Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 3 of 24

Page 3 of 24 •  1, 2, 3, 4 ... 13 ... 24

1, 2, 3, 4 ... 13 ... 24

massive money supply decrease in '90 of BOJ

massive money supply decrease in '90 of BOJ

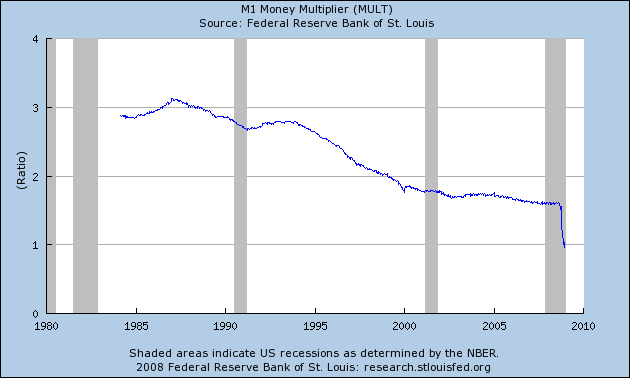

I think the major difference between Japan from '89 - '01 and USA today is also the totally different central bank policy. The BOJ reduced the money supply in a very massive way - see also chart_1: http://www.boj.or.jp/en/type/ronbun/rev/data/rev07e01.pdf

whereas the FED is increasing the money supply http://www.shadowstats.com/alternate_data/money-supply / massive increase of M1!

Any objects or other thoughts in this matter?

whereas the FED is increasing the money supply http://www.shadowstats.com/alternate_data/money-supply / massive increase of M1!

Any objects or other thoughts in this matter?

silberruecken- Posts : 30

Join date : 2008-11-12

silberruecken- Posts : 30

Join date : 2008-11-12

Editorial part 1 of 3

Editorial part 1 of 3

Editorial part 1 (of 3): "What has caused the financial turmoil?"

I know that I have simplified things and that the real cause of the unraveling is more towards the use of papermoney itselves but I have to start somewhere...Having said that, what do you think?

Shelby, thanks for the charts posted above of which I used one in the editorial.

I know that I have simplified things and that the real cause of the unraveling is more towards the use of papermoney itselves but I have to start somewhere...Having said that, what do you think?

Shelby, thanks for the charts posted above of which I used one in the editorial.

LibertySilver- Posts : 65

Join date : 2008-10-30

Re: Inflation or Deflation?

Re: Inflation or Deflation?

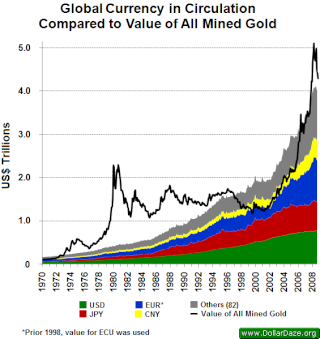

Editorial about hyperdeflation leading to hyperinflation with some scary charts of how FED is creating papermoney out of thin air (instead of banks creating them by loans which isn't much better but anyways...)

http://libertysilver.se/pages.php/page/editorial_090114/language/en

http://libertysilver.se/pages.php/page/editorial_090114/language/en

LibertySilver- Posts : 65

Join date : 2008-10-30

Re: Inflation or Deflation?

Re: Inflation or Deflation?

Excellent 2nd article. Much more concise than 1st one. The charts tell the picture.

What these charts say is that people only have one refuge, which is gold & silver. But it will be a strange kind of refuge, because the fiat system is a monopoly on commerce now. So one can own gold & silver and still becoming poorer. Actually they are not poorer in the long run and over all asset classes and all economies internationally, but in terms of their daily expenditures and realities, they may feel that gold & silver are not performing a useful function in the short term. Everyone was waiting for the massive hyperinflation event where the masses rush into precious metals. This time is different...

Just holding on to your net worth will be the hardest thing in this period. It is not about appreciation of value, as much as it is about just holding on to what you have. And you need to sell EVERYTHING except gold & silver and get very lean and playin the waiting game of letting your capital survive. Which also means your capital needs to be outside of cabal choke points. Which to me, means yuo need to have your capital not all in one country. YOu need some of your capital outside of your home country, ready to deploy to new investment opportunities coming in the developing world.

If you are determined to fight out in 100% domestic posture (not international), then I think you need to get your metal in coins. Bars may have a peak moment, then you can cash out of them, but the coins will have the longest run, as eventually we get down to a scary economy on the local level. You need to be ready to barter and trade on a local level, where the cabal won't be able to choke to such granularity. But if you have a large net worth in metal, you simply won't be able to utilitize all your metal effectively in such a strategy (limitation of time and energy to barter locally in small increments). You really have to be international in order to fully profit from this period... In which case bars then have utility for moving large $$$ in small space and economy-of-scale. But just remember that the larger the denomination of metal, then the less local barter opportunities you will have and thus the higher you move up into the cabal controlled choke points (dealers, banks, borders, customs agents, etc).

LibertySilver, perhaps yuo can elaborate on this, if you get my direction...

What these charts say is that people only have one refuge, which is gold & silver. But it will be a strange kind of refuge, because the fiat system is a monopoly on commerce now. So one can own gold & silver and still becoming poorer. Actually they are not poorer in the long run and over all asset classes and all economies internationally, but in terms of their daily expenditures and realities, they may feel that gold & silver are not performing a useful function in the short term. Everyone was waiting for the massive hyperinflation event where the masses rush into precious metals. This time is different...

Just holding on to your net worth will be the hardest thing in this period. It is not about appreciation of value, as much as it is about just holding on to what you have. And you need to sell EVERYTHING except gold & silver and get very lean and playin the waiting game of letting your capital survive. Which also means your capital needs to be outside of cabal choke points. Which to me, means yuo need to have your capital not all in one country. YOu need some of your capital outside of your home country, ready to deploy to new investment opportunities coming in the developing world.

If you are determined to fight out in 100% domestic posture (not international), then I think you need to get your metal in coins. Bars may have a peak moment, then you can cash out of them, but the coins will have the longest run, as eventually we get down to a scary economy on the local level. You need to be ready to barter and trade on a local level, where the cabal won't be able to choke to such granularity. But if you have a large net worth in metal, you simply won't be able to utilitize all your metal effectively in such a strategy (limitation of time and energy to barter locally in small increments). You really have to be international in order to fully profit from this period... In which case bars then have utility for moving large $$$ in small space and economy-of-scale. But just remember that the larger the denomination of metal, then the less local barter opportunities you will have and thus the higher you move up into the cabal controlled choke points (dealers, banks, borders, customs agents, etc).

LibertySilver, perhaps yuo can elaborate on this, if you get my direction...

Re: Inflation or Deflation?

Re: Inflation or Deflation?

Excellent 2nd article. Much more concise than 1st one. The charts tell the picture.

Thanks Shelby, I agree. Wasn't too happy with the first part myselves. Not aspiring to be a writer anyways but have got some positive feedback on the small articles I've written before and since there is not much information available here in Sweden about the silver market (publishing the articles in dual language swedish/english) it simply can't hurt.

What these charts say is that people only have one refuge, which is gold & silver. But it will be a strange kind of refuge, because the fiat system is a monopoly on commerce now.

Yes, the perception is that paper is the only money available but this might change relatively quickly as we run down Exters Pyramid. With the bond market about to crash, we'll only have the papermoney step left. I think the dollar will appreciate against other paper currencies during this recently started leg down in the stock markets (coming 1-3 months) . Thereafter I believe currencies (paper as well as real physical currency - gold & silver) with decouple from the stock market as the dollar (and other currencies but especially the dollar) will depreciate with extreme volatility. So sure, deflation in some assets now, but with the current speed of nationalization of evertything the perception of paper as money will eventually become more and more questioned.

If you are determined to fight out in 100% domestic posture (not international), then I think you need to get your metal in coins. Bars may have a peak moment, then you can cash out of them, but the coins will have the longest run, as eventually we get down to a scary economy on the local level.

I'm having some plans and have found an interesting jurisdiction from where I can help Europeans with investing in silver without paying VAT. I'm still investigating this though. The location is minimal government, minimum tax, minimum restrictions, very safe relatively in terms of crime etc. and would be suitable for a vault. More on that later...

LibertySilver- Posts : 65

Join date : 2008-10-30

Re: Inflation or Deflation?

Re: Inflation or Deflation?

LibertySilver wrote:...I'm having some plans and have found an interesting jurisdiction from where I can help Europeans with investing in silver without paying VAT. I'm still investigating this though. The location is minimal government, minimum tax, minimum restrictions, very safe relatively in terms of crime etc. and would be suitable for a vault. More on that later...

Good to hear. How are sure the cabal can't attack there? Is that Gibraltar?

Re: Inflation or Deflation?

Re: Inflation or Deflation?

No, not Gibraltar but not to a bad guess...

LibertySilver- Posts : 65

Join date : 2008-10-30

Debt bubble implosion can not be stablized

Debt bubble implosion can not be stablized

http://video.google.com/videoplay?docid=8689277699414868058&hl=en

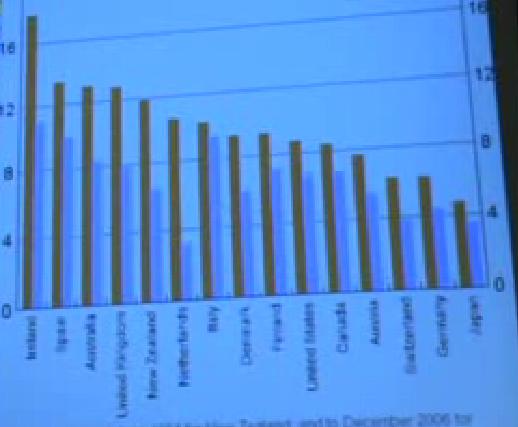

(chart brown bar is debt rate of growth, and blue bar is GDP rate of growth)

He explains in the above Q&A portion of video why the situation can't be stablized and must implode. Look all the OECD countries have a massive problem.

So what will the OECD govts do? They will try to stabalize which means hyperinflation. I see massive volatility between deflation and failed attempts to reflate. Thus I see broken producers and massive shortages. I see massive tempest of hell coming.

See his whole video also:

http://video.google.com/videoplay?docid=1375113008927627575

Listen also to Doug Casey:

https://www.youtube.com/watch?v=cyq6Y_EfWQA

https://www.youtube.com/watch?v=cXGOCyvnjaU (says you must get some assets outside USA)

(chart brown bar is debt rate of growth, and blue bar is GDP rate of growth)

He explains in the above Q&A portion of video why the situation can't be stablized and must implode. Look all the OECD countries have a massive problem.

So what will the OECD govts do? They will try to stabalize which means hyperinflation. I see massive volatility between deflation and failed attempts to reflate. Thus I see broken producers and massive shortages. I see massive tempest of hell coming.

See his whole video also:

http://video.google.com/videoplay?docid=1375113008927627575

Listen also to Doug Casey:

https://www.youtube.com/watch?v=cyq6Y_EfWQA

https://www.youtube.com/watch?v=cXGOCyvnjaU (says you must get some assets outside USA)

Will we shift back to inflation?

Will we shift back to inflation?

No! The fear will remain deflation! So the pyschology of the people will remain stuck in fearing deflation. I think Casey gets this partially wrong:

http://caseyresearch.com/pdfs/20090116_ObamaNewerDeal.pdf

The reflation will always be insufficient compared to the $600+ trillion in imploding derivatives wave after wave.

The stimulus (going mostly to lower/middle incomes) will mostly end up in China, and bankers pockets, as it will be used to service debt and maintain material life and China produces everything.

I do agree that the monetization of Tbonds/bills, means that people with any wealth move down Exter's Pyramid to gold. I also see shortages, which will be bullish for silver as people will perceive that commodities are rare and thus will brush off the notion that silver will decline in a deflation. Silver will outperform now forward (but with volatility in ratio to gold). However sometime in 2010, the fear of wealthy will shift to one of capital controls as Obama has to do something about the "hoarding" and the selling of dollar/Tbonds. I do not know if gold might outperform at that time due to being more portable if at 40 ratio, but I will say the silver bull market will be a long one, and I think the notion of physically moving gold across borders is perhaps arcane.

http://caseyresearch.com/pdfs/20090116_ObamaNewerDeal.pdf

The reflation will always be insufficient compared to the $600+ trillion in imploding derivatives wave after wave.

The stimulus (going mostly to lower/middle incomes) will mostly end up in China, and bankers pockets, as it will be used to service debt and maintain material life and China produces everything.

I do agree that the monetization of Tbonds/bills, means that people with any wealth move down Exter's Pyramid to gold. I also see shortages, which will be bullish for silver as people will perceive that commodities are rare and thus will brush off the notion that silver will decline in a deflation. Silver will outperform now forward (but with volatility in ratio to gold). However sometime in 2010, the fear of wealthy will shift to one of capital controls as Obama has to do something about the "hoarding" and the selling of dollar/Tbonds. I do not know if gold might outperform at that time due to being more portable if at 40 ratio, but I will say the silver bull market will be a long one, and I think the notion of physically moving gold across borders is perhaps arcane.

DEFLATION of HOMES, PAPER ASSETS and EQUITIES, But INFLATION in REAL GOODS

DEFLATION of HOMES, PAPER ASSETS and EQUITIES, But INFLATION in REAL GOODS

IT'S GOING TO BE INFLATION and DEFLATION at the SAME TIME

I still believe we will see DEFLATION and INFLATION at the same time. DEFLATION of worthless ASSETS, but INFLATION of FOOD, ENERGY and COMMODITIES. Will will get a DEVALUATION of the DOLLAR overnight and then GOLD and SILVER will rise. Secondly as the BANKS become NATIONALIZED....say goodbye to PAPER ASSETS. Furthermore.....RETAIL, COMMERICAL and HOME REAL ESTATE values will IMPLODE further. Thus...this is the DEFLATION.

We all are GROWN UPS but some do not realize a good PORTION of our OIL SUPPLY comes in at $60-100 dollars a BARREL MARGINAL COST of PRODUCTION. OIL SAND COMPANIES are going BANKRUPT....and SUPPLY DESTRUCTION will OUTWEIGH DEMAND DESTRUCTION....just as the 600 TRILLION in DERIVATIVES will OUTWEIGH the TRILLIONS of DOLLARS printed by the FED.

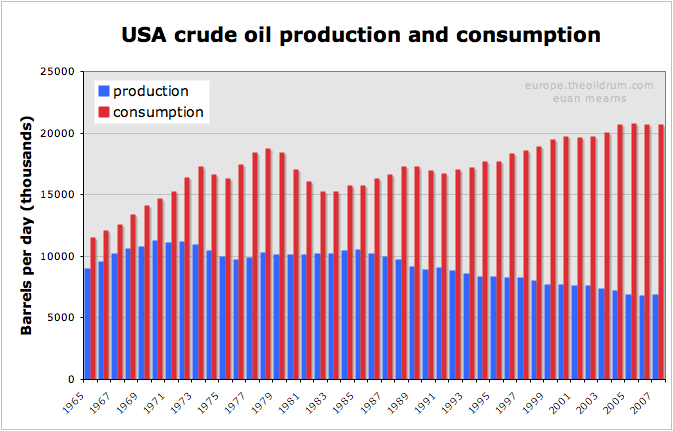

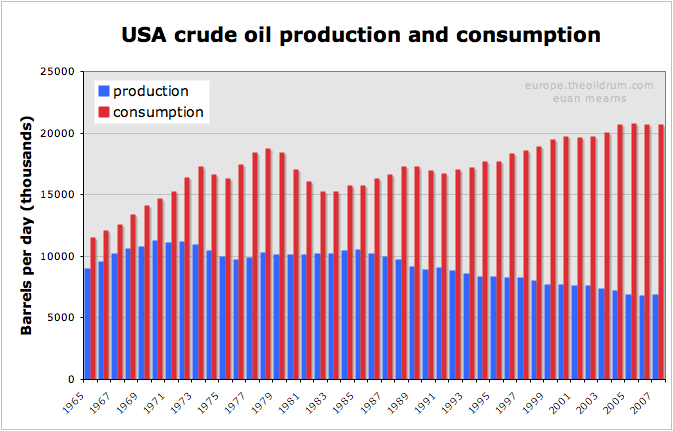

So, YES....we will see DEFLATION of worthless SUBURBAN SPRAWL, and most PAPER ASSETS. But, do not forget this GRAPH my friends:

All one has to do is look at the RED and BLUE LINES. The BLUE is the USA OIL PRODUCTION......the RED is the USA OIL CONSUMPTION. This is the BIG PROBLEM no one wants to touch with a TEN FOOT POLE. When the BANKING SYSTEM COLLAPSES...and gets nationalized......PAPER DOLLARS will no longer be taken as PAYMENT for OIL. Sure, OIL production will drop, not by DEMAND DESTRUCTION...but through FIAT DESTRUCTION as the many countries...especially the UNITED STATES will not be able to AFFORD it. Again.......there may be less WORLD OIL PRODUCTION due to the fact that many countries with WORTHLESS FIAT DOLLARS will not be able to afford it. I could see OIL becoming more VALUABLE in whatever NEW CURRENCY (middle east, Chinese, Russian or basket) or by its being sold by GOLD or SILVER, etc.

The GREAT DISINTEGRATION of the UNITED STATES is UNDERWAY. This is STAGE 1 entering STAGE 2

I still believe we will see DEFLATION and INFLATION at the same time. DEFLATION of worthless ASSETS, but INFLATION of FOOD, ENERGY and COMMODITIES. Will will get a DEVALUATION of the DOLLAR overnight and then GOLD and SILVER will rise. Secondly as the BANKS become NATIONALIZED....say goodbye to PAPER ASSETS. Furthermore.....RETAIL, COMMERICAL and HOME REAL ESTATE values will IMPLODE further. Thus...this is the DEFLATION.

We all are GROWN UPS but some do not realize a good PORTION of our OIL SUPPLY comes in at $60-100 dollars a BARREL MARGINAL COST of PRODUCTION. OIL SAND COMPANIES are going BANKRUPT....and SUPPLY DESTRUCTION will OUTWEIGH DEMAND DESTRUCTION....just as the 600 TRILLION in DERIVATIVES will OUTWEIGH the TRILLIONS of DOLLARS printed by the FED.

So, YES....we will see DEFLATION of worthless SUBURBAN SPRAWL, and most PAPER ASSETS. But, do not forget this GRAPH my friends:

All one has to do is look at the RED and BLUE LINES. The BLUE is the USA OIL PRODUCTION......the RED is the USA OIL CONSUMPTION. This is the BIG PROBLEM no one wants to touch with a TEN FOOT POLE. When the BANKING SYSTEM COLLAPSES...and gets nationalized......PAPER DOLLARS will no longer be taken as PAYMENT for OIL. Sure, OIL production will drop, not by DEMAND DESTRUCTION...but through FIAT DESTRUCTION as the many countries...especially the UNITED STATES will not be able to AFFORD it. Again.......there may be less WORLD OIL PRODUCTION due to the fact that many countries with WORTHLESS FIAT DOLLARS will not be able to afford it. I could see OIL becoming more VALUABLE in whatever NEW CURRENCY (middle east, Chinese, Russian or basket) or by its being sold by GOLD or SILVER, etc.

The GREAT DISINTEGRATION of the UNITED STATES is UNDERWAY. This is STAGE 1 entering STAGE 2

SRSrocco- Posts : 22

Join date : 2008-11-02

Re: Inflation or Deflation?

Re: Inflation or Deflation?

I find it interesting that the consumption line was so high around 1979, then dropped off. I would have thought that there would not have been a peak like that then down to 1983. Why was it so high around 1978-80?

Yellowcaked- Posts : 39

Join date : 2008-10-22

Re: Inflation or Deflation?

Re: Inflation or Deflation?

Yellowcaked wrote:I find it interesting that the consumption line was so high around 1979, then dropped off. I would have thought that there would not have been a peak like that then down to 1983. Why was it so high around 1978-80?

What do you mean "consumption line"?

From email:

> On the internet situation, my concern is power supply. The electric grid

> in

> the U.S. is largely a patchwork of independent systems, much like a tangle

> of country roads. There are very few backbone/superhighway transmission

> lines, as the grid was developed nationally thru small towns connecting

> their systems to their neighbors. It would shock most folks to learn how

> weak and prone to sabotage it is.

Large server farms have located near hydropower and have diesel generator backups. I think much of the internet is diesel backed up. So short-term prices may go up, but service should remain for those who can pay. The trend of decreasing international prices for netaccess should resume. I agree connectivity might become less geographically ubiquitious, although I hear that Obama plans a infrastructure spending on this information grid.

I think WiFiMAX might become very important, as then a connection can be broadbast in radius of miles, from a diesel backed up tower.

I see the "cabal" (the govt/fascist apparatus) achieving more towards their goal to centralize control of the distribution of electricity and internet connectivity.

Surburbia will die. So that connectivity and grid may die as well. People will move towards cities and connectivity/grid can be focused.

Internationally I suspect we won't see this problem in developing nations. I see 6 billion growth markets...

...think what is dying and what is growing...

What do you think?

>

> I agree that mental labor is more resource efficient than physical, but

> fear

> that we will have to rebuild our economy thru some sort of manufacturing

> base. I also believe the knowledge of physical trades (welding,

> carpentry,

> farming, etc) will become more important as market efficiencies collapse.

> (Jim Rogers spoke about this in one of his interviews about a year ago).

IMO, if this occurs, this will be a short-term phenomenon, as society will choose to be saved by the new world order (Amero, etc) instead and will not fight their hearding into cities, where they can be serviced by immigrants working at a few $$ per day. I see USA moving more to what Europe did, which is a dependent socialistic society of do-nothing. In short-term, we would see massive suffering and dislocation, and thus your scenario, but I just don't think this scales well to the American culture at this juncture. We are not going back to the 1800s. People will choose their intraveneous latte in a socialist city life instead-- they will be alive but not even know it. Some of you will resist in the rural areas, but you will be marginalized by what the majority chooses to accept. My Belgium friend tells me in his country you need a permit to have any farm animal, even on a farm, which carries with it many requirements (e.g. vet injections, inspections, etc), which make farming totally not worth doing. Society-at-large will marginalize the rural life.

Most Americans have no desire whatsoever to go back to rural and "trades" life. When the last factories close, that is it for industrial life in America. Americans want to live a socialized life. They don't want to get their fingers dirty. I do not see a reset and a rebuilding. I see a long multi-decade decline into increasing socialism, excessive taxation, zombie life, as we see in Europe.

I think you even need a permit to have a pet in some places in Europe. YOu probably need a shitting permit for your dog to release himself. <joke>You probably even need a permit to pick your nose, because of the fungal waste product...I do not know if eating your bugars can exempt you...</joke> But this is progress? I mean here in Philippines taxi drivers stop in the road and urinate there at the side of their car...that is already illegal in the USA. It is only a short-hop to the above... Adam & Eve were naked, but nakedness is illegal in most Western countries, but it is not abnormal to see naked people in the provinces in Philippines taking a bath in river.

>

> The world will need the services that you are looking to provide, and it's

> just a matter of finding the best alternative to meet the challenges we'll

> face.

Thanks. Well of course the new world order currency will win in the end. But I think we have the opportunity now to help intrepret the path to it, and be part of the positive aspects of it that occur in interim stages. I see a window of oppportunity for barter and silver as money, as a release valve to unteneable situation the "cabal" is offering now. Society doesn't want the scorched financial earth result, and so those who offer ways forward which can co-exist with the "cabal", may have a shot of doing important and big things. I am not sure if I have the correct ideas, I am just trying.

Hyperinflation will be driven by de-pegging the Yuan?

Hyperinflation will be driven by de-pegging the Yuan?

Must read:

http://www.gold-eagle.com/editorials_08/decarbonnel012009.html

http://www.marketskeptics.com/2008/12/how-deflation-creates-hyperinflation.html

The predicted massive cycle turn downwards in March fits well with the above hypothesis. So debt based assets (everything except commodities & cheap consumer goods) will deflate, while cheap consumer goods will inflate due to dollar depreciation against Yuan and internal inflation in China soaking up the consumer goods raising the prices??? Hmmmm, but many factories closed in China and so China still has a lot of spare capacity in manufacturing. So it seems to me that China can increase capacity to keep consumer goods prices low, and rather that will drive the inflation into the raw inputs-- the commodities. I think the raw inputs (oil, food for more workers to work hard, commodities) are losing production, factories are closing for cheap consumer goods, but which one can be restarted the fastest? Well for sure the factories have to be restarted, else China will have riots, but commodity mines take time to restart after much higher prices have been established.

You would have to be pretty brave to buy base metals, plastic manufacturers, etc... but that may be the speculative play of a lifetime. Then again, the above also implies monetary breakage, so precious metals should also run. Silver is both base and monetary metal. Silver looks to run big time, but price fixing efforts may come into play, but I am not sure if that will be after a big run, or to delay a big run. I wonder if the possible failure of Barclays would allow the manipulators to do something drastic with the silver held in the SLV to depress the price?

http://www.gold-eagle.com/editorials_08/decarbonnel012009.html

http://www.marketskeptics.com/2008/12/how-deflation-creates-hyperinflation.html

The predicted massive cycle turn downwards in March fits well with the above hypothesis. So debt based assets (everything except commodities & cheap consumer goods) will deflate, while cheap consumer goods will inflate due to dollar depreciation against Yuan and internal inflation in China soaking up the consumer goods raising the prices??? Hmmmm, but many factories closed in China and so China still has a lot of spare capacity in manufacturing. So it seems to me that China can increase capacity to keep consumer goods prices low, and rather that will drive the inflation into the raw inputs-- the commodities. I think the raw inputs (oil, food for more workers to work hard, commodities) are losing production, factories are closing for cheap consumer goods, but which one can be restarted the fastest? Well for sure the factories have to be restarted, else China will have riots, but commodity mines take time to restart after much higher prices have been established.

You would have to be pretty brave to buy base metals, plastic manufacturers, etc... but that may be the speculative play of a lifetime. Then again, the above also implies monetary breakage, so precious metals should also run. Silver is both base and monetary metal. Silver looks to run big time, but price fixing efforts may come into play, but I am not sure if that will be after a big run, or to delay a big run. I wonder if the possible failure of Barclays would allow the manipulators to do something drastic with the silver held in the SLV to depress the price?

One possible scenario

One possible scenario

Something I emailed to my mother:

I may be making one last attempt to "save the world". If I launch an digital metal cash service, then you can have the option to hold your silver in that if you want, so you don't have to put the coins at your house. If I do launch this service, people can take delivery of coins at any time with the push of a button on the internet.

2009 is not going to be a nice year. Hopefully your sales orders will be written before the bottom falls out on unemployment going to 30% nationwide (it is already 16%). 50% unemployment by 2010.

China will be forced to unload dollars later in 2009, because the yuan peg is killing their economy with massive deflation, inflation, and unemployment. They just can not keep the yuan devalued any longer without having a revolution internally. So therefor, the dollar will fall off a cliff and there is be massive rise in prices in USA in 2009, just as the same time there will be massive unemployment.

I expect riots in USA, some rednecks will start shooting, then the govt will use that as an excuse to institute road blocks and confiscate all gun ownership in USA. Maybe this will be in 2010.

When the dollar goes bezerk, then expect all sort of controls on our banking withdrawals and transfers to be sure we are not buying gold or otherwise trying to "get out" of the dollar. The govt will have only 2 choices:

* raise taxes to near 100%

* print money

They will probably do the latter until we have a Zimbabwe situation in USA. But then they will have to do the tax thing and keep everyone locked into dollars so they can confiscate all the wealth via taxes.

We are going into a massive tempest.

I may be making one last attempt to "save the world". If I launch an digital metal cash service, then you can have the option to hold your silver in that if you want, so you don't have to put the coins at your house. If I do launch this service, people can take delivery of coins at any time with the push of a button on the internet.

2009 is not going to be a nice year. Hopefully your sales orders will be written before the bottom falls out on unemployment going to 30% nationwide (it is already 16%). 50% unemployment by 2010.

China will be forced to unload dollars later in 2009, because the yuan peg is killing their economy with massive deflation, inflation, and unemployment. They just can not keep the yuan devalued any longer without having a revolution internally. So therefor, the dollar will fall off a cliff and there is be massive rise in prices in USA in 2009, just as the same time there will be massive unemployment.

I expect riots in USA, some rednecks will start shooting, then the govt will use that as an excuse to institute road blocks and confiscate all gun ownership in USA. Maybe this will be in 2010.

When the dollar goes bezerk, then expect all sort of controls on our banking withdrawals and transfers to be sure we are not buying gold or otherwise trying to "get out" of the dollar. The govt will have only 2 choices:

* raise taxes to near 100%

* print money

They will probably do the latter until we have a Zimbabwe situation in USA. But then they will have to do the tax thing and keep everyone locked into dollars so they can confiscate all the wealth via taxes.

We are going into a massive tempest.

We are not going back to 1800s!

We are not going back to 1800s!

I have to refute something SRSrocco wrote in another forum that many us read:

http://jasonhommelforum.com/forums/showpost.php?p=50943&postcount=2189

Steve I agree with all the possible bad outcomes you listed, and I agree there will be a period where rural homesteads may see a resurgence, but Steve there is no way people are going back to a rural life. NO WAY! YOU ARE DREAMING!

Majority of people will choose to be crammed into cities instead, which will solve the energy problem and will allow them to continue on their migration towards the zombies in Revelations.

Steve, the lowest cost, highest specialization of labor paradigms win. The useless eaters end up caged in the smallest area for the most efficiency. They then parasite on the system (socialism), some of them add highly specialized mental labor to the system. Packing people into cities is the most economic result. Rural homesteads is not.

We are headed for a war between the rural rebels who want to remain free, and the cities which want to control the rural for their own use. This is North versus South all over again. The world is constantly moving in this direction, where most people move to the more economically efficient cities and high specialization of labor (not jack of all trades rural folk, which is highly unproductive in comparison).

I am throwing my efforts behind a new world order with silver and gold as money and increasing efficiency in labor, with more people moving to cities, dying suburbs, and more people doing mental labor on the internet. I would love to live on a farm and that simple life, but that is not the future.

Realize that yes for a while there will be disruptions in food supply, etc, which will force people to huddle into cities and then the new world order will rise up with cities in control of the farms, and new money system.

I am so sure of this, I can't see any possibility that the majority move back to farms. Sorry Steve, I don't know where you get that idea from???????

The cities will send troops to the farms as necessary to enforce the supply of food. There reduction in use of oil by the move into cities and mass transportion, will over time free up enough energy for farming. As well, the cities will eventually be run on natural gas, nuclear, as it can be delivered in mass transportion forms (subways can run on electricity), etc. Of course the transistion period will be chaotic, which is why I agree with all your stated bad outcomes over the next 10 years or so.

http://jasonhommelforum.com/forums/showpost.php?p=50943&postcount=2189

Steve I agree with all the possible bad outcomes you listed, and I agree there will be a period where rural homesteads may see a resurgence, but Steve there is no way people are going back to a rural life. NO WAY! YOU ARE DREAMING!

Majority of people will choose to be crammed into cities instead, which will solve the energy problem and will allow them to continue on their migration towards the zombies in Revelations.

Steve, the lowest cost, highest specialization of labor paradigms win. The useless eaters end up caged in the smallest area for the most efficiency. They then parasite on the system (socialism), some of them add highly specialized mental labor to the system. Packing people into cities is the most economic result. Rural homesteads is not.

We are headed for a war between the rural rebels who want to remain free, and the cities which want to control the rural for their own use. This is North versus South all over again. The world is constantly moving in this direction, where most people move to the more economically efficient cities and high specialization of labor (not jack of all trades rural folk, which is highly unproductive in comparison).

I am throwing my efforts behind a new world order with silver and gold as money and increasing efficiency in labor, with more people moving to cities, dying suburbs, and more people doing mental labor on the internet. I would love to live on a farm and that simple life, but that is not the future.

Realize that yes for a while there will be disruptions in food supply, etc, which will force people to huddle into cities and then the new world order will rise up with cities in control of the farms, and new money system.

I am so sure of this, I can't see any possibility that the majority move back to farms. Sorry Steve, I don't know where you get that idea from???????

The cities will send troops to the farms as necessary to enforce the supply of food. There reduction in use of oil by the move into cities and mass transportion, will over time free up enough energy for farming. As well, the cities will eventually be run on natural gas, nuclear, as it can be delivered in mass transportion forms (subways can run on electricity), etc. Of course the transistion period will be chaotic, which is why I agree with all your stated bad outcomes over the next 10 years or so.

re: We are not going back to 1800s!

re: We are not going back to 1800s!

First of all, I completely agree with SRSrocco that people should get out of their retirement plans asap, and I agree that most USA real estate will become illiquid and incur increasing property taxes from bankrupted states and local govts. I do believe things will get chaotic and much worse and highly socialistically fascist. I would get out of everything that you can't carry with you, with exceptions for high density rental properties especially in regions that were not debt-inflated (what Rich Man, Poor Man has been buying).

Also I want to clarify that when I said I am betting the new world order will happen, it is because it will! I would be stupid to pretend it won't happen, when it is a natural progression of mankind. I am not trying to help the new world order be more fascist, I am trying to do something which will make the new world order more free (gold & silver based!). I am trying to be in harmony with the natural direction of mankind, which I am hoping will embrace a real gold & silver money system, not some cabal manipulated facism. I think we have a unique moment in history to offer the better version of the new world order. I am trying to be clever and offer in forms that match what the masses will want now (e.g. my proposed SpendStuff.com to get people into bartering their junk, people love junk and trading tired junk for new junk, fits the mass culture, then trying to get people into trading silver and gold for these things with the proposed CoinATM.com).

Steve, I agree that life has to change. There McExcessLife has to end. Agreed! But the rural life is not the only alternative. One alternative is socialist-fascist-totalitarian rationing. Another alternative is to take all that wasteful use of resources for western luxury living, redirect it to huge export farms in India (precisely what Rothschild is investing in, google it! India is #1 producer of food in world!), and then keep the "useless eaters" (not my term) in the cities where their resource usage will be much less. Once you have people concentrated in a small area then transportation & housing resources cost goes down by an order-of-magnitude. Also very efficient electrical power (e.g. hydro and nuclear) can be used for almost all energy needs, when people are concentrated in small areas, supplement with natural gas in some cities where location is proximate to supplies. I am not knowledgeable about heating in the cold winter regions. I read about heating oil, but as I remember in my youth natural gas can be used for heating. I think there is 100s of years of methane gas in Siberia, I don't know if that is viable input. I simply understand scientifically based on the Entropy of systems, that we will NOT run out of energy until the Sun stops sending energy to Earth. It is simply a matter of proper organization technology and society to fit the energy paradigms that are currently viable.

I do agree there is a massive, chaotic adjust ahead for the next decade or more.

The question is how will society cope and adjust. I want to try to do my part to help us adjust faster.

I love rural and simple life, but I also see how impractical that lifestyle is. If I was growing my own food, I would have no time to develop any programs to help change the world in positive ways. I also see that at least 50% of the people in the rural areas in Asia can't wait to leave and get to the cities-- probably 90+%. That is not to say I won't end up on a farm someday, but that will be retirement or a hobby, not my full force of participation to best of my specialized abilities. We all have specialized knowledge and we are most productive when we use those talents. Steve are you getting a little bit bored on the farm since you left your 6 figure job in the city? I agree with you that rural areas are more pleasant to live in, but doing the farming with your own hands, do you think that is the most productive use of your brain? You could live in rural India and have some peasants do that work, and they would be grateful. Or better yet, live on a producing farm in rural Argentina and just rent. Set up your satellite internet connection and do consulting. I understand the Argentine govt taxes the heck out of exports, so there is a lot of cheap produce available within the country.

Also I want to clarify that when I said I am betting the new world order will happen, it is because it will! I would be stupid to pretend it won't happen, when it is a natural progression of mankind. I am not trying to help the new world order be more fascist, I am trying to do something which will make the new world order more free (gold & silver based!). I am trying to be in harmony with the natural direction of mankind, which I am hoping will embrace a real gold & silver money system, not some cabal manipulated facism. I think we have a unique moment in history to offer the better version of the new world order. I am trying to be clever and offer in forms that match what the masses will want now (e.g. my proposed SpendStuff.com to get people into bartering their junk, people love junk and trading tired junk for new junk, fits the mass culture, then trying to get people into trading silver and gold for these things with the proposed CoinATM.com).

Steve, I agree that life has to change. There McExcessLife has to end. Agreed! But the rural life is not the only alternative. One alternative is socialist-fascist-totalitarian rationing. Another alternative is to take all that wasteful use of resources for western luxury living, redirect it to huge export farms in India (precisely what Rothschild is investing in, google it! India is #1 producer of food in world!), and then keep the "useless eaters" (not my term) in the cities where their resource usage will be much less. Once you have people concentrated in a small area then transportation & housing resources cost goes down by an order-of-magnitude. Also very efficient electrical power (e.g. hydro and nuclear) can be used for almost all energy needs, when people are concentrated in small areas, supplement with natural gas in some cities where location is proximate to supplies. I am not knowledgeable about heating in the cold winter regions. I read about heating oil, but as I remember in my youth natural gas can be used for heating. I think there is 100s of years of methane gas in Siberia, I don't know if that is viable input. I simply understand scientifically based on the Entropy of systems, that we will NOT run out of energy until the Sun stops sending energy to Earth. It is simply a matter of proper organization technology and society to fit the energy paradigms that are currently viable.

I do agree there is a massive, chaotic adjust ahead for the next decade or more.

The question is how will society cope and adjust. I want to try to do my part to help us adjust faster.

I love rural and simple life, but I also see how impractical that lifestyle is. If I was growing my own food, I would have no time to develop any programs to help change the world in positive ways. I also see that at least 50% of the people in the rural areas in Asia can't wait to leave and get to the cities-- probably 90+%. That is not to say I won't end up on a farm someday, but that will be retirement or a hobby, not my full force of participation to best of my specialized abilities. We all have specialized knowledge and we are most productive when we use those talents. Steve are you getting a little bit bored on the farm since you left your 6 figure job in the city? I agree with you that rural areas are more pleasant to live in, but doing the farming with your own hands, do you think that is the most productive use of your brain? You could live in rural India and have some peasants do that work, and they would be grateful. Or better yet, live on a producing farm in rural Argentina and just rent. Set up your satellite internet connection and do consulting. I understand the Argentine govt taxes the heck out of exports, so there is a lot of cheap produce available within the country.

re: We are not going back to 1800s!

re: We are not going back to 1800s!

SRSrocco (Steve) provided a clarification in the other forum, that I hope I summarize correctly. Seems he is saying that we will not go back to inferior technology but reorganize the long-distance "just in time" distribution systems into local self-contained economies that produce what they need locally and do not trade. Or he is saying that production will move closer to the sources of the raw materials, or factories will move closer to the sources of inputs.

Steve such a paradigm would be backwards in the efficiency of economies-of-scale and diversity of market sources needed to drive the most competition and thus the highest efficiencies. Also transportation fuel is not the major problem of the world, if you remove debt-based demand. The problem of the world is misappropriation of consumption, due to excessive use of debt. Debt always misappropriates capital and then everything gets out-of-balance and collapses.

Not to be accusatory or combative, but it appears to me that you are conflating the imbalances caused by debt misappropriate of capital, and misassigning blame to the efficiency of diverse distribution systems. These systems are efficient so they adjust to the demand, and if the demand is misappropriated, then the distribution systems become misappropriated. But the inherent efficiency of diverse distribution systems (open competition, etc) is an essential feature of the rapid progress of mankind and going back to stringent local sourcing would drive man back to the Dark Ages (remember it was the road network of Roman Empire that brought prosperity and the debasement/debt collapse crippled the road network into Dark Ages). Sorry won't happen, although we will get a scare. The new gold backed world currency will come to save the day, and the march of mankind will continue on maximum efficiencies, which means clustered in cities, and diverse distribution trunklines. The internet naturally organizes itself in this cluster and trunk (hub & spoke) connections mesh topology, as do the road networks, as does the brain, as do the veins in our body, etc....

It is not that integrated, self-sufficient communities can't be done technologically, rather it is that human nature will become lazy and some people will do more of the work than others, and they will want to trade their labor for maximum value outside their local community. A basic principle of free market (max efficiency) economic theory is competition. Local means limited competition. And this is why the new world order and world govt is unavoidable, because economic integration forces political integration. I was watching a documentary on TV of how the building a giant canal linking North and South China, unified the country politically because the increased trade brought more competition, prosperity, and tied the economic fate of both regions to each other. This is exactly what globalization of trade has done. The internet was a big factor in this also.

Steve such a paradigm would be backwards in the efficiency of economies-of-scale and diversity of market sources needed to drive the most competition and thus the highest efficiencies. Also transportation fuel is not the major problem of the world, if you remove debt-based demand. The problem of the world is misappropriation of consumption, due to excessive use of debt. Debt always misappropriates capital and then everything gets out-of-balance and collapses.

Not to be accusatory or combative, but it appears to me that you are conflating the imbalances caused by debt misappropriate of capital, and misassigning blame to the efficiency of diverse distribution systems. These systems are efficient so they adjust to the demand, and if the demand is misappropriated, then the distribution systems become misappropriated. But the inherent efficiency of diverse distribution systems (open competition, etc) is an essential feature of the rapid progress of mankind and going back to stringent local sourcing would drive man back to the Dark Ages (remember it was the road network of Roman Empire that brought prosperity and the debasement/debt collapse crippled the road network into Dark Ages). Sorry won't happen, although we will get a scare. The new gold backed world currency will come to save the day, and the march of mankind will continue on maximum efficiencies, which means clustered in cities, and diverse distribution trunklines. The internet naturally organizes itself in this cluster and trunk (hub & spoke) connections mesh topology, as do the road networks, as does the brain, as do the veins in our body, etc....

It is not that integrated, self-sufficient communities can't be done technologically, rather it is that human nature will become lazy and some people will do more of the work than others, and they will want to trade their labor for maximum value outside their local community. A basic principle of free market (max efficiency) economic theory is competition. Local means limited competition. And this is why the new world order and world govt is unavoidable, because economic integration forces political integration. I was watching a documentary on TV of how the building a giant canal linking North and South China, unified the country politically because the increased trade brought more competition, prosperity, and tied the economic fate of both regions to each other. This is exactly what globalization of trade has done. The internet was a big factor in this also.

Last edited by Shelby on Thu Jan 29, 2009 1:26 am; edited 1 time in total

re: We are not going back to 1800s!

re: We are not going back to 1800s!

Getting the correct world view is key to understanding what is happening and where we are headed in the future.

I surmise I hope correctly that SRSrocco has made a clarification that it is the concentration of production that must die-- it seems he is now implying that it is not necessary all of it must be local (?):

http://jasonhommelforum.com/forums/showthread.php?p=50970#post50970

If that is a correct interpretation of SRSrocco's opinion, then I agree. Read my prior post (some of quoted above), wherein I explained that natural topology for distribution/networking systems are a "hub and spoke", also known as a "Tree" topology or an "Extended Star", or a "star-bus" where each star/hub network (i.e. city road network or internet ISP) is connected by highways/spokes/trunks in point-to-point topology.

The "fully connected mesh" topology would be 100% local production, and it can't scale well because it is extremely inefficient as it grows in size. I had explained in prior post economically in terms of human motivational behavior why that is so. It can also be shown to be true in terms of cost of network resources and complexity of network.

I think it is possible Steve may still be conflating a bit the concepts of "globalization of trade must die" and "concentrated production caused by concentrated central managment of debt must die". I agree with the latter, but the former is antithetical to natural minimization of cost. Like all failed economics (i.e. Communism, and current fiat concentrated debt system), going against the capitalism (free market) of efficiency of minimization of cost (maximization of specialization of labor and economies-of-scale) is futile. Thus going against globalization (as trunk lines connecting more highly interconnected local communities) it futile. However, I agree with Steve that the local networks need to become more interconnected in terms of production (they are in terms of internet and highways, but production is too much concentrated in China).

As with in my opinion based on facts that I am aware of, the bogus "peak energy" conflation, one must keep their eye on the real problem (concentrated of debt and mgmt of the economy by a few money master banks), and not confuse the effects (i.e. cartelization of energy production) of the real problem, as being the causes. The real problem is the overuse of debt and the concentration that causes (banking cartels). Jason Hommel of SilverStockReport.com was correct about that point. For example, apparently mankind could produce enough ethanol to replace any peak in cheap oil, if the cartelization (overuse of debt) will stop subverting:

https://goldwetrust.forumotion.com/economics-f4/energy-economics-t52.htm#832

Shelby wrote:SRSrocco (Steve) provided a clarification in the other forum, that I hope I summarize correctly. Seems he is saying that we will not go back to inferior technology but reorganize the long-distance "just in time" distribution systems into local self-contained economies that produce what they need locally and do not trade. Or he is saying that production will move closer to the sources of the raw materials, or factories will move closer to the sources of inputs.

Steve such a paradigm would be backwards in the efficiency of economies-of-scale and diversity of market sources needed to drive the most competition and thus the highest efficiencies...

I surmise I hope correctly that SRSrocco has made a clarification that it is the concentration of production that must die-- it seems he is now implying that it is not necessary all of it must be local (?):

http://jasonhommelforum.com/forums/showthread.php?p=50970#post50970

If that is a correct interpretation of SRSrocco's opinion, then I agree. Read my prior post (some of quoted above), wherein I explained that natural topology for distribution/networking systems are a "hub and spoke", also known as a "Tree" topology or an "Extended Star", or a "star-bus" where each star/hub network (i.e. city road network or internet ISP) is connected by highways/spokes/trunks in point-to-point topology.

The "fully connected mesh" topology would be 100% local production, and it can't scale well because it is extremely inefficient as it grows in size. I had explained in prior post economically in terms of human motivational behavior why that is so. It can also be shown to be true in terms of cost of network resources and complexity of network.

I think it is possible Steve may still be conflating a bit the concepts of "globalization of trade must die" and "concentrated production caused by concentrated central managment of debt must die". I agree with the latter, but the former is antithetical to natural minimization of cost. Like all failed economics (i.e. Communism, and current fiat concentrated debt system), going against the capitalism (free market) of efficiency of minimization of cost (maximization of specialization of labor and economies-of-scale) is futile. Thus going against globalization (as trunk lines connecting more highly interconnected local communities) it futile. However, I agree with Steve that the local networks need to become more interconnected in terms of production (they are in terms of internet and highways, but production is too much concentrated in China).

As with in my opinion based on facts that I am aware of, the bogus "peak energy" conflation, one must keep their eye on the real problem (concentrated of debt and mgmt of the economy by a few money master banks), and not confuse the effects (i.e. cartelization of energy production) of the real problem, as being the causes. The real problem is the overuse of debt and the concentration that causes (banking cartels). Jason Hommel of SilverStockReport.com was correct about that point. For example, apparently mankind could produce enough ethanol to replace any peak in cheap oil, if the cartelization (overuse of debt) will stop subverting:

https://goldwetrust.forumotion.com/economics-f4/energy-economics-t52.htm#832

Silver is already a day's wage

Silver is already a day's wage

We know that when silver and gold were money, 1oz of silver was a day's wage. Well I guess the bottom rung was 1 dime a day.

Well in the developing world (Asia and Latin America), that is already the case, with the office worker earning roughly $10 - $20 per day, and the bottom rung sweat shops earning as low as $1 per day.

So all that remains to happen before silver becomes money again in terms of store of value, is for the debt-inflated, overvalued Western fiat economic system to implode due to the competition from developing world. Then we will be left with the world wage level balanced. So either silver must go up in fiat price, or the westerner's wages must go down in fiat price. So either we will have deflation of western wages or we will have inflation of prices (and developing world wages) due to devaluation of fiat relative to commodities. So if developing world (China) stays tied to fiat system, then they will have massive inflation as they will have to raise wages, else the west must have imploding wages. What do you think is more likely politically?

This sort of completes the world view of prior post above and the post linked below:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60.htm#853

And so now you might have some idea how I can promote 1oz coins. They are a day's wage and will remain so, as this rebalancing tempest wrecks havoc in west and world economy. Each mint tube of 20 coins we sell, will be month (4 weeks) of stored labor (5 day work week). Actually more, because a silver dollar was only 3/4th of an oz of silver. A $5 roll of 90% dimes will be roughly a (5 day work) weeks worth of labor.

We might not need 90% durability for silver as money now, as we have plastic now:

http://www.collectons.com/shop/item/2913/10-Lighthouse-Coin-Capsules-for-39mm-Coins

http://www.collectons.com/shop/item/2587/100-Kointain-Museum-Quality-Coin-Holders-SILVER-EAGLES

Well in the developing world (Asia and Latin America), that is already the case, with the office worker earning roughly $10 - $20 per day, and the bottom rung sweat shops earning as low as $1 per day.

So all that remains to happen before silver becomes money again in terms of store of value, is for the debt-inflated, overvalued Western fiat economic system to implode due to the competition from developing world. Then we will be left with the world wage level balanced. So either silver must go up in fiat price, or the westerner's wages must go down in fiat price. So either we will have deflation of western wages or we will have inflation of prices (and developing world wages) due to devaluation of fiat relative to commodities. So if developing world (China) stays tied to fiat system, then they will have massive inflation as they will have to raise wages, else the west must have imploding wages. What do you think is more likely politically?

This sort of completes the world view of prior post above and the post linked below:

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60.htm#853

And so now you might have some idea how I can promote 1oz coins. They are a day's wage and will remain so, as this rebalancing tempest wrecks havoc in west and world economy. Each mint tube of 20 coins we sell, will be month (4 weeks) of stored labor (5 day work week). Actually more, because a silver dollar was only 3/4th of an oz of silver. A $5 roll of 90% dimes will be roughly a (5 day work) weeks worth of labor.

We might not need 90% durability for silver as money now, as we have plastic now:

http://www.collectons.com/shop/item/2913/10-Lighthouse-Coin-Capsules-for-39mm-Coins

http://www.collectons.com/shop/item/2587/100-Kointain-Museum-Quality-Coin-Holders-SILVER-EAGLES

Banks will be forced to loan out their reserves (with 9x multiplier), else they will go bankrupt

Banks will be forced to loan out their reserves (with 9x multiplier), else they will go bankrupt

I do not always agree with Gary North (e.g. he hates silver passionately), but he presents a very good logical argument for coming mass inflation:

http://www.garynorth.com/public/4551.cfm

Here is more on this from CaseyResearch:

http://financialsense.com/editorials/casey/2009/0130.html

My question is how do the banks plan on getting out of Treasuries without losing value, if stampede out of them begins? Would the Fed simply give them Ameros and the rest get stuck with worthless Treasuries and worthless dollars.

In short, the Fed + Banks can do what ever they want in paper and legal realm. They just can't print metal out of thin air.

http://www.garynorth.com/public/4551.cfm

Here is more on this from CaseyResearch:

http://financialsense.com/editorials/casey/2009/0130.html

My question is how do the banks plan on getting out of Treasuries without losing value, if stampede out of them begins? Would the Fed simply give them Ameros and the rest get stuck with worthless Treasuries and worthless dollars.

In short, the Fed + Banks can do what ever they want in paper and legal realm. They just can't print metal out of thin air.

Best article I have read lately on the coming hyperinflation

Best article I have read lately on the coming hyperinflation

http://financialsense.com/fsu/editorials/kirby/2009/0202.html

I need to think about how I could graph that article's point succinctly. I had actually written the same point in this forum previously, and also I had written back in 2006 in Hommel's forum that (some of portion of) the derivatives should be counted as money supply (and thus that money supply and velocity were skyrocketing, which is why any slowdown in their growth can put the world into severe recession as you see now).

The govt may try to stop the mad rush out of fiat with capital and price controls. That would of course contain nominal prices somewhat perhaps, but it will be a very public signal of fascist desperation, that sends gold to the moon.

I need to think about how I could graph that article's point succinctly. I had actually written the same point in this forum previously, and also I had written back in 2006 in Hommel's forum that (some of portion of) the derivatives should be counted as money supply (and thus that money supply and velocity were skyrocketing, which is why any slowdown in their growth can put the world into severe recession as you see now).

The govt may try to stop the mad rush out of fiat with capital and price controls. That would of course contain nominal prices somewhat perhaps, but it will be a very public signal of fascist desperation, that sends gold to the moon.

Page 3 of 24 •  1, 2, 3, 4 ... 13 ... 24

1, 2, 3, 4 ... 13 ... 24

Page 3 of 24

Permissions in this forum:

You cannot reply to topics in this forum