Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 4 of 24

Page 4 of 24 •  1, 2, 3, 4, 5 ... 14 ... 24

1, 2, 3, 4, 5 ... 14 ... 24

Exponential expansion of perpetual debt

Exponential expansion of perpetual debt

Exponential expansion of perpetual debt

Fekete reminds us that for each halving of the interest rate, then the market price (i.e. liquidation value) of PRE-EXISTING bonds (debt) doubles:

http://www.gold-eagle.com/gold_digest_08/fekete021209.html

Fekete also explains that the "total notional value of derivatives represents the liquidation value of insured bonded debt", meaning that derivatives are the mechanism by which the market transfers the market price (change) risk to the whole market (socialization of risk, i.e. "insurance").

I have an additional insight, that it is actually worse than Fekete is writing, because of the cycling between rising and decreasing interest rates. When the interest rates are doubled (i.e. 2002 - 2006, 2010 - 2014), then the derivatives defaults proliferate. This causes massive increases in new debt for bailouts (2000 - 2002, 2007 - 2009) which are larger than all the debt outstanding (e.g. $10 trillion so far in 2008) and the halving of the interest rates drives doubles the notional value of the derivatives again. But understand that the amount of debt has increased then by a factor of 2 or 4 also, so actually the derivatives will increase by a factor of 8 or 16 or 32 (and that is only for a doubling and halving of interest rate cycle). Now imagine the interest rates are increased by a factor of 16 (2001 - 2006), then halved by a factor of 16 (2007 - 2009), then increased by a factor of 16 again (2010 - 2014), plus you had say a quadrupling of the base national debt in that, then you end up with 16 x 16 x 16 x 4 = 16,384 (164,000%) increase in derivatives (as compared to 2001 starting point). That means we could easily see derivatives grow to 16,384 trillion (16 quadrillion).

Fekete goes on to explain that as this notional value albatross grows, the actual Fed Notes (M1) that we use to run our banking system, has to eventually increase because some (even very small %) of the people want to cash out of this gamblers system, and even 1% of $16,384 trillion = $163 trillion.

The only thing stopping hyperinflation is the unwillingness of people to cash out the market value of bonds.

However there is one more aspect. I don't think the Fed can do another interest rate rising cycle and survive. Because with the notional value of derivatives already at $1000 trillion, and when interest rates rise, then everyone has an incentive to cash out of the underlying bonds creating margin calls on the derivatives, so even 1% of $1000 trillion is $10 trillion. The Fed will prefer the deflation route and continuing to halve the interest rates by buying the Tbonds itself!!

The public will walk away from the bond market leaving the Fed as the only buyer. Thus the leakage from bonds will get severe. At that point, this will be synonmous as if interest rates has been raised. You will see it in the price of gold going to $5000 or $10,000. At that point, the Fed has nothing more to gain by buying Tbonds and as gold will be setting the interest rates on fiat (this is what backwardation is signalling). That will be Armageddon. Capital controls, police state, everthing has been prepared for that moment...

Get ready....

Fekete reminds us that for each halving of the interest rate, then the market price (i.e. liquidation value) of PRE-EXISTING bonds (debt) doubles:

http://www.gold-eagle.com/gold_digest_08/fekete021209.html

Fekete also explains that the "total notional value of derivatives represents the liquidation value of insured bonded debt", meaning that derivatives are the mechanism by which the market transfers the market price (change) risk to the whole market (socialization of risk, i.e. "insurance").

I have an additional insight, that it is actually worse than Fekete is writing, because of the cycling between rising and decreasing interest rates. When the interest rates are doubled (i.e. 2002 - 2006, 2010 - 2014), then the derivatives defaults proliferate. This causes massive increases in new debt for bailouts (2000 - 2002, 2007 - 2009) which are larger than all the debt outstanding (e.g. $10 trillion so far in 2008) and the halving of the interest rates drives doubles the notional value of the derivatives again. But understand that the amount of debt has increased then by a factor of 2 or 4 also, so actually the derivatives will increase by a factor of 8 or 16 or 32 (and that is only for a doubling and halving of interest rate cycle). Now imagine the interest rates are increased by a factor of 16 (2001 - 2006), then halved by a factor of 16 (2007 - 2009), then increased by a factor of 16 again (2010 - 2014), plus you had say a quadrupling of the base national debt in that, then you end up with 16 x 16 x 16 x 4 = 16,384 (164,000%) increase in derivatives (as compared to 2001 starting point). That means we could easily see derivatives grow to 16,384 trillion (16 quadrillion).

Fekete goes on to explain that as this notional value albatross grows, the actual Fed Notes (M1) that we use to run our banking system, has to eventually increase because some (even very small %) of the people want to cash out of this gamblers system, and even 1% of $16,384 trillion = $163 trillion.

The only thing stopping hyperinflation is the unwillingness of people to cash out the market value of bonds.

However there is one more aspect. I don't think the Fed can do another interest rate rising cycle and survive. Because with the notional value of derivatives already at $1000 trillion, and when interest rates rise, then everyone has an incentive to cash out of the underlying bonds creating margin calls on the derivatives, so even 1% of $1000 trillion is $10 trillion. The Fed will prefer the deflation route and continuing to halve the interest rates by buying the Tbonds itself!!

The public will walk away from the bond market leaving the Fed as the only buyer. Thus the leakage from bonds will get severe. At that point, this will be synonmous as if interest rates has been raised. You will see it in the price of gold going to $5000 or $10,000. At that point, the Fed has nothing more to gain by buying Tbonds and as gold will be setting the interest rates on fiat (this is what backwardation is signalling). That will be Armageddon. Capital controls, police state, everthing has been prepared for that moment...

Get ready....

China, TBonds, Dollar, Inflation

China, TBonds, Dollar, Inflation

China has again affirmed that it will not stop recycling it's trade surplus into dollar TBonds:

http://www.ft.com/cms/s/0/ba857be6-f88f-11dd-aae8-000077b07658.html

China has a net trade surplus with the world. That means China has more dollars incoming than outgoing. If it spends these dollars, then it will eliminate it's trade surplus.

One would think that China would like to eliminate it's trade surplus (spend the dollars), because politically (age bubble demographically) China needs to grow as fast as possible. But if China grows too fast, the price inflation gets too high. One can think of price inflation as mis-allocated capital, because if production increases proportionally with the money supply, then real GDP (real income) is positive. The faster the growth, the more waste. Also there is the issue of uneven growth, so then the disadvantaged sectors see negative real growth in their income relative to nominal price increases.

So the issue for China is that it's exports grew faster than it's maximum (optimum) sustainable internal growth rate. This has a lot to do with the overvalued dollar. It is much economically faster to build concentrated factory zones to sell exports to overvalued consumers, than to profit on building up brick & mortar in far flung, undervalued (by pegged Yuan) provinces.

However, the simple solution for China is to let the Yuan float in a free market, so then the trade surplus will be eliminated by increasing imports as foreign goods would become less expensive in China, which obviously is more efficient as it would reduce price inflation in China and thus increase China's real GDP (real incomes).

Why does China not want to allow the Yuan to float freely? Because it would be the end of the Communist Party's grip on control. In short, a managed economy does not co-exist with a free market economy.

Thus as a matter of survival for the current political system in China, there must be a surplus. Period.

So where to store the surplus, if can't spend it? Well if they stored it in gold, then they would defacto eliminate their Yuan-dollar peg, because they would send gold to the moon and kill the dollar system. There is no other fiat currency that is any less vulnerable to devaluation than the dollar, which also has sufficient bond market size.

So as a matter of survival for the current political system in China, there must be inflation instead of efficiency and gold. As I have written many times, China is part of the global monetary regime problem and will not go willingly to a gold system. I have explained above why that is so.

In short, China has exported socialism, mis-allocation, suppression of freedom to the West, by feeding the West's insatiable desire for debt-based inflation. Or let's just say it has been symbiotic.

But China's current political system (society) has another threat to it's survival. Growth must be maintained, due to demographic politics. Thus China must tolerate high inflation (because they won't tolerate a free market Yuan valuation), and thus China is amassing huge mis-allocations of capital.

The bottom line is that the political systems of the world now all favor massive inflation in a futile attempt to resist the free market valuations that gold & silver are going to force on the market. And this inflation will be expressed as mis-allocated capital, meaning deflation (moderation) in price of many things overproduced, and inflation in price of raw materials. Of course with much volatility along the way, because of the booms and busts of mis-allocating capital via the manipulation of the value of money.

The way this ends is failure of the current political and monetary system of the world. It ends with massive failure and wasted resources. It can end with hyperinflationary blowoffs, or by govt decree to a new monetary regime (which is an instant hyperinflation/devaluation). But in no case does it end with monetary deflation. Even the Great Depression did not have deflation, as the value of gold was revalued from $20 to $33 instantly, while the prices of many things were falling (thus the net gain for gold was several fold). And that was a time of much more restraint, because the world was on gold standard monetary system.

When thinking about how this will play out, I want you to remember one word, "confidence". Imagine the party game of musical chairs, or the stampede if someone yells "bomb" inside a venue of mass gathering. The current systems are only continue to function, because people are blind to how broken the systems are (and how much their fiat net worth and incomes are being robbed/devalued). We are headed into a tempest of failures and mis-allocation of capital by govts in attempt to create success (which will only create more failure, i.e. more mis-allocation). As "confidence" erodes, the govts (current political system) will resort to capital controls. The govts will resist the free market solution until the govts do not exist any more. As capital controls increase, public confidence will degrade precipitiously. This will be a self-feeding snowball.

Thoughts?

http://www.ft.com/cms/s/0/ba857be6-f88f-11dd-aae8-000077b07658.html

...Luo Ping, a director-general at the China Banking Regulatory Commission..., said: “Except for US Treasuries, what can you hold?” he asked. “Gold? You don’t hold Japanese government bonds or UK bonds. US Treasuries are the safe haven. For everyone, including China, it is the only option.”...

...“We hate you guys. Once you start issuing $1 trillion-$2 trillion [$1,000bn-$2,000bn] . . .we know the dollar is going to depreciate, so we hate you guys but there is nothing much we can do.”...

China has a net trade surplus with the world. That means China has more dollars incoming than outgoing. If it spends these dollars, then it will eliminate it's trade surplus.

One would think that China would like to eliminate it's trade surplus (spend the dollars), because politically (age bubble demographically) China needs to grow as fast as possible. But if China grows too fast, the price inflation gets too high. One can think of price inflation as mis-allocated capital, because if production increases proportionally with the money supply, then real GDP (real income) is positive. The faster the growth, the more waste. Also there is the issue of uneven growth, so then the disadvantaged sectors see negative real growth in their income relative to nominal price increases.

So the issue for China is that it's exports grew faster than it's maximum (optimum) sustainable internal growth rate. This has a lot to do with the overvalued dollar. It is much economically faster to build concentrated factory zones to sell exports to overvalued consumers, than to profit on building up brick & mortar in far flung, undervalued (by pegged Yuan) provinces.

However, the simple solution for China is to let the Yuan float in a free market, so then the trade surplus will be eliminated by increasing imports as foreign goods would become less expensive in China, which obviously is more efficient as it would reduce price inflation in China and thus increase China's real GDP (real incomes).

Why does China not want to allow the Yuan to float freely? Because it would be the end of the Communist Party's grip on control. In short, a managed economy does not co-exist with a free market economy.

Thus as a matter of survival for the current political system in China, there must be a surplus. Period.

So where to store the surplus, if can't spend it? Well if they stored it in gold, then they would defacto eliminate their Yuan-dollar peg, because they would send gold to the moon and kill the dollar system. There is no other fiat currency that is any less vulnerable to devaluation than the dollar, which also has sufficient bond market size.

So as a matter of survival for the current political system in China, there must be inflation instead of efficiency and gold. As I have written many times, China is part of the global monetary regime problem and will not go willingly to a gold system. I have explained above why that is so.

In short, China has exported socialism, mis-allocation, suppression of freedom to the West, by feeding the West's insatiable desire for debt-based inflation. Or let's just say it has been symbiotic.

But China's current political system (society) has another threat to it's survival. Growth must be maintained, due to demographic politics. Thus China must tolerate high inflation (because they won't tolerate a free market Yuan valuation), and thus China is amassing huge mis-allocations of capital.

The bottom line is that the political systems of the world now all favor massive inflation in a futile attempt to resist the free market valuations that gold & silver are going to force on the market. And this inflation will be expressed as mis-allocated capital, meaning deflation (moderation) in price of many things overproduced, and inflation in price of raw materials. Of course with much volatility along the way, because of the booms and busts of mis-allocating capital via the manipulation of the value of money.

The way this ends is failure of the current political and monetary system of the world. It ends with massive failure and wasted resources. It can end with hyperinflationary blowoffs, or by govt decree to a new monetary regime (which is an instant hyperinflation/devaluation). But in no case does it end with monetary deflation. Even the Great Depression did not have deflation, as the value of gold was revalued from $20 to $33 instantly, while the prices of many things were falling (thus the net gain for gold was several fold). And that was a time of much more restraint, because the world was on gold standard monetary system.

When thinking about how this will play out, I want you to remember one word, "confidence". Imagine the party game of musical chairs, or the stampede if someone yells "bomb" inside a venue of mass gathering. The current systems are only continue to function, because people are blind to how broken the systems are (and how much their fiat net worth and incomes are being robbed/devalued). We are headed into a tempest of failures and mis-allocation of capital by govts in attempt to create success (which will only create more failure, i.e. more mis-allocation). As "confidence" erodes, the govts (current political system) will resort to capital controls. The govts will resist the free market solution until the govts do not exist any more. As capital controls increase, public confidence will degrade precipitiously. This will be a self-feeding snowball.

Thoughts?

China, TBonds, Dollar, Inflation

China, TBonds, Dollar, Inflation

Hi Shelby,

I was reading an extract from a group of analysts called Global Europe Anticipation Bulletin (GEAB at http://www.leap2020.eu/) who publish a report called LEAP/E2020 that has been highly accurate in its "anticipations" over the last 3 years or so.

They appear to be in agreement with your analysis in key areas. The extract is here:

http://www.globalresearch.ca/index.php?context=va&aid=12332

In part it says:

"Back in February 2006, LEAP/E2020 estimated that the global systemic crisis would unfold in 4 main structural phases: trigger, acceleration, impact and decanting phases. This process enabled us to properly anticipate events until now. However our team has now come to the conclusion that, due to the global leaders’ incapacity to fully realise the scope of the ongoing crisis (made obvious by their determination to cure the consequences rather than the causes of this crisis), the global systemic crisis will enter a fifth phase in the fourth quarter of 2009, a phase of global geopolitical dislocation."

IMHO gold's recent behaviour lends support to this scenario.

All the best,

Angophera

I was reading an extract from a group of analysts called Global Europe Anticipation Bulletin (GEAB at http://www.leap2020.eu/) who publish a report called LEAP/E2020 that has been highly accurate in its "anticipations" over the last 3 years or so.

They appear to be in agreement with your analysis in key areas. The extract is here:

http://www.globalresearch.ca/index.php?context=va&aid=12332

In part it says:

"Back in February 2006, LEAP/E2020 estimated that the global systemic crisis would unfold in 4 main structural phases: trigger, acceleration, impact and decanting phases. This process enabled us to properly anticipate events until now. However our team has now come to the conclusion that, due to the global leaders’ incapacity to fully realise the scope of the ongoing crisis (made obvious by their determination to cure the consequences rather than the causes of this crisis), the global systemic crisis will enter a fifth phase in the fourth quarter of 2009, a phase of global geopolitical dislocation."

IMHO gold's recent behaviour lends support to this scenario.

All the best,

Angophera

Guest- Guest

Weimer or Nazi? Which will we get first?

Weimer or Nazi? Which will we get first?

https://goldwetrust.forumotion.com/stocks-f2/interesting-charts-t72.htm#1080

Bottom line is we are headed for probably a mix of inflation, implosion, totalitarianism.

It has come like a thief in the night. Unless people turn to gold and accept the 777 DOW level deflation, then we are headed into a tempest mix of horrors (mix of inflation, implosion, totalitarianism). Remember deflation (of fiat) is a good thing. It means you can buy more prosperity with same amount of gold. It means purging the non-productive usury debt engine.

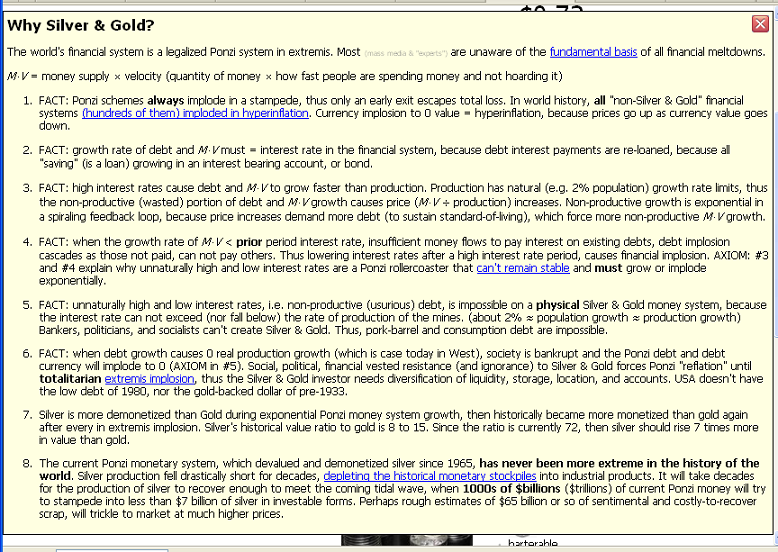

Also, read my "Why Silver & Gold?" popup on this page to understand:

http://VaultOz.com

Bottom line is we are headed for probably a mix of inflation, implosion, totalitarianism.

It has come like a thief in the night. Unless people turn to gold and accept the 777 DOW level deflation, then we are headed into a tempest mix of horrors (mix of inflation, implosion, totalitarianism). Remember deflation (of fiat) is a good thing. It means you can buy more prosperity with same amount of gold. It means purging the non-productive usury debt engine.

Also, read my "Why Silver & Gold?" popup on this page to understand:

http://VaultOz.com

Proof that M * V = interest rate

Proof that M * V = interest rate

Regarding item #2 in my prior post, here is the proof:

http://goldmeasures.com/2007/05/country-analysis.html

http://farm4.static.flickr.com/3040/2585998653_59b16af31e_b.jpg

Note that NZ Andy's chart above does not include the velocity of money (he only plots M vs interest rate, not M * V), so that is one reason his chart shows a slight deviation. Also the question is how to measure the money supply and which interest rate is the weighted average for the entire economy. So you can't plot the proof exactly, but the chart above is close enough to be axiomatic proof.

http://goldmeasures.com/2007/05/country-analysis.html

http://farm4.static.flickr.com/3040/2585998653_59b16af31e_b.jpg

Note that NZ Andy's chart above does not include the velocity of money (he only plots M vs interest rate, not M * V), so that is one reason his chart shows a slight deviation. Also the question is how to measure the money supply and which interest rate is the weighted average for the entire economy. So you can't plot the proof exactly, but the chart above is close enough to be axiomatic proof.

Who was 100% correct in 2006 about the macroeconomics?

Who was 100% correct in 2006 about the macroeconomics?

Me:

http://www.coolpage.com/commentary/economic/shelby/Inflating%20Deflation.html (<-- CLICK THIS LINK!!!)

However, like most people, I got the specifics of how to profit from it wrong. Actually generally speaking, there is no (nominal) profit in a deflation, for a few a time to plant seeds by buying distressed assets at great values (but apparently the govt is currently refusing to allow some assets to fall as much as they need to...this will be a point of my thinking now). But I did say to sell silver at $21 and even demanded that 50% of mine be sold, but Hommel refused to sell it, when he was holding my silver for me. When I had him send me my silver, he sent me old "crater of the moon" pot marked Engelhard bars (whereas we know he had shiny nice ones, which he later sold on his seekbullion auctions).

Hold on to your wallet! Money and credit could be much harder to find for the next 10 years. Losing 15% on each purchase and sale of bullion could wipe you out. You see most of us wanted to believe we could profit off the demise of our Western economy, and we were not realistic because we wanted our fantasy. And of course, there will be peddlers who fill the demand we create for fantasy.

And I did write in numerous threads in Hommel forum in Oct 2007 (2007! before they crashed!), that I was selling out of junior stocks to cash. I was particularly concerned about the naked shorting at that time. But most everyone in the forum was against my stance, and so I rode one of my largest holding down with rest of them (SEG.TO), luckily I sold most of the others. Also the CEO of SEG.TO did not inform me in my numerous conversations that they were depending on the promise of a bridge loan. He hinted at it, and I should have known better. That is why I don't touch juniors now, they are a pure speculation and you win only at the loss of overexcited naive gamblers who overpay for stock.

I need to go back to thinking for myself. I was often writing in 2006 and 2007 in the Hommel forum that China would crash when USA did. I was constantly refuted by Hommel, challenged in a "reverse psychology" manipulative manner to pump stocks instead.

I urge you to read this:

http://globaleconomicanalysis.blogspot.com/2009/01/brink-of-debt-disaster.html

http://globaleconomicanalysis.blogspot.com/2009/01/peter-schiff-was-wrong.html

http://globaleconomicanalysis.blogspot.com/2009/02/fiat-world-mathematical-model.html

I am doing some thinking about his points now, and it seems to rhyme with my seminal article in 2006, linked above.

=============

P.S. What is particularly painful for me, is to see that my name was once associated with this man Hommel, who continues to peddle overpriced stuff to naive people:

http://silverstockreport.com/2009/resale-value.html

You don't need to pay $20 per ounce for something that is absolutely useless (in an investment sense, the numismatic value is obvious). They are just selling novelties and trinkets. If you want silver, there are numerous options to buy it at spot or even below spot if you don't mind the ugliness of your silver, or < $1 over spot for brand new beautiful silver (email me if you don't believe me and I will tell you where to you can buy). It pains me to see Hommel, who many times wrote that numismatics are a fraud, to peddle this crap this way. He is destroying any semblence of credibility about silver investing on value. He has shown his true colors, which by his very own words is that he is the fraud:

http://silverstockreport.com/2008/confiscation.html

I know what his response to me would be. He would say people are lucky to be able to get some silver at any price. HOGWASH! Or he would probably say that it is a free market. True! And that is why I am free to write this!

Ignore that man! He is bad for your investment health. He is bad for your spiritual health. I have given many examples in this forum already of why on both counts.

Btw, Hommel doesn't bother to mention that the eBay+Paypal (required on ebay!) costs are about 11 - 18%, not including shipping and insurance (e.g. 50% of the cost of a single round), the spot price movement risk, as Paypal doesn't pay out immediately, and the 5% reserve that Paypal holds back, and the cost of buyers who lie and get buyer protection. Just one bad buyer erases all your margin on your other sales. Plus the labor and overhead of selling in small lots. Etc. If selling on eBay was so lucrative, I would be doing it more. Figure the 10 x $20 round sale, is really only netting about $13, once all the costs mentioned above are factored in. The single 1oz sale on eBay is a joke. None of us have time for that. Figure it is net profit of about -$20 once you factor the value of your time and effort.

I am not going to comment about him personally. I am merely stating some facts above. The facts make it self-evident that he is peddling snake oil. Of course on a spiritual level, there is good in every person, and I continue to pray.

Disclosure: I did attempt to create a service recently to sell precious metals at very low margins over spot.

http://www.coolpage.com/commentary/economic/shelby/Inflating%20Deflation.html (<-- CLICK THIS LINK!!!)

Inflating Deflation

by Shelby H. Moore III

Created: February 12, 2006

Updated: March 23, 2006

First world economies face an unavoidable dilemma, regardless whether globalization is switched on or off, either sacrifice now with decades of retirement demographic deflation (globalization off), or sacrifice later by inflating the deflation of globalization for temporary illusionary "wealth", which will end in a hyper-catastrophic global collapse Greater depression.

World politics have chosen "sacrific later", and on the order of 30 - 50% of the capital in developing markets derived from globalization, as well as the matching consumption debt in first world, is "unproductive" and due to be wiped out...

However, like most people, I got the specifics of how to profit from it wrong. Actually generally speaking, there is no (nominal) profit in a deflation, for a few a time to plant seeds by buying distressed assets at great values (but apparently the govt is currently refusing to allow some assets to fall as much as they need to...this will be a point of my thinking now). But I did say to sell silver at $21 and even demanded that 50% of mine be sold, but Hommel refused to sell it, when he was holding my silver for me. When I had him send me my silver, he sent me old "crater of the moon" pot marked Engelhard bars (whereas we know he had shiny nice ones, which he later sold on his seekbullion auctions).

Hold on to your wallet! Money and credit could be much harder to find for the next 10 years. Losing 15% on each purchase and sale of bullion could wipe you out. You see most of us wanted to believe we could profit off the demise of our Western economy, and we were not realistic because we wanted our fantasy. And of course, there will be peddlers who fill the demand we create for fantasy.

And I did write in numerous threads in Hommel forum in Oct 2007 (2007! before they crashed!), that I was selling out of junior stocks to cash. I was particularly concerned about the naked shorting at that time. But most everyone in the forum was against my stance, and so I rode one of my largest holding down with rest of them (SEG.TO), luckily I sold most of the others. Also the CEO of SEG.TO did not inform me in my numerous conversations that they were depending on the promise of a bridge loan. He hinted at it, and I should have known better. That is why I don't touch juniors now, they are a pure speculation and you win only at the loss of overexcited naive gamblers who overpay for stock.

I need to go back to thinking for myself. I was often writing in 2006 and 2007 in the Hommel forum that China would crash when USA did. I was constantly refuted by Hommel, challenged in a "reverse psychology" manipulative manner to pump stocks instead.

I urge you to read this:

http://globaleconomicanalysis.blogspot.com/2009/01/brink-of-debt-disaster.html

http://globaleconomicanalysis.blogspot.com/2009/01/peter-schiff-was-wrong.html

http://globaleconomicanalysis.blogspot.com/2009/02/fiat-world-mathematical-model.html

I am doing some thinking about his points now, and it seems to rhyme with my seminal article in 2006, linked above.

=============

P.S. What is particularly painful for me, is to see that my name was once associated with this man Hommel, who continues to peddle overpriced stuff to naive people:

http://silverstockreport.com/2009/resale-value.html

You don't need to pay $20 per ounce for something that is absolutely useless (in an investment sense, the numismatic value is obvious). They are just selling novelties and trinkets. If you want silver, there are numerous options to buy it at spot or even below spot if you don't mind the ugliness of your silver, or < $1 over spot for brand new beautiful silver (email me if you don't believe me and I will tell you where to you can buy). It pains me to see Hommel, who many times wrote that numismatics are a fraud, to peddle this crap this way. He is destroying any semblence of credibility about silver investing on value. He has shown his true colors, which by his very own words is that he is the fraud:

http://silverstockreport.com/2008/confiscation.html

http://www.google.com/search?hl=en&ei=mgKuSfD_EZWukAWQo5i4Bg&sa=X&oi=spell&resnum=0&ct=result&cd=1&q=site%3Asilverstockreport.com+numismatic&spell=1Jason Hommel wrote:...Some scammers will try to convince you that "numismatic" items are immune from confiscation. Whatever! I think numismatics are just another form of confiscation themselves; they are expensive idols, special images on coins that supposedly have higher value, but the value is to the seller of the items, as they usually have a very large spread, and you get much less back when you try to sell them. Even if you get "cheap" numismatic coins for only 15% over spot, I reason, why pay 15% more for "special" bullion, when you can pay 5% just to protect the real stuff?...

I know what his response to me would be. He would say people are lucky to be able to get some silver at any price. HOGWASH! Or he would probably say that it is a free market. True! And that is why I am free to write this!

Ignore that man! He is bad for your investment health. He is bad for your spiritual health. I have given many examples in this forum already of why on both counts.

Btw, Hommel doesn't bother to mention that the eBay+Paypal (required on ebay!) costs are about 11 - 18%, not including shipping and insurance (e.g. 50% of the cost of a single round), the spot price movement risk, as Paypal doesn't pay out immediately, and the 5% reserve that Paypal holds back, and the cost of buyers who lie and get buyer protection. Just one bad buyer erases all your margin on your other sales. Plus the labor and overhead of selling in small lots. Etc. If selling on eBay was so lucrative, I would be doing it more. Figure the 10 x $20 round sale, is really only netting about $13, once all the costs mentioned above are factored in. The single 1oz sale on eBay is a joke. None of us have time for that. Figure it is net profit of about -$20 once you factor the value of your time and effort.

I am not going to comment about him personally. I am merely stating some facts above. The facts make it self-evident that he is peddling snake oil. Of course on a spiritual level, there is good in every person, and I continue to pray.

Disclosure: I did attempt to create a service recently to sell precious metals at very low margins over spot.

Last edited by Shelby on Fri Oct 30, 2009 5:45 pm; edited 2 times in total (Reason for editing : to insert "(nominal)" to clarify that we can make relative gains in deflation)

100% correct

100% correct

I agree on the snake oil saleman. How his cost can be as high as he claims, is bull. Claims he buys 1000 oz. bars at 20 cents over spot, but lost money when selling at 2.00 over spot. How anybody can believe his line, it makes no sence.

Now on to more important things.

Being able to advoid shipping cost and high premiums is going to make VaultOz.com great for trading. Is trading in and out of vault oz. going to be welcomed? My only other concern is knowing if you have backup plan if something where to happen (God forbid) to you. Maybe you could address that concern.

Now on to more important things.

Being able to advoid shipping cost and high premiums is going to make VaultOz.com great for trading. Is trading in and out of vault oz. going to be welcomed? My only other concern is knowing if you have backup plan if something where to happen (God forbid) to you. Maybe you could address that concern.

kwp1- Posts : 18

Join date : 2008-10-29

re: Hommel's costs and my potential VaultOz service

re: Hommel's costs and my potential VaultOz service

Hommel has stated that he is using a more expensive mint closeby to him, at $1.25 per round minting cost. So I do believe he has higher cost. But I only pay $0.55 per ounce minting cost at the mint I use, but I have not yet found supplier that can sell me Comex bars at 20cents. I was paying 55 to 60 cents back when silver was $10, but now I can probably get 35 cents or better. But then there are roundtrip shipping costs, handling overhead, etc. I do believe Hommel is correct to say that his costs are $2+. My costs are $1+. But just because his costs are double mine, doesn't give him a moral license to trick people into paying more.

I am currently willing to sell my rounds at my cost. If anyone is interested, contact me. But I am not writing here to peddle them, I can sell them to wholesalers and that is more efficient for me any way. I just mention it as a favor to anyone who needs some brand new Buffalo rounds at lowest possible price (before I offload them wholesale). One reason is because I would like to transistion more to "silver as electronic money" type of perspective. I realize we all need some physical in our hands, but that is not really the future. That is just to satisfy our insecurities and fantasies. The real future must continue to be that money moves much faster than physically storing it in our basement. When money goes into the basement, it means most people will starve to death, like the Dark Ages after Rome. That is not the scenario I want to target as a business, as there is no business in that scenario. If we are really headed for that, then I would rather write internet software that can aid people in general to share and keep in touch and create, etc.. I would leave the metals business in that dire scenario. So I need for gold bugs to understand, that the scenario they are planning for, can not help them. Rather I think money will continue to flow, so if gold+silver becomes money, then it must flow. So I just think the whole concept of storing 2 tons of metal in your basement is not well matched to any reasonable scenario for profit. Hommel has tons of silver stored locally and so I take immediately as a warning sign of something to not do (copy a zealot).

About the VaultOz.com site that I have been working on (and which is not yet taking orders), I think you are astute on the main weakness, in that how can I build the trust level (economy-of-scale) and what are the advantage over GoldMoney.com?? Also I think there is not too much demand for that kind of service. The market seems to be split in two dipolar extremes. On the one side, you have gold/silver bugs who think the metal must be in their basement, and then you have the mainstream who will probably just put metal in their IRA (either an ETF or at a depository), which means it won't really be money:

http://financialsense.com/editorials/casey/2009/0225.html

There doesn't seem to be too much awareness other than those two extremes.

I am currently stalled on VaultOz.com and doing a deep think. It seems it might be better to build a service based off of GoldMoney.com. I mean if people could use their GoldMoney.com to buy bullion on demand, that might be more popular and trustable?

If I do open a service, there will be procedures and governance put in place to insure it works whether I am around or not.m This would then be detailed on the website for the service.

I am currently willing to sell my rounds at my cost. If anyone is interested, contact me. But I am not writing here to peddle them, I can sell them to wholesalers and that is more efficient for me any way. I just mention it as a favor to anyone who needs some brand new Buffalo rounds at lowest possible price (before I offload them wholesale). One reason is because I would like to transistion more to "silver as electronic money" type of perspective. I realize we all need some physical in our hands, but that is not really the future. That is just to satisfy our insecurities and fantasies. The real future must continue to be that money moves much faster than physically storing it in our basement. When money goes into the basement, it means most people will starve to death, like the Dark Ages after Rome. That is not the scenario I want to target as a business, as there is no business in that scenario. If we are really headed for that, then I would rather write internet software that can aid people in general to share and keep in touch and create, etc.. I would leave the metals business in that dire scenario. So I need for gold bugs to understand, that the scenario they are planning for, can not help them. Rather I think money will continue to flow, so if gold+silver becomes money, then it must flow. So I just think the whole concept of storing 2 tons of metal in your basement is not well matched to any reasonable scenario for profit. Hommel has tons of silver stored locally and so I take immediately as a warning sign of something to not do (copy a zealot).

About the VaultOz.com site that I have been working on (and which is not yet taking orders), I think you are astute on the main weakness, in that how can I build the trust level (economy-of-scale) and what are the advantage over GoldMoney.com?? Also I think there is not too much demand for that kind of service. The market seems to be split in two dipolar extremes. On the one side, you have gold/silver bugs who think the metal must be in their basement, and then you have the mainstream who will probably just put metal in their IRA (either an ETF or at a depository), which means it won't really be money:

http://financialsense.com/editorials/casey/2009/0225.html

There doesn't seem to be too much awareness other than those two extremes.

I am currently stalled on VaultOz.com and doing a deep think. It seems it might be better to build a service based off of GoldMoney.com. I mean if people could use their GoldMoney.com to buy bullion on demand, that might be more popular and trustable?

If I do open a service, there will be procedures and governance put in place to insure it works whether I am around or not.m This would then be detailed on the website for the service.

Last edited by Shelby on Wed Mar 04, 2009 3:59 pm; edited 1 time in total

Re: Inflation or Deflation?

Re: Inflation or Deflation?

Shelby, private message is dissabled. How does one contact you?

jack- Posts : 17

Join date : 2008-10-30

Email me; Help me double-check the gold and silver mathematics to make sure we are not in for a crash

Email me; Help me double-check the gold and silver mathematics to make sure we are not in for a crash

antithesis@coolpage.com (that is my public email address, when I reply you get my private email address)

I am going back and double-checking all our silver/gold bug assumptions about the silver and gold story. I am looking at the various mathematical models of inflation (and thus the precious metal prices):

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-15.htm#1113

I am going back and double-checking all our silver/gold bug assumptions about the silver and gold story. I am looking at the various mathematical models of inflation (and thus the precious metal prices):

https://goldwetrust.forumotion.com/precious-metals-f6/gold-as-an-investment-t60-15.htm#1113

Can't defend the weirdness anymore.

Can't defend the weirdness anymore.

Shelby wrote:...It pains me to see Hommel, who many times wrote that numismatics are a fraud, to peddle this crap this way. He is destroying any semblence of credibility about silver investing on value. He has shown his true colors, which by his very own words is that he is the fraud:

http://silverstockreport.com/2008/confiscation.html

Some of Jason's behavior has been bizarre, to say the least. I even questioned, on his forum, why he was pretending, in his e-mail, that he was trying to unravel the "mystery" behind his NWO rounds (designed by his brother Terbo Ted). Of course, I got no answer (last post):

http://jasonhommelforum.com/forums/showthread.php?t=3211

This post was in reference to this e-mail:

http://silverstockreport.com/2009/new-world-order.html

Maybe I didn't explain myself properly. I was trying to ask for clarification, with a bit of humor. My conclusion, is that he is just trying to sucker people. Anyways, I won't defend him anymore, and will pretty much ignore his opinions.

Last edited by nuwrldudder on Wed Mar 04, 2009 9:16 pm; edited 1 time in total

nuwrldudder- Posts : 30

Join date : 2008-11-18

last about Hommel

last about Hommel

Well he is getting $3 per oz over spot at seekbullion with that promotion. The gullibles ate it hook, line, and sinker. May also be that "I am doing good deed for God, because Hommel is special with God" effect also.

Socialism or hyperinflation?

Socialism or hyperinflation?

Do you have a link on the imminent 401K freeze? I have seen a lot of general talk and speculation only so far.

I have been writing since 2006 that retirement plans were the fraudulant scheme to bankrupt the middle class.

The powergrabbers need an incideous mechanism such as the stock market implosion and everyone vested in IRAs/401K, because the nation still has many private guns.

So this supports my concept that hyperinflation will avoided, because velocity of money will be forceably constrained.

Socialism is the only alternative to hyperinflation. Hyperinflation everyone rushes to escape fiat (social money), and in socialism everyone slows down because they can't escape fiat (social money). I think we are in for latter in USA? A scorched earth depression. Gold and silver will hold their value because they will be only thing people will speed up for, while the fiat will be only useful for buying govt production. There is a humorous video to illustrate the value of govt production:

https://www.youtube.com/watch?v=5CaMUfxVJVQ

In Weimer Germany hyperinflation was necessited because there was no way to keep Germans locked into a fiat (they could simply cross the border); whereas, today the dollar is so pervasive world-wide, that totalitarian socialism is "path of least resistance" option instead.

I have been writing since 2006 that retirement plans were the fraudulant scheme to bankrupt the middle class.

The powergrabbers need an incideous mechanism such as the stock market implosion and everyone vested in IRAs/401K, because the nation still has many private guns.

So this supports my concept that hyperinflation will avoided, because velocity of money will be forceably constrained.

Socialism is the only alternative to hyperinflation. Hyperinflation everyone rushes to escape fiat (social money), and in socialism everyone slows down because they can't escape fiat (social money). I think we are in for latter in USA? A scorched earth depression. Gold and silver will hold their value because they will be only thing people will speed up for, while the fiat will be only useful for buying govt production. There is a humorous video to illustrate the value of govt production:

https://www.youtube.com/watch?v=5CaMUfxVJVQ

In Weimer Germany hyperinflation was necessited because there was no way to keep Germans locked into a fiat (they could simply cross the border); whereas, today the dollar is so pervasive world-wide, that totalitarian socialism is "path of least resistance" option instead.

more thoughts on Socialism or hyperinflation?

more thoughts on Socialism or hyperinflation?

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25473508

For leverage:

* http://finance.yahoo.com/q?s=AGQ

* Even more: http://finance.yahoo.com/q/op?s=AGQ

* More liquid: http://finance.yahoo.com/q/op?s=SLV

For investment holding when TSHTF, consider GoldMoney.com and the site I am working on VaultOz.com

VaultOz aims to be the best mix, where you can get your coins on demand, but pay very near spot and have liquidity to cash out in GoldMoney, cash, or physical delivery.

As for TSHTF scenario, note I have am regularly published on gold-eagle.com and financialsense.com, and I am preparing a new essay where I will explain that if Tbonds are ever allowed to be liquidated, then Fed will be forced to monetize Tbonds to keep interest rates down, which would mean hyperinflation. But Fed banks (fiat money masters) don't want to allow hyperinflation, because that would allow people to escape the dollar (and fiat in general). Instead, all signs point that they will instead nationalize (socialize) everything, including retirement and brokerage accounts, and no one will be allowed to sell. Socialism is the anti-dote for hyperinflation, because instead of running from fiat, people are forced to stay in fiat against their will by the collective force of society, and thus people slow down and do not work at all. This is the scorched earth Greatest Depression scenario, the world economy freezes, and the money masters take near 100% control. The 20% that resist will be taken out (many indications of this already).

Believe it or not, the world is still ruled by kings, they just changed their methodology to be more incideous (less overt). The Bible speaks about how this will come like a thief in the night. It is here now folks. Believe it or not. Most of you will ignore me again for another 2 years, then not only will you lose your entire investment in MMG (I warned Aloha in 2007), but you will lose your entire freedom.

Sorry to say, you guys are talking about leverage at a time where imo you should be thinking more about your survival. You digital dollars won't be worth squat, when the govt nationalizes the entire economy and you can only buy govt production with your dollars. In socialism, all production becomes inferior, slow, long lines, uncreative, dead, dark, rationed, etc.

I am not making any money on my endeavors, so don't think I am selling snake oil. I am genuinely concerned for my and your future.

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25473527

Yadayadayada....don't you realize "compliance" means "mine the shareholders"? I don't mean to be disrespectful, but please consider not being so gullible. The entire system is rigged to steal your money. The stock market is one big Las Vegas (the house always wins). Read this for the calculation which proves it:

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11.htm#17

Oh and if you think that G*R* stock isn't mining the shareholders, you just wait and you can lose more money there. I have had experience with them and their pumper man as well.

It is built into the psychology of you men, that you want to believe that you are "investing", but you are just getting your gambler crack fix, with a different set of terminology that makes you think you are "professional". Reality is we are just crackheads.

The sign of the bottom in this market, will be when people won't mention the word "stock" as it brings such distaste to their mouth, they can't spit enough to remove the bad feelings. Old men will shift through garbage remembering how foolish they were to triple dip into the same Koolaid.

For leverage:

* http://finance.yahoo.com/q?s=AGQ

* Even more: http://finance.yahoo.com/q/op?s=AGQ

* More liquid: http://finance.yahoo.com/q/op?s=SLV

For investment holding when TSHTF, consider GoldMoney.com and the site I am working on VaultOz.com

VaultOz aims to be the best mix, where you can get your coins on demand, but pay very near spot and have liquidity to cash out in GoldMoney, cash, or physical delivery.

As for TSHTF scenario, note I have am regularly published on gold-eagle.com and financialsense.com, and I am preparing a new essay where I will explain that if Tbonds are ever allowed to be liquidated, then Fed will be forced to monetize Tbonds to keep interest rates down, which would mean hyperinflation. But Fed banks (fiat money masters) don't want to allow hyperinflation, because that would allow people to escape the dollar (and fiat in general). Instead, all signs point that they will instead nationalize (socialize) everything, including retirement and brokerage accounts, and no one will be allowed to sell. Socialism is the anti-dote for hyperinflation, because instead of running from fiat, people are forced to stay in fiat against their will by the collective force of society, and thus people slow down and do not work at all. This is the scorched earth Greatest Depression scenario, the world economy freezes, and the money masters take near 100% control. The 20% that resist will be taken out (many indications of this already).

Believe it or not, the world is still ruled by kings, they just changed their methodology to be more incideous (less overt). The Bible speaks about how this will come like a thief in the night. It is here now folks. Believe it or not. Most of you will ignore me again for another 2 years, then not only will you lose your entire investment in MMG (I warned Aloha in 2007), but you will lose your entire freedom.

Sorry to say, you guys are talking about leverage at a time where imo you should be thinking more about your survival. You digital dollars won't be worth squat, when the govt nationalizes the entire economy and you can only buy govt production with your dollars. In socialism, all production becomes inferior, slow, long lines, uncreative, dead, dark, rationed, etc.

I am not making any money on my endeavors, so don't think I am selling snake oil. I am genuinely concerned for my and your future.

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25473527

Yadayadayada....don't you realize "compliance" means "mine the shareholders"? I don't mean to be disrespectful, but please consider not being so gullible. The entire system is rigged to steal your money. The stock market is one big Las Vegas (the house always wins). Read this for the calculation which proves it:

https://goldwetrust.forumotion.com/economics-f4/stocks-vs-precious-metals-vs-bonds-vs-real-estate-t11.htm#17

Oh and if you think that G*R* stock isn't mining the shareholders, you just wait and you can lose more money there. I have had experience with them and their pumper man as well.

It is built into the psychology of you men, that you want to believe that you are "investing", but you are just getting your gambler crack fix, with a different set of terminology that makes you think you are "professional". Reality is we are just crackheads.

The sign of the bottom in this market, will be when people won't mention the word "stock" as it brings such distaste to their mouth, they can't spit enough to remove the bad feelings. Old men will shift through garbage remembering how foolish they were to triple dip into the same Koolaid.

Racketeering 101 - the bailouts explained to a 10 year old

Racketeering 101 - the bailouts explained to a 10 year old

http://news.goldseek.com/GoldSeek/1236751380.php

What a racket! First, the bankers drove up the debt astronomical by lowering interest rates and loaning to anyone with a heartbeart or even some dead bones. They wrote insurance contracts on the debt called "derivatives", for "risk free profits", in which they are the beneficiary on both sides of the derivative contracts (their web of bankers). They first got the "risk free" profits, BECAUSE then when the debt bubble crashed, they get paid again as the beneficiary of the worthless (when marked-to-market) derivatives, because the govt is making them whole. Then they use this govt bailout money to buy the Tbonds that the govt is borrowing from the bankers, to get the bailout money to pay to the bankers.

Don't you find that just a little bit criminal?

This is an exponential theft paradigm, meaning we are on the 29th day of the Water Lily phenomenon:

http://en.wikipedia.org/wiki/Exponential_growth#The_water_lily

What can you do about it? I only see one outlet for your frustration that could truely work and make you rich at same time:

http://VaultOz.com

All other options will pit you against an 80% apathetic, ignorant, and/or misdirected hope on Obama-buzzwords populace. However, VaultOz stands ready to wake people up with an exponential profit motive fever.

==========

Add: make sure you read this post by SRSrocco if you have free access to the Hommel forum. It is one of Steve's best imo:

http://jasonhommelforum.com/forums/showthread.php?p=51320#post51320

Here is what is possibly at stake:

http://www.contrahour.com/contrahour/2009/03/martin-armstrong-is-it-time-to-turn-out-the-lights.html

...And what has the banks been doing with the trillions already given them? Man, don’t you get it? They have been buying up all those US government IOU bonds, notes and paper and socking them away in their bank vaults. Instead of the US having to monetize the new debt or sell it to Americans and foreigners, the big banks are acquiring much of it from the vast give away funds that the taxpayers have been giving them...

What a racket! First, the bankers drove up the debt astronomical by lowering interest rates and loaning to anyone with a heartbeart or even some dead bones. They wrote insurance contracts on the debt called "derivatives", for "risk free profits", in which they are the beneficiary on both sides of the derivative contracts (their web of bankers). They first got the "risk free" profits, BECAUSE then when the debt bubble crashed, they get paid again as the beneficiary of the worthless (when marked-to-market) derivatives, because the govt is making them whole. Then they use this govt bailout money to buy the Tbonds that the govt is borrowing from the bankers, to get the bailout money to pay to the bankers.

Don't you find that just a little bit criminal?

This is an exponential theft paradigm, meaning we are on the 29th day of the Water Lily phenomenon:

http://en.wikipedia.org/wiki/Exponential_growth#The_water_lily

What can you do about it? I only see one outlet for your frustration that could truely work and make you rich at same time:

http://VaultOz.com

All other options will pit you against an 80% apathetic, ignorant, and/or misdirected hope on Obama-buzzwords populace. However, VaultOz stands ready to wake people up with an exponential profit motive fever.

==========

Add: make sure you read this post by SRSrocco if you have free access to the Hommel forum. It is one of Steve's best imo:

http://jasonhommelforum.com/forums/showthread.php?p=51320#post51320

Here is what is possibly at stake:

http://www.contrahour.com/contrahour/2009/03/martin-armstrong-is-it-time-to-turn-out-the-lights.html

...This causes the collapse in state and local revenues forcing states to raise taxes even higher and this is precisely the combination of a debt crisis that ends societies and has been the destroyer of civilization. When it goes to extremes as it did in Byzantium, it even destroyed capitalism reducing the average worker into a peasant who was forced to sell himself, his family, and future children into servitude just to survive...

re: prediction

re: prediction

Fed announced buying Tbills yesterday.

Many of the people have no idea what is about to hit them. They are in denial or zombie addictive false reality state-of-mind.

The strikes are beginning here in Philippines. I see on the faces of people that they are hunkering down, and they are warning already "rice or war!".

I can not predict exactly every detail, but I think it is clear we are mostly likely heading into something as bad as what lead to World Wars, if not worse.

It Was Just Time

It Was Just Time

I don't know if anyone else has commented already, that Martin Armstrong's "It Is Just Time" prediction made back in October 2008, for a major turn event on March 19, nailed the exact day (after) the Fed announced to start buying government bonds directly.

http://www.contrahour.com/contrahour/files/ItsJustTimeMartinArmstrong.pdf

He had also predicted ahead of time the turn that coincided with the peak in the precious metals prices last March 2008.

Google "Martin Armstrong", for the remarkable story about how accurate his computer model predictions have been, and him being in the maximum security prison without a trial, together with the Shoe Bomber and the Unibomber, alledgedly because of his unwillingness to share his model with the CIA.

Unlike the prior swap programs shell games, which gave money to banks who had not loaned it back out, this direct monetization of Treasuries, apparently puts money directly into the economy and seems to cement an exponentially accelerating decay to complete destruction of the world's financial system.

We are now in the 29 or 30th day of the exponential effect of change, as illustrated by the Water Lily:

http://en.wikipedia.org/wiki/Exponential_growth#The_water_lily

I think most people (even most gold and silver analysts and enthusiasts) are still stuck on trying to figure out how to cope or ride out the current system, as if there will be a system. I suggest reading Armstrong's latest predictions about complete failure and return to brutality of the Dark Ages:

http://www.contrahour.com/contrahour/2009/03/martin-armstrong-is-it-time-to-turn-out-the-lights.html

What can we collectively do to stop this? Nothing.

The sooner we realize that we have only one pathway forward, the better each of our individual chance for survival. The Bible talks about this time, and the wisdom of how to prepare. Remember the people were instructed to come out of Egypt into a place where they were trapped, but Moses opened the sea for them. But I will let the reader decide if they want to pursue the Bible. That one pathway is to come out of the system entirely. The only way for an individual to come out of the Great system, is to go back to a very simple life of self-sufficiency, as devoid as possible of any material want or need. Your gold and silver may not be that useful. Many may end up throwing it in the streets, because it probably won't buy food, due to the mayhem coming will seek out those people who ever spend a silver dime in public.

The Great system has a plan to stop self-sufficiency:

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=92002

http://www.worldviewtimes.com/article.php/articleid-4287

How can one survive without the permission to plant and harvest food? I think there are no jungles in USA, perhaps one could move quickly to place with them. Small cohesive communities will be disbanded. The flat lands of the USA are sitting ducks for roaming marauders. Seek the mountains, and the most difficult terrain. Seek not to resist and make war, but to come out entirely in a peaceful condition of separation. Seek terrain where helicopters can not easily drop defoliating chemicals on your gardens. Remember the Great system will be promoting and instigating all sides in the coming civil disorder, so trust no human leaders.

I understand math. I understand exponential change better than most analysts. I understand a Geometric Series. I have done numerous calcuations.

It was just time. Don't be too late to come out of the system. The clock is ticking, there isn't much time remaining.

There will come a new dawn after this mess plays out. It may take the form of a precious metals backed currency. This is orthogonal to the need to come of the current system, while one still can. Such a globally systemic transistion is not smooth and predictable by any man, nor likely favorable to masses who have tried to game the system. The truth lies outside the Great system. Should one seek to store wealth, consider that most were forced to bury it for eons or give it to marauders in the prior Dark Ages. No part of the system is safe from raping, including any storage service for precious metals. Perhaps the new dawn will come quicker this time, as time tends to accelerate. My point is to think how to disengage from the system, perhaps bury the metal for a future time. It wasn't my preferred choice. I tried in vain to search for a smooth transistion solution-- there is none, only fantasies or denial of truth. I can not stress enough that the highest priority is to remove what has been your life, from your life. Make yourself independent as possible from the Great system of money. For once...

P.S. If anyone wants to buy Buffalo 0.999 1oz silver rounds, I am selling them for $1 over spot in lots of 100oz. Contact me via email for how to order at this price (antithesis@coolpage.com). There are photos at VaultOz.com. These are brand new in mint tubes of 20 from the Highland mint, stored at a reputable depository that ships within 24 - 48 hours of your payment. I manufactured about 17,000oz and have about 9,000oz remaining to sell. I am no longer planning to do this as a business and am liquidating at a loss, so I can move my silver assets outside the USA.

http://www.contrahour.com/contrahour/files/ItsJustTimeMartinArmstrong.pdf

He had also predicted ahead of time the turn that coincided with the peak in the precious metals prices last March 2008.

Google "Martin Armstrong", for the remarkable story about how accurate his computer model predictions have been, and him being in the maximum security prison without a trial, together with the Shoe Bomber and the Unibomber, alledgedly because of his unwillingness to share his model with the CIA.

Unlike the prior swap programs shell games, which gave money to banks who had not loaned it back out, this direct monetization of Treasuries, apparently puts money directly into the economy and seems to cement an exponentially accelerating decay to complete destruction of the world's financial system.

We are now in the 29 or 30th day of the exponential effect of change, as illustrated by the Water Lily:

http://en.wikipedia.org/wiki/Exponential_growth#The_water_lily

I think most people (even most gold and silver analysts and enthusiasts) are still stuck on trying to figure out how to cope or ride out the current system, as if there will be a system. I suggest reading Armstrong's latest predictions about complete failure and return to brutality of the Dark Ages:

http://www.contrahour.com/contrahour/2009/03/martin-armstrong-is-it-time-to-turn-out-the-lights.html

What can we collectively do to stop this? Nothing.

The sooner we realize that we have only one pathway forward, the better each of our individual chance for survival. The Bible talks about this time, and the wisdom of how to prepare. Remember the people were instructed to come out of Egypt into a place where they were trapped, but Moses opened the sea for them. But I will let the reader decide if they want to pursue the Bible. That one pathway is to come out of the system entirely. The only way for an individual to come out of the Great system, is to go back to a very simple life of self-sufficiency, as devoid as possible of any material want or need. Your gold and silver may not be that useful. Many may end up throwing it in the streets, because it probably won't buy food, due to the mayhem coming will seek out those people who ever spend a silver dime in public.

The Great system has a plan to stop self-sufficiency:

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=92002

http://www.worldviewtimes.com/article.php/articleid-4287

How can one survive without the permission to plant and harvest food? I think there are no jungles in USA, perhaps one could move quickly to place with them. Small cohesive communities will be disbanded. The flat lands of the USA are sitting ducks for roaming marauders. Seek the mountains, and the most difficult terrain. Seek not to resist and make war, but to come out entirely in a peaceful condition of separation. Seek terrain where helicopters can not easily drop defoliating chemicals on your gardens. Remember the Great system will be promoting and instigating all sides in the coming civil disorder, so trust no human leaders.

I understand math. I understand exponential change better than most analysts. I understand a Geometric Series. I have done numerous calcuations.

It was just time. Don't be too late to come out of the system. The clock is ticking, there isn't much time remaining.

There will come a new dawn after this mess plays out. It may take the form of a precious metals backed currency. This is orthogonal to the need to come of the current system, while one still can. Such a globally systemic transistion is not smooth and predictable by any man, nor likely favorable to masses who have tried to game the system. The truth lies outside the Great system. Should one seek to store wealth, consider that most were forced to bury it for eons or give it to marauders in the prior Dark Ages. No part of the system is safe from raping, including any storage service for precious metals. Perhaps the new dawn will come quicker this time, as time tends to accelerate. My point is to think how to disengage from the system, perhaps bury the metal for a future time. It wasn't my preferred choice. I tried in vain to search for a smooth transistion solution-- there is none, only fantasies or denial of truth. I can not stress enough that the highest priority is to remove what has been your life, from your life. Make yourself independent as possible from the Great system of money. For once...

P.S. If anyone wants to buy Buffalo 0.999 1oz silver rounds, I am selling them for $1 over spot in lots of 100oz. Contact me via email for how to order at this price (antithesis@coolpage.com). There are photos at VaultOz.com. These are brand new in mint tubes of 20 from the Highland mint, stored at a reputable depository that ships within 24 - 48 hours of your payment. I manufactured about 17,000oz and have about 9,000oz remaining to sell. I am no longer planning to do this as a business and am liquidating at a loss, so I can move my silver assets outside the USA.

re: It Was Just Time

re: It Was Just Time

> Your recent letter stated that you would move your silver assets outside

> of

> the USA. Where and why?

I probably said more already than I should and want.

I will not say where. But if you really want to have silver (and/or gold) in another country, you can do it. Just get working on it. CaseyResearch.com Without Borders may be able to help you, I think you can email them specific questions if you subscribe.

The why in my view is because capital will get trapped in the new socialist USA, where it will be taxed to death (a form of confiscation), and in an economy that won't ever grow again for decades. In my view, the USA may also be heading into a Nazi Germany type mayhem.

I am trying to be apolitical, but watch this:

https://www.youtube.com/watch?v=eAaQNACwaLw

Some plan to hide their metal, and I just hope they are prepared to leave it buried potentially for decades.

May not end up that bad, but why risk it? I would rather have my capital on the outside of the USA, where there will be booming investments in the developing world. Most people will risk staying inside USA, because they have family there and do not realistically envision uprooting. But the people in Weimer Germany apparently felt that way, even in the early stages of Hilter's reign. But by the end, they would have lived, if they had gotten out earlier.

Even CaseyResearch.com is writing to expect exchange controls, meaning people will not be able to get out of USA. They will be trapped inside.

> of

> the USA. Where and why?

I probably said more already than I should and want.

I will not say where. But if you really want to have silver (and/or gold) in another country, you can do it. Just get working on it. CaseyResearch.com Without Borders may be able to help you, I think you can email them specific questions if you subscribe.

The why in my view is because capital will get trapped in the new socialist USA, where it will be taxed to death (a form of confiscation), and in an economy that won't ever grow again for decades. In my view, the USA may also be heading into a Nazi Germany type mayhem.

I am trying to be apolitical, but watch this:

https://www.youtube.com/watch?v=eAaQNACwaLw

Some plan to hide their metal, and I just hope they are prepared to leave it buried potentially for decades.

May not end up that bad, but why risk it? I would rather have my capital on the outside of the USA, where there will be booming investments in the developing world. Most people will risk staying inside USA, because they have family there and do not realistically envision uprooting. But the people in Weimer Germany apparently felt that way, even in the early stages of Hilter's reign. But by the end, they would have lived, if they had gotten out earlier.

Even CaseyResearch.com is writing to expect exchange controls, meaning people will not be able to get out of USA. They will be trapped inside.

re: It Was Just Time

re: It Was Just Time

> I sold all my metals and am currently "shorting" both gold and silver.

> I follow the Elliott Wave System very close and we have another wave

> that's

> going to come down rather severely, at which time when it bottoms I'll be

> back buying again.

Please send me more info on that prediction. Everything I have seen, says that technical indictors are point up to next resistance at $16.

The only scenarios that I can see can bring silver and gold down are:

1. Outright manipulation by the Comex, meaning a price with no market real weighting. Perhaps a blowoff manipulation before the default? Do you really expect to be able to get back in physical with such?

2. Rapidly rising interest rates. This does not seem likely. Fed is monetizing Tbonds.

3. Massive decrease in world fiat cash and massive slide into a worse depression of economic activity. This would be a nuclear financial bomb, seems there will be mayhem. You better have your own store of food and guns. Gold/silver would still be a way to store long-term value.

P.S. Hope you have a stop in case it runs to $16 now.

It seems to me in all the above scenarios that physical may become unavailable, even if the price were lower. I think window of time to acquire and bury your physical for the long-term, is rapidly closing. If paper gains are your only goal, then I could see playing russian roulette right now. Interested to hear your feedback on my statements.

=============

ADDED:

Read Maund and tell me why he is wrong:

http://www.gold-eagle.com/editorials_08/maund031909.html

Prechter and Martin Armstrong are predicting massive further depression. But does that drag silver and gold down, and is there any physical remaining at that lower price?

I mean we are on the cusp of governments moving in to "clamp down" (and/or taxification) modes, so do you think silver and gold will still be available in any such extreme future buying opportunity?

Taxification = high tax that is effectively confiscation

I don't think anyone is going to escape with any wealth by following the official routes. That was whole point of my article, that you have to jump off the ship and bury your gold and silver and minimize your life. Other you down with the big ship, even if you do want to buy or have gold but not buried.

Just think about what a lower precious metals price means. It means the world can have no prosperity at all. It means total enslavement. Why? Because only a higher PMs' price can mean we are lessening the problem that we are currently in globally.

> I follow the Elliott Wave System very close and we have another wave

> that's

> going to come down rather severely, at which time when it bottoms I'll be

> back buying again.

Please send me more info on that prediction. Everything I have seen, says that technical indictors are point up to next resistance at $16.

The only scenarios that I can see can bring silver and gold down are:

1. Outright manipulation by the Comex, meaning a price with no market real weighting. Perhaps a blowoff manipulation before the default? Do you really expect to be able to get back in physical with such?

2. Rapidly rising interest rates. This does not seem likely. Fed is monetizing Tbonds.

3. Massive decrease in world fiat cash and massive slide into a worse depression of economic activity. This would be a nuclear financial bomb, seems there will be mayhem. You better have your own store of food and guns. Gold/silver would still be a way to store long-term value.

P.S. Hope you have a stop in case it runs to $16 now.

It seems to me in all the above scenarios that physical may become unavailable, even if the price were lower. I think window of time to acquire and bury your physical for the long-term, is rapidly closing. If paper gains are your only goal, then I could see playing russian roulette right now. Interested to hear your feedback on my statements.

=============

ADDED:

Read Maund and tell me why he is wrong:

http://www.gold-eagle.com/editorials_08/maund031909.html

Prechter and Martin Armstrong are predicting massive further depression. But does that drag silver and gold down, and is there any physical remaining at that lower price?

I mean we are on the cusp of governments moving in to "clamp down" (and/or taxification) modes, so do you think silver and gold will still be available in any such extreme future buying opportunity?

Taxification = high tax that is effectively confiscation

I don't think anyone is going to escape with any wealth by following the official routes. That was whole point of my article, that you have to jump off the ship and bury your gold and silver and minimize your life. Other you down with the big ship, even if you do want to buy or have gold but not buried.

Just think about what a lower precious metals price means. It means the world can have no prosperity at all. It means total enslavement. Why? Because only a higher PMs' price can mean we are lessening the problem that we are currently in globally.

Page 4 of 24 •  1, 2, 3, 4, 5 ... 14 ... 24

1, 2, 3, 4, 5 ... 14 ... 24

Page 4 of 24

Permissions in this forum:

You cannot reply to topics in this forum