Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 23 of 24

Page 23 of 24 •  1 ... 13 ... 22, 23, 24

1 ... 13 ... 22, 23, 24

China's "new deal" make work misallocation

China's "new deal" make work misallocation

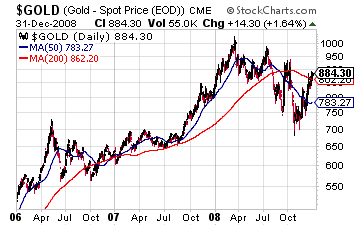

See my prior post too about Peter Schiff and gold.

China is making work and lining the pockets of corrupt local officials, by taking on debt on projects with no cash flow that sit empty. They will hit the inflation wall eventually (when resources are wasted, it causes prices of resources to rise above wages), I think probably 2013:

http://www.bloomberg.com/video/72429864/

China is making work and lining the pockets of corrupt local officials, by taking on debt on projects with no cash flow that sit empty. They will hit the inflation wall eventually (when resources are wasted, it causes prices of resources to rise above wages), I think probably 2013:

http://www.bloomberg.com/video/72429864/

Warren Buffet interview on Charlie Rose yesterday

Warren Buffet interview on Charlie Rose yesterday

http://www.charlierose.com/view/interview/11845

This could have gone in the Inflation vs. Deflation thread. He explains his politics, and he also explains his economic outlook.

He thinks the chance of double-dip is negligible, except if:

1. EU contagion spreads to USA.

2. USA public loses confidence in the govt.

He doesn't seem to think that running a deficit that is 10% of GDP could be making the economy worse (negative marginal-utility-of-debt). He sees that his businesses are expanding, except for those in the housing sector and he thinks we are working off the excess inventory with new household formation.

I think he is missing a key point. For a significant percentage of Americans, their skills are not competitive in global marketplace unless we lower their wages. I think that is why he sees housing construction starts as a key metric, because that industry can employ many of these low skilled people.

And here is the big point Buffet is missing:

http://grandfather-economic-report.com/state_local.htm#spending

And that doesn't include regulatory compliance (which is increasing radically now under Obama), and the mandatory health care system which is not really private. I would suppose the above chart also doesn't include Fannie and Freddie, which are pseudo-government agencies (feds backstop them), and now the government owns General Motors too, I wonder if that is in the above chart? And then the Fed seems to own another $1 trillion or so of the country's businesses on its balance sheet. And then there is the actuarial size of the government (which is off the charts), which is what is being accrued based on future promises. You see we pay for all these things through the depreciation of the currency.

(in private email with M.W.Hodges, it appears that rough estimates of total government spending and mandates might be 67 - 75+% of national income)

So Buffet does not have a very good handle on the fact of why the capitalism of America is being bleed to death.

Maybe soon we will approach Eurozone Rigor Mortise if we are not already there:

http://anepigone.blogspot.com/2008/03/government-spending-as-percentage-of.html

==============================

ADD: another lie from Warren Buffet

Buffet said the very poor pay essentially no tax. Maybe that was a slip of the tongue, but it is simply untrue.

Actually the person making less than $7000, actually about 18% of the income in Federal payroll taxes, and that doesn't include state-level taxes, and sales taxes (poor spend most of their money and sales taxes are as high as double-digits). So poor are paying probably around 1/3 (33%) of their income in taxes.

http://market-ticker.org/akcs-www?post=192433

This could have gone in the Inflation vs. Deflation thread. He explains his politics, and he also explains his economic outlook.

He thinks the chance of double-dip is negligible, except if:

1. EU contagion spreads to USA.

2. USA public loses confidence in the govt.

He doesn't seem to think that running a deficit that is 10% of GDP could be making the economy worse (negative marginal-utility-of-debt). He sees that his businesses are expanding, except for those in the housing sector and he thinks we are working off the excess inventory with new household formation.

I think he is missing a key point. For a significant percentage of Americans, their skills are not competitive in global marketplace unless we lower their wages. I think that is why he sees housing construction starts as a key metric, because that industry can employ many of these low skilled people.

And here is the big point Buffet is missing:

http://grandfather-economic-report.com/state_local.htm#spending

And that doesn't include regulatory compliance (which is increasing radically now under Obama), and the mandatory health care system which is not really private. I would suppose the above chart also doesn't include Fannie and Freddie, which are pseudo-government agencies (feds backstop them), and now the government owns General Motors too, I wonder if that is in the above chart? And then the Fed seems to own another $1 trillion or so of the country's businesses on its balance sheet. And then there is the actuarial size of the government (which is off the charts), which is what is being accrued based on future promises. You see we pay for all these things through the depreciation of the currency.

(in private email with M.W.Hodges, it appears that rough estimates of total government spending and mandates might be 67 - 75+% of national income)

email wrote:Hello Michael,

Thank you so much for the reply.

1. Most of the posts on goldwetrust.forumotion.com are mine. I used to own

GoldWeTrust.com (but no more). I have written extensively on numerous

financial sites, and jot down my developing thoughts there at that

informal forum. I am mainly a software programmer (and little bit of a

mathematician and self-taught economist). I am currently working on a

decentralization solution from the technical side (a radically new

computer language named Copute.com). I've pretty much given up on

educating people, because even those who say they want to end the current

problem (i.e. Ron Paul supporters), want to do it from the center. This

means they don't really want to decentralize (they are playing right into

the status quo and eventual NWO), they want the leaders to do it for them.

You may disagree with me. Or you may prefer a purely data-centric

exposition and I am in support of your effort in that regard.

2. Agreed % of national income is a more meaningful relative measure. I

had visited your site many times over the years (before you got your own

domain), and just recently read that you knew Dr. Milton Friedman.

3. If I come across any useful data that I think you might not have, I

will email it to you.

4. So just guesstimating, as of 2010 government spending could be roughly

67% of national income, and that is not including mandated spending of

Obamacare, the Fed's ownership of income producing assets (i.e. the

spending is going into the Fed), the accrual accounting of long-term

entitlement spending, and probably doesn't include government

nationalization (ownership) of most real estate via Freddie&Fannie,

General Motors, etc..

So to put it bluntly, the government is probably responsible for more then

3/4 (75%) of the economy.

I think your 50% chart does not make the point strong enough, and the

correlation of that probability is spread out across too many pages, and

people may not interpret how close we are to the fascist tipping point

where we are so close to government being 100% of the economy, that the

system eats itself. Typically what happens is the society will use

eugenics (rationing, etc) as it tries to rid itself of its fat, e.g.

Hilter's Germany believe it or not, was really about the Utopian health

care system and the desire to purge the "misfits" ("who were causing all

the economic problems"). This delusion creeps in when the government

reaches too large of a share of the economy (and no one wants to blame

themselves, i.e. fuzzy centralized "solutions", e.g. Ron Paul). The only

solution is for the individuals to come out of the system and

decentralize. There is no longer any way to fix the system from the

center. It is a mathematical fact of entropy and thermodynamics.

> Hello Shelby,

> Thanks for writing. You are to be complimented on your thrust.

> I viewed your URL you sent containing one of my graphics, and read most of

> the comments of others RE Buffet. I found many very good, and in some

> cases spot-on - - revealing some sharp people involved with thinking caps

> on.

>

> From my visit to your site GoldWeTrust.com I gathered you are its

> moderator. Although I'm unfamiliar with that, perhaps you might fill me in

> on its makeup, objectives, etc. - - since I found you appear to be leading

> valuable discussions on important subjects.

>

> You asked savvy a question.

> Regarding your 'about Buffet', I will not comment on what Buffet says on

> that subject or his motivation. Certainly, like most and which is natural,

> Buffet has his own agendas and self-interest, which is his right.

>

> In my own thoughts, I prefer data and data trends over rhetoric-only, in

> my work try to display said data on various critical subjects and then

> provoke the reader to form own views based on said data or present

> reliable data to the contrary.

>

> Hoping its helpful to you, I will take some time with my morning coffee to

> provide some response to your questions. Since I'm unsure how much of my

> works, the Grandfather Economic Report series, you have explored, other

> that part from which you copied your graphic of govt. spending ratios,

> below I will try to anticipate what might be pertinent to your questions

> from my own work - - point you various places and hope its helpful.

>

> Regarding your question as to what might be missing from the govt.

> spending numbers in my graphic, allow me first to state the numbers which

> comprise Federal and state&local spending in that graphic for 2010:

> $3.8 trillion federal govt. spending - 32% nat income

> $2.1 trillion state/local govt. spending - 18% nat income

> Sum = $5.9 trillion

>

> [said data are direct from appendix tables of latest annual Executive

> Branch's Economic Report to Congress]

> (Keep in mind the graphic states said spending as a percent national

> income, not of GDP. If related to GDP, which my late mentor Noble Laureate

> Dr. Milton Friedman advised me against for reasons you will find elsewhere

> in my work, the ratios would be somewhat lower).

>

> I will attach a few graphics to this email to enable you, if you wish, to

> review quicker later.

>

> Attached is a historic progression graphic ('Expanded Govt. Spending Share

> of Economy') of said govt. spending ratio data as shown in the chapter

> Govt. Spending

> Report, being the 3rd graphic on that page. It tells quite a dramatic

> story, over time, reaching all-time highs lately. You might also find

> helpful info from several graphics in the 2 chapters: Govt. Growth Report

> and the Federal Govt. Spending Report [a 2-web page report]

>

> Now to your quest for info RE what is not included in my graphic you

> displayed in your

> https://goldwetrust.forumotion.com/t9p540-inflation-or-deflation under the

> Buffet section.

>

> 1. Regulations - Add $2 trillion > Let's first respond to your point on

> regulations, where you said > 'And that doesn't include regulatory

> compliance (which is increasing radically now under Obama).'

> Again, I offer you some info, in case you have not yet found, from another

> of my chapters, called The Regulation Compliance Cost Report [a 3-web page

> report] You might scan a few graphics there and note said regulatory

> compliance costs (of course) are not included in reported govt. spending

> data because no attempt is made to collect, report and budget.

> From that chapter you will note my estimate (and this chapter says just

> that, my estimate from studies found and there referenced) is that fed +

> state/local govt regulatory compliance costs passed on to the private

> sector exceeds $2 trillion (another 17+% of the economy's nat income) - -

> which one should add to the above stated $5.9 trillion spending, thereby

> expanding the share of the economy impacted by govt all levels.

> (Shelby - let me here ask you, which in that chapter I ask all readers, to

> please let me know if in your endeavors you find more relevant studies on

> this subject than referenced and reported in that chapter, as such

> unfortunately are few and far between).

> Attached to this email is one of the graphics from that chapter ('Free

> Private Sector with spending & regulations 2010 vs 1947).

>

> 2. You mentioned possibly the mandated healthcare add-on. I have no data

> yet on that add-on, but if it is upheld such will be a huge biggie

> addition. So far I have not found (to me) creditable data as to what it

> might cost the private sector - - which, unfortunately, is typical of all

> govt. regulations issued - - as I cover in the regulation report chapter.

> While on this HealthCare subject, you might find the time to scan another

> chapter, called The HealthCare Report, which soon will be further updated,

> time permitting.

>

> 3. In your web report also you said, 'I would suppose the above chart also

> doesn't include Fannie and Freddie, which are pseudo-government agencies

> (feds backstop them), and now the government owns General Motors too, I

> wonder if that is in the above chart?'

> Very good points, Shelby. Although I do not have proof with hard data

> backup, until I do have such it would be savvy to assume such is NOT

> included. One simply needs to say > 'show me the data.'

>

> 4. Another biggie, of course, is that unlike most private sector

> accounting govt. does NOT accrue for future expenses - - such as Social

> Security, Medicare, Medicaid, government pensions and health care

> insurance federal and state/local. These are huge. I try to quantify some

> of such liabilities in a simple chapter you might find interesting, called

> Debt Summary Table. Additionally, for sure, spending does not incl.

> on-going and needed accruals for losses in GM, or in AIG, or in the TBTF

> banks, and on and on.

>

> 5. In general, you are correct that not all govt. spending is captured in

> published data. Therefore, reported governmental impacts certainly are not

> over-stated, rather under-stated.

> Just as companies, individuals, and governments oh so often love to

> over-state asset values - - for sure they NEVER overstate debt values and

> more often than not purposely understate their debts.

> Thus - - when we put together a 3-web page extensive chapter about debt,

> called America's Total Debt Report, such reports debts revealed, therefore

> understating all debt.

>

> Just in case it stimulates, I include two other graphics of major trends

> used by PTB to date to prop up things >

> trend US dollar internationally (from chapter called Foreign Exchange

> Report ) and trend dollar internally (from chapter called Inflation

> Report). Note the similar, long-term trends.

>

> There can be little doubt America, and much of the developed west, have

> extended and pretended so long by debt and trade deficits and government

> growth and currency depreciation that limits are now rapidly on top of us

> - - producing a huge runaway threat to my children's and grandchildren's

> generation.

>

> --------------------------------------------------------------------------------

>

> Let me stop here.

> You are invited to explore more of the Grandfather Economic Report series.

>

> I hope above is responsive and useful.

> I encourage you to continue your probing.

> When you have a chance let me hear about your takeaway and possible uses.

>

> very best regards,

>

> Michael Hodges

> Grandfather Economic Report

> http://grandfather-economic-report.com/

>

> Each generation hopes their children and

> grandchildren will have more security,

> education quality and economic opportunity.

>

> Certain trends threaten their future -

> compared to the past. Here's the proof.

> --------------------------------------------------------------------------------

>

>

>

> From: Shelby Moore

> Sent: Tuesday, August 16, 2011 10:11 PM

> To: michael-hodges@comcast.net

> Subject: Does your govt % of GDP include health care mandates, etc?

>

>

> I am trying to figure out what is the error in Warren Buffet's otherwise

> sound logic, and it appears to be he is not paying attention to the govt

> as a% of GDP. And as I state at following link, I wonder if you are

> missing many big factors in your calculation?

>

> https://goldwetrust.forumotion.com/t9p540-inflation-or-deflation#4521

So Buffet does not have a very good handle on the fact of why the capitalism of America is being bleed to death.

Maybe soon we will approach Eurozone Rigor Mortise if we are not already there:

http://anepigone.blogspot.com/2008/03/government-spending-as-percentage-of.html

==============================

ADD: another lie from Warren Buffet

Buffet said the very poor pay essentially no tax. Maybe that was a slip of the tongue, but it is simply untrue.

Actually the person making less than $7000, actually about 18% of the income in Federal payroll taxes, and that doesn't include state-level taxes, and sales taxes (poor spend most of their money and sales taxes are as high as double-digits). So poor are paying probably around 1/3 (33%) of their income in taxes.

http://market-ticker.org/akcs-www?post=192433

Finally, let's deal with the "but the poor!" crap and the truth about your W2 income.

Unlike most of the hacks who attacked this proposal I've run a business and made payroll. I'm well aware of exactly what the payroll account actually looks like, what's withheld and what you never see as an employee.

First, you have deducted from your check 6.2% and 1.45% of your gross hourly (or salary) wages. The 6.2% caps off eventually, but the 1.45% does not. Most people do not hit the cap - unless you're in the top quintile, you pay this on every dollar and see it in every check.

But in fact you pay twice that much, because the employer is required to send the same amount in although they are prohibited by law from itemizing it on your pay stub and telling you the truth - you were, in fact, offered and paid 7.65% more than your wage.

I don't care what the government says I can tell you. All I care about are facts.

Oh, but that's not all! Employers are also required to pay FUTA. That's the unemployment tax, and it's presently 6.2% on the first $7,000 in wages. There's an offset if you pay into a state fund, but you still pay - it's just who you pay. The working poor and lower-middle class - that is, someone making $10/hour or $20,000 a year for a standard 2,000 hour work-year (50 weeks of 40 hours) in fact is paying about 3% of his wages in that tax as well - and it's federally illegal to itemize that on the employees pay stub and disclose exactly how much is stolen from him in the form of that tax. Since this tax caps out at $7k in annual wages it is extremely regressive, even more so than Social Security.

There are other employment taxes as well, but those are the big federal ones, and pretending they don't exist is intentionally dishonest.

So is ignoring unemployment insurance that must be maintained along with Workman's Comp. Both are legally required and both are also extremely regressive, given that lower-income people tend to be more mobile when it comes to paid unemployment (it's a fact, like it or not) and thus tend to ramp your unemployment insruance rates (at least until you cap off.) The latter two are state-specific and so I'll ignore them - in other words, I'm understating the common worker's actual compensation in my example.

Last edited by Shelby on Sat Nov 15, 2014 5:29 am; edited 1 time in total

QE2.5 already underway (with effects coming on a lag)

QE2.5 already underway (with effects coming on a lag)

QE3 to follow as SuperCongress passes stimulus:

http://www.financialsense.com/contributors/bob-eisenbeis/2011/08/19/central-bank-policy-euro-bonds-and-qe3

* EU won't disintegrate, it is becoming more dependent every day, i.e.debtors remain slaves to the lenders and socialism spreads.

* EU is becoming more like the USA (states with balanced budget admendments and Federal money printing operation) and the USA is becoming more like the EU (heavily indebted, ingrained socialism).

Thus I would expect the markets to bottom within a month or two (or less). My S&P bottom target remains 945 - 1030.

Notice the Libya revolution is likely to be viewed as positive, and thus may cause the gold premium to temporary abate.

We are likely to see more recession scare to bring about support for the fiscal stimulus and Fed actions:

http://www.financialsense.com/contributors/chris-puplava/2011/08/19/bernankes-worst-nightmare-pushing-on-a-string

http://www.financialsense.com/contributors/bob-eisenbeis/2011/08/19/central-bank-policy-euro-bonds-and-qe3

* EU won't disintegrate, it is becoming more dependent every day, i.e.debtors remain slaves to the lenders and socialism spreads.

* EU is becoming more like the USA (states with balanced budget admendments and Federal money printing operation) and the USA is becoming more like the EU (heavily indebted, ingrained socialism).

Thus I would expect the markets to bottom within a month or two (or less). My S&P bottom target remains 945 - 1030.

Notice the Libya revolution is likely to be viewed as positive, and thus may cause the gold premium to temporary abate.

We are likely to see more recession scare to bring about support for the fiscal stimulus and Fed actions:

http://www.financialsense.com/contributors/chris-puplava/2011/08/19/bernankes-worst-nightmare-pushing-on-a-string

QE3 loan refinancing scheme

QE3 loan refinancing scheme

http://brucekrasting.blogspot.com/2011/08/feds-plan-rumors-of-news.html?showComment=1314865077223#c5750009698133096018

shelby wrote:

Karl Denninger comment on Bruce Krastings article, and afaics Karl is correct in his analysis of possible side-effects, but Karl doesn't get the point that the banksters want to destroy the pensions to push the dependence on the NWO.

http://market-ticker.org/akcs-www?post=193323

The next step in the "Think Like a Bankster" plan is now underway, "Transfer asset ownership, but retain prior owners as renters where possible":

http://www.thestreet.com/story/11224917/1/a-huge-housing-bargain--but-not-for-you.html

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

Also someone pointed out that the refinancing thing enables the Robosigner issue to be solved in favor of the banksters:

http://brucekrasting.blogspot.com/2011/08/feds-plan-rumors-of-news.html?showComment=1314938630761#c5314869645644137976

Anonymous wrote:

shelby wrote:

Excellent detective work.

This is ratcheting step of the bankster model, where it kills off the community banks and gets all the securities into bankster control:

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

This will provide the stagflation hell I am expecting in 2012.

Yeah people will get more money, but prices will go up, so the people lose, the govt's share of the economy continues to increase, and the negative marginal-utility-of-debt will continue to increase (the more stimulost, the faster the "REAL" GDP is shrinking, i.e. nominal GDP minus the true inflation rate, not the liar CPI stats).

Karl Denninger comment on Bruce Krastings article, and afaics Karl is correct in his analysis of possible side-effects, but Karl doesn't get the point that the banksters want to destroy the pensions to push the dependence on the NWO.

http://market-ticker.org/akcs-www?post=193323

The next step in the "Think Like a Bankster" plan is now underway, "Transfer asset ownership, but retain prior owners as renters where possible":

http://www.thestreet.com/story/11224917/1/a-huge-housing-bargain--but-not-for-you.html

http://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

Also someone pointed out that the refinancing thing enables the Robosigner issue to be solved in favor of the banksters:

http://brucekrasting.blogspot.com/2011/08/feds-plan-rumors-of-news.html?showComment=1314938630761#c5314869645644137976

Anonymous wrote:

This is an attempt by the banksters to rewrite all the notes and get borrowers to sign fresh.

Dont forget the robocop and MERS fiasco.

This would turn any non recourse loan into a recourse loan in the states allow such.

Major CYA

The banks love it because it creates the documents that may needed in the future to foreclose on borrowers.

Ben gets TARP II

The FED slims down

Fannie & Freddie takes on more shit loans.

Once upon a time on Christmas Eve past, there was a treasury secretary named Tiny Tim, who in the stillness of the night, raised the limit of toxic coal that F/F could swallow.

Unlimited.

Well Tiny Tim says it is time to make F/F swallow.

In Bernanke we bust & In Geithner we doubt

No doubt Hank is on speed dial for both.

What a freakin cartoon!

And they're gonna get away with it.

Unfucxing real

Let me distill Armstrong's analysis of the Swiss franc devaluation

Let me distill Armstrong's analysis of the Swiss franc devaluation

http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-swiss-devalue-franc-090711.pdf

Essentially he said that the Swiss action redirects capital inflows from transient franc-denominated financial assets which pay 0% (thus are not attractive if franc will not be allowed appreciate relative to Euro) to devalued hard assets within Switzerland. Either way, Switzerland will experience stagflation, now instead of consumers holding a bunch of imported cheap goods in exchange for hot money inflows, the Swiss central bank will hold a boatload of Euros and Swiss consumers will pay higher prices for imported goods.

Armstrong says this is brilliant because it reduces the risk of sudden hot money outflows, and again Martin shows that he is not a free market thinker.

It is better for the govt to not intervene and let the Swiss consumers have ownership of their capital than central bank centralizes the ownership of the imported capital. Armstrong is wrong.

He is correct that this will drive more safe haven capital to gold. He doesn't make the point that it also exports the capital of Switzerland to support the Euro bailout.

The main point is that Switzerland has joined the EU monetary union. That is massive bullish for gold long-term (not necessarily short-term), because one-by-one every country that was not a disaster, is joining to become a disaster.

Essentially he said that the Swiss action redirects capital inflows from transient franc-denominated financial assets which pay 0% (thus are not attractive if franc will not be allowed appreciate relative to Euro) to devalued hard assets within Switzerland. Either way, Switzerland will experience stagflation, now instead of consumers holding a bunch of imported cheap goods in exchange for hot money inflows, the Swiss central bank will hold a boatload of Euros and Swiss consumers will pay higher prices for imported goods.

Armstrong says this is brilliant because it reduces the risk of sudden hot money outflows, and again Martin shows that he is not a free market thinker.

It is better for the govt to not intervene and let the Swiss consumers have ownership of their capital than central bank centralizes the ownership of the imported capital. Armstrong is wrong.

He is correct that this will drive more safe haven capital to gold. He doesn't make the point that it also exports the capital of Switzerland to support the Euro bailout.

The main point is that Switzerland has joined the EU monetary union. That is massive bullish for gold long-term (not necessarily short-term), because one-by-one every country that was not a disaster, is joining to become a disaster.

Reminder about the sudden end to the dollar coming in 2012

Reminder about the sudden end to the dollar coming in 2012

Discussion from February 2011:

Shelby wrote:Andy it is very interesting to ponder how the debasement of the dollar is going to play out at the end game.

I had reasoned and asserted in 2010, that global HYPERinflation would be impossible for any extended period of time, because hyper-inflating commodities would shut down production globally and it would quickly crater into global depression and chaos.

When there is a single country that is HYPERinflating its currency, then production only stops within that country. The production of commodities and services continues on indefinitely in the vast majority of the world, so the HYPERinflation can continue in that country for some time.

[...]

So yes, we will get a hyperinflation, but it will be nearly instant. You will either have gold and silver or you won't. Most westerners won't.

The other way it works is a stampede to gold & silver (and not commodities), with supply constrained by the globalists themselves, thus most westerners won't get any that way either. Which is what I think would happen if the westerners woke up and tried to buy gold & silver in massive quantities too soon. I wanted to test this theory by trying to find a way to market gold & silver at an exponential rate to westerners. I think it probably is just a pipe dream though.

anonymous wrote:Shelby,

Agree it will be nearly instant, travelling like a shock wave, agree it will probably be set off by something in Europe, then a short delay before the shock wave appears.

I think it will all happen very quickly, a game of musical chairs with 2 billion or so people and very few chairs to buy, it can’t last long once it starts.

Shelby wrote:Note that this chart if used the correct ShadowStats.com data, it would look much worse. It would instead show the fall continuing straight down off cliff after 1975 and not slowing down and down to less than $0.01 (1 penny) already. Also the historic volatility between $0.40 and $1.00 would look much smaller and be squeezed to the top the chart (due to the correct logarithmic scaling). Logarithmic scaling is the only way for humans to correctly visualize the exponential function (proportional change):

changed my mind

changed my mind

Having thought more about how the entropic efficiency is aided by "the path of the least resistance" in terms of orders moving faster to their demise, I think Armstrong is correct. This action forces Swiss citizens to buy gold instead of cheap imports.

Shelby wrote:http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-swiss-devalue-franc-090711.pdf

Essentially he said that the Swiss action redirects capital inflows from transient franc-denominated financial assets which pay 0% (thus are not attractive if franc will not be allowed appreciate relative to Euro) to devalued hard assets within Switzerland. Either way, Switzerland will experience stagflation, now instead of consumers holding a bunch of imported cheap goods in exchange for hot money inflows, the Swiss central bank will hold a boatload of Euros and Swiss consumers will pay higher prices for imported goods.

Armstrong says this is brilliant because it reduces the risk of sudden hot money outflows, and again Martin shows that he is not a free market thinker.

It is better for the govt to not intervene and let the Swiss consumers have ownership of their capital than central bank centralizes the ownership of the imported capital. Armstrong is wrong.

He is correct that this will drive more safe haven capital to gold. He doesn't make the point that it also exports the capital of Switzerland to support the Euro bailout.

The main point is that Switzerland has joined the EU monetary union. That is massive bullish for gold long-term (not necessarily short-term), because one-by-one every country that was not a disaster, is joining to become a disaster.

Dallas Fed, Richard Fisher - deadcat bounces, as dollar breaks out?

Dallas Fed, Richard Fisher - deadcat bounces, as dollar breaks out?

Says that he didn't agree with QE2, the Fed has monetized some of the debt, and that all the members don't want to throw in the towel and get runaway inflation like in Weimer or Argentina. That is a pretty strong statement. It seems to me to indicate that it is very unlikely the Fed will act on QE3 on Sept 20.

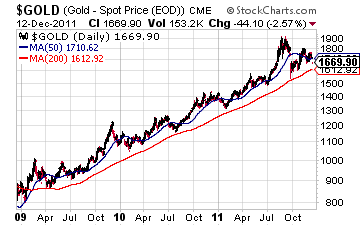

We might get a natural bounce in the markets now, if Greece makes it past Wednesday, and with China vowing to buy Italy's bonds. DAX is probably due for a bounce. Gold is having trouble moving up with the dollar also moving up, as I expected. We might get a relaxation in the dollar back down to the breakout line at around 76.5, before the move towards 81. That might give gold one more chance to move up. It is looking to me still like there is going to be some final capitulation in S&P by November, perhaps as early as Oct or late Sept.

Gold could make another run up, or it could languish down into a range, or even drop.

At this point, I looking to put or call any extremes, and waiting that capitulation to do my final loading of silver. I do think eventually the USA will do a QE3, even if it just takes the form of the SuperCongress approving a big stimulost package, which the Fed is then obligated to fund to maintain low interest rates through 2013. This is clearly the final peak for the US Treasuries, because the Fed has thrown in the towel by making such a guarantee. So Fisher can say this or that, but the reality is the Fed already threw in the towel, it is just that the Fed govt has to actually do the spending. This won't be hyperinflation, but it will be severe stagflation, by a series of SuperCongress actions. It is the possible that we need that selloff on the markets in order to give the SuperCongress their cover for pushing through the stimulost.

http://finance.yahoo.com/blogs/daily-ticker/dollar-rebounds-richard-fisher-not-happy-being-nicest-171013340.html

I see a potential bearish H&S on the S&P which projects down to about $1030, and on gold a bearish descending triangle and H&S that projects to below $1700.

PIIGS spreads are skyrocketing:

http://market-ticker.org/akcs-www?post=194035

We might get a natural bounce in the markets now, if Greece makes it past Wednesday, and with China vowing to buy Italy's bonds. DAX is probably due for a bounce. Gold is having trouble moving up with the dollar also moving up, as I expected. We might get a relaxation in the dollar back down to the breakout line at around 76.5, before the move towards 81. That might give gold one more chance to move up. It is looking to me still like there is going to be some final capitulation in S&P by November, perhaps as early as Oct or late Sept.

Gold could make another run up, or it could languish down into a range, or even drop.

At this point, I looking to put or call any extremes, and waiting that capitulation to do my final loading of silver. I do think eventually the USA will do a QE3, even if it just takes the form of the SuperCongress approving a big stimulost package, which the Fed is then obligated to fund to maintain low interest rates through 2013. This is clearly the final peak for the US Treasuries, because the Fed has thrown in the towel by making such a guarantee. So Fisher can say this or that, but the reality is the Fed already threw in the towel, it is just that the Fed govt has to actually do the spending. This won't be hyperinflation, but it will be severe stagflation, by a series of SuperCongress actions. It is the possible that we need that selloff on the markets in order to give the SuperCongress their cover for pushing through the stimulost.

http://finance.yahoo.com/blogs/daily-ticker/dollar-rebounds-richard-fisher-not-happy-being-nicest-171013340.html

I see a potential bearish H&S on the S&P which projects down to about $1030, and on gold a bearish descending triangle and H&S that projects to below $1700.

PIIGS spreads are skyrocketing:

http://market-ticker.org/akcs-www?post=194035

China CONSUMER consumption falls from 46% to 34% of GDP in past 10 years

China CONSUMER consumption falls from 46% to 34% of GDP in past 10 years

http://www.bloomberg.com/news/2011-09-15/short-seller-muddy-waters-block-says-chinese-consumer-demand-overstated.html

Note though that GDP is much larger now.

This means that China's GDP is becoming more capital asset intensive, not less. Hmmm. China is going to crash hard, when it finally crashes. They are going to have a massive oversupply of bridges to no where, and buildings in the wrong places.

Note though that GDP is much larger now.

This means that China's GDP is becoming more capital asset intensive, not less. Hmmm. China is going to crash hard, when it finally crashes. They are going to have a massive oversupply of bridges to no where, and buildings in the wrong places.

China's blackmarket loan market crashing?

China's blackmarket loan market crashing?

http://globaleconomicanalysis.blogspot.com/2011/09/china-loan-shark-market-crashes-scores.html

China's "cash crunch", yikes!:

http://www.bloomberg.com/video/75962446/

Signs that Chinese are repatriating cash.

We could have liquidity crunch as I had been expecting since May. This would be the emergency that spurs the global QE3 reaction.

As I have said, we are heading for the bottom on the next selloff of silver and commodities. Be prepared to buy the fear and lockin your huge gains for 2012.

China's "cash crunch", yikes!:

http://www.bloomberg.com/video/75962446/

Signs that Chinese are repatriating cash.

We could have liquidity crunch as I had been expecting since May. This would be the emergency that spurs the global QE3 reaction.

As I have said, we are heading for the bottom on the next selloff of silver and commodities. Be prepared to buy the fear and lockin your huge gains for 2012.

China's consumption share of GDP has dropped from 45% in 2000 to 34%

China's consumption share of GDP has dropped from 45% in 2000 to 34%

I share this because it is so striking. China's consumption share of GDP has dropped from 45% in 2000 to 34%, which is apparently unprecedented in the history of the world. Normal ranges are 50 - 65%, and recession lows perhaps to 45%. The implication is that China can not escape from a near-term implosion of their over-spending on infrastructure and subsequent decades of slow growth in the 3% range. Refer the link at the bottom of this article:

http://www.financialsense.com/contributors/michael-pettis/2011/10/21/chinese-malinvestment-is-worse-than-most-people-think

I extrapolate the implication is that the developing world is like a coiled spring of rising relative wages, that will be accelerated once China's mercantile model implodes and they become another developing consumer engine. It looks like China's mercantile model will hit the wall at about the same time that the western debt props do.

==============

China driven inflation to continue to at least 2013

http://mpettis.com/2011/07/no-hard-landing-but-no-solution/

http://www.financialsense.com/contributors/michael-pettis/2011/10/21/chinese-malinvestment-is-worse-than-most-people-think

I extrapolate the implication is that the developing world is like a coiled spring of rising relative wages, that will be accelerated once China's mercantile model implodes and they become another developing consumer engine. It looks like China's mercantile model will hit the wall at about the same time that the western debt props do.

==============

China driven inflation to continue to at least 2013

http://mpettis.com/2011/07/no-hard-landing-but-no-solution/

Re: Inflation or Deflation?

Re: Inflation or Deflation?

http://esr.ibiblio.org/?p=3894#comment-335858

Another sign that China is overinvested (malinvested) in capital infrastructure.

The most impressive capitalist moment I had was seeing a store built in a day. As in, the first day, the street corner was empty. Second day, construction. Third day, a free standing, fully staffed and operational cosmetics store.

Another sign that China is overinvested (malinvested) in capital infrastructure.

BIG PICTURE: Muni crash underway

BIG PICTURE: Muni crash underway

http://www.infowars.com/the-municipal-bond-market-is-imploding/

The real estate sector which is the source of local taxes, it going to get much worse:

http://www.infowars.com/ten-million-american-families-sliding-towards-foreclosure/

Cities can't borrow, states can't run a deficit but they can cannibalize city tax revenue:

http://humboldtlib.blogspot.com/2011/10/ca-ground-zero-for-muni-bond-crash.html

My conclusion is that within a few months, we will need another massive federal stimulus, and this will also give the Feds more control (i.e. the states will capitulate on Real Id, TSA police will supplement local police, etc.). Also I think the EU is dragging their feet, and at some point we will get a global contagion and need a massive global stimulus.

The question is that does come at us in multiple blows with only small half-steps on renewed stimulus throughout 2012, and then when the big crackup comes does the system fail perhaps by 2013 or 2014.

Or do we get some severe contagion within the next 3 months or so, then a huge stimulus reaction like in 2008.

Perhaps that question is irrelevant in terms of our investments. The central banks will have to debase, they have no other choice. They will debase until the inflation rate and thus "rationing" is so high that the masses riot in the streets by the millions. At that point, they will reset the currencies with a gold backing and super high interest rates.

We want to be in silver for as long as China still has the capacity to debase more and pump up their economy again. I think China can go through another debasement cycle before their population erupts into massive riots.

The real estate sector which is the source of local taxes, it going to get much worse:

http://www.infowars.com/ten-million-american-families-sliding-towards-foreclosure/

Cities can't borrow, states can't run a deficit but they can cannibalize city tax revenue:

http://humboldtlib.blogspot.com/2011/10/ca-ground-zero-for-muni-bond-crash.html

My conclusion is that within a few months, we will need another massive federal stimulus, and this will also give the Feds more control (i.e. the states will capitulate on Real Id, TSA police will supplement local police, etc.). Also I think the EU is dragging their feet, and at some point we will get a global contagion and need a massive global stimulus.

The question is that does come at us in multiple blows with only small half-steps on renewed stimulus throughout 2012, and then when the big crackup comes does the system fail perhaps by 2013 or 2014.

Or do we get some severe contagion within the next 3 months or so, then a huge stimulus reaction like in 2008.

Perhaps that question is irrelevant in terms of our investments. The central banks will have to debase, they have no other choice. They will debase until the inflation rate and thus "rationing" is so high that the masses riot in the streets by the millions. At that point, they will reset the currencies with a gold backing and super high interest rates.

We want to be in silver for as long as China still has the capacity to debase more and pump up their economy again. I think China can go through another debasement cycle before their population erupts into massive riots.

Outlook through 2012

Outlook through 2012

My crystal ball has become more lucid again.

I suggest reading the following linked article carefully, including watching the video and the linked PDF file near the end of this article:

http://www.financialsense.com/contributors/doug-short/2011/11/11/http%3A/%252Fadvisorperspectives.com/dshort/updates/ecri-weekly-leading-index

What is apparently happening is that the moderation of inflation since May, has caused consumers and producers in the USA to splurge a little bit on back-to-school spending (buy while the prices are low!), by increasing their debt.

Shelby wrote:

But a tsunami of municipal bond defaults is underway (already at $11 billion 2011, which is greater than $8.5b in 2008, and accelerating with $4 billion Jefferson county default last week):

https://goldwetrust.forumotion.com/t9p555-inflation-or-deflation#4644

http://www.huffingtonpost.com/2011/08/02/meredith-whitney-there-are-increasing-double-dip-recession_n_916200.html

http://finance.fortune.cnn.com/2011/06/06/meredith-whitney-state-finances-are-worse-than-estimated/ (states spending 36% more than tax revenue, Fed backstop ended in June)

http://www.zerohedge.com/news/will-meredith-whitney-be-proved-right-end

The recession will hit Q1 2012 in USA.

However, this is coincident with China about ready to start easing again (China will not hit the wall until after 2013 when they've wasted all of their savings):

http://www.financialsense.com/contributors/chris-puplava/2011/11/11/stage-is-set-for-possible-china-surprise-in-2012

And EU is about ready to apply their "bazooka" QE:

http://www.nytimes.com/2011/11/11/world/europe/11iht-letter11.html?_r=2&partner=rss&emc=rss

http://yrah53.wordpress.com/2011/11/10/binismaghi/

So what we have is a mixed bag bottoming process in terms of commodity inflation. The Fed and SuperCongress will be forced to bailout the failing municipalities in terms of providing unemployment assistance, food stamps, etc.. So the QE worldwide is going to be back on the upswing, starting first in China and EU, then USA to follow by Q2 2012.

Thus I see massive inflation before the end of 2012, with an easy double in the silver price to $65+. The commodities have probably already seen their lows, although we might get one more dip of silver into the $26 - $30 range, if you are lucky.

Oil flow from the middle east is likely to be shut off in 2012. The elite appear to be going for a massive inflationary event before 12/12/2012 to bring the world to its knees. This severe inflation will cause the world to go into such debt debt, that after 12/12/2012, we will enter a very chaotic period with the global economy in disarray.

=========================================================================

My recent comments on why I think the EU will integrate into a fiscal union with plenty of QE

=========================================================================

Read this linked article:

Out Of The Ashes Of The Collapse Of The Eurozone Will A "United States Of Europe" Arise?

Also, Germany pushes towards EU fiscal unification before end of 2012.

Shelby wrote:

I suggest reading the following linked article carefully, including watching the video and the linked PDF file near the end of this article:

http://www.financialsense.com/contributors/doug-short/2011/11/11/http%3A/%252Fadvisorperspectives.com/dshort/updates/ecri-weekly-leading-index

What is apparently happening is that the moderation of inflation since May, has caused consumers and producers in the USA to splurge a little bit on back-to-school spending (buy while the prices are low!), by increasing their debt.

Shelby wrote:

I am very curious what this entire report says?

http://www.shadowstats.com/article/no-396-3rd-quarter-gdp-october-confidence-september-durables-orders-and-home-sales

Denninger has some similar comments:

http://market-ticker.org/akcs-www?post=196634

http://market-ticker.org/akcs-www?post=196699

It is important to know if the government is cooking the numbers, or what is actually going on, so we can determine if this rally has long-term legs or is just a quick deadcat bounce as Denninger is implying below:

http://market-ticker.org/akcs-www?post=196679

But a tsunami of municipal bond defaults is underway (already at $11 billion 2011, which is greater than $8.5b in 2008, and accelerating with $4 billion Jefferson county default last week):

https://goldwetrust.forumotion.com/t9p555-inflation-or-deflation#4644

http://www.huffingtonpost.com/2011/08/02/meredith-whitney-there-are-increasing-double-dip-recession_n_916200.html

http://finance.fortune.cnn.com/2011/06/06/meredith-whitney-state-finances-are-worse-than-estimated/ (states spending 36% more than tax revenue, Fed backstop ended in June)

http://www.zerohedge.com/news/will-meredith-whitney-be-proved-right-end

The recession will hit Q1 2012 in USA.

However, this is coincident with China about ready to start easing again (China will not hit the wall until after 2013 when they've wasted all of their savings):

http://www.financialsense.com/contributors/chris-puplava/2011/11/11/stage-is-set-for-possible-china-surprise-in-2012

And EU is about ready to apply their "bazooka" QE:

http://www.nytimes.com/2011/11/11/world/europe/11iht-letter11.html?_r=2&partner=rss&emc=rss

http://yrah53.wordpress.com/2011/11/10/binismaghi/

So what we have is a mixed bag bottoming process in terms of commodity inflation. The Fed and SuperCongress will be forced to bailout the failing municipalities in terms of providing unemployment assistance, food stamps, etc.. So the QE worldwide is going to be back on the upswing, starting first in China and EU, then USA to follow by Q2 2012.

Thus I see massive inflation before the end of 2012, with an easy double in the silver price to $65+. The commodities have probably already seen their lows, although we might get one more dip of silver into the $26 - $30 range, if you are lucky.

Oil flow from the middle east is likely to be shut off in 2012. The elite appear to be going for a massive inflationary event before 12/12/2012 to bring the world to its knees. This severe inflation will cause the world to go into such debt debt, that after 12/12/2012, we will enter a very chaotic period with the global economy in disarray.

=========================================================================

My recent comments on why I think the EU will integrate into a fiscal union with plenty of QE

=========================================================================

Read this linked article:

Out Of The Ashes Of The Collapse Of The Eurozone Will A "United States Of Europe" Arise?

Also, Germany pushes towards EU fiscal unification before end of 2012.

Shelby wrote:

Armstrong has so many errors in this paper. I find it to be one of his worst, e.g.There will be only two

possible solutions; (1) MONETIZE the debt or (2) DEFAULT on the debt.

The govt can also force retirees to hold the debt as their retirement investments.

This problem is a political one, where no one wants to give up their govt benefits, thus monetizing is not a solution either, because the demand for benefits will always increase (Iron Law of Political Economics).

Thus monetization and default are the same, the only potential difference could possibly be how the pain is distributed.

Bottom line is that everyone who sucks the tit of govt, and does not get their savings out of paper, is going to lose.

The pertinent timing indicator for gold is that when the monetary system is backed by gold, interest rates will climb, and that is the time to sell gold for equity investments.

Some people will prefer to buy bonds at that point, but saving-at-interest is the same as encouraging debt and pooling capital, and is how society ends up where it is now. It is also severely underperforms equity investment:

https://goldwetrust.forumotion.com/t124p30-theory-of-everthing#4640

I am hopefully going to make an online academy, and there one of the subjects I will teach is Economics. Adam Smith was wrong, Martin Armstrong is wrong, etc (Jason Hommel is correct):

https://goldwetrust.forumotion.com/t182-technology-that-changes-everything#4645

As for silver, when the world has moved to default stage where interest rates will be allowed to climb, then silver will collapse too, because there will be very little capital (paper will be destroyed) and thus growth in China will slow down to maybe 3% or negative for a while.

Some people think the great default is as soon as 2012. The central banks can keep printing money for as long as inflation is not out-of-control.

So the first thing we need to see is silver going crazy $75+ (probably $150+), before the central banks are out of ammunition.

The rollercoaster gyrations between QE and pause, are accelerating and shortening in cycle period, and this keeps people out of silver especially due to the volatility.

I think the govts and central banks are going to pause and delay as long as they can, but ultimately they will QE everything. And silver is going to rocket higher, probably sometime in 2012.

It will be a very volatile ride. Because the politics is much more fractured, and the inflation bomb fuse is very short now. The central banks and govts are trying to not have their hand forced, but they soon have no choice but to light that fuse.

Some people argue that Germans will never allow it, but of course all those retirees with their life savings in bonds, they want higher interest rates, but the system of saving-at-interest is a theft system that encourages debt formation. Thus there is no way they are going to get what they want. Instead the default will fall on their backs, as it should, because they did an evil thing their whole life.

Another factual error by armstrong

Armstrong wrote:In Germany, two thirds of Germans surveyed in recent

polls believe that their parliament should NOT ratify more money for the euro-zone bailout fund and

agree with former chancellor Helmut Kohl that Angela Merkel's government is undermining Germany's

influence abroad. Chancellor Merkel is facing a revolt in her own party within parliament over a

September 29 vote to ratify more money and powers for the euro rescue fund. She is being publicly

criticized even by her ex-mentor Helmut Kohl who was the architect of German reunification. The real

danger is that Merkel’s refusal to restructure the euro-debt threatens far more than Greece. The

German people cannot be suppressed forever. They will get to vote one day and Merkel will be kicked

out the back door. Germany will turn inward and far more isolationist and the trade barriers will rise in

Europe

But he is wrong. Former chancellor Helmut Kohl is calling for more money printing:

http://www.spiegel.de/international/germany/0,1518,782757,00.htmlKohl. In recent years, he said in an interview this week with the magazine Internationale Politik, Germany "has not been a reliable power -- neither in domestic policy nor in foreign policy." He claimed to often wonder "where Germany stands today and where it is heading."

Halting Efforts

Kohl, who originally plucked Merkel out of obscurity to make her a cabinet minister in 1991, was referring primarily to trans-Atlantic relations and to concerns that the US no longer sees Germany as a vital foreign partner.Kohl provided the hard place. His criticism of the chancellor in the Internationale Politik interview was not limited to her foreign policy profile. The committed European also repeated his vociferous critique of Merkel's halting attempts to prevent the euro zone from crumbling. He said that "we have no choice" but to provide aid to Greece. Europe, he feels, needs "energetic action and a package of forward-looking, intelligently thought-out measures free of ideology with which we can get Europe and the euro back on track and secure our future."

http://www.spiegel.de/international/europe/0,1518,775085,00.html

You can clearly see that the people of Europe want the "discipline" of a political union:

http://www.spiegel.de/international/europe/0,1518,775085,00.html

Europeans are collectivists! They will always opt for collectivity over efficiency! Anyone who has worked with anyone from Europe will know this is true!

Even the "populist" parties in Germany, are not calling for less government. In fact, one of them calls for free education for everyone. And they were angry at Merkel for not joining the "liberate Libya" war.

Soros on EU

Read this together with my prior 2 emails on Armstrong, then I think you will see what is coming is the "bazooka" as I had expected:

http://www.nytimes.com/2011/11/11/world/europe/11iht-letter11.html?_r=2&partner=rss&emc=rss

Holding silver for $75+. Govts will massively QE again. They have no other choice. The people want govts to fix the problem. They don't want their retirement accounts (in Germany for example), i.e. their investments in debt, to decline in value.

Everybody has a vested interest to see interests rates continue to decline. Remember when interest rates rise, then bond investments lose value, i.e. retirement plans will implode.

Europe is mostly retirees.

People get this logic backwards, they think rising interest rates are good for retirees. No! The opposite actually. Rising interest rates means the economy is imploding and the retirees are being wiped out.

Actually retirees should stay away from bonds entirely, but that is my bigger point about that people are too stupid and want debasement.

re: Soros on EU

I simply don't view it as force. The Germans want their cake and eat it too. Europeans are hypocrites. The German retirees want to be able to buy bonds of the PIIGS, then sell them manufactured goods and take all the money back, then expect their retirement plans to be solvent. That is a collectivist model and not capitalism. The Germans don't want capitalism. And so they will not get it. Soros is not forcing socialism on them.

No I was expecting a crash of S&P to about 950, not as massive as 2008. I expect the next massive crash after 2012 (when inflation brings the global economy to its knees).

On Oct 2010, I wrote an article published at marketoracle (when silver was $22), predicting it to go to $45 - $47 before summer of 2011, then to drop to $25 - $27.

That is exactly what happened.

I don't think the drop in the S&P is done yet. ECRI is still expecting another wave of recessionary forces.

I expect EU, USA, and China will be back in stimulating monetary mode before summer 2012. And that is why I am speculating on a double of the silver and oil price before end of 2012.

>

> Not surprising hardcore globalist Soros wants to force Germans onto the EU

> Titanic. Thanks for the link, I wasn't familiar with his "bazooka"

> metaphor.

>

> Weren't you expecting a massive PE crash (and I assume an economic crash)

> this November?

78% of Germans want what Soros wants

Soros is not forcing EU integration on them, they want it:

http://finance.yahoo.com/news/poll-78-percent-germans-see-102232348.html

Refer to my prior post "re: Soros on EU".

Globalists prepare to replace the national govts of EU

http://market-ticker.org/akcs-www?post=197378

http://www.infowars.com/super-globalist-to-replace-italys-berlusconi/

Printing press is being readied to spread the pain to the masses

Printing press is being readied to spread the pain to the masses

http://www.financialsense.com/contributors/john-mauldin/2011/11/14/where-is-the-ecb-printing-press

Make sure you read the entire article. He made most the same points I made recently. See below...

==========================================

my logic on resolution of the current socialism

Ultimately the ECB and Fed are going to have to print more money. The EU will require new agreements. It will be simple threat to the EU members:

"vote for NWO style fiscal integration, or face economic collapse"

The retirees in EU have no choice, ditto the retirees in the USA.

To make it more sure, they will drive chaos in ME to drive price of oil to $150+.

Socialism doesn't escape into early defaults and adaption. It increases concentration until it results in some form of totalitarianism. Every time in history.

We could probably trace all of this back to the wiring of the brain for rewards and positive feelings (of security, primitive survival instincts, etc).

===============================================

It is easy to get people to vote for a new treaty, when the offer is they vote or they don't get ECB+Fed monetization and they get kicked out of EU and experience economic collapse.

They will use Greece as the example of what happens when you get kicked out. They will turn Greece into a scorched earth.

This is why they plan to take oil to $200 in 2012, so that those who don't vote yes, end up in starvation.

Yes we will be getting serious contagion throughout 2012, but at the same time, massive monetization for those who vote "yes" to the NWO.

Those who vote "no", are going to be set out to starve.

Now how do you think they plan to deal with us owners of gold and silver? They surely will...

============================================

Socialism until death do us part

He is missing the point.

The point is either you get on the monetization bandwagon, or you watch your country starve. Iceland was an exception.

The politics will be that "everyone shares the pain, so that none of us starve".

"You are either for us, or against us."

"One for all, and all for one."

============================================

Indeed that is very important in the near-term. Thanks.

Into 2012, the central banks will monetize. If necessary, the US Fed will do the monetization for the EU.

===============================

the printing press enables the vested interests to unwittingly enslave themselves

The key difference is that printing money means the inflation tax affects the middle class and savers the most.

The point of printing is it enables those who don't save to steal from those who save. This will be maximized. This is to maximize the totalitarianism that will result, i.e. NWO, more restrictive governance, etc..

This is simply the "borrower is slave to lender" coming true. Bond holders (e.g. retirees via their retirement plans) didn't realize they were actually debtors. This is true, their so called asset is really a liability due to the fact that it is denominated in fiat. This is more complex than I feel like explaining right now.

http://www.financialsense.com/contributors/charles-hugh-smith/2011/11/14/the-world-is-drowning-in-debt-and-europe-laces-on-concrete-boots

France will want the Eurozone to bail out their banks, and that means the ECB. If France gets such a deal, Ireland will certainly demand – and get – one, too.

But the choice is print or let the euro perish. I see no other realistic solution, aside from massive austerity, willingly accepted by Europeans everywhere, along with the nationalization of their banks, etc., as described above. I think there is even less willingness to endure all that.

It is a hard choice, I know. If you held a gun to my head and asked, “What do you think they will do?” I would have to say, “I think the ECB prints.” But not without a lot of rancor and solemn pledges and maybe a rewriting of the treaty in order to get Germany to go along.

Make sure you read the entire article. He made most the same points I made recently. See below...

==========================================

my logic on resolution of the current socialism

Ultimately the ECB and Fed are going to have to print more money. The EU will require new agreements. It will be simple threat to the EU members:

"vote for NWO style fiscal integration, or face economic collapse"

The retirees in EU have no choice, ditto the retirees in the USA.

To make it more sure, they will drive chaos in ME to drive price of oil to $150+.

Socialism doesn't escape into early defaults and adaption. It increases concentration until it results in some form of totalitarianism. Every time in history.

We could probably trace all of this back to the wiring of the brain for rewards and positive feelings (of security, primitive survival instincts, etc).

===============================================

It is easy to get people to vote for a new treaty, when the offer is they vote or they don't get ECB+Fed monetization and they get kicked out of EU and experience economic collapse.

They will use Greece as the example of what happens when you get kicked out. They will turn Greece into a scorched earth.

This is why they plan to take oil to $200 in 2012, so that those who don't vote yes, end up in starvation.

Yes we will be getting serious contagion throughout 2012, but at the same time, massive monetization for those who vote "yes" to the NWO.

Those who vote "no", are going to be set out to starve.

Now how do you think they plan to deal with us owners of gold and silver? They surely will...

============================================

Socialism until death do us part

yellowcaked wrote:nice quote from Armstrong:

http://www.martinarmstrong.org/files/Speak-See-Hear-Nothing%2011-09-2011.pdThe assumption that the ECB can save the day is up there with Santa Claus.

He is missing the point.

The point is either you get on the monetization bandwagon, or you watch your country starve. Iceland was an exception.

The politics will be that "everyone shares the pain, so that none of us starve".

"You are either for us, or against us."

"One for all, and all for one."

============================================

yellowcaked wrote:My guess is the EUR market this week feels some shakedown because the ESEF cannot attract buyers for their bonds to backstop Italy.

Could be some real volatility ahead:

http://www.zerohedge.com/news/european-ponzi-goes-full-retard-efsf-found-monetize-itself

Indeed that is very important in the near-term. Thanks.

Into 2012, the central banks will monetize. If necessary, the US Fed will do the monetization for the EU.

===============================

the printing press enables the vested interests to unwittingly enslave themselves

I think countries who vote 'no' or 'yes' will get scorched at $200 oil.

The key difference is that printing money means the inflation tax affects the middle class and savers the most.

The point of printing is it enables those who don't save to steal from those who save. This will be maximized. This is to maximize the totalitarianism that will result, i.e. NWO, more restrictive governance, etc..

This is simply the "borrower is slave to lender" coming true. Bond holders (e.g. retirees via their retirement plans) didn't realize they were actually debtors. This is true, their so called asset is really a liability due to the fact that it is denominated in fiat. This is more complex than I feel like explaining right now.

http://www.financialsense.com/contributors/charles-hugh-smith/2011/11/14/the-world-is-drowning-in-debt-and-europe-laces-on-concrete-boots

Printing presses on your mark, get ready, set, and go...

Printing presses on your mark, get ready, set, and go...

Moment of printing truth imminent for EU:

http://www.financialsense.com/contributors/gonzalo-lira/2011/11/16/we-are-in-the-middle-of-a-run-on-europe-and-it-is-gonna-get-worse

Recently read, Fed voting member Ballard also said Fed would also print if needed to shore up EU.

=================

http://www.financialsense.com/contributors/bruce-krasting/2011/11/16/thin-ice

Bruce thinks Germany won't bailout the rest of EU. I think he fails to appreciate the real politics, which is German retirees don't want their retirement plans to go bankrupt. Their banks loaned money to the rest of EU. And if EU implodes, so do German exports and economy. Thus driving interest rates sky high in Germany too, thus crashing the value of existing German bonds (i.e. retirement plans with domestic bonds).

The Germans have just as much debt ratio as USA. They will print. Their political "saving face" is to talk tough against printing, but when SHTF, no one wants to crash.

Besides, the Fed will print for the ECB, if necessary.

I think the only question is how deep they let this contagion run before they bring out their bazooka.

That is why I say buy as there is this fear of collapse. The fear will soon be reversed to a fear of inflation.

========================

China is nearly bankrupt:

http://www.financialsense.com/contributors/michael-shedlock/2011/11/16/chinese-banking-system-nearly-bankrupt

I say one more round of desperate money printing for the world, and that will be inflation hell and end game. It will accelerate, probably runaway inflation in late 2012.

===================

Remember Lindsey Williams said must get out of paper

The MF Global scam of lending our your cash in your brokerage accounts is widespread:

http://market-ticker.org/akcs-www?post=197706

http://market-ticker.org/akcs-www?post=197702

=================

In my opinion, we need to buyers here, and especially any dip below $30, back up the truck with the remainder of cash. I think silver leads on the way down, and lags on the way up. So silver should be about done with finding a bottom, as I believe the world is going to print like mad sometime in 2012. I think silver and copper have already sniffed this.

Maximum downside i see for silver on this bottoming process is $21. But I doubt lower than the $25 - $27, I had predicted back on Oct 2010:

http://www.marketoracle.co.uk/Article23786.html ("Silver will bottom at $22, then $45 by March 2011, then crash to $25")

==============

Don't forget the end game:

http://www.marketoracle.co.uk/Article20327.html

http://www.financialsense.com/contributors/gonzalo-lira/2011/11/16/we-are-in-the-middle-of-a-run-on-europe-and-it-is-gonna-get-worse

Recently read, Fed voting member Ballard also said Fed would also print if needed to shore up EU.

=================

http://www.financialsense.com/contributors/bruce-krasting/2011/11/16/thin-ice

Bruce thinks Germany won't bailout the rest of EU. I think he fails to appreciate the real politics, which is German retirees don't want their retirement plans to go bankrupt. Their banks loaned money to the rest of EU. And if EU implodes, so do German exports and economy. Thus driving interest rates sky high in Germany too, thus crashing the value of existing German bonds (i.e. retirement plans with domestic bonds).

The Germans have just as much debt ratio as USA. They will print. Their political "saving face" is to talk tough against printing, but when SHTF, no one wants to crash.

Besides, the Fed will print for the ECB, if necessary.

I think the only question is how deep they let this contagion run before they bring out their bazooka.

That is why I say buy as there is this fear of collapse. The fear will soon be reversed to a fear of inflation.

========================

China is nearly bankrupt:

http://www.financialsense.com/contributors/michael-shedlock/2011/11/16/chinese-banking-system-nearly-bankrupt

I say one more round of desperate money printing for the world, and that will be inflation hell and end game. It will accelerate, probably runaway inflation in late 2012.

===================

Remember Lindsey Williams said must get out of paper

The MF Global scam of lending our your cash in your brokerage accounts is widespread:

http://market-ticker.org/akcs-www?post=197706

http://market-ticker.org/akcs-www?post=197702

=================

In my opinion, we need to buyers here, and especially any dip below $30, back up the truck with the remainder of cash. I think silver leads on the way down, and lags on the way up. So silver should be about done with finding a bottom, as I believe the world is going to print like mad sometime in 2012. I think silver and copper have already sniffed this.

Maximum downside i see for silver on this bottoming process is $21. But I doubt lower than the $25 - $27, I had predicted back on Oct 2010:

http://www.marketoracle.co.uk/Article23786.html ("Silver will bottom at $22, then $45 by March 2011, then crash to $25")

==============

Don't forget the end game:

http://www.marketoracle.co.uk/Article20327.html

re: China is nearly bankrupt

re: China is nearly bankrupt

Shelbylook wrote:

China is nearly bankrupt:

http://www.financialsense.com/contributors/michael-shedlock/2011/11/16/chinese-banking-system-nearly-bankrupt

> I'm sure you've read about all of the Chinese protesters smashing sales

> offices and building models in high-rise apartments that have lost much of

> their value. The Asian culture used to value thrift and saving, how

> quickly they succumbed to the globalist debt greed model!

Two things about Asian culture afaics:

1. The men love gambling, alcohol, women, since the time of villages and cock fighting. The women tend to save for spending on the children's education, but here they demand conformance (females being focused on security and faith in social systems).

2. They prefer to save in terms of capital infrastructure, e.g. buildings. They save only very small portion in gold and silver. Even the Indians love usury-- they are the "5/6" lenders here in Philippines.

Sorry but the image people have of Asians is not reality.

The Japanese have a per capital debt of $69T, versus only $30T for USA.

==========================

> Thanks for the insight. The Asian [I knew]

> grew up in a different era and came from well educated families, so their

> fixation on saving money is not a good representation of the whole group.

> The older one was surprised at how frugal I am and how I eschewed any type

> of debt (mortgage, car loans, etc.), he told me I was into saving like the

> Chinese. The other influences on my view came from the cliches of main

> stream media - not a reliable source!

Perhaps I was slightly unclear. Asians do save more and borrow less personally, but they don't do very accurate economic assessments of where to invest their savings. The females put it in the fractional reserve bank "where it is safe", and the males invest "in a business", which typically means buying a building as it can produce an income and it is sign of accomplishment (big and visible).

If a capital investment can also have a capital gain, this fulfills all their core values:

1. "safe"

2. "a business", e.g. an office building

3. gambling culture

And once a majority (or significant minority) has a building, it becomes a social status symbol, then everybody has to have it, so they start borrowing to achieve social acceptability.

For Asians, social peer pressure is enormous. Look at how it is considered anti-social in Japan to move away from a irradiated region and not be stoic.

Then they are corrupted in governance, where they milk it for maximum personal gain. Thus via the banks and their savings, through the government borrowing, they are actually net debtors.

The Japanese debt is predominantly in the government and banking, not personal:

http://www.financialsense.com/contributors/charles-hugh-smith/2011/11/14/the-world-is-drowning-in-debt-and-europe-laces-on-concrete-boots

Asians need to "save face" in the social perspective. This is why they can steal from themselves at the government level, where they are respected leaders who are "doing the good for the people" ("hey look how many buildings we built for our people").

The fundamental cultural value is that Asians view economics in terms of social good, because of their desire for social harmony. Thus they fall into any traps that head towards centralization, pooling resources, etc.. Which is very low entropy and failure directed. I would guess off-top-of-my-head, this is probably the fundamental cause of all Asian regression over the centuries.

Again refer to my entropic economic theorem.

============================================

Another evidence that Asians love real estate "investments"

http://www.financialsense.com/contributors/mark-nestmann/2011/11/18/foreign-investors-in-u-s-real-estate-beware