Inflation or Deflation?

+18

wescal

lucky

Jim

studbkr

RandyH

cdavport

nuwrldudder

jack

kwp1

Yellowcaked

SRSrocco

LibertySilver

dz20854

silberruecken

neveroldami

Jeremy

explore

Shelby

22 posters

Page 22 of 24

Page 22 of 24 •  1 ... 12 ... 21, 22, 23, 24

1 ... 12 ... 21, 22, 23, 24

Greece bailout is both stimulative and contagious

Greece bailout is both stimulative and contagious

http://finance.yahoo.com/news/Greece-gets-new-bailout-with-apf-1229167797.html?x=0&sec=topStories&pos=4&asset=&ccode=

This both includes more stimulus and avoiding lowering Greece wages to make them competitive, thus making the problem worse long-term while adding stimulus short-term, while also setting off a short-term contagion in terms of the selective default (the bonds holders are taking a loss). Perhaps they will allow banks to not mark-to-market these losses thus delaying the contagion effect? But there is also the contagion effect that now the bond vigillantes know that selective default is where it ends up for all the PIIGS and the brave ones are going to start betting against the eurozone. Eventually the entire eurozone will fail because of their guarantees of the PIIGS debt which they had resisted but now have begun.

Lindsey Williams timeline is exactly being fulfilled. The entire eurozone will fail later, perhaps in 2012 since these effects are accelerating.

This both includes more stimulus and avoiding lowering Greece wages to make them competitive, thus making the problem worse long-term while adding stimulus short-term, while also setting off a short-term contagion in terms of the selective default (the bonds holders are taking a loss). Perhaps they will allow banks to not mark-to-market these losses thus delaying the contagion effect? But there is also the contagion effect that now the bond vigillantes know that selective default is where it ends up for all the PIIGS and the brave ones are going to start betting against the eurozone. Eventually the entire eurozone will fail because of their guarantees of the PIIGS debt which they had resisted but now have begun.

Lindsey Williams timeline is exactly being fulfilled. The entire eurozone will fail later, perhaps in 2012 since these effects are accelerating.

Besides the BKX bearish H&S, what other evidence of economic slowdown?

Besides the BKX bearish H&S, what other evidence of economic slowdown?

Besides the BKX bearish H&S and the correlation to period between QE1 and QE2 (which I showed in a prior post), what other evidence of economic slowdown?

If you watch several of these interviews on Yahoo Finance, it seems there is a lot of expectation for a pickup in GDP growth in the 2nd half of the year:

http://finance.yahoo.com/blogs/breakout/wall-street-washington-us-clarity-please-125325914.html;_ylt=AjabAuw8.ySOwVBA79I6Y9O7YWsA;_ylu=X3oDMTE2bXE5cDY1BHBvcwMxMgRzZWMDdG9wU3RvcmllcwRzbGsDd2FsbHN0cmVldHRv?sec=topStories&pos=7&asset=&ccode=

The consistent theme is that pickup from improvement of Japan supply chain. However, I never thought Japan crisis would be much of a factor, and the reason is because we don't have a supply-side problem, we have a demand-side problem. The July business survey seems to confirm my hypothesis:

http://market-ticker.org/akcs-www?post=190431 (zoom the chart for the survey)

The survey compares change since June. Notice that although there was an improvement in new orders from -7% to 0%, that is still not growth, and the increase in shipped orders were taken out of unfilled orders, while inventories grew. Employment weakened. So flat growth is all we got out of that May 2011 reduction in the commodities prices (lower prices for consumers), with demand insufficient to maintain the queue of unfilled orders nor draw down of inventories. And now commodity prices are rising again as China's tightening is winding down.

And why didn't we get more demand? Because the consumer is so tapped out that they are now maxing out their credit cards:

http://market-ticker.org/akcs-www?post=190500

Because they are losing jobs and wages are not rising while inflation does:

http://market-ticker.org/akcs-www?post=190430

If you watch several of these interviews on Yahoo Finance, it seems there is a lot of expectation for a pickup in GDP growth in the 2nd half of the year:

http://finance.yahoo.com/blogs/breakout/wall-street-washington-us-clarity-please-125325914.html;_ylt=AjabAuw8.ySOwVBA79I6Y9O7YWsA;_ylu=X3oDMTE2bXE5cDY1BHBvcwMxMgRzZWMDdG9wU3RvcmllcwRzbGsDd2FsbHN0cmVldHRv?sec=topStories&pos=7&asset=&ccode=

The consistent theme is that pickup from improvement of Japan supply chain. However, I never thought Japan crisis would be much of a factor, and the reason is because we don't have a supply-side problem, we have a demand-side problem. The July business survey seems to confirm my hypothesis:

http://market-ticker.org/akcs-www?post=190431 (zoom the chart for the survey)

The survey compares change since June. Notice that although there was an improvement in new orders from -7% to 0%, that is still not growth, and the increase in shipped orders were taken out of unfilled orders, while inventories grew. Employment weakened. So flat growth is all we got out of that May 2011 reduction in the commodities prices (lower prices for consumers), with demand insufficient to maintain the queue of unfilled orders nor draw down of inventories. And now commodity prices are rising again as China's tightening is winding down.

And why didn't we get more demand? Because the consumer is so tapped out that they are now maxing out their credit cards:

http://market-ticker.org/akcs-www?post=190500

Because they are losing jobs and wages are not rising while inflation does:

http://market-ticker.org/akcs-www?post=190430

Will markets go up if Tea Party blocks debt ceiling raise?

Will markets go up if Tea Party blocks debt ceiling raise?

Smoke and mirrors or for real? (we will soon find out)

http://market-ticker.org/akcs-www?post=190618

Are political leaders trying to create a new form of elite congress in order to eliminate the power of the tea party?

The so called "deficit reduction" may have been a lie:

http://market-ticker.org/akcs-www?post=190577

It is indeed a lie that we would default if the Aug. 2 deadline passes:

http://market-ticker.org/akcs-www?post=190590

In fact, if the marginal utility of debt is now negative, then reducing debt spending will actually have no material effect on _real_ GDP, other than short-term gyrations. The nominal GDP would drop, but so would inflation. Markets might even (eventually) go up, if the debt reduction was done in a way that had long-term expectations of reduced government regulation, lower inflation, etc.. However, the negative impacts in the markets would be due to uncertainty created from a deadlocked Congress, and from the initial absorption of the nominal reduction in (probably global) GDP.

================ email to Karl Denninger ========================

Subject: Karl I applaud your recent blogs at market-ticker.org

In fact, if the marginal utility of debt is now negative, then reducing debt spending will actually have no material effect on _real_ GDP, other than short-term gyrations. The nominal GDP would drop, but so would inflation. Markets might even (eventually) go up, if the debt reduction was done in a way that had long-term expectations of reduced government regulation, lower inflation, etc.. However, the negative impacts in the markets would be due to uncertainty created from a deadlocked Congress, and from the initial absorption of the nominal reduction in (probably global) GDP.

I am pro-growth. I am for the 7 year jubilee. I think we agree on more than you may realize. I would like to see a world where there are no borders but not for a big govt along with it, i.e. I agree with you that an immigrant shouldn't be allowed to force us to pay taxes for her welfare. I want a world where Americans are just as free to live and invest any where in the world, whereas currently they are not allowed to. Mexico for example discriminates against us, and Asia is even worse.

On the issue of the gold standard, I am not for it. I am for the state not having a monopoly on the issuance of money, because where ever there is a monopoly, the crooks will always gather and gain control. ALWAYS. This is the main area where you and I disagree. You think that a representative form of govt can print a paper legal tender. NO! THAT IS EXACTLY WHAT ROTHSCHILD WANTS. We need the 1000s of private banks issuing money (backed by what ever their patrons demand). Yeah I know the history of banking and this lead to where we are now. What I want you to note is that during the 1800s, depressions were more closely spaced and over with quickly. This was a self-correcting system. Unlike what we have in 1900s under a central authority is a runaway system that never corrects.

The big picture solution is that we have technology that didn't exist in the 1800s. And the more we can get people involved in the knowledge business, then the system can just route around (Coase's Theorem) these attempts at centralization. And I am putting my effort on exactly that:

http://copute.com

http://market-ticker.org/akcs-www?post=190618

Are political leaders trying to create a new form of elite congress in order to eliminate the power of the tea party?

The so called "deficit reduction" may have been a lie:

http://market-ticker.org/akcs-www?post=190577

It is indeed a lie that we would default if the Aug. 2 deadline passes:

http://market-ticker.org/akcs-www?post=190590

In fact, if the marginal utility of debt is now negative, then reducing debt spending will actually have no material effect on _real_ GDP, other than short-term gyrations. The nominal GDP would drop, but so would inflation. Markets might even (eventually) go up, if the debt reduction was done in a way that had long-term expectations of reduced government regulation, lower inflation, etc.. However, the negative impacts in the markets would be due to uncertainty created from a deadlocked Congress, and from the initial absorption of the nominal reduction in (probably global) GDP.

================ email to Karl Denninger ========================

Subject: Karl I applaud your recent blogs at market-ticker.org

In fact, if the marginal utility of debt is now negative, then reducing debt spending will actually have no material effect on _real_ GDP, other than short-term gyrations. The nominal GDP would drop, but so would inflation. Markets might even (eventually) go up, if the debt reduction was done in a way that had long-term expectations of reduced government regulation, lower inflation, etc.. However, the negative impacts in the markets would be due to uncertainty created from a deadlocked Congress, and from the initial absorption of the nominal reduction in (probably global) GDP.

I am pro-growth. I am for the 7 year jubilee. I think we agree on more than you may realize. I would like to see a world where there are no borders but not for a big govt along with it, i.e. I agree with you that an immigrant shouldn't be allowed to force us to pay taxes for her welfare. I want a world where Americans are just as free to live and invest any where in the world, whereas currently they are not allowed to. Mexico for example discriminates against us, and Asia is even worse.

On the issue of the gold standard, I am not for it. I am for the state not having a monopoly on the issuance of money, because where ever there is a monopoly, the crooks will always gather and gain control. ALWAYS. This is the main area where you and I disagree. You think that a representative form of govt can print a paper legal tender. NO! THAT IS EXACTLY WHAT ROTHSCHILD WANTS. We need the 1000s of private banks issuing money (backed by what ever their patrons demand). Yeah I know the history of banking and this lead to where we are now. What I want you to note is that during the 1800s, depressions were more closely spaced and over with quickly. This was a self-correcting system. Unlike what we have in 1900s under a central authority is a runaway system that never corrects.

The big picture solution is that we have technology that didn't exist in the 1800s. And the more we can get people involved in the knowledge business, then the system can just route around (Coase's Theorem) these attempts at centralization. And I am putting my effort on exactly that:

http://copute.com

We are overdue for a deflationary move

We are overdue for a deflationary move

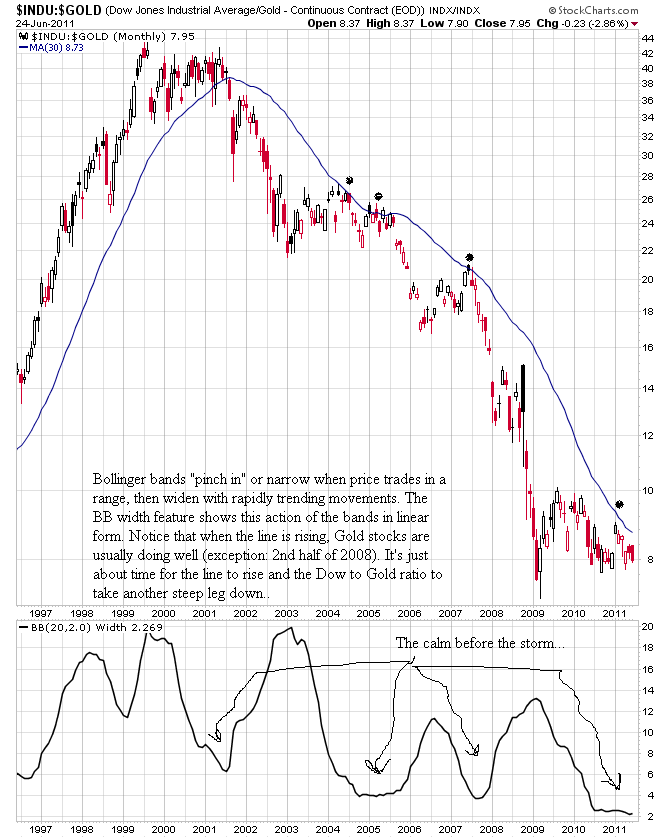

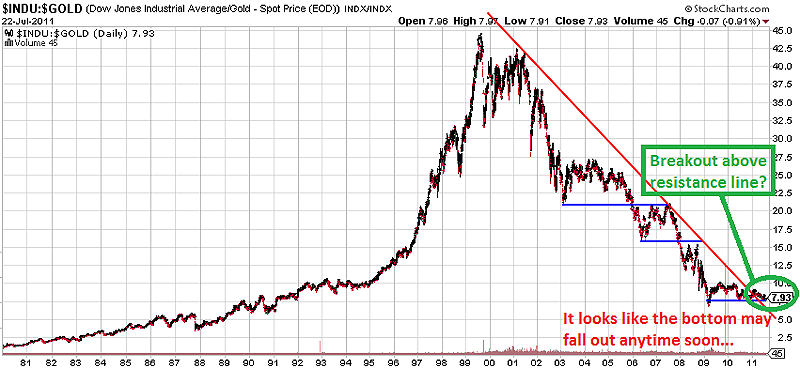

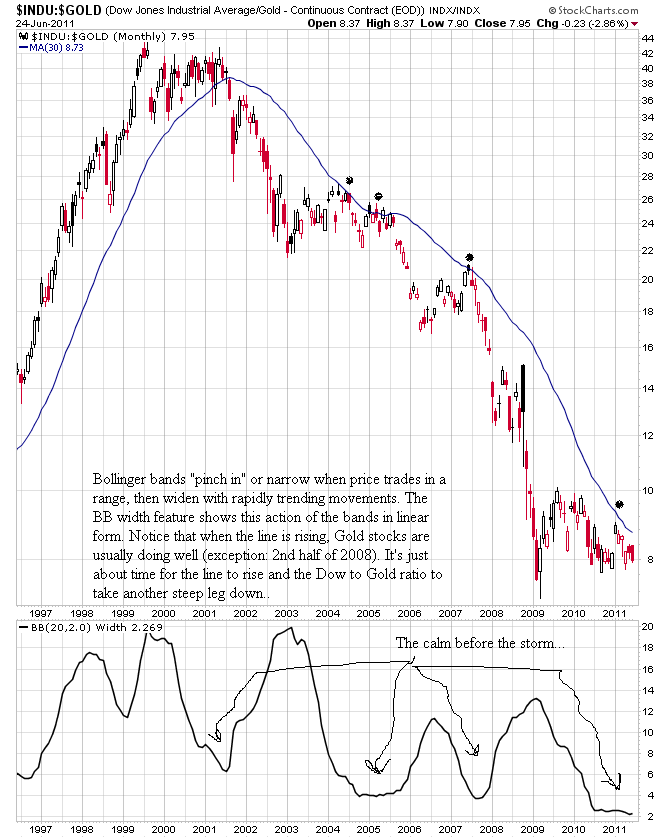

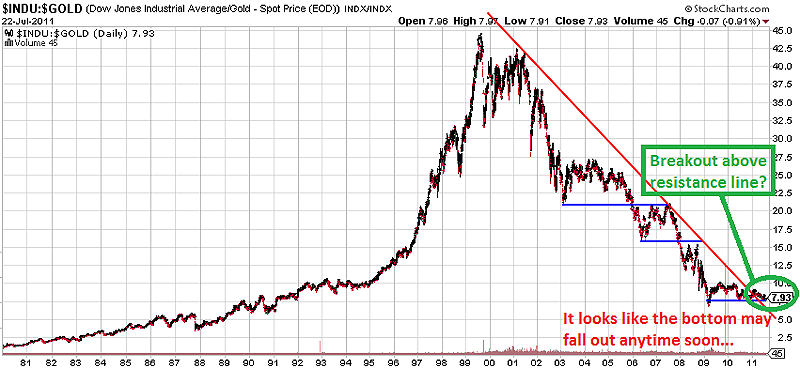

Oh I forgot about this chart!

But notice the drops except those since Q3 2008, the deflationary move was gold moving up faster than the stock market, not a crash in either. Looks like we are currently in that short sideways move in 2007 (see the black dot), before another big fall. This is sort of what I expect, a massive acceleration of inflation in 2012 with gold rising faster than the DOW, then fall of the cliff in 2013 as we did in 2008 (because the global economy will be suffocated by the inflation in 2012).

Here it is logarithmic, and it shows a waterfall as should be expected:

http://www.24hgold.com/english/contributor.aspx?article=3550127176G10020

Here it is non-logarithmic (which I don't consider to be correct way to plot charts, so the breakout of the red line is not an accurate timing indicator):

http://www.gold-eagle.com/editorials_08/weytjens072311.html

Note in the short-term, we could still get another rise up to the blue line (30 month or 120 week moving average), meaning correction to silver:

=============

ADD: summary of my outlook

Before 2013, gold rising faster than DOW. After 2013, another global contagion, with DOW falling or stagnant, but gold may rise or not fall as much 2008 (gold doing exceptionally better than DOW in any case).

My near-term point is we have room in that chart short-term for another pullback in silver.

In 2012, the chart must start moving down significantly, and I expect that to coincide with virulent, resurgent, brutal inflation from EU stimulus and QE3 and the knockon effects of the prior stimulii that has the marginal utility of debt negative, i.e. approaching saturation globally and any increase in debt like pouring fire on inflation, so I expect gold to increase faster than the Dow increases and I want to hold silver during this period.

But by roughly 2013, I expect the global economy to fall apart from this inflation, so then I expect more of a 2008 style crash, except the dynamics may be more tilted towards riots, war, and sovereign defaults, so gold may even go up if Dow goes down. This is why I would probably sell some silver for gold towards the peak of the 2012 inflation insanity. Then of course buy back into silver again after say a 25 - 50% rise in the gold/silver ratio.

But notice the drops except those since Q3 2008, the deflationary move was gold moving up faster than the stock market, not a crash in either. Looks like we are currently in that short sideways move in 2007 (see the black dot), before another big fall. This is sort of what I expect, a massive acceleration of inflation in 2012 with gold rising faster than the DOW, then fall of the cliff in 2013 as we did in 2008 (because the global economy will be suffocated by the inflation in 2012).

Here it is logarithmic, and it shows a waterfall as should be expected:

http://www.24hgold.com/english/contributor.aspx?article=3550127176G10020

Here it is non-logarithmic (which I don't consider to be correct way to plot charts, so the breakout of the red line is not an accurate timing indicator):

http://www.gold-eagle.com/editorials_08/weytjens072311.html

Note in the short-term, we could still get another rise up to the blue line (30 month or 120 week moving average), meaning correction to silver:

=============

ADD: summary of my outlook

Before 2013, gold rising faster than DOW. After 2013, another global contagion, with DOW falling or stagnant, but gold may rise or not fall as much 2008 (gold doing exceptionally better than DOW in any case).

My near-term point is we have room in that chart short-term for another pullback in silver.

In 2012, the chart must start moving down significantly, and I expect that to coincide with virulent, resurgent, brutal inflation from EU stimulus and QE3 and the knockon effects of the prior stimulii that has the marginal utility of debt negative, i.e. approaching saturation globally and any increase in debt like pouring fire on inflation, so I expect gold to increase faster than the Dow increases and I want to hold silver during this period.

But by roughly 2013, I expect the global economy to fall apart from this inflation, so then I expect more of a 2008 style crash, except the dynamics may be more tilted towards riots, war, and sovereign defaults, so gold may even go up if Dow goes down. This is why I would probably sell some silver for gold towards the peak of the 2012 inflation insanity. Then of course buy back into silver again after say a 25 - 50% rise in the gold/silver ratio.

Leaders are attempting to trick the tea party house members

Leaders are attempting to trick the tea party house members

Perhaps the tea party can block the debt limit rise (they had 90 signers on the cap & cut recently):

http://www.bloomberg.com/news/2011-07-28/house-debt-limit-vote-sets-stage-for-showdown-on-u-s-default.html

The dynamics are more complex than I have time to summarize.

OTOH, the Boehmer plan actually doesn't have any cuts, it is all a lie:

http://market-ticker.org/akcs-www?post=190833

So one would think the democrats will eventually agree to this, if Boehmer can get the tea party to vote for it.

It looks like a trick. Democrats are pretending to be against this, this is so Boehmer can trick the tea party into voting yes. Then after that, they will make some insignificant change, and the Dems will suddenly announce they will accept the plan.

This is all a trick to keep from cutting anything. Boehmer works for the banksters.

Somebody needs to get the word out!! If the tea party will just say "no", then we can perhaps avoid this coffin corner effect coming, where you can't cut the spending any more because then the taxes won't be enough to pay the debt payments:

http://market-ticker.org/akcs-www?post=190845

Go here for epicenter of Tea Party:

http://www.rushlimbaugh.com

Specifically you must read this:

http://www.rushlimbaugh.com/home/daily/site_072711/content/01125113.guest.html

http://www.bloomberg.com/news/2011-07-28/house-debt-limit-vote-sets-stage-for-showdown-on-u-s-default.html

The dynamics are more complex than I have time to summarize.

OTOH, the Boehmer plan actually doesn't have any cuts, it is all a lie:

http://market-ticker.org/akcs-www?post=190833

So one would think the democrats will eventually agree to this, if Boehmer can get the tea party to vote for it.

It looks like a trick. Democrats are pretending to be against this, this is so Boehmer can trick the tea party into voting yes. Then after that, they will make some insignificant change, and the Dems will suddenly announce they will accept the plan.

This is all a trick to keep from cutting anything. Boehmer works for the banksters.

Somebody needs to get the word out!! If the tea party will just say "no", then we can perhaps avoid this coffin corner effect coming, where you can't cut the spending any more because then the taxes won't be enough to pay the debt payments:

http://market-ticker.org/akcs-www?post=190845

Go here for epicenter of Tea Party:

http://www.rushlimbaugh.com

Specifically you must read this:

http://www.rushlimbaugh.com/home/daily/site_072711/content/01125113.guest.html

Different ways of explaining & visualizing the NEGATIVE marginal-utility-of-debt

Different ways of explaining & visualizing the NEGATIVE marginal-utility-of-debt

An alternative title for this is "Silver better than gold in every scenario (even if debt ceiling not raised)".

If you would like to send someone a copy of this article, here is a link that does not require a password, just right-click that link and choose "Copy link", then paste it into an email. Google reports that Jason's article is getting attention from other bloggers.

Recently Jason Hommel of the SilverStockReport.com, wrote a very clairvoyant qualitative explanation of why adding more debt and government spending, actually decreases the real GDP. He explained that it would be better to reduce the debt and government spending, as the real GDP would then rise. This is opposite of what most people think would happen, and opposite the fear propaganda being spread in the mass media, but it is a mathematical fact when the marginal-utility-of-debt is negative, then adding more debt actually decreases the real GDP, and thus conversely that reducing debt will increase real GDP. Of course the nominal GDP would decrease (or increase more slowly), so that some people whose income depends on government spending, would see their incomes decline (as deflation would spread into the economy), but the real GDP would actually increase, which means people in productive business would see their fortunes increase and those holding gold would see their fortunes decrease (this will be explained quantitatively).

Hommel also explained that it was possible for the government to spend without borrowing the money by printing the money out-of-thin-air, and at the end of this, I will explain the differences of that versus borrowing the money from "investors" (ahem, I will show the source of money is printed out-of-thin-air by the banks).

First, I think is important to show a quantitative explanation and proof that negative marginal-utility-of-debt is a fact, so that people can put proof behind their qualitative understanding and personal anecdotal experience. At the end, I will show the quantitative differences if we continue to add government spending (with or without adding more debt).

Quantitative Proof

The word "marginal" (debt) means the "added" (debt). When this is negative, it means that adding more debt, is causing the real GDP to decrease, instead of increase. The nominal GDP is increasing (the economic activity measured in current prices), but when you subtract cost-of-living increases (inflation in prices), then the real GDP is decreasing. This means on average, most people are seeing their standard-of-living-decline. Although wages might be increasing slightly or stagnant, the prices are increasing faster.

Also realize the charts that follow are using the governments calculation of CPI (inflation of prices), which has been argued to be vastly understated. Thus the charts below would show a much more drastically negative marginal-utility-of-debt, if the CPI used was reported by the government to be higher. The government reported CPI may be correct, as viewed from the perspective of someone who spends most of their income on housing (as this is declining in price), computers (as these are also declining in price), and imported goods where labor was formerly a big component of their cost (but these prices will start to increase as developing world wages are increasing now). But for people who spend most of their income on education, food, and energy (fuel, electricity, transportation), then the government reported CPI is vastly understating the increase in prices they are paying. Also there is a global factor to this, where inflation is lower for westerners who spend most of their income on deflating houses, versus the other 7 billion people who spend most of their income on food, energy, and education, and who have rising housing costs. The profligate government spending in the west, is exporting this inflation to the developing world.

It is very important when viewing the following chart that you don't get hopeful about the bounce upward in the blue line that may or may not have occurred since 2010, because you must note that the line is still below 0% (it will be if I can find an updated chart), and thus the economy is still shrinking (i.e. in a Great Depression since it has been sustained below 0% for 3 years).

One simplest way to plot the marginal-utility-of-debt is a chart that shows for each $dollar or debt added, how many $dollars of real GDP is increased or decreased. It has been steadily decreasing towards $0, then it fell off a cliff in 2008 to negative and hasn't recovered to positive. Here is that chart:

However, the above chart may not satisfy some people, because it may not be intuitive as to how the chart was calculated, and it doesn't show the absolute level of the real GDP, so we can not see if we are in a Great Depression.

It is very important when viewing the following chart that you don't get hopeful about the bounce upward in the red line for real GDP, because you must note that the line is still below 0%, and thus the economy is still shrinking (i.e. in a Great Depression since it has been sustained below 0% for 3 years).

Another way of visualizing marginal-utility-of-debt, is to plot a chart (with all lines expressed as as percentage change of that metric compared to the prior year, i.e. year-over-year "Y/O/Y"), with a green line for the nominal GDP, a blue line for debt as percentage of GDP, and a red line for real GDP. If the red line is equal to the green line minus the blue line, then it means all increases in debt are reflected as equivalent increase in CPI. If that the blue line is increasing faster than the red line is, there is a negative marginal-utility-of-debt. If the red line is below 0%, we are in recession. If the red line is below 0% for more than 6 months, then we are in a depression. If the red line is well below 0% and for years, then we are in a Great Depression.

However, I don't have such a chart. But there is a chart of real GDP, which you can correlate to the following chart. It confirms that we have continuing negative marginal-utility-of-debt (since 2009 charts show maximum real GDP rise of 5 - 7% and following chart shows public federal government debt rise of 7%), but if you believe the government's CPI then we are not in Great Depression, but if you believe SGS's computation, then we are.

Instead, if we assume that all increases in federal government debt are reflected as equivalent increase in CPI, then we plot the red line as the green line minus the blue line, then we get the following chart (and the article for the chart). Note this chart is assuming the CPI reported from the government is a lie. It is possible the assumption may be wrong, and that some of the government spending is not going into prices, but rather into paying down private debt (i.e. savings), and/or exported to the developing world where the inflation is much higher. But what this chart does show is that marginal-utility-of-debt for nominal GDP is negative, and nominal GDP is where government gets its taxes. So from the standpoint of the fiscal sustainability of the government's borrowing, the following chart is an appropriate assumption.

Govenment Deficit Spending With or Without Debt

Again do not get fooled by a rising nominal GDP, because it is nearly meaningless, because the increase or continuation of your income is meaningless, unless you also factor in the change in prices. Caveat: for those people whose income would be lost entirely, by a decline (or slow down in increase) in nominal GDP that a reduction in government spending would entail, they can argue that nominal GDP is important, except that eventually the declining real GDP will force the outcome any way (i.e. a default by the federal government). Overall for most people (and eventually for all, because kicking the can down the road only works for so long), real GDP measures the direction of the future.

So the charts above proved that increasing the federal government debt is decreasing the real GDP. Increasing federal government debt is the same as saying increase deficit spending (spending more than tax receipts)-- note I will explain later the option of increasing government spending by printing the deficit out-of-thin-air as Hommel proposed. What is important is we first recognize that increased government deficit spending is correlated to reduced real GDP. Thus Hommel's qualitative points about government spending being wasteful and harmful, are proven quantitatively.

If the federal government were to stop deficit spending, which either means a drastic reduction in spending or a large increase in taxes, then the real GDP would increase. That is a fact, proven by the quantitative charts. Note that increasing the tax rates, will also decrease the government spending, because the nominal GDP will decline when taxes are increased. Thus increasing tax rates is the same as decreasing government spending, if the government is committed to a balanced budget. The difference between raising taxes and decreasing spending, is that all throughout history, the government raises taxes, but never lowers the spending, thus the deficit spending never declines. So the tax rates rise versus spending decrease debt, is really about whether the government is serious about reducing spending. That is why the Tea Party republicans are correct, that cutting spending to a balanced budget is the only sane and credible action.

So we know quantitatively that if the government were to do the correct thing and decrease spending to a balanced budget, the real GDP would rise and overall the economy would be more prosperous. Most people would be able to increase their standard-of-living, even though the nominal GDP would decline (or the increase would slow down), prices would decline much faster (or increase much slower). Qualitatively, those wasteful activities from government spending (which are causing the real GDP to decline), would be eliminated, and thus there would be many people without wasteful jobs, looking for productive jobs. Thus businesses would prosper because they would find more opportunities to hire at affordable wages and eager employees.

Quantitatively if the government were to eliminate its borrowing via a balanced budget, then interest rates would decline. Since gold pays no interest, it rises in price when the interest rates are less than the rise in prices (which has been the case lately). So if prices were to drop in price, then since interest rates can not become negative, then gold would fall in price. So it would then be more profitable to hold (corporate, if government stops borrowing) bonds than gold. So we can say quantitatively that productive people would become more prosperous and lazy people and passive investors would become less profitable. Note holding a corporate bond is much more like investing than holding a government bond, because it is more free market (has more degrees-of-freedom), as individual corporations can fail and bond holders can lose, while other corporations and bond holders can prosper. However, a usurious bond is never as free market as capital ownership which can be bought and sold, because usury is a long-term futures contract that has less degrees-of-freedom.

Note silver is a different story, because the 7/8ths of the world's population uses 1/10 per capita of the silver that the other 1/8 does (because silver is used in high-tech and high-end products that middle class economies can afford), thus as the developing world becomes more prosperous (which will be even more the case if the indebted western countries become more prosperous), then demand for silver could increase 70 times (7000%) over next decade or so. Silver has a positive outcome no matter which path the governments take, even world war would drive the demand for silver.

If the federal government instead printed the money out-of-thin-air to fund deficit spending, then the real GDP would continue to decline, because assuming the government just kept spending constant, the wasteful activities would still continue. Realize that the current level of spending far exceeds tax receipts, so a constant level of spending is still deficit spending. The supply of money would increase and prices would go up, while the nominal GDP would not increase. Thus we can say quantitatively (mathematically) that real GDP would continue to decline.

When the government borrows money from "investors", this money was also printed out-of-thin-air by the banks, given the fractional reserve system of making loans that are greater than the money they have on deposit. So the difference is that the government is making interest payments to the banks for nothing. The banks get to create money and loan it and parasite on the economy. So although deficit spending is bad in either case (because wasteful government activities consume resources that private sector would allocate more efficiently), it would be much better for the government to print its own money for deficit spending, than to borrow it from banks.

If you would like to send someone a copy of this article, here is a link that does not require a password, just right-click that link and choose "Copy link", then paste it into an email. Google reports that Jason's article is getting attention from other bloggers.

Recently Jason Hommel of the SilverStockReport.com, wrote a very clairvoyant qualitative explanation of why adding more debt and government spending, actually decreases the real GDP. He explained that it would be better to reduce the debt and government spending, as the real GDP would then rise. This is opposite of what most people think would happen, and opposite the fear propaganda being spread in the mass media, but it is a mathematical fact when the marginal-utility-of-debt is negative, then adding more debt actually decreases the real GDP, and thus conversely that reducing debt will increase real GDP. Of course the nominal GDP would decrease (or increase more slowly), so that some people whose income depends on government spending, would see their incomes decline (as deflation would spread into the economy), but the real GDP would actually increase, which means people in productive business would see their fortunes increase and those holding gold would see their fortunes decrease (this will be explained quantitatively).

Hommel also explained that it was possible for the government to spend without borrowing the money by printing the money out-of-thin-air, and at the end of this, I will explain the differences of that versus borrowing the money from "investors" (ahem, I will show the source of money is printed out-of-thin-air by the banks).

First, I think is important to show a quantitative explanation and proof that negative marginal-utility-of-debt is a fact, so that people can put proof behind their qualitative understanding and personal anecdotal experience. At the end, I will show the quantitative differences if we continue to add government spending (with or without adding more debt).

Quantitative Proof

The word "marginal" (debt) means the "added" (debt). When this is negative, it means that adding more debt, is causing the real GDP to decrease, instead of increase. The nominal GDP is increasing (the economic activity measured in current prices), but when you subtract cost-of-living increases (inflation in prices), then the real GDP is decreasing. This means on average, most people are seeing their standard-of-living-decline. Although wages might be increasing slightly or stagnant, the prices are increasing faster.

Also realize the charts that follow are using the governments calculation of CPI (inflation of prices), which has been argued to be vastly understated. Thus the charts below would show a much more drastically negative marginal-utility-of-debt, if the CPI used was reported by the government to be higher. The government reported CPI may be correct, as viewed from the perspective of someone who spends most of their income on housing (as this is declining in price), computers (as these are also declining in price), and imported goods where labor was formerly a big component of their cost (but these prices will start to increase as developing world wages are increasing now). But for people who spend most of their income on education, food, and energy (fuel, electricity, transportation), then the government reported CPI is vastly understating the increase in prices they are paying. Also there is a global factor to this, where inflation is lower for westerners who spend most of their income on deflating houses, versus the other 7 billion people who spend most of their income on food, energy, and education, and who have rising housing costs. The profligate government spending in the west, is exporting this inflation to the developing world.

It is very important when viewing the following chart that you don't get hopeful about the bounce upward in the blue line that may or may not have occurred since 2010, because you must note that the line is still below 0% (it will be if I can find an updated chart), and thus the economy is still shrinking (i.e. in a Great Depression since it has been sustained below 0% for 3 years).

One simplest way to plot the marginal-utility-of-debt is a chart that shows for each $dollar or debt added, how many $dollars of real GDP is increased or decreased. It has been steadily decreasing towards $0, then it fell off a cliff in 2008 to negative and hasn't recovered to positive. Here is that chart:

However, the above chart may not satisfy some people, because it may not be intuitive as to how the chart was calculated, and it doesn't show the absolute level of the real GDP, so we can not see if we are in a Great Depression.

It is very important when viewing the following chart that you don't get hopeful about the bounce upward in the red line for real GDP, because you must note that the line is still below 0%, and thus the economy is still shrinking (i.e. in a Great Depression since it has been sustained below 0% for 3 years).

Another way of visualizing marginal-utility-of-debt, is to plot a chart (with all lines expressed as as percentage change of that metric compared to the prior year, i.e. year-over-year "Y/O/Y"), with a green line for the nominal GDP, a blue line for debt as percentage of GDP, and a red line for real GDP. If the red line is equal to the green line minus the blue line, then it means all increases in debt are reflected as equivalent increase in CPI. If that the blue line is increasing faster than the red line is, there is a negative marginal-utility-of-debt. If the red line is below 0%, we are in recession. If the red line is below 0% for more than 6 months, then we are in a depression. If the red line is well below 0% and for years, then we are in a Great Depression.

However, I don't have such a chart. But there is a chart of real GDP, which you can correlate to the following chart. It confirms that we have continuing negative marginal-utility-of-debt (since 2009 charts show maximum real GDP rise of 5 - 7% and following chart shows public federal government debt rise of 7%), but if you believe the government's CPI then we are not in Great Depression, but if you believe SGS's computation, then we are.

Instead, if we assume that all increases in federal government debt are reflected as equivalent increase in CPI, then we plot the red line as the green line minus the blue line, then we get the following chart (and the article for the chart). Note this chart is assuming the CPI reported from the government is a lie. It is possible the assumption may be wrong, and that some of the government spending is not going into prices, but rather into paying down private debt (i.e. savings), and/or exported to the developing world where the inflation is much higher. But what this chart does show is that marginal-utility-of-debt for nominal GDP is negative, and nominal GDP is where government gets its taxes. So from the standpoint of the fiscal sustainability of the government's borrowing, the following chart is an appropriate assumption.

Govenment Deficit Spending With or Without Debt

Again do not get fooled by a rising nominal GDP, because it is nearly meaningless, because the increase or continuation of your income is meaningless, unless you also factor in the change in prices. Caveat: for those people whose income would be lost entirely, by a decline (or slow down in increase) in nominal GDP that a reduction in government spending would entail, they can argue that nominal GDP is important, except that eventually the declining real GDP will force the outcome any way (i.e. a default by the federal government). Overall for most people (and eventually for all, because kicking the can down the road only works for so long), real GDP measures the direction of the future.

So the charts above proved that increasing the federal government debt is decreasing the real GDP. Increasing federal government debt is the same as saying increase deficit spending (spending more than tax receipts)-- note I will explain later the option of increasing government spending by printing the deficit out-of-thin-air as Hommel proposed. What is important is we first recognize that increased government deficit spending is correlated to reduced real GDP. Thus Hommel's qualitative points about government spending being wasteful and harmful, are proven quantitatively.

If the federal government were to stop deficit spending, which either means a drastic reduction in spending or a large increase in taxes, then the real GDP would increase. That is a fact, proven by the quantitative charts. Note that increasing the tax rates, will also decrease the government spending, because the nominal GDP will decline when taxes are increased. Thus increasing tax rates is the same as decreasing government spending, if the government is committed to a balanced budget. The difference between raising taxes and decreasing spending, is that all throughout history, the government raises taxes, but never lowers the spending, thus the deficit spending never declines. So the tax rates rise versus spending decrease debt, is really about whether the government is serious about reducing spending. That is why the Tea Party republicans are correct, that cutting spending to a balanced budget is the only sane and credible action.

So we know quantitatively that if the government were to do the correct thing and decrease spending to a balanced budget, the real GDP would rise and overall the economy would be more prosperous. Most people would be able to increase their standard-of-living, even though the nominal GDP would decline (or the increase would slow down), prices would decline much faster (or increase much slower). Qualitatively, those wasteful activities from government spending (which are causing the real GDP to decline), would be eliminated, and thus there would be many people without wasteful jobs, looking for productive jobs. Thus businesses would prosper because they would find more opportunities to hire at affordable wages and eager employees.

Quantitatively if the government were to eliminate its borrowing via a balanced budget, then interest rates would decline. Since gold pays no interest, it rises in price when the interest rates are less than the rise in prices (which has been the case lately). So if prices were to drop in price, then since interest rates can not become negative, then gold would fall in price. So it would then be more profitable to hold (corporate, if government stops borrowing) bonds than gold. So we can say quantitatively that productive people would become more prosperous and lazy people and passive investors would become less profitable. Note holding a corporate bond is much more like investing than holding a government bond, because it is more free market (has more degrees-of-freedom), as individual corporations can fail and bond holders can lose, while other corporations and bond holders can prosper. However, a usurious bond is never as free market as capital ownership which can be bought and sold, because usury is a long-term futures contract that has less degrees-of-freedom.

Note silver is a different story, because the 7/8ths of the world's population uses 1/10 per capita of the silver that the other 1/8 does (because silver is used in high-tech and high-end products that middle class economies can afford), thus as the developing world becomes more prosperous (which will be even more the case if the indebted western countries become more prosperous), then demand for silver could increase 70 times (7000%) over next decade or so. Silver has a positive outcome no matter which path the governments take, even world war would drive the demand for silver.

If the federal government instead printed the money out-of-thin-air to fund deficit spending, then the real GDP would continue to decline, because assuming the government just kept spending constant, the wasteful activities would still continue. Realize that the current level of spending far exceeds tax receipts, so a constant level of spending is still deficit spending. The supply of money would increase and prices would go up, while the nominal GDP would not increase. Thus we can say quantitatively (mathematically) that real GDP would continue to decline.

When the government borrows money from "investors", this money was also printed out-of-thin-air by the banks, given the fractional reserve system of making loans that are greater than the money they have on deposit. So the difference is that the government is making interest payments to the banks for nothing. The banks get to create money and loan it and parasite on the economy. So although deficit spending is bad in either case (because wasteful government activities consume resources that private sector would allocate more efficiently), it would be much better for the government to print its own money for deficit spending, than to borrow it from banks.

Prepare for collapse

Prepare for collapse

The debt ceiling deal cuts no spending. It is way of saying "$2.1 trillion in reduced deficits" which really means they are counting that the Bush tax cuts expire in 2012, generating an expected $2.1 trillion in tax revenue (mostly from the lower tax brackets!). Now that the debt ceiling is raised until 2013, the tea party can obtain no cuts until 2013, because there isn't veto override power and Obama will veto any cuts. It is worth listening to Karl Denninger's layman explanation on this.

The $2.1 trillion in revenue will get sucked right out of nominal GDP, so overall tax revenues won't rise, the tax rates will rise, but the tax revenue will be the same (i.e. the GDP will fall by $2.1 trillion), and thus there are not cuts. It is just a restructing of wealth from the middle class to the very rich. The reason the tax revenues can't rise is because it is has been proven that tax policy can not generate new business (i.e. GDP), unless it involves tax cuts. Historically over the decades, the percentage of tax revenues in the GDP has remained constant, even as the tax rates change.

Per my prior post in this thread, the marginal-utility-of-debt is now NEGATIVE, meaning additional debt and deficit spending REDUCES real GDP, i.e. a form of de-stimulus. The more they spend, the faster they will destroy the real GDP. This will take the form of accelerating inflation and defaults-- severe stagflation, i.e. great depression combined with inflation as the developed world defaults and the developing world inflates, a/k/a Collapsflation. I predicted this Inflating Deflation, back in early 2006.

Shelby Moore III wrote in 2006:

The collapse is accelerating. The tea party is now irrelevant. TPTB have won with certainty, barring some technological paradigm shift.

Also Ron Paul is claiming that the debt ceiling raise law contains provisions for a "Super Congress" which will ram through future tax increases and deficit limit raises, thus centralizing power and further removing the representation of frustrated Americans:

http://www.infowars.com/ron-paul-sounds-alarm-on-disturbing-super-congress/

Alex Jones gives his conspiracy theory perspective on this (I am not saying I agree with all of his points, but worth listening to):

https://www.youtube.com/watch?v=NO9JJ7X25Eg (describes the details of how the "Super Congress" can overrule congress to make law)

https://www.youtube.com/watch?v=Kj1uZlV2t9A

http://www.infowars.com/lyndon-larouche-obama-to-become-fuhrer-after-debt-ceiling-vote/ (1st video details the new law, 2nd video says collapse is immediate, 4th video near the end explains that deadlock is caused by people who think they have money in their investments, stocks, etc, but the will lose everything because that value does not exist)

https://www.youtube.com/watch?v=bPJrlxuGdPw

http://www.infowars.com/infowars-special-report-super-congress-paves-super-highway-to-gun-control/

http://www.infowars.com/government-mandates-free-birth-control/ (destroy the birth-rate, then demographics and economics collapses, video shows that western ladies use birth control from teenage forward, which leads to adverse physical and mental health later)

Regarding LaRouche's claims TPTB wants to cull the human population to 1 billion, my conspiracy theory (again this is just a theory and that is not to say I believe it), I had a couple of years ago figured out that the reason they needed to kill all 6 billion people, is because silver would go to the moon if they did not (because the developing world only uses 1/10 of the silver per capita as the developed world).

Since the public holds massive quantities of silverware, it would recapitalize the masses if silver was allowed to rise so incredibly. Imagine 70 times the current demand of silver.

TPTB have to marginalize silver, because it is the money of the masses.

Disclaimer: I am not spreading any hate against any one nor inciting any unrest nor illegal activity. I am pointing out that some people have opinions about what recently happened, but they are not necessarily my opinions.

========================

FROM EMAIL

========================

No can't you see that is a diversionary tactic planted by the infiltrators.

The last line in the sand was the debt ceiling vote. This email is just talk that can never be brought to a vote.

The tea party has been effectively destroyed. Game over. Move to next stage, which is riots and guerrilla warfare from frustrated americans who have no representation. Exactly what the TPTB want so they can move to the "body cavity" searches (announced recently by the TSA) and "show me your papers" stage.

TPTB have calculated that those who suck on the tit of socialism in the USA are sufficient in number to demand that the "terrorists" be controlled. They appear to have calculated correctly.

>

> After I sent you the last reply I opened this TeaParty newsletter which

> confirms that they are still focusing on the bigger picture.

> A one-time limited GAO audit of the Federal Reserve that was mandated by

> the Dodd-Frank Wall Street Reform and Consumer Protection Act has

> uncovered some eye-popping corruption at the Fed and the mainstream media

> is barely even covering it.

>

> It turns out that the Federal Reserve made $16.1 trillion in secret loans

> to their bankster friends during the financial crisis.

>

> These loans only went to the "too big to fail" banks and to foreign

> financial institutions. Not a penny of these loans went to small banks or

> to ordinary Americans. Not only did the banksters get trillions in nearly

> interest-free loans, but the Fed actually paid them over 600 million

> dollars to help run the emergency lending program. The GAO investigation

> revealed some absolutely stunning conflicts of interest, and yet the

> mainstream media does not even seem interested. Solid evidence of the

> looting of America has been put right in front of us, and yet hardly

> anyone wants to talk about it.

>

> The Tea Party Needs Your Help To Stop The Obama Regime

The $2.1 trillion in revenue will get sucked right out of nominal GDP, so overall tax revenues won't rise, the tax rates will rise, but the tax revenue will be the same (i.e. the GDP will fall by $2.1 trillion), and thus there are not cuts. It is just a restructing of wealth from the middle class to the very rich. The reason the tax revenues can't rise is because it is has been proven that tax policy can not generate new business (i.e. GDP), unless it involves tax cuts. Historically over the decades, the percentage of tax revenues in the GDP has remained constant, even as the tax rates change.

Per my prior post in this thread, the marginal-utility-of-debt is now NEGATIVE, meaning additional debt and deficit spending REDUCES real GDP, i.e. a form of de-stimulus. The more they spend, the faster they will destroy the real GDP. This will take the form of accelerating inflation and defaults-- severe stagflation, i.e. great depression combined with inflation as the developed world defaults and the developing world inflates, a/k/a Collapsflation. I predicted this Inflating Deflation, back in early 2006.

Shelby Moore III wrote in 2006:

First world economies face an unavoidable dilemma, regardless whether globalization is switched on or off, either sacrifice now with decades of retirement demographic deflation (globalization off), or sacrifice later by inflating the deflation of globalization for temporary illusionary "wealth", which will end in a hyper-catastrophic global collapse Greater depression.

World politics have chosen "sacrific later", and on the order of 30 - 50% of the capital in developing markets derived from globalization, as well as the matching consumption debt in first world, is "unproductive" and due to be wiped out.

Contrarian investors can drastically increase their wealth betting on hyper-inflation of commodoties and precious metals.

The collapse is accelerating. The tea party is now irrelevant. TPTB have won with certainty, barring some technological paradigm shift.

Also Ron Paul is claiming that the debt ceiling raise law contains provisions for a "Super Congress" which will ram through future tax increases and deficit limit raises, thus centralizing power and further removing the representation of frustrated Americans:

http://www.infowars.com/ron-paul-sounds-alarm-on-disturbing-super-congress/

Alex Jones gives his conspiracy theory perspective on this (I am not saying I agree with all of his points, but worth listening to):

https://www.youtube.com/watch?v=NO9JJ7X25Eg (describes the details of how the "Super Congress" can overrule congress to make law)

https://www.youtube.com/watch?v=Kj1uZlV2t9A

http://www.infowars.com/lyndon-larouche-obama-to-become-fuhrer-after-debt-ceiling-vote/ (1st video details the new law, 2nd video says collapse is immediate, 4th video near the end explains that deadlock is caused by people who think they have money in their investments, stocks, etc, but the will lose everything because that value does not exist)

https://www.youtube.com/watch?v=bPJrlxuGdPw

http://www.infowars.com/infowars-special-report-super-congress-paves-super-highway-to-gun-control/

http://www.infowars.com/government-mandates-free-birth-control/ (destroy the birth-rate, then demographics and economics collapses, video shows that western ladies use birth control from teenage forward, which leads to adverse physical and mental health later)

Regarding LaRouche's claims TPTB wants to cull the human population to 1 billion, my conspiracy theory (again this is just a theory and that is not to say I believe it), I had a couple of years ago figured out that the reason they needed to kill all 6 billion people, is because silver would go to the moon if they did not (because the developing world only uses 1/10 of the silver per capita as the developed world).

Since the public holds massive quantities of silverware, it would recapitalize the masses if silver was allowed to rise so incredibly. Imagine 70 times the current demand of silver.

TPTB have to marginalize silver, because it is the money of the masses.

Disclaimer: I am not spreading any hate against any one nor inciting any unrest nor illegal activity. I am pointing out that some people have opinions about what recently happened, but they are not necessarily my opinions.

========================

FROM EMAIL

========================

No can't you see that is a diversionary tactic planted by the infiltrators.

The last line in the sand was the debt ceiling vote. This email is just talk that can never be brought to a vote.

The tea party has been effectively destroyed. Game over. Move to next stage, which is riots and guerrilla warfare from frustrated americans who have no representation. Exactly what the TPTB want so they can move to the "body cavity" searches (announced recently by the TSA) and "show me your papers" stage.

TPTB have calculated that those who suck on the tit of socialism in the USA are sufficient in number to demand that the "terrorists" be controlled. They appear to have calculated correctly.

>

> After I sent you the last reply I opened this TeaParty newsletter which

> confirms that they are still focusing on the bigger picture.

> A one-time limited GAO audit of the Federal Reserve that was mandated by

> the Dodd-Frank Wall Street Reform and Consumer Protection Act has

> uncovered some eye-popping corruption at the Fed and the mainstream media

> is barely even covering it.

>

> It turns out that the Federal Reserve made $16.1 trillion in secret loans

> to their bankster friends during the financial crisis.

>

> These loans only went to the "too big to fail" banks and to foreign

> financial institutions. Not a penny of these loans went to small banks or

> to ordinary Americans. Not only did the banksters get trillions in nearly

> interest-free loans, but the Fed actually paid them over 600 million

> dollars to help run the emergency lending program. The GAO investigation

> revealed some absolutely stunning conflicts of interest, and yet the

> mainstream media does not even seem interested. Solid evidence of the

> looting of America has been put right in front of us, and yet hardly

> anyone wants to talk about it.

>

> The Tea Party Needs Your Help To Stop The Obama Regime

Tax revenue can't be raised with rates when marginal-utility-of-debt is negative

Tax revenue can't be raised with rates when marginal-utility-of-debt is negative

Sent to: grossdaniel11@yahoo.com

Tax revenue can't be raised with rates when marginal-utility-of-debt is negative. You only have one choice, which is lower spending. Any tax rate hikes will chomp on GDP, because debt is, so revenues decline. In short, the more they spend, the more the _real_ GDP is declining, unless you believe the liar CPI stats.

And you claim to be an economist. Geez. You will be just like the economists who study the Great Depression and still never understood economics in the slightest. We need to throw all you fools to your destiny by standing back with our gold and laughing.

Ref: http://finance.yahoo.com/blogs/daniel-gross/u-credit-rating-victim-gop-sabotage-021622372.html

In case you don't believe the marginal-utility-of-debt is negative:

https://goldwetrust.forumotion.com/t9p540-inflation-or-deflation#4484

Tax revenue can't be raised with rates when marginal-utility-of-debt is negative. You only have one choice, which is lower spending. Any tax rate hikes will chomp on GDP, because debt is, so revenues decline. In short, the more they spend, the more the _real_ GDP is declining, unless you believe the liar CPI stats.

And you claim to be an economist. Geez. You will be just like the economists who study the Great Depression and still never understood economics in the slightest. We need to throw all you fools to your destiny by standing back with our gold and laughing.

Ref: http://finance.yahoo.com/blogs/daniel-gross/u-credit-rating-victim-gop-sabotage-021622372.html

In case you don't believe the marginal-utility-of-debt is negative:

https://goldwetrust.forumotion.com/t9p540-inflation-or-deflation#4484

2012+ outlook: QE3 will be set a ceiling on the long bond

2012+ outlook: QE3 will be set a ceiling on the long bond

http://www.google.com/search?q=Operation+Twist

What this means is that the Fed (US central bank) will let short-term credit, e.g. credit cards and consumer credit, interest rates rise. And it will try to put a floor or a bounce in housing (to keep the housing bubble pumped up), and then the Feds (US govt) can borrow as much money as they can agree to spend on bailing out the dying consumer.

This is of course massively monetarily inflationary (to nominal GDP), and at the same time massively deflationary to REAL production, i.e. real GDP.

This is going to fail when the price of things is higher than the Feds can subsidize the consumer to afford. The Feds can't directly print money, i.e. money has to be either loaned into existence from banks, or the Fed has to borrow it from the Fed (via long bonds) and spend it into the economy. So hyper-inflation will rather difficult to sustain, plus it would require that the dollar be dumped as the world currency, because for as long as the other currencies (e.g. Yuan) are semi-pegged to the dollar by money printing of the world's central banks, then any hyperinflation in the dollar would mean the entire world would have to hyperinflate. But we can see with the riots all over, that it is nearly impossible to hyperinflate the entire world, because the people will simply quit producing and strike. I think it would incredibly difficult, instead some countries would have revolutions and stop pegging their currencies to the dollar as their people would demand survival. Understand that in the developing world, the people don't have so much debt, so they don't have any need for inflation, unlike here in the west where inflation is acceptable to debtors for as long as the Feds subsidize them and inflation is acceptable to the wealthy that invest in gold and silver. In the developing world, there is no political base to continue inflation beyond the point where the people can no longer buy food and pay their bills.

I think what is going to happen is we will see massive inflation into 2012 (on the order of $200+ gas, $3000 gold, $75 silver). Then in 2013, China will hit the wall as I described above, where the people can no longer buy food and pay their bills (they have some pockets of this already and it will spread). Middle East has hit the wall (they have no production, so inflation hits their people very hard), so Middle East will go into revolution in 2012 and stop producing oil (because the people aren't getting these profits, so they will fight over it).

When China hits the wall, it means they have no choice, they have to stop tying their currency to the dollar. So they will finally have to eat the loss of exports to the west, and eat the popping of their real estate bubble. But they can finance this internally, because they have huge savings, so we will see China have a bad crash, but it will not be the end of China's growth, as it will return with a stronger base later. For some year or years, China will go through a very bad crash and readjustment, as millions of factory workers will lose their jobs. The alternative is China can try to keep pumping up their bubbles and stay hitched to the dollar longer and basically shoot millions of people, but eventually they be forced to quit because too many of their population won't be able to afford to eat and pay rent. I think that wall is probably 2013, because of the massive inflation wave coming in 2012 and the fact that China is already showing signs of being near that wall. I could be wrong and China could somehow avoid the wall for a few more years. I doubt it. Chanos doubts it.

So at some point the dollar comes unhitched, and at the point the Euro and dollar go into hyperinflation, except that the governments of EU and USA don't really have an effective way to increase money in circulation at exponential rates, because I explained early the money has to be borrowed into existence and the political battles over increasing spending. However, at that the point the dollar becomes illiquid internationally, then wealthy people will wantt to get rid of dollars, so the dollars will return home and that is hyperinflationary. So I think the governments of EU and USA will be forced to prevent the sale of dollar bonds, to prevent hyperinflation. So we will see capital controls towards end of 2012 or in 2013. Since the government won't be able to increase spending fast enough, they will resort to a command economy, i.e. price controls and rationing.

So we are not going to see hyperinflation, rather we will see severe inflation coupled with rationing and capital controls. In terms of exchange value the dollar will plummet (when China is internally forced to unpeg from the dollar), so in that respect it will be hyperinflation, but the government will prevent the prices from reflecting the market exchange value of the dollar via both price and capital controls.

So what this means is that gold is going to skyrocket once the massive inflation of 2012 causes China to become unglued, silver will take hit because loss of industrial demand due to the pullback of China and rationing in the west.

This situation will persist until they reconstitute the dollar and Euro to gold and disenfranchise all the citizenry (force default on them), which will also surely take the form of stealing from all the millionaires they can.

Once the currencies are reconstituted, perhaps with regional currency unions or other form of movement towards world currency unification, then the developing world will become a solid base of growth and the west will bottom. Then silver will be the best investment, as the 7 billion in the developing world have to catch up on their per capita consumption to the west. Silver being an early indicator of the future, will likely bottom and start moving up again early.

The unknowns are to what degree does this transition involve war an/or depopulation. Typically business is detached from these matters. In other words, TPTB just see those as part of the ongoing business progression. So unless they plan world war at this stage, then we are likely to see a quick transition to the new world order. I don't think they want world war, because they do not have enough credit and ownership in the developing world. Right now the developing world is owned by the Taipans and leaders in those nations who have raped their own people. TPTB wants to go put consumer credit the developing world so it can take the whole pie, as it is doing in the west now. So I don't think TPTB will go for the massive depopulation event now at this juncture. I think rather they will use only the necessary violence in the USA to maximize the amount of the USA economy they can own. So they will push it as far as they are still making gains, then they will reconstitute the dollar.

It seems to me they will be constrained in the USA by how much the people will accept. If the people roll over and accept Nazi Germany, then they will get it. But I can clearly see the USA citizenry is not going to allow that. There is going to be some level of violence, we just have to wait and see where the wall is that TPTB can not overcome in terms of efficiency. Efficiency is where their efforts become counter-productive, in that the losses from more people are joining resistance becomes greater than the continued profits from theft of the rest of the compliant citizenry (the good sheep with their behinds raised up at all times for rear entry).

What this means is that the Fed (US central bank) will let short-term credit, e.g. credit cards and consumer credit, interest rates rise. And it will try to put a floor or a bounce in housing (to keep the housing bubble pumped up), and then the Feds (US govt) can borrow as much money as they can agree to spend on bailing out the dying consumer.

This is of course massively monetarily inflationary (to nominal GDP), and at the same time massively deflationary to REAL production, i.e. real GDP.

This is going to fail when the price of things is higher than the Feds can subsidize the consumer to afford. The Feds can't directly print money, i.e. money has to be either loaned into existence from banks, or the Fed has to borrow it from the Fed (via long bonds) and spend it into the economy. So hyper-inflation will rather difficult to sustain, plus it would require that the dollar be dumped as the world currency, because for as long as the other currencies (e.g. Yuan) are semi-pegged to the dollar by money printing of the world's central banks, then any hyperinflation in the dollar would mean the entire world would have to hyperinflate. But we can see with the riots all over, that it is nearly impossible to hyperinflate the entire world, because the people will simply quit producing and strike. I think it would incredibly difficult, instead some countries would have revolutions and stop pegging their currencies to the dollar as their people would demand survival. Understand that in the developing world, the people don't have so much debt, so they don't have any need for inflation, unlike here in the west where inflation is acceptable to debtors for as long as the Feds subsidize them and inflation is acceptable to the wealthy that invest in gold and silver. In the developing world, there is no political base to continue inflation beyond the point where the people can no longer buy food and pay their bills.

I think what is going to happen is we will see massive inflation into 2012 (on the order of $200+ gas, $3000 gold, $75 silver). Then in 2013, China will hit the wall as I described above, where the people can no longer buy food and pay their bills (they have some pockets of this already and it will spread). Middle East has hit the wall (they have no production, so inflation hits their people very hard), so Middle East will go into revolution in 2012 and stop producing oil (because the people aren't getting these profits, so they will fight over it).

When China hits the wall, it means they have no choice, they have to stop tying their currency to the dollar. So they will finally have to eat the loss of exports to the west, and eat the popping of their real estate bubble. But they can finance this internally, because they have huge savings, so we will see China have a bad crash, but it will not be the end of China's growth, as it will return with a stronger base later. For some year or years, China will go through a very bad crash and readjustment, as millions of factory workers will lose their jobs. The alternative is China can try to keep pumping up their bubbles and stay hitched to the dollar longer and basically shoot millions of people, but eventually they be forced to quit because too many of their population won't be able to afford to eat and pay rent. I think that wall is probably 2013, because of the massive inflation wave coming in 2012 and the fact that China is already showing signs of being near that wall. I could be wrong and China could somehow avoid the wall for a few more years. I doubt it. Chanos doubts it.

So at some point the dollar comes unhitched, and at the point the Euro and dollar go into hyperinflation, except that the governments of EU and USA don't really have an effective way to increase money in circulation at exponential rates, because I explained early the money has to be borrowed into existence and the political battles over increasing spending. However, at that the point the dollar becomes illiquid internationally, then wealthy people will wantt to get rid of dollars, so the dollars will return home and that is hyperinflationary. So I think the governments of EU and USA will be forced to prevent the sale of dollar bonds, to prevent hyperinflation. So we will see capital controls towards end of 2012 or in 2013. Since the government won't be able to increase spending fast enough, they will resort to a command economy, i.e. price controls and rationing.

So we are not going to see hyperinflation, rather we will see severe inflation coupled with rationing and capital controls. In terms of exchange value the dollar will plummet (when China is internally forced to unpeg from the dollar), so in that respect it will be hyperinflation, but the government will prevent the prices from reflecting the market exchange value of the dollar via both price and capital controls.

So what this means is that gold is going to skyrocket once the massive inflation of 2012 causes China to become unglued, silver will take hit because loss of industrial demand due to the pullback of China and rationing in the west.

This situation will persist until they reconstitute the dollar and Euro to gold and disenfranchise all the citizenry (force default on them), which will also surely take the form of stealing from all the millionaires they can.

Once the currencies are reconstituted, perhaps with regional currency unions or other form of movement towards world currency unification, then the developing world will become a solid base of growth and the west will bottom. Then silver will be the best investment, as the 7 billion in the developing world have to catch up on their per capita consumption to the west. Silver being an early indicator of the future, will likely bottom and start moving up again early.

The unknowns are to what degree does this transition involve war an/or depopulation. Typically business is detached from these matters. In other words, TPTB just see those as part of the ongoing business progression. So unless they plan world war at this stage, then we are likely to see a quick transition to the new world order. I don't think they want world war, because they do not have enough credit and ownership in the developing world. Right now the developing world is owned by the Taipans and leaders in those nations who have raped their own people. TPTB wants to go put consumer credit the developing world so it can take the whole pie, as it is doing in the west now. So I don't think TPTB will go for the massive depopulation event now at this juncture. I think rather they will use only the necessary violence in the USA to maximize the amount of the USA economy they can own. So they will push it as far as they are still making gains, then they will reconstitute the dollar.

It seems to me they will be constrained in the USA by how much the people will accept. If the people roll over and accept Nazi Germany, then they will get it. But I can clearly see the USA citizenry is not going to allow that. There is going to be some level of violence, we just have to wait and see where the wall is that TPTB can not overcome in terms of efficiency. Efficiency is where their efforts become counter-productive, in that the losses from more people are joining resistance becomes greater than the continued profits from theft of the rest of the compliant citizenry (the good sheep with their behinds raised up at all times for rear entry).

more correlations on my prior post in this thread

more correlations on my prior post in this thread

I am also calling for a peak sometime in late 2012 or early 2013:

https://goldwetrust.forumotion.com/t9p540-inflation-or-deflation#4506 (the prior post in this thread)

Thanks for the additional correlating factors. Also note that the Fed was created by a law in 1913 for 99 years, so their expiry is coming. I think TPTB will move us to a new dollar and Euro at that time.

> https://goldwetrust.forumotion.com/t44p75-what-is-money#4505

>

> I'd like to propose

> something extra which is that I remember the Y2K bug (which never

> materialised) with lead to the Snp500 peaking in Jan 2000.

>

> With the Mayan predictions possible that this peak is in Jan 2013?

> Coincides with the Facebook IPO and reelection of Obama.

>

> Only thing that makes me think otherwise is Glencore's IPO. Bit early

> don't you think?

Silver is likely to get a boost today after Fed announcement.

http://www.marketwatch.com/story/qe3-expect-at-most-qe-21-at-fed-meeting-2011-08-08

Fed is likely to move closer in language to the QE3 that I explained.

I don't think they will come out and promise to buy the long bond and hold it below a certain percentage interest rate, but I think they will provide language which indicates that they are prepared to do so, if it becomes necessary.

This should hopefully get silver to catch up with gold to around $44+, so then we can take profits before the economy rolls over and the Fed is actually forced to start the QE3 action of buying long bonds.

The alternative perspective is that there is really no stimulus until the Congress acts to increase spending, because the Fed buying the long bond doesn't actually inject any money into the economy until someone borrows more (due to the lower long term interest rates that the Fed would create). But I suppose that unemployment and food stamp benefits automatically increase as people apply for them? So all the Fed is doing is making a guarantee that the federal government can borrow long-term at lower rates. Hmmm, that might reassure the market that the USA is in no danger of default any time soon. Inflation depends on how much the federal government spends (how large he deficits are). Like I said, unless the Fed starts buying other things directly in the economy, then hyperinflation is difficult, because someone has to borrow the new money into existence.

=====================================

=====================================

=====================================

I do think the Fed will act today, because the stock market is down another 5% today. The S&P downgrade was well timed with the Tuesday Fed meeting.

One problem is gold might take a hit, which might drag silver down. But if the Fed's language is sufficiently inflationary, gold might stabilize and silver catch up.

The Fed can't keep both the bond and stock market up.