/michael-shedlock/2011/10/13/unprecedented-drop-in-port-traffic

Port traffic on the West coast is down significantly. Expected traffic for September is also way lower. Yet analysts have been busy raising expectations for the holiday season. One thing for sure, one group is wrong.

It's not just port traffic that is down. Spokesmen for Burlington Northern Santa Fe Railway and Federal Express said the same thing.

Chris Martenson:

http://www.financialsense.com/contributors/chris-martenson/2011/10/11/big-trouble-brewing

The Probability of A Near-Term Market Crash Is Growing Uncomfortably High

I do not toss around the idea of a market crash lightly. If you've been following me long enough, you know that only in very rare instances do I issue a cautionary Alert (I've only issued four since my website launched in 2008), and I am generally not given to hyperbole.

Let's be clear: I'm not issuing an Alert at this time. But I am concerned that a materially adverse disruption to the financial markets is increasingly likely in the near future.

Sheridan:

http://www.financialsense.com/contributors/cris-sheridan/2011/10/12/markets-stage-strong-rally-fundamental-problems-still-remain

Subsiding fears over a near-term European crisis with plans to recapitalize their banking system along with better-than-expected economic data coming out of the US have launched the markets strongly out of their recent new lows made earlier this month.

Recent data from the National Association of Active Investment Managers (NAAIM) also showed that bearish sentiment had recently dropped to levels not seen since the last major market bottom formed in March 2009.

The major question on many investors’ minds right now, however, is “How long can it last?”

It appears that the markets and the financial press are currently fulfilling a recent study released by Nature showing that our brains are hardwired to reject or ignore any sort of negative news. Then again, this study isn’t all that surprising if you listen to CNBC.

In all honesty, recent positive news hasn’t changed anything fundamentally regarding Europe’s wider problems or the near certainty of a global and US recession. But, then again, we could easily dismiss these hard realities for another week, month, or quarter until another crack in the damn sends water shooting all over the place.

Page 7 of 7 •  1, 2, 3, 4, 5, 6, 7

1, 2, 3, 4, 5, 6, 7

Similar topics

Similar topics» What Is Money?

» Natural Health and Gods Healing

» Internet Socialism

» Inflation or Deflation?

» Is Capitalism or is Socialism increasing?

» Natural Health and Gods Healing

» Internet Socialism

» Inflation or Deflation?

» Is Capitalism or is Socialism increasing?

Page 7 of 7

Permissions in this forum:

You cannot reply to topics in this forum